Healthcare's Financial Frontier: Innovators Converge at Pepperdine's Groundbreaking Symposium

Finance

2025-04-14 17:00:00

Pepperdine Graziadio Business School is set to elevate the conversation on healthcare's financial landscape with its milestone 10th Annual Future of Healthcare Symposium. Scheduled for Thursday, April 24, 2025, this prestigious event will transform the school's Malibu campus into a hub of innovative thinking and strategic dialogue. Under the compelling theme Investing in Health: Financing the Future of Healthcare through Innovation, Investment, and Impact, the symposium promises to be a groundbreaking gathering of healthcare's most visionary leaders and experts. Participants will explore cutting-edge strategies that are reshaping how healthcare is financed, developed, and delivered. From 10:30 AM to 3 PM Pacific Time, attendees will have the opportunity to engage with industry pioneers, delve into transformative investment approaches, and discover how disruptive technologies are revolutionizing healthcare financing. The event represents a critical platform for professionals seeking to understand and influence the future of healthcare investment and innovation. This landmark symposium not only marks a decade of thought leadership but also signals Pepperdine Graziadio Business School's ongoing commitment to driving meaningful conversations that can potentially reshape the healthcare ecosystem. MORE...

Breaking: How Digital Tokens Are Revolutionizing Global Trade Finance

Finance

2025-04-14 16:38:14

Trade Finance: The Invisible Backbone of Global Commerce

In the complex landscape of international trade, where supply chains are constantly evolving and geopolitical tensions reshape economic boundaries, one fundamental element remains unchanged: trade finance. Far more than a mere financial mechanism, trade finance is the critical lifeline that enables global transactions, bridging the gap between exporters and importers with seamless payment solutions.

At its core, trade finance is the essential lubricant that keeps the wheels of international commerce turning. It provides the financial guarantees, credit instruments, and risk mitigation strategies that empower businesses to conduct cross-border trade with confidence. Whether it's a small manufacturer in Southeast Asia or a multinational corporation in Europe, trade finance offers the financial infrastructure that transforms potential business opportunities into actual transactions.

As global trade dynamics continue to shift—driven by factors like tariff changes, geopolitical realignments, and emerging economic trends—trade finance remains the constant, adaptable force that ensures smooth, secure, and efficient international exchanges. It is the unsung hero of global economic connectivity, silently enabling billions of dollars in trade every single day.

MORE...Financial Showdown: AMLO Pushes Minister to Squeeze Banks on Lending Costs

Finance

2025-04-14 16:16:05

In a bold move to stimulate economic growth, Mexican President Claudia Sheinbaum has taken decisive action to ease financial burdens on businesses and entrepreneurs. On Monday, she directly instructed Finance Minister Edgar Amador to engage with banking institutions and negotiate lower interest rates for both commercial and development loans. The presidential directive aims to make borrowing more affordable and accessible, potentially providing a significant boost to Mexico's economic landscape. By encouraging banks to reduce their lending rates, Sheinbaum hopes to create more opportunities for businesses to invest, expand, and drive economic progress. This proactive approach signals the government's commitment to supporting economic development and providing financial relief to companies struggling with high borrowing costs. The initiative could prove crucial in helping businesses recover and grow in the current economic climate. MORE...

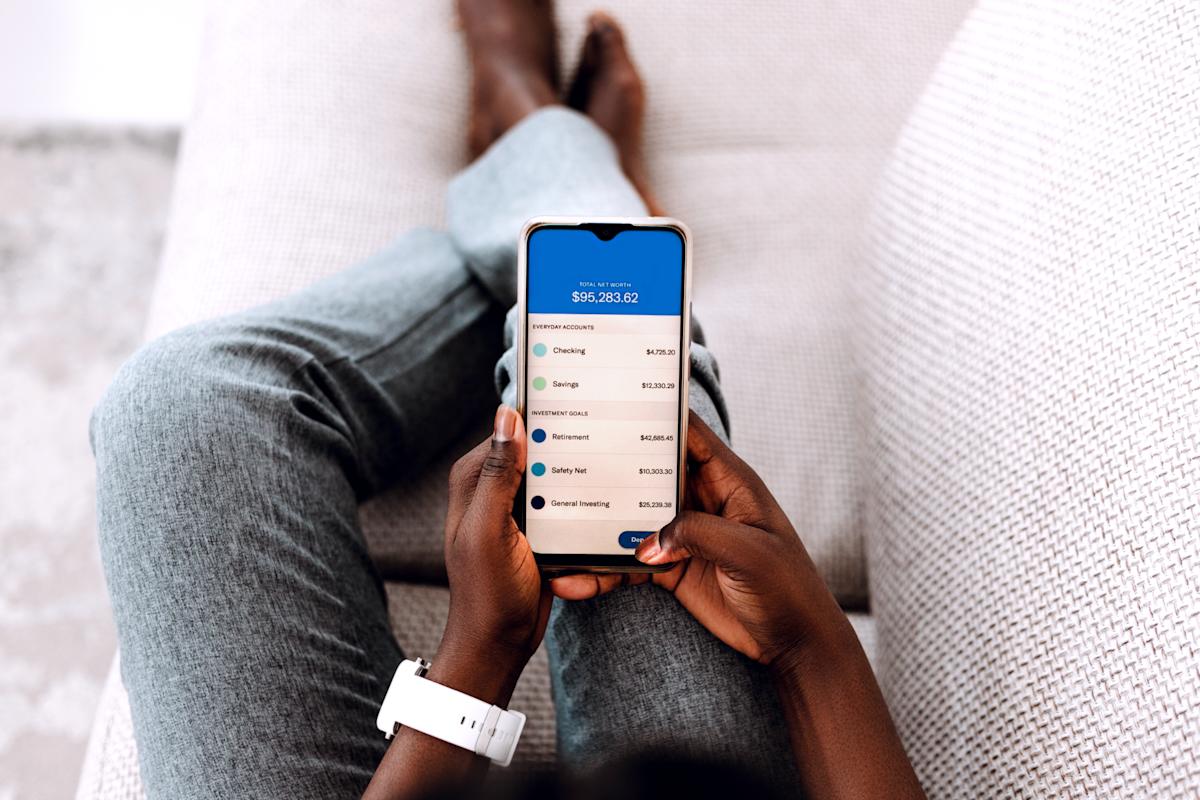

Why Your Bank Might Be Silently Draining Your Wallet

Finance

2025-04-14 15:52:54

Is Your Long-Time Bank Holding You Back Financially? We all have that familiar bank we've been loyal to for years—perhaps since our first savings account as a teenager. But have you ever paused to critically examine whether this long-standing relationship is truly serving your financial best interests? Loyalty is admirable, but when it comes to banking, sentimentality could be costing you money. Financial institutions are constantly evolving, introducing new products, competitive rates, and innovative services. What worked perfectly for you a decade ago might now be outdated or unnecessarily expensive. Smart financial management means periodically reassessing your banking relationships. Are you earning competitive interest rates? Are the fees reasonable? Do the bank's digital tools and services align with your current lifestyle and banking needs? These are crucial questions that can potentially save you hundreds, if not thousands, of dollars over time. Don't let comfort or inertia prevent you from exploring better banking options. A little research and willingness to switch could unlock significant financial advantages and put more money back in your pocket. MORE...

Money Lessons from the Small Screen: What '90s Sitcoms Secretly Taught Us About Personal Finance

Finance

2025-04-14 15:50:00

Financial Wisdom from 90s TV: Unexpected Money Lessons from Your Favorite Shows

Remember those classic 90s sitcoms that kept us glued to the television? Beyond their laugh tracks and memorable characters, these shows surprisingly offered some timeless financial advice that still resonates today.

Credit Card Caution: Learning from TV Characters' Mistakes

Shows like "Friends" and "Seinfeld" often depicted characters struggling with financial challenges, subtly teaching viewers about responsible credit card usage. Whether it was Rachel Green's shopping sprees or Chandler Bing's sarcastic financial commentary, these storylines highlighted the importance of managing credit wisely and avoiding unnecessary debt.

Emergency Funds: A Lesson from Unexpected Plot Twists

90s television frequently showcased characters navigating unexpected financial challenges, demonstrating the critical need for emergency savings. From job losses to surprise expenses, these narratives underscored the importance of having a financial safety net that can cushion life's unpredictable moments.

Windfall Management: Smart Strategies from Sitcom Scenarios

Many 90s shows featured characters receiving unexpected money—inheritances, lottery wins, or sudden bonuses. These plotlines offered valuable insights into responsible windfall management, emphasizing the significance of thoughtful financial planning over impulsive spending.

Key Takeaways

- Monitor and manage credit card spending

- Build a robust emergency fund

- Approach unexpected income with strategic planning

- Learn from characters' financial successes and mistakes

Who knew that your favorite 90s TV shows could double as unexpected financial advisors? Next time you're binge-watching nostalgic sitcoms, pay attention—you might just pick up some valuable money management tips!

MORE...Investing Smarter: The Strategic Shield Against Market Volatility

Finance

2025-04-14 15:30:00

As U.S. markets opened higher on Monday, investors remain cautiously optimistic despite ongoing trade war tensions. Alex Morris, CEO and CIO of F/m Investments, offers a nuanced perspective on the current market dynamics, cautioning against hasty investment decisions. Morris warns that while the market's upward momentum might be tempting, investors should resist the urge to immediately jump back in. Instead, he recommends a strategic approach focused on disciplined portfolio rebalancing and exploring opportunities in short-duration fixed income investments. The current market landscape demands a measured and thoughtful strategy. Rather than chasing rallies, investors should prioritize careful analysis and risk management. Morris's insights underscore the importance of maintaining a long-term perspective and avoiding impulsive market moves. For more expert analysis and in-depth market insights, be sure to check out the latest Morning Brief and stay informed about the evolving financial landscape. MORE...

Wall Street Veteran from Gaming Giant Lands Top Finance Role at Warner Music

Finance

2025-04-14 15:21:37

Warner Music Group has made a strategic leadership move by bringing Armin Zerza, a seasoned executive from Activision Blizzard, on board as its new chief financial officer. The renowned music entertainment company announced the high-profile appointment on Monday, signaling a fresh approach to financial leadership. Zerza, known for his extensive experience in the corporate finance world, joins Warner Music Group after an impressive tenure at Activision Blizzard. His expertise is expected to drive financial innovation for a label that represents global superstars like Ed Sheeran and Dua Lipa. The appointment underscores Warner Music Group's commitment to bringing top-tier talent from diverse industries to strengthen its executive team and continue its position as a powerhouse in the music entertainment landscape. MORE...

Trade Tensions Linger: How Trump's Tariffs Keep Corporate Leaders on Edge

Finance

2025-04-14 15:15:42

Trump's Tariff Uncertainty Sends Shockwaves Through Corporate America

The business world is currently gripped by mounting tension as President Trump's unpredictable tariff policies create a climate of uncertainty that has corporate leaders and Wall Street strategists on high alert.

In an exclusive report, Yahoo Finance's Josh Schafer breaks down the intricate dynamics of this economic landscape, highlighting how the ongoing trade tensions are causing significant anxiety among top executives and financial experts.

The volatile tariff environment is forcing companies to reassess their strategic planning, with many CEOs struggling to navigate the complex and rapidly changing international trade regulations. This uncertainty is not just a minor concern, but a potential game-changer for businesses across multiple sectors.

For deeper insights and expert analysis on the latest market developments, viewers are encouraged to explore more of the Morning Brief series, which provides comprehensive coverage of these critical economic trends.

MORE...Trade War Tensions: Could a Financial Meltdown Be Lurking Around the Corner?

Finance

2025-04-14 14:58:42

The Trade War's Lingering Economic Shadow: Trump's Policies May Have Caused Lasting Damage A recent analysis by Scope Ratings suggests that former US President Donald Trump's aggressive trade confrontations could have inflicted deep and potentially long-lasting economic wounds on the global economy. The international credit rating agency warns that the trade war's repercussions extend far beyond temporary market disruptions, potentially setting the stage for a more serious financial crisis. The comprehensive assessment highlights the profound economic consequences of the trade tensions that characterized Trump's presidency, particularly the escalating tariff battles with China. These confrontational trade policies may have fundamentally altered international economic relationships and supply chains, creating systemic risks that could continue to reverberate through global markets. Scope Ratings' experts emphasize that the economic damage is not merely a short-term phenomenon but could represent a structural shift with far-reaching implications. The trade war's impact goes beyond immediate financial metrics, potentially reshaping international trade dynamics and economic strategies for years to come. While the immediate tensions have subsided, the underlying economic strain remains a significant concern for policymakers and economic strategists worldwide. The potential for a future financial crisis looms as a stark reminder of the complex and interconnected nature of global economic relationships. MORE...

Breaking: The Financial Revolution You Never Knew You Needed - Open Banking Explained

Finance

2025-04-14 14:27:02

Open Banking: Revolutionizing Financial Services in the Digital Age

In an era of digital transformation, open banking is emerging as a groundbreaking approach that's reshaping how we interact with financial services. This innovative concept allows third-party financial providers to securely access and leverage consumer banking data, creating a more connected and dynamic financial ecosystem.

What Exactly is Open Banking?

Open banking is a progressive financial model that enables banks to share customer financial information with authorized third-party providers through secure application programming interfaces (APIs). This collaborative approach breaks down traditional banking barriers, empowering consumers with more personalized and flexible financial solutions.

How Open Banking Works

By implementing robust security protocols, open banking platforms allow customers to grant controlled access to their financial data. This means innovative fintech companies can develop cutting-edge services like personalized budgeting tools, advanced loan comparisons, and tailored financial advice—all with the customer's explicit consent.

Benefits of Open Banking

- Enhanced financial transparency

- More personalized banking experiences

- Increased competition and innovation

- Simplified financial management

Potential Risks to Consider

While open banking offers tremendous opportunities, it's crucial to be aware of potential risks such as data privacy concerns and cybersecurity challenges. Consumers should always verify the credentials of third-party providers and understand their data-sharing permissions.

As technology continues to evolve, open banking represents a significant step towards a more interconnected and customer-centric financial landscape.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421