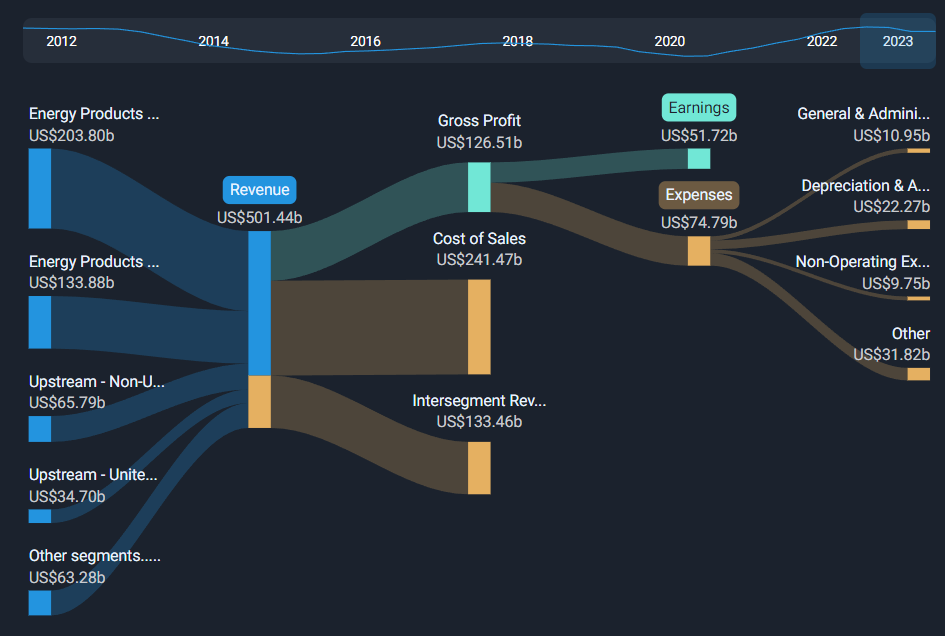

Inside the VC Drought: Why Venture Capital's Pulse Has Flatlined Since 2019

Finance

2025-02-20 18:15:00

Venture Capital Faces Prolonged Challenges in Turbulent Market Landscape

The venture capital (VC) sector continues to navigate through a challenging economic environment, marked by rising borrowing costs and investor hesitancy. Despite initial optimism surrounding potential market improvements, the industry remains in a state of uncertainty.

Bradley Tusk, founder of Tusk Venture Partners, offers a candid assessment of the current VC landscape, describing it as "effectively dead for the last four years." He highlights two critical factors that have dampened market expectations:

- Minimal liquidity in IPO and mergers and acquisitions (M&A) activities

- Uncertain prospects for interest rate cuts and business-friendly regulations

Tusk points out that while there were hopes of market revitalization through Federal Reserve interest rate adjustments and potential pro-business policies, these expectations have yet to materialize. The ongoing complexity of governance and central bank monetary policies further contribute to the market's unpredictability.

With a notably pessimistic outlook, Tusk suggests that a near-term recovery seems unlikely, stating he would be "shocked" if liquidity were to return soon. This sentiment underscores the significant challenges facing the venture capital ecosystem in the current economic climate.

Investors and entrepreneurs alike continue to watch closely as the market navigates these turbulent waters, seeking signs of potential stabilization and renewed growth.

MORE...Walmart's Financial Chief Reveals Bullish Outlook: 'We're in a Strong Position'

Finance

2025-02-20 18:13:37

Walmart Delivers Strong Q4 Earnings, But Cautious Outlook Dampens Investor Enthusiasm Retail giant Walmart surpassed Wall Street expectations with its fourth-quarter earnings report, yet the company's conservative profit forecast triggered a slight pullback in its stock price during Thursday's trading session. In an exclusive interview with Yahoo Finance, Walmart's Chief Financial Officer John David Rainey expressed confidence in the company's current market position. "We're feeling really good about where we stand," Rainey noted, providing insights into the retailer's performance and consumer spending trends. Despite beating earnings estimates, Walmart's measured outlook seemed to temper initial market excitement. Investors carefully parsed the company's forward-looking statements, which reflected a pragmatic approach to the evolving retail landscape. The earnings report offers a fascinating glimpse into consumer behavior and Walmart's strategic navigation of current economic challenges. For more in-depth market analysis and expert perspectives, finance enthusiasts are encouraged to explore additional coverage on Wealth. As the retail sector continues to adapt to changing consumer dynamics, Walmart remains a bellwether for understanding broader economic trends and consumer spending patterns. MORE...

Breaking: How One Platform Is Revolutionizing Project Financing Worldwide

Finance

2025-02-20 17:36:11

Cutler Development's Latest Project Finds Success Through Strategic Partnership with Iowa Title Guaranty In the complex world of real estate development, smooth financing can make all the difference. For Cutler Development, their recent project exemplified the power of strategic collaboration, with Iowa Title Guaranty playing a pivotal role in streamlining the entire financing process. By leveraging Iowa Title Guaranty's expertise and comprehensive services, Cutler Development navigated the financial landscape with unprecedented ease. The partnership transformed what could have been a challenging financing journey into a seamless, efficient experience that ultimately contributed to the project's successful completion. This collaboration underscores the importance of choosing the right financial partners in real estate development. Iowa Title Guaranty's commitment to providing tailored solutions proved instrumental in helping Cutler Development turn their vision into reality, demonstrating how the right support can truly accelerate project success. MORE...

Mortgage Rates Tumble: 30-Year Loans Hit Lowest Point in Two Months

Finance

2025-02-20 17:01:28

Homebuyers Catch a Break: Mortgage Rates Continue Downward Trend In a promising development for the housing market, 30-year mortgage rates in the United States have dropped for the fifth consecutive week, reaching their lowest point since late December. This welcome relief comes just in time for the peak home-buying season, offering potential homeowners a glimmer of hope in the competitive real estate landscape. According to Freddie Mac, the mortgage lending giant, the average 30-year fixed-rate mortgage has slightly decreased to 6.85% from 6.87% in the previous week. While the change may seem minimal, even a marginal reduction can translate to significant savings for homebuyers. Additionally, 15-year fixed-rate mortgages, a popular choice among homeowners looking to refinance at more favorable rates, have also seen a modest decline. This trend suggests a potentially more accessible housing market for those seeking to make their homeownership dreams a reality. As the spring and summer months traditionally mark the busiest period for home sales, these softening rates could provide the much-needed boost for both first-time buyers and those looking to upgrade their living situations. MORE...

Tragedy Turns to Compensation: Delta's $30K Lifeline for Toronto Flight Survivors

Finance

2025-02-20 16:28:05

In a remarkable gesture of goodwill, Delta Air Lines has announced an extraordinary compensation package for passengers who were aboard the harrowing Minneapolis-to-Toronto flight that recently experienced a dramatic crash landing. The airline will provide each passenger with a substantial $30,000 payment, with absolutely no conditions or complicated claims process attached. This unprecedented compensation demonstrates Delta's commitment to passenger care and support in the wake of a traumatic travel experience. By offering a significant financial settlement directly and unconditionally, the airline is showing its dedication to taking immediate responsibility and providing meaningful relief to those affected by the incident. The $30,000 per passenger payout represents a direct and compassionate approach to addressing the stress and potential disruption caused by the emergency landing. Passengers can use these funds as they see fit, whether for medical expenses, travel disruptions, or personal recovery needs. Delta's swift and generous response sets a new standard for airline customer support during unexpected and potentially distressing travel incidents, potentially redefining how airlines approach passenger compensation in emergency situations. MORE...

Seeking Fiscal Watchdogs: Shaker Heights Schools Invite Community Members to Finance Committee

Finance

2025-02-20 16:11:57

Stepping into a pivotal role, the newly appointed individual will seamlessly bridge the gap between the current term's remaining months and the start of an exciting three-year tenure beginning in August. This transition promises to bring fresh perspectives and continuity to the position, ensuring a smooth and dynamic leadership progression. MORE...

Crypto Chaos: Trump Teases 'DOGE Dividend' as Musk's Twitter Transformation Accelerates

Finance

2025-02-20 16:05:59

In a surprising twist, President Donald Trump has thrown his support behind a novel concept dubbed the 'DOGE dividend', signaling yet another unexpected development in the ongoing narrative surrounding Elon Musk's strategic cost-reduction initiative. The proposed dividend, which centers around the popular meme-inspired cryptocurrency Dogecoin, represents a fascinating intersection of political interest and technological innovation. This latest move underscores the Trump administration's increasingly unconventional approach to economic and technological policy. By embracing the DOGE dividend concept, the administration continues to demonstrate its willingness to explore unorthodox strategies and engage with emerging digital trends. The proposal highlights the dynamic and unpredictable nature of current economic and technological discussions. As the initiative gains traction, it remains to be seen how this unique approach will impact Musk's broader cost-cutting efforts and the cryptocurrency landscape. The convergence of political endorsement and digital currency innovation presents an intriguing narrative that continues to captivate both tech enthusiasts and political observers. MORE...

Seeds of Success: TAB Bank Cultivates $5M Agricultural Finance Boost

Finance

2025-02-20 16:05:00

TAB Bank Boosts Agricultural Finance with Strategic $5 Million Lending Partnership

In a significant move to support agricultural entrepreneurs, TAB Bank has successfully closed a $5 million Lender Finance facility with a pioneering Nevada-based financial firm specializing in agricultural financing. This strategic partnership is set to revolutionize funding opportunities for farmers, agricultural businesses, and fresh produce exporters across Mexico.

The innovative financing solution is specifically designed to empower small- and mid-sized growers worldwide, providing them with critical financial resources to expand and sustain their agricultural operations. By leveraging a deep understanding of the agricultural sector, the company has crafted a next-generation financial approach that addresses the unique challenges faced by farmers.

"Built by growers for growers" is more than just a slogan—it represents a commitment to delivering tailored financial solutions that understand the intricate needs of agricultural professionals. This landmark collaboration between TAB Bank and the Nevada-based factoring finance company signals a promising future for agricultural financing.

The facility will enable agricultural businesses to access flexible funding, supporting their growth, operational needs, and global market expansion efforts.

MORE...Retail Giant's Warning Sparks Market Jitters: Dow and S&P 500 Retreat on Walmart's Cautionary Signal

Finance

2025-02-20 16:01:26

The Trump administration continues to make waves with its aggressive economic strategy, focusing intently on trade policy and government spending reduction. As tariffs reshape international trade dynamics and budget cuts target federal expenditures, the administration's bold approach is drawing significant attention from economists, policymakers, and global markets. The ongoing tariff implementation signals a dramatic shift in America's economic engagement, challenging long-established international trade norms. Meanwhile, proposed governmental cost-cutting measures aim to streamline federal operations and reduce national spending, reflecting a commitment to fiscal discipline. These strategic moves underscore the administration's determination to redefine economic relationships, both domestically and internationally. By leveraging trade barriers and reducing government expenses, the policy approach seeks to strengthen American economic competitiveness and create a more lean, responsive federal infrastructure. Stakeholders across various sectors are closely monitoring these developments, recognizing the potential long-term implications for businesses, workers, and global economic relationships. The unfolding strategy represents a significant departure from previous administrative approaches, promising to reshape economic landscapes in unprecedented ways. MORE...

Financial Planning Legends: CFP Board Honors Trailblazers Who Shaped Modern Wealth Management

Finance

2025-02-20 15:00:00

In a landmark move to celebrate the most influential pioneers of financial planning, the CFP Board has unveiled its groundbreaking Financial Planning Hall of Fame. This prestigious new recognition program aims to honor visionary leaders who have fundamentally reshaped the financial planning profession through their extraordinary achievements and unwavering commitment to excellence. The Hall of Fame seeks to spotlight individuals whose innovative contributions have not only elevated professional standards but also profoundly enhanced the broader societal impact of financial planning. Professionals and industry leaders are invited to submit nominations for these exceptional trailblazers during the open nomination period, which runs from today through March 31, 2025. By creating this distinguished platform, the CFP Board underscores its dedication to recognizing and celebrating the transformative leaders who have driven meaningful progress in financial planning, inspiring current and future professionals to continue pushing the boundaries of the field. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421