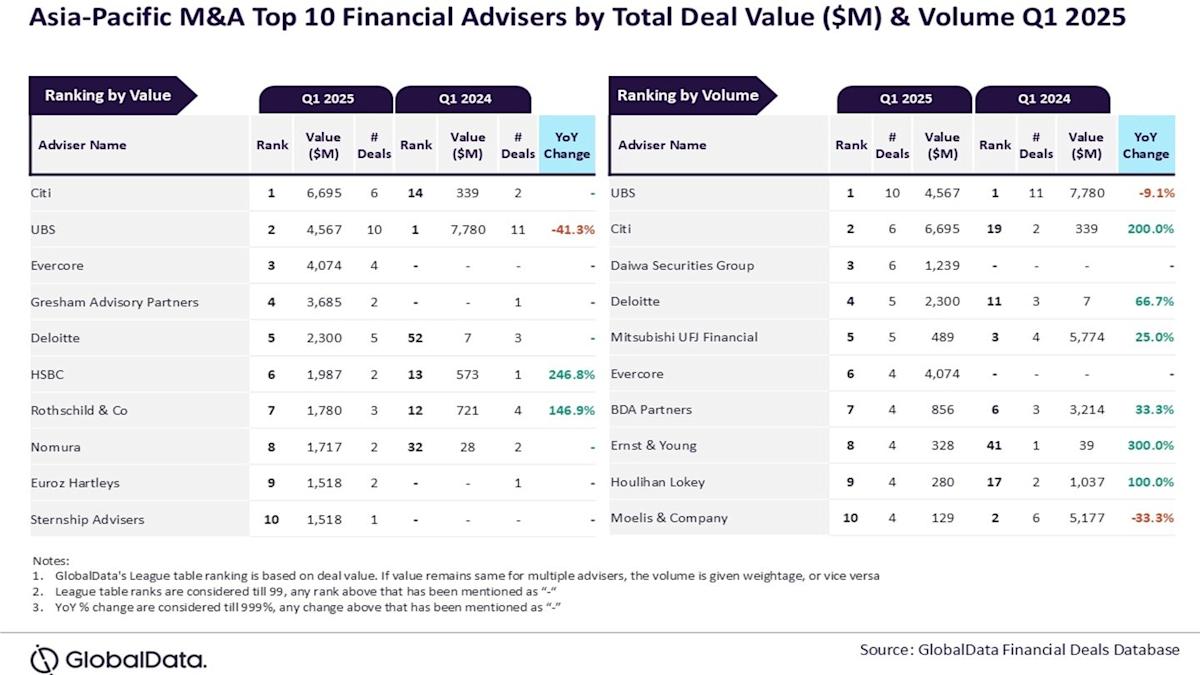

Financial Titans Dominate: Citi and UBS Surge Ahead in Asia-Pacific M&A Advisory Landscape

Finance

2025-04-16 14:39:58

In a standout performance this quarter, UBS emerged as the top investment banking leader, demonstrating its market prowess by successfully advising on an impressive 10 transactions. The Swiss banking giant's strategic deal-making and financial expertise positioned it at the forefront of the industry, showcasing its ability to navigate complex financial landscapes and deliver exceptional value to clients. UBS's remarkable achievement highlights the bank's robust deal-making capabilities and its strong presence in the global financial advisory market. By securing the highest deal volume, the bank has reinforced its reputation as a premier financial institution capable of executing sophisticated and high-stakes transactions across various sectors. The bank's success underscores its deep market insights, extensive network, and skilled team of financial professionals who consistently drive strategic business opportunities. This quarter's performance is a testament to UBS's continued commitment to excellence in investment banking and its ability to create significant value for its clients and shareholders. MORE...

Trade Tensions Thaw? China Extends Diplomatic Olive Branch to US in Tariff Standoff

Finance

2025-04-16 14:00:38

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Tech Tremors: Nvidia's Plunge Sends Shockwaves Through Wall Street Indexes

Finance

2025-04-16 13:37:57

Wall Street experienced a downturn as Nvidia's disclosure of stringent chip export restrictions to China sent ripples through the technology sector. The market's volatility was further amplified by lingering uncertainties surrounding potential trade policy shifts, creating a complex landscape for investors to navigate. Nvidia's announcement of costly new limitations on semiconductor exports to China triggered an immediate market reaction, highlighting the ongoing tensions in the global technology supply chain. Investors found themselves carefully reassessing their positions, weighing the potential economic implications of these export constraints. The market sentiment was further complicated by the speculative environment surrounding potential trade policy changes, leaving investors on edge and searching for clarity in an increasingly unpredictable economic landscape. Technology stocks, in particular, felt the immediate impact of these developments, reflecting the delicate balance of international trade and technological innovation. MORE...

Koalafi Supercharges Leadership: Strategic Hires Signal Bold Move in Consumer Finance Frontier

Finance

2025-04-16 13:10:00

Koalafi Strengthens Leadership Team with Strategic Appointments, Paving the Way for Future Innovation In a bold move that underscores its commitment to growth and cutting-edge financial solutions, Koalafi has unveiled a series of high-profile leadership appointments. These strategic hires signal the company's ambitious vision and determination to remain at the forefront of consumer finance innovation. The carefully selected leadership team brings a wealth of expertise and fresh perspectives, positioning Koalafi to accelerate its market expansion and deliver transformative financial services. By bringing in top-tier talent, the company demonstrates its dedication to sustainable growth and maintaining its competitive edge in the rapidly evolving financial technology landscape. These appointments reflect Koalafi's proactive approach to talent acquisition and its unwavering commitment to driving meaningful change in the consumer finance sector. As the company continues to push boundaries and explore new opportunities, these strategic leadership moves are set to propel Koalafi towards an exciting and dynamic future. MORE...

Gender Equality in Finance Hits Turbulence: New Study Reveals Alarming Setback

Finance

2025-04-16 13:05:43

The momentum of women's advancement to leadership roles in top financial institutions has unexpectedly stalled, with recent data revealing a concerning trend. A comprehensive new report highlights that the progress of female executives in the financial sector is not only decelerating but potentially at risk due to emerging policy shifts in the United States and other global markets. The study underscores a critical moment for gender diversity in corporate leadership, as hard-won gains appear increasingly fragile. Rollbacks in diversity initiatives threaten to undermine years of gradual progress, potentially reversing the incremental steps taken towards more inclusive executive representation. Financial institutions, once seen as bastions of male-dominated leadership, had been making steady strides in promoting women to senior positions. However, this latest report suggests that the pace of change has dramatically slowed, raising urgent questions about the sustainability of workplace diversity efforts. As companies and policymakers grapple with these challenges, the findings serve as a stark reminder that achieving gender equality in corporate leadership requires continuous commitment and proactive strategies. The future of women's representation in top financial roles now hangs in a delicate balance, demanding renewed attention and dedicated action. MORE...

Tariffs, Trade Wars, and Your Wallet: Unpacking the Economic Impact of Trump's Policies Ahead of the Federal Election

Finance

2025-04-16 13:00:09

As Canada Prepares for Election, Trade Tensions and Economic Uncertainty Loom Large With national elections on the horizon, Canada finds itself navigating a complex economic landscape marked by escalating trade tensions and market volatility. The looming shadow of U.S. tariffs threatens to disrupt the country's economic stability, creating a challenging backdrop for political discourse and voter sentiment. Amid these turbulent conditions, Canadians are bracing for a pivotal electoral moment that could reshape the nation's economic strategy and international trade relationships. The impact of ongoing trade disputes, particularly with the United States, has sent ripples through financial markets and raised concerns about potential economic slowdown. Join us today at noon for an exclusive personal finance Q&A, where expert analysts will break down the economic implications, discuss market strategies, and provide insights into how these developments might affect your financial planning and investment decisions. Stay informed, stay prepared – your financial future depends on understanding the current economic landscape. MORE...

Latin America's Open Finance Revolution: Belvo Bags $15M to Supercharge Financial Innovation

Finance

2025-04-16 13:00:00

Fintech startup Belvo has secured a significant $15 million in funding, marking a major milestone for the company. The investment round saw strategic participation from Quona Capital, a venture capital firm known for backing innovative financial technology companies. This latest funding injection is set to propel Belvo's growth and expansion in the rapidly evolving financial technology landscape, highlighting the company's potential and investor confidence in its mission. MORE...

Breaking: Velocity Financial Set to Unveil Q1 2025 Performance in Upcoming Investor Reveal

Finance

2025-04-16 12:30:00

Velocity Financial, a prominent player in commercial investor lending, is set to unveil its financial performance for the first quarter of 2025. The company will release its comprehensive financial results after the market closes on Thursday, May 1, 2025. Investors and financial analysts are invited to join an exclusive conference call and live webcast featuring Velocity's executive management team. The detailed financial review will take place at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) on the same day, providing a deep dive into the company's quarterly achievements and strategic outlook. Stakeholders can expect a transparent and insightful presentation of Velocity Financial's (NYSE:VEL) performance, offering valuable insights into the company's current market position and future growth strategies. MORE...

Breaking: Runway Growth Finance Set to Unveil Q1 Lending Insights Amid Market Uncertainty

Finance

2025-04-16 12:30:00

RWAY Capital: Unveiling Q1 2025 Financial Performance and Lending Insights Growth-stage investment firm RWAY is set to release its first-quarter 2025 financial results on May 13, promising investors and industry analysts a comprehensive look into its lending strategies and market performance. The company will host a detailed conference call at 5 PM Eastern Time, where key executives are expected to share insights into their current lending portfolio, market trends, and strategic outlook for the upcoming quarters. Investors, financial analysts, and industry professionals are encouraged to tune in for a deep dive into RWAY's latest financial developments and forward-looking perspectives in the growth-stage capital market. Stay prepared for an informative session that could provide valuable perspectives on emerging lending trends and investment opportunities. MORE...

Breaking Point: How Multilateral Development Banks Can Rescue Climate Finance from the Brink

Finance

2025-04-16 12:23:15

Mastering the Global Economic Landscape: Your Strategic Guide to Success In today's interconnected world, understanding the intricate dynamics of the global economy isn't just an advantage—it's a necessity. Whether you're an aspiring entrepreneur, a seasoned investor, or a curious professional, navigating the complex economic terrain requires insight, strategy, and adaptability. Our comprehensive approach breaks down the multifaceted aspects of global economic trends, empowering you to make informed decisions with confidence. From emerging market opportunities to geopolitical shifts that impact trade and investment, we provide you with the critical knowledge needed to stay ahead of the curve. Key insights include: • Comprehensive analysis of international market trends • Real-time economic indicators and predictive modeling • Strategic frameworks for global business navigation • In-depth understanding of cross-border economic interactions Don't just observe the global economy—become a strategic player. Our expert-driven resources equip you with the tools to transform economic challenges into breakthrough opportunities. Learn to read economic signals, anticipate market movements, and position yourself for success in an ever-changing global landscape. Your economic intelligence starts here. Are you ready to unlock your potential and make your next strategic move? MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421