Wall Street's New Frontier: Inside the Cutthroat World of Breaking into Finance

Finance

2025-04-18 14:46:05

Navigating the Finance Career Landscape: Insights for 2025 and Beyond

In an era of rapid technological transformation and evolving professional landscapes, Business Insider embarked on a comprehensive exploration of the finance career ecosystem. Our in-depth investigation involved candid conversations with a diverse range of professionals – from ambitious students and seasoned recruiters to industry executives and emerging talent.

Our mission was clear: to uncover the critical skills, strategies, and insights that will define successful finance careers in 2025. Through exclusive interviews and expert analysis, we've compiled a comprehensive guide that offers unprecedented insights into the future of financial careers.

Dive into our collection of compelling stories and dynamic video content that reveal the roadmap for aspiring finance professionals. Whether you're a recent graduate, mid-career professional, or industry leader, our comprehensive coverage provides actionable strategies to thrive in the rapidly changing financial landscape.

Discover the skills, technologies, and mindsets that will set you apart in the competitive world of finance. Your career transformation starts here.

MORE...Precision Bearings Giant RBC Crushes Earnings Expectations, Stock Soars

Finance

2025-04-18 14:31:34

Navigating Market Challenges: Wasatch Global Investors Shares Insights on Small Cap Growth Strategy Wasatch Global Investors recently unveiled its comprehensive first-quarter 2025 investor letter for the Small Cap Growth Strategy, offering a candid look at the current market landscape. The investment firm's analysis reveals a challenging quarter for U.S. stocks, marked by significant market headwinds. Investors faced a complex economic environment as potential tariff implications and anticipated government funding reductions created uncertainty. The market sentiment was further dampened by softer economic indicators that tested investor confidence. The Russell 2000® index reflected these broader market pressures, highlighting the nuanced challenges facing small-cap investments. The detailed investor letter provides a deep dive into the strategic approach and market perspectives of Wasatch Global Investors, offering valuable insights for those tracking small-cap growth opportunities. Interested stakeholders can access the full report through the firm's official channels, gaining a comprehensive understanding of the current investment landscape. As market dynamics continue to evolve, Wasatch Global Investors remains committed to providing transparent and strategic guidance for investors navigating these complex financial terrains. MORE...

Dogecoin's Crypto Coup: How DOGE is Gutting a Key Financial Watchdog Agency

Finance

2025-04-18 14:20:19

Elon Musk's long-standing vendetta against the Consumer Financial Protection Bureau (CFPB) is finally taking shape. The controversial entrepreneur, known for his bold statements and aggressive business tactics, is now actively moving to dismantle the federal agency that has been a thorn in his side. For years, Musk has been vocal about his desire to "delete" the CFPB, viewing the regulatory body as an obstacle to his business interests. Now, he appears to be translating those inflammatory words into concrete action. The ongoing efforts to undermine or completely eliminate the agency represent a significant escalation in Musk's ongoing battle with financial regulators. This latest move highlights Musk's confrontational approach to government oversight, particularly when he perceives regulations as hindering his business operations. The CFPB, established to protect consumers from predatory financial practices, has found itself squarely in the crosshairs of one of America's most prominent and unpredictable business leaders. As the situation unfolds, many are watching closely to see how Musk's campaign against the CFPB will ultimately play out, and what implications it might have for consumer protection and financial regulation in the United States. MORE...

Financial Guru Suze Orman Reveals: The Smart Way to Help Your Child Tackle Student Debt

Finance

2025-04-18 14:17:59

Supporting Your Adult Child's Student Loan Debt: Tax Implications Explained

Many parents find themselves wanting to help their children navigate the challenging landscape of student loan debt. But before writing a check, it's crucial to understand the potential tax implications of such financial support.

Recently, a 75-year-old listener named Marlene sought advice from financial expert Suze Orman on her popular "Women & Money" podcast. Her specific question centered around gifting her 50-year-old son $17,000 to alleviate his student loan burden.

Understanding Gift Tax Exclusion

While the intention to help is admirable, parents should be aware that simply giving money doesn't automatically translate to a tax deduction. The gift tax exclusion allows individuals to give a certain amount annually without incurring tax penalties, but this doesn't equate to a direct tax write-off.

Parents considering financial assistance for their adult children should consult with a tax professional to fully understand the nuanced implications of their generosity. Each financial situation is unique, and personalized guidance can help maximize potential benefits while avoiding unexpected tax complications.

Ultimately, supporting a child's financial journey requires careful planning, open communication, and a strategic approach to managing both family dynamics and financial responsibilities.

MORE...Cash is King: How Veteran Traders Outsmart Market FOMO Panic

Finance

2025-04-18 13:55:41

In the dynamic world of investing, cash isn't just a passive holding—it's a strategic tool that can provide both flexibility and opportunity. Veteran Wall Street trader Kenny Polcari offers a nuanced perspective, emphasizing that while cash is a valuable asset, investors shouldn't become too comfortable with large cash reserves. Polcari warns that parking money in cash for extended periods can actually hinder wealth creation. Smart investors understand that cash should be viewed as a dynamic resource—a strategic position that allows for quick market moves and potential investment opportunities, rather than a long-term parking spot for funds. The key is balance: maintaining enough liquidity to seize opportunities while ensuring that your money is actively working to generate returns. Cash can serve as a buffer during market volatility, but it should not become a permanent investment strategy. Savvy investors know that strategic deployment of cash—whether into stocks, bonds, real estate, or other investment vehicles—is crucial for long-term financial growth. By keeping cash as a tool rather than a destination, investors can maximize their potential for building wealth. MORE...

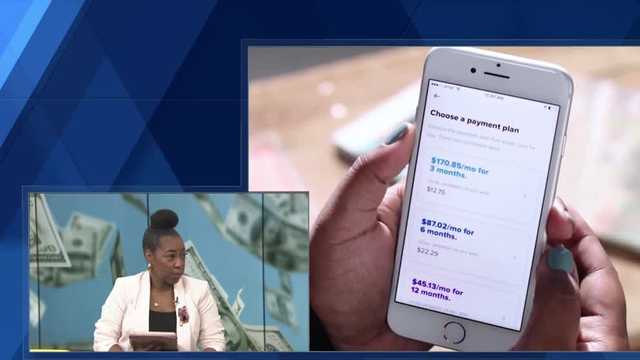

The BNPL Trap: 5 Critical Insights Before You Swipe and Defer

Finance

2025-04-18 13:49:00

Short-Term Loans and Installment Credits: Navigating Financial Options

In a recent in-depth discussion, WESH 2's Jason Guy sat down with Reshell Smith, founder and CEO of AMES Financial Solutions, to unpack the complex world of short-term loans and installment credits. Their conversation shed light on the nuanced financial landscape that many consumers navigate when seeking quick financial relief.

Understanding the Pros and Cons

Short-term loans and installment credits can be both a lifeline and a potential financial pitfall. Smith emphasized the importance of understanding these financial tools before making any hasty decisions. While they can provide immediate financial breathing room, they also come with significant considerations that consumers must carefully weigh.

Key Advantages

- Quick access to funds during emergency situations

- Flexible repayment options

- Potential to build credit when managed responsibly

Potential Drawbacks

- Higher interest rates compared to traditional loans

- Risk of falling into a debt cycle

- Potential negative impact on long-term financial health

Experts like Smith recommend thorough research and careful financial planning before committing to any short-term lending option. Understanding the fine print and assessing one's personal financial situation is crucial in making an informed decision.

MORE...Financial Pro Reveals: 5 Money Moves to Outsmart Tariff Uncertainty

Finance

2025-04-18 12:53:02

In the unpredictable world of global economics, market reactions to tariff news can feel like a rollercoaster ride. While I can't dictate how financial markets will respond to international trade tensions, I have complete control over my personal financial strategy. The key is to focus on what you can manage: your spending habits, savings approach, and investment decisions. Instead of getting swept up in the anxiety of market fluctuations, take a proactive stance. Develop a resilient financial plan that can weather economic uncertainties. This means creating a robust budget that allows for flexibility, building an emergency fund to provide a safety net, and making strategic investment choices that align with your long-term financial goals. By maintaining discipline and a forward-thinking mindset, you can navigate economic challenges with confidence and peace of mind. Remember, financial empowerment comes from taking charge of the aspects of your financial life that you can directly influence. Stay informed, remain adaptable, and keep your eyes on your personal financial objectives. MORE...

Yen's Value Defended: Japan Pushes Back Against Currency Manipulation Claims

Finance

2025-04-18 12:19:16

In a firm statement to Japan's parliament on Friday, Finance Minister Katsunobu Kato emphatically denied allegations of currency manipulation, pushing back against claims made by former U.S. President Donald Trump that Japan intentionally weakens the yen to boost its export sector. Kato's robust defense comes ahead of his upcoming diplomatic trip to Washington, where he is expected to engage in high-level bilateral discussions. The finance minister's comments aim to dispel any misconceptions about Japan's foreign exchange practices and maintain transparent international economic relations. By directly addressing the accusations in a public forum, Kato seeks to preemptively defuse potential tensions and reinforce Japan's commitment to fair and market-driven currency valuation. His statement underscores the country's dedication to responsible economic policy and international financial norms. The timing of Kato's remarks is strategic, signaling Japan's proactive approach to managing diplomatic and economic relationships with key global partners like the United States. MORE...

Financial Shockwaves: Kukies Warns of Global Economic Ripple Effect

Finance

2025-04-18 11:30:33

From Wall Street to Economic Strategy: A Goldman Sachs Veteran's Perspective on German Economic Revival In an exclusive insight into Germany's economic planning, a former Goldman Sachs banker has emerged as a key architect behind Friedrich Merz's ambitious €1 trillion spending blueprint. This comprehensive economic strategy aims to revitalize Germany's economic landscape, addressing critical infrastructure and investment challenges. The banker, leveraging his extensive financial expertise from his Goldman Sachs background, has played a pivotal role in structuring a plan that could potentially transform Germany's economic trajectory. His deep understanding of financial markets and strategic investment has been instrumental in crafting a nuanced approach to national economic development. Central to the discussion are the potential implications of US tariffs, which the banker views as a complex challenge for international economic dynamics. His perspective offers a unique blend of Wall Street insight and strategic economic planning, providing a sophisticated analysis of the potential impacts on global trade and investment. The €1 trillion spending plan, spearheaded by Friedrich Merz, represents a bold vision for Germany's economic future. It signals a commitment to substantial investment in critical sectors, infrastructure, and technological innovation, potentially positioning Germany at the forefront of economic transformation. As global economic landscapes continue to shift, this strategic approach demonstrates the critical role of experienced financial professionals in shaping national economic policies and navigating complex international economic challenges. MORE...

Synovus Financial Crushes Q1 Earnings: Profit Surge Defies Wall Street Predictions

Finance

2025-04-18 10:36:29

Synovus Financial Delivers Strong First Quarter Performance in 2025

Synovus Financial (NYSE:SNV) has reported impressive financial results for the first quarter of 2025, showcasing robust growth and financial strength. The banking institution demonstrated significant momentum with a notable increase in revenue and key financial metrics.

Highlights of Q1 2025 Financial Performance

- Revenue Surge: The company achieved a remarkable revenue of $559.9 million, representing a substantial 16% year-over-year growth

- The impressive financial performance underscores Synovus Financial's strategic positioning and effective business strategies

- Investors and analysts are likely to view these results positively, reflecting the bank's resilience in a dynamic economic landscape

The strong first-quarter results signal continued momentum for Synovus Financial, highlighting the organization's ability to navigate complex market conditions and deliver value to shareholders.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421