Financial Guru Dave Ramsey Drops Bombshell Advice on Retirement Savings and Social Security

Finance

2025-04-21 00:47:12

In a stark warning that's sending shockwaves through financial circles, a renowned personal finance bestselling author is sounding the alarm on a critical economic challenge facing American households. The expert reveals a looming financial crisis that could potentially devastate millions of unprepared families. With rising inflation, stagnant wages, and increasing economic uncertainty, Americans are finding themselves caught in a perfect storm of financial vulnerability. The author argues that most households are critically underprepared for unexpected economic shocks, leaving them dangerously exposed to potential financial ruin. Key concerns highlighted include: • Insufficient emergency savings • Mounting consumer debt • Lack of comprehensive financial planning • Inadequate retirement preparations The message is clear and urgent: Americans must take immediate action to fortify their financial foundations. By developing strategic savings plans, reducing unnecessary expenses, and creating multiple income streams, families can build resilience against economic unpredictability. Financial experts recommend starting with a comprehensive review of personal finances, establishing an emergency fund covering 3-6 months of expenses, and investing in diversified financial instruments that can provide long-term stability. As economic landscapes continue to shift, proactive financial management isn't just advisable—it's essential for survival and prosperity in today's challenging economic environment. MORE...

Money Moves: How Teens Can Unlock Financial Success Before Adulthood

Finance

2025-04-21 00:00:00

Mastering Money: A Teen's Guide to Financial Wisdom Navigating the world of personal finance can be challenging, but it doesn't have to be overwhelming. For teenagers standing on the brink of financial independence, understanding money management is like having a secret superpower that can shape their future success. Learning to handle money wisely isn't just about saving—it's about making smart, informed choices that will set the foundation for long-term financial health. By developing key financial skills early, teens can avoid common money traps and build a solid path toward financial confidence. Key strategies for teen financial success include: • Creating and sticking to a budget • Understanding the difference between wants and needs • Learning about saving and investing • Recognizing the importance of credit • Developing responsible spending habits Think of financial literacy as your personal roadmap to economic empowerment. Every dollar you save, every smart decision you make now can compound into significant opportunities in the future. Don't be intimidated—start small, stay curious, and watch your financial knowledge grow. Remember, financial independence isn't about perfection; it's about progress. By taking the first steps to understand money management, teens can transform their financial future and build a foundation of economic confidence that will serve them for life. MORE...

Age-Proof Your Wealth: Financial Gurus Reveal Insider Strategies for Building Long-Term Funds

Finance

2025-04-20 23:03:27

Mastering Your Financial Future: Expert Strategies for Building Resilience and Wealth In today's unpredictable economic landscape, financial stability is more crucial than ever. A leading banking expert has shared invaluable insights to help individuals strengthen their financial foundation and create long-term wealth. The key to financial resilience lies in strategic planning and smart money management. Experts recommend starting with a comprehensive approach that combines disciplined saving, strategic investing, and proactive financial planning. Key strategies include: • Creating a robust emergency fund that covers 3-6 months of living expenses • Diversifying investment portfolios to minimize risk • Consistently tracking and reviewing personal spending habits • Developing multiple income streams • Investing in personal skills and professional development By implementing these practical tips, individuals can build a more secure financial future, navigate economic uncertainties with confidence, and gradually accumulate wealth. The journey to financial resilience is not about making drastic changes overnight, but about making consistent, informed decisions that compound over time. Remember, financial success is a marathon, not a sprint. With patience, discipline, and the right strategies, anyone can transform their financial outlook and create a more stable, prosperous future. MORE...

Financial Pitfalls: What Gen X Doesn't Know About Surviving Today's Economic Landscape

Finance

2025-04-20 23:01:24

The Financial Tightrope: Gen X Navigates Unprecedented Economic Challenges Generation X finds itself at the epicenter of a perfect financial storm, weathering a complex landscape of economic pressures that test their financial resilience like never before. Squeezed between supporting adult children struggling to gain financial independence and caring for aging parents, this generation is facing unprecedented economic challenges. Mounting economic uncertainties, including persistent inflation, volatile job markets, and escalating tariffs, are creating a perfect storm of financial stress for Gen X. Unlike their younger millennial counterparts or more established boomer parents, this generation is uniquely positioned at a critical intersection of financial responsibilities. Many Gen Xers are simultaneously managing multiple financial fronts: supporting their children's career transitions, helping elderly parents with medical and living expenses, and attempting to maintain their own financial stability. The traditional career trajectory has been disrupted, forcing many to reinvent their professional paths while managing these complex family financial dynamics. The economic pressures are not just theoretical—they're deeply personal. Stagnant wages, rising living costs, and a rapidly changing job market mean that Gen X must be more adaptable and strategic than ever before. Their financial planning now requires unprecedented flexibility and resilience. As they navigate this challenging terrain, Gen X is proving to be remarkably resourceful, leveraging their mid-career experience and adaptability to overcome these multifaceted economic challenges. MORE...

From Pennies to Prosperity: Insider Secrets to Lifelong Financial Mastery

Finance

2025-04-20 23:01:00

In a revealing snapshot of financial ambition, new research from HSBC UK Premier shows that an impressive 80% of individuals are actively pursuing financial objectives. This compelling statistic highlights the proactive approach many people are taking towards their financial future. The study underscores a widespread commitment to personal financial planning, demonstrating that the majority of people are not content to simply drift through their financial lives. Instead, they are setting clear goals and working strategically to achieve them. Whether it's saving for a dream home, building an emergency fund, planning for retirement, or investing in personal development, these financial aspirations reflect a growing awareness of the importance of financial health and long-term planning. HSBC UK Premier's research provides an encouraging glimpse into the financial mindset of modern individuals, showing that most people are motivated to take control of their financial destinies and work towards meaningful financial milestones. MORE...

After GM Financial: Berce's Smooth Ride into New Horizons

Finance

2025-04-20 22:27:17

From Subprime Lending to Automotive Transformation: A CEO's Remarkable Journey Mary Barra's leadership at General Motors represents a remarkable tale of corporate reinvention, transforming a once-struggling automaker into a cutting-edge mobility technology powerhouse. Her journey from a Fort Worth-based organization's subprime lending roots to the helm of one of the world's most iconic automotive companies is a testament to strategic vision and adaptive leadership. Navigating through complex economic landscapes, Barra has steered GM through unprecedented challenges, including the 2008 financial crisis and the recent global pandemic. Her strategic approach has not only rescued the company from potential bankruptcy but has also positioned GM at the forefront of electric vehicle innovation and sustainable transportation. Under her guidance, GM has undergone a radical transformation, shifting from traditional automotive manufacturing to a forward-thinking technology enterprise. By embracing electric vehicles, autonomous driving technologies, and sustainable manufacturing practices, Barra has redefined the company's identity and future trajectory. Her leadership style combines bold strategic decisions with a deep understanding of technological trends, making her one of the most respected CEOs in the automotive industry. From managing financial complexities to driving technological innovation, Barra's journey exemplifies resilience, adaptability, and visionary leadership. MORE...

Money Mastery Unleashed: Franklin Township Hosts Game-Changing Financial Workshop

Finance

2025-04-20 21:17:00

Master Your Financial Future: Unlock Wealth Strategies in Uncertain Times

Join renowned CPA Carletta O. Beckwith for an exclusive virtual masterclass that will transform your approach to personal finance. In today's unpredictable economic landscape, having the right knowledge and strategies can make all the difference between financial stress and financial success.

This groundbreaking masterclass is designed to empower you with:

- Proven wealth-building techniques

- Strategies to navigate economic volatility

- Confidence-boosting financial insights

- Practical tools for long-term financial growth

Don't let economic uncertainty hold you back. Learn from an expert who has helped countless individuals turn financial challenges into opportunities. Carletta O. Beckwith will guide you step-by-step towards creating a robust and resilient financial future.

Limited spots available! Secure your place now and take the first step towards financial mastery.

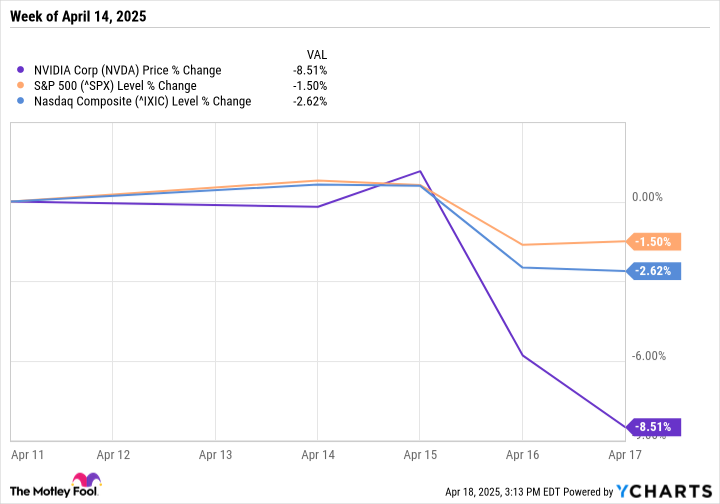

MORE...Nvidia's Market Rollercoaster: Inside the High-Stakes Trading Week of April 14-18

Finance

2025-04-20 19:00:00

In a week marked by market volatility, Nvidia (NASDAQ: NVDA), the powerhouse behind cutting-edge AI semiconductor technology, experienced a notable stock price decline. The chipmaker's shares tumbled 8.5% during the shortened four-day trading week, which was abbreviated due to the Good Friday market closure. By week's end, Nvidia's stock settled at $101.49 per share, reflecting the broader market sentiment surrounding tech and semiconductor stocks. The company wasn't alone in this downturn, as its key competitor Advanced Micro Devices (AMD) also saw a significant 6.3% drop during the same period. This recent price movement highlights the ongoing dynamics and investor sentiment in the rapidly evolving artificial intelligence and semiconductor landscape, where Nvidia continues to be a prominent player driving technological innovation. MORE...

Tesla's Value Plunge: YouTuber Exposes Elon Musk's Broken Promise of Self-Driving Appreciation

Finance

2025-04-20 18:00:23

Tech YouTuber Zack Nelson, widely recognized as JerryRigEverything, has publicly challenged Elon Musk's previous bold claim about Tesla vehicle value. In a recent social media post, Nelson revealed the stark reality of his 2018 Tesla Model X's current market worth - a mere $22,400, which represents approximately 20% of its original purchase price. The dramatic depreciation directly contradicts Musk's earlier assertion that Teslas equipped with Full Self-Driving (FSD) technology would actually increase in value over time. Nelson pointedly highlighted this discrepancy, sharing a screenshot that graphically illustrates the significant financial loss. "I remember when @ElonMusk claimed my @Tesla with FSD was an appreciating asset," Nelson wrote. "Here we are seven years later, and the vehicle is worth just a fraction of what I initially paid." This revelation serves as a critical reminder for potential electric vehicle investors about the importance of carefully evaluating long-term value propositions, especially when confronted with ambitious marketing claims. MORE...

Numbers That Predict Millions: How AI Is Reshaping Wall Street's Crystal Ball

Finance

2025-04-20 17:00:03

In the fascinating world of artificial intelligence, statistical methods serve as the foundational building blocks for developing sophisticated Large Language Models (LLMs). Descriptive and inferential statistics are not just mathematical tools, but powerful techniques that breathe life into machine learning algorithms. Descriptive statistics act as the initial lens through which researchers understand complex data landscapes. By summarizing and organizing massive datasets, these methods help data scientists extract meaningful patterns and insights. Mean, median, standard deviation, and variance become critical metrics that reveal the underlying structure of linguistic data, enabling more precise model training. Inferential statistics take this understanding a step further, allowing researchers to make robust predictions and draw meaningful conclusions from sample data. Through techniques like hypothesis testing and confidence intervals, data scientists can generalize findings and validate the statistical significance of their model's performance. In the context of LLMs, these statistical methods play multiple crucial roles: 1. Data Preprocessing: Identifying and handling outliers 2. Model Validation: Assessing model reliability and generalizability 3. Performance Measurement: Quantifying model accuracy and precision 4. Error Analysis: Understanding and minimizing statistical variations By leveraging these fundamental statistical approaches, researchers can develop more intelligent, nuanced, and reliable language models that push the boundaries of artificial intelligence and natural language processing. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421