Wall Street Braces: Market Futures Dip as Investors Await Fed's Next Move

Finance

2025-02-20 00:25:21Content

Wall Street's Attention Rivets on White House as Economic Tensions Escalate

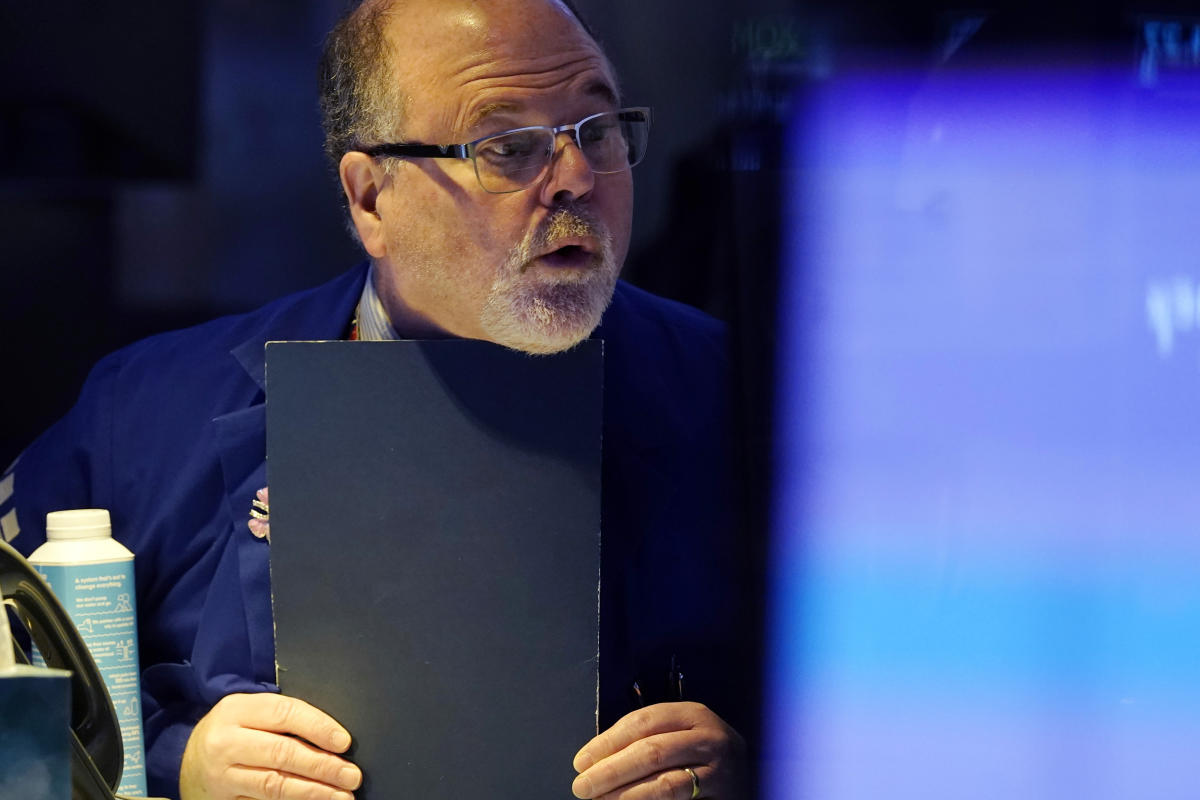

Investors are closely monitoring the latest developments from the White House as ongoing tariff tensions continue to send ripples through financial markets. The economic landscape is experiencing significant shifts, with recent defense spending announcements creating substantial momentum for military contracting corporations.

The intricate dance of international trade policies and government spending is keeping market participants on the edge of their seats. As geopolitical strategies unfold, investors are carefully analyzing the potential impacts on various sectors, particularly those with strong ties to government contracts and international trade.

Military contractors are experiencing notable volatility, with new defense budget allocations promising to reshape the competitive landscape. These strategic spending decisions are not just numbers on a spreadsheet, but potential game-changers for companies positioned at the intersection of national security and technological innovation.

The current economic environment demands unprecedented attention, as each policy announcement and trade negotiation could trigger significant market movements. Savvy investors are staying alert, ready to navigate the complex and dynamic financial terrain.

Market Tremors: White House Policies and Defense Spending Reshape Economic Landscape

In the intricate world of global economics, the intersection of political decision-making and market dynamics continues to create seismic shifts that reverberate through financial ecosystems. Recent developments surrounding White House policies and defense spending are painting a complex picture of economic transformation that demands close scrutiny and strategic understanding.Navigating Uncertain Economic Terrain: A Deep Dive into Policy-Driven Market Disruptions

Tariff Dynamics and Market Volatility

The ongoing implementation of tariffs has emerged as a critical factor driving market uncertainty. Investors are closely monitoring the nuanced interactions between international trade policies and their potential ripple effects across various economic sectors. These trade mechanisms are not merely abstract economic instruments but powerful tools that can dramatically reshape corporate strategies and investor sentiment. Financial analysts have observed intricate patterns of market response, where even subtle shifts in tariff frameworks can trigger significant portfolio realignments. The complex interplay between geopolitical tensions and economic policy creates an environment of perpetual adaptation for market participants.Defense Spending: Transforming Corporate Landscapes

Recent defense spending announcements have sent profound tremors through military contracting corporations, signaling a potential restructuring of industrial relationships. These strategic investments represent more than mere budgetary allocations; they symbolize a comprehensive reimagining of national security infrastructure and technological capabilities. Military contractors are experiencing unprecedented levels of strategic recalibration. The emerging landscape demands agility, technological innovation, and a deep understanding of geopolitical complexities. Companies that can rapidly adapt to these evolving requirements are positioned to emerge as dominant players in this transformative environment.Investor Strategies in a Volatile Economic Ecosystem

Sophisticated investors are developing increasingly nuanced approaches to navigate these turbulent market conditions. The traditional models of risk assessment are being fundamentally challenged, requiring a more holistic and dynamic understanding of economic interdependencies. Successful investment strategies now demand a multidimensional perspective that integrates geopolitical analysis, technological trends, and macroeconomic indicators. The ability to anticipate and interpret complex systemic changes has become a critical competitive advantage in contemporary financial landscapes.Technological Innovation and Economic Resilience

The intersection of policy-driven market changes and technological innovation presents unprecedented opportunities for economic resilience. Companies that can effectively leverage technological capabilities while maintaining strategic flexibility are most likely to thrive in this dynamic environment. Emerging technologies are not just disrupting traditional business models but are becoming fundamental drivers of economic transformation. The capacity to integrate advanced technological solutions with adaptive strategic frameworks will increasingly define corporate success in the coming years.Global Economic Interconnectedness

The current economic landscape underscores the profound interconnectedness of global markets. Policy decisions made in one jurisdiction can instantaneously trigger cascading effects across international economic systems, highlighting the need for sophisticated, nuanced approaches to economic management. Understanding these complex interdependencies requires a holistic perspective that transcends traditional disciplinary boundaries. Economists, policymakers, and corporate strategists must collaborate to develop more comprehensive frameworks for interpreting and responding to global economic dynamics.RELATED NEWS

Finance

Wall Street Insider Reveals Survival Strategies for Turbulent Market Rollercoaster

2025-04-11 23:04:56

Finance

Debt Decoded: The Ultimate Survival Guide for 2025 Grads Tackling Student Loans

2025-04-16 17:30:13

Finance

Riding the Market Storm: How One Savvy Stock Could Turn Volatility into Victory

2025-03-24 20:42:25