Recession Veteran Reveals: The Shocking Truth About Selling Investments in Retirement

Finance

2025-04-17 19:30:59

Navigating Market Turbulence: The Investor's Secret Weapon of Patience In the unpredictable world of financial markets, successful retirement planning isn't about making perfect predictions—it's about maintaining a steady hand when uncertainty strikes. Financial experts consistently emphasize that investors who resist the temptation to panic during market downturns are ultimately the most likely to secure long-term financial success. When markets experience volatility, the natural human instinct is to react emotionally. Fear can drive investors to make hasty decisions, like selling investments at the worst possible moment or completely abandoning their carefully crafted retirement strategies. However, seasoned financial planners warn that such knee-jerk reactions can permanently damage long-term investment growth. The key to weathering financial storms is perspective. Historically, markets have always recovered, and those who remain disciplined during challenging periods are best positioned to capitalize on the eventual rebound. By staying committed to a well-diversified investment strategy and avoiding impulsive moves, investors can transform market volatility from a threat into an opportunity. Remember, retirement planning is a marathon, not a sprint. Maintaining composure, trusting your long-term strategy, and making calculated, rational decisions will ultimately prove more valuable than any short-term emotional response. MORE...

Wall Street Buzz: Schwab and Amex Earnings Spark Market Excitement, Hertz Stock Soars

Finance

2025-04-17 18:18:45

As the trading week drew to a close, stock markets experienced a volatile session marked by notable corporate performances and strategic investments. The Dow Jones Industrial Average faced downward pressure, primarily due to UnitedHealth's decline, while other sectors showed mixed signals of resilience and growth. Charles Schwab emerged as a standout performer, with shares climbing after announcing record first-quarter revenue that impressed investors. Meanwhile, American Express delivered a solid earnings report, surpassing estimates, though the company also highlighted higher-than-expected expenses. In a surprising market development, Hertz saw continued gains following a significant investment from Pershing Square, the renowned investment firm led by Bill Ackman. This strategic move has sparked renewed investor interest in the struggling rental car company. Investors and market watchers are advised to stay closely tuned to the minute-by-minute market developments through reliable financial news platforms like Yahoo Finance's Market Minute for the most up-to-date insights and analysis. MORE...

Trade Tensions Ease: Trump Signals Breakthrough in China Negotiations

Finance

2025-04-17 17:42:28

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Zayo's Financial Lifeline: Fiber Giant Negotiates Debt Reprieve with Creditors

Finance

2025-04-17 17:40:53

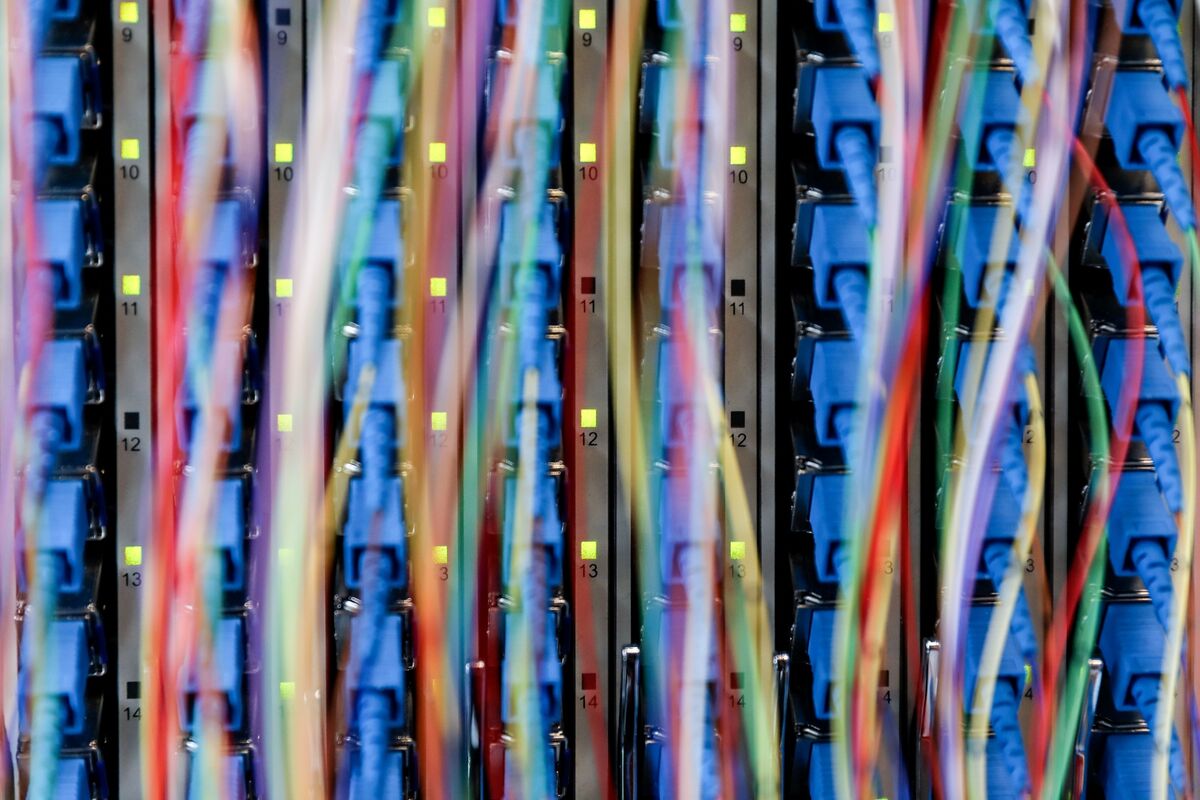

Zayo Group Holdings Inc., a prominent fiber-network infrastructure provider, is currently engaged in confidential negotiations with a key steering committee of lenders. The discussions center around potentially restructuring and extending the company's existing debt obligations, according to sources with direct knowledge of the ongoing talks. The behind-the-scenes deliberations suggest that Zayo is proactively managing its financial landscape, seeking flexible terms that could provide the company with greater financial maneuverability and strategic breathing room. While specific details remain closely guarded, the negotiations underscore the company's commitment to maintaining a robust and sustainable financial position in the competitive telecommunications infrastructure market. Industry observers are closely watching these developments, as the outcome could signal Zayo's strategic approach to debt management and its long-term financial health. MORE...

Breaking: High School Students Dive Deep into Financial Survival Skills

Finance

2025-04-17 17:22:44

Navigating Financial Realities: Local Credit Union Empowers College Students In a dynamic effort to prepare young adults for financial independence, Affinity Federal Credit Union transformed Raritan Valley Community College into a real-world financial simulation arena. The innovative Financial Reality Fair provided 68 students with an immersive experience that goes far beyond traditional classroom learning. As rising living costs challenge today's young professionals, the event offered participants a hands-on journey through critical financial decision-making. Students stepped into a simulated adult life, confronting practical challenges like budgeting for rent, managing grocery expenses, understanding credit scores, and developing smart savings strategies. This interactive workshop bridged the gap between academic theory and real-world financial management, equipping students with essential skills needed to navigate their economic futures confidently. By experiencing the complex financial choices awaiting them after graduation, participants gained invaluable insights into responsible money management. The Financial Reality Fair represents a proactive approach to financial literacy, empowering the next generation to make informed, strategic decisions about their personal finances in an increasingly complex economic landscape. MORE...

Plastic Power: 5 Credit Cards That Will Supercharge Your Post-Grad Financial Journey

Finance

2025-04-17 17:16:52

Mastering Credit Cards: A Guide for New Graduates and Young Professionals

Stepping into the world of personal finance can be daunting, especially when it comes to credit cards. Whether you're a recent graduate just starting to build credit or a young professional looking to optimize your spending strategy, navigating the credit landscape requires smart decision-making.

In an insightful discussion, Yahoo Finance Senior Writer Kendall Little offers expert advice on how to make the most of credit cards and establish a solid financial foundation. Her key recommendations focus on two critical aspects: building a strong credit history and selecting the right credit card that aligns with your lifestyle and financial goals.

For those just beginning their credit journey, understanding the basics of responsible credit use is crucial. This includes making timely payments, keeping credit utilization low, and choosing cards that offer benefits tailored to your spending habits.

Want to dive deeper into financial wisdom and market insights? Check out more expert analysis and guidance on Wealth to help you make informed financial decisions.

MORE...AI Revolution in Finance: Quadient Leads the Charge in Cutting-Edge Automation

Finance

2025-04-17 16:58:00

In today's fast-paced business environment, traditional manual Accounts Receivable (AR), Accounts Payable (AP), and invoice management processes are becoming increasingly problematic. These outdated methods are not just inefficient—they're potential minefields of operational challenges that can significantly impact an organization's financial health and strategic performance. Manual processing creates a perfect storm of risks: time-consuming workflows, increased potential for human error, and heightened vulnerability to fraudulent activities. Finance teams find themselves trapped in a cycle of tedious data entry, reconciliation, and verification, which not only consumes valuable resources but also introduces critical compliance and accuracy risks. Payment delays become almost inevitable with manual systems, disrupting vendor relationships and potentially damaging the company's financial reputation. Moreover, the lack of real-time visibility and tracking makes it challenging to maintain precise financial controls and make informed strategic decisions. By transitioning to automated, integrated financial management solutions, organizations can transform these pain points into opportunities for improved efficiency, reduced risk, and enhanced financial agility. Modern digital platforms offer streamlined processes, robust security measures, and comprehensive analytics that empower finance teams to work smarter, not harder. MORE...

Gold's Rollercoaster Ride: Navigating the Glittering Market After Peak Prices

Finance

2025-04-17 16:41:41

Gold prices experienced a notable pullback on Thursday morning, retreating from recent record-breaking highs as investors strategically moved to secure their gains. The market's volatility stems from mounting uncertainties surrounding international tariff policies, creating a complex landscape for precious metal traders. Michael Gayed, a seasoned portfolio manager at Tidal Financial Group and the insightful publisher of the Lead-Lag Report, shared his nuanced perspective on the current gold market dynamics. In an exclusive interview with Wealth, Gayed revealed his increasingly cautious stance on gold investments, signaling potential shifts in the precious metals sector. Investors are closely monitoring the market's intricate movements, weighing the potential risks and opportunities presented by the current economic climate. The recent price fluctuations underscore the importance of strategic decision-making and adaptive investment approaches. For more in-depth expert analysis and cutting-edge market insights, viewers are encouraged to explore additional content on Wealth, where top financial professionals provide comprehensive market commentary and strategic guidance. MORE...

Wall Street's Hidden Gems: Financial Titans Dominate IBD 50 Ranking

Finance

2025-04-17 16:38:50

Investors' Spotlight: ICICI Bank Emerges as a Promising Investment Opportunity In the dynamic world of financial services, one stock is capturing the attention of market strategists and investors alike. ICICI Bank, a prominent player in the banking sector, is currently positioned at an attractive entry point that savvy investors should not overlook. The bank's stock is currently forming a compelling cup-with-handle base, a technical chart pattern that signals potential strength and upward momentum. This formation suggests that ICICI Bank is not just another banking stock, but a strategic investment opportunity with promising growth prospects. As a leader among banking stocks, ICICI Bank has demonstrated resilience and strategic positioning in a competitive market. The current buy zone presents an opportune moment for investors looking to add a robust financial services stock to their portfolio. Traders and investors are advised to closely monitor ICICI Bank's performance, as its current technical setup indicates a potential breakout that could deliver significant returns in the near term. MORE...

Cross-Border Investment Surge: Canadians Go All-In on US Stock Market

Finance

2025-04-17 16:35:14

Despite ongoing diplomatic tensions between Canada and the United States, Canadian investors demonstrated remarkable confidence in the U.S. stock market during February, purchasing a record-breaking volume of American shares. The surge coincided with U.S. stock markets reaching unprecedented heights, according to the latest official data released on Thursday. Statistics Canada revealed that Canadian investors enthusiastically acquired C$29.8 billion in U.S. shares, with a strategic focus on large-cap technology and financial sector stocks. This impressive investment trend underscores the strong financial interconnectedness between the two North American neighbors, even amid political challenges. The robust investment activity suggests that Canadian investors remain optimistic about the potential and resilience of U.S. financial markets, prioritizing economic opportunities over geopolitical friction. The record-breaking share purchases highlight the continued attractiveness of American stocks to Canadian investors seeking diversification and growth. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421