Global Giants Allianz and Jio Financial Forge Groundbreaking Partnership in Indian Market

Finance

2025-03-20 10:07:52

In a strategic move that could reshape India's insurance landscape, Mukesh Ambani's Jio Financial Services Ltd. has taken a significant step forward by securing a preliminary agreement with global insurance giant Allianz SE. The potential partnership aims to establish a robust insurance venture in one of the world's fastest-growing markets. Sources close to the negotiations reveal that this collaboration represents a promising opportunity for both companies to tap into India's expanding insurance sector. Mukesh Ambani, known for his transformative business strategies, appears poised to leverage Allianz's international expertise with Jio's deep understanding of the Indian market. The preliminary agreement signals a potential game-changing alliance that could bring innovative insurance solutions to millions of Indian consumers. While specific details of the partnership are still being finalized, the collaboration hints at an exciting new chapter in India's financial services ecosystem. Industry observers are watching closely, anticipating how this partnership between Jio Financial Services and Allianz might disrupt and enhance insurance offerings in the country. MORE...

Economic Calm: Why the Fed's Patience Trumps Tariff Tensions

Finance

2025-03-20 10:00:59

Federal Reserve Chair Jerome Powell is navigating a complex economic landscape, carefully absorbing lessons from the pandemic era and the enigmatic "vibecession" while maintaining a cautious approach to monetary policy. In recent remarks, Powell has signaled a strategic patience, acknowledging the unprecedented economic disruptions of recent years. The Fed's leadership recognizes that traditional economic indicators may not fully capture the nuanced economic recovery and shifting consumer sentiments. The term "vibecession" - a blend of "vibe" and "recession" - reflects the disconnect between statistical economic data and the lived economic experiences of many Americans. Powell seems acutely aware of this phenomenon, suggesting that the central bank must look beyond mere numbers to understand the economic reality. By waiting for clearer economic signals, Powell is demonstrating a measured approach. He understands that hasty decisions could potentially destabilize the delicate economic recovery, especially in a post-pandemic environment marked by volatility and uncertainty. The Fed's current strategy appears to prioritize comprehensive data analysis and a holistic understanding of economic trends, rather than rushing to implement sweeping monetary policy changes. This approach reflects a sophisticated and adaptive response to the complex economic challenges of our time. MORE...

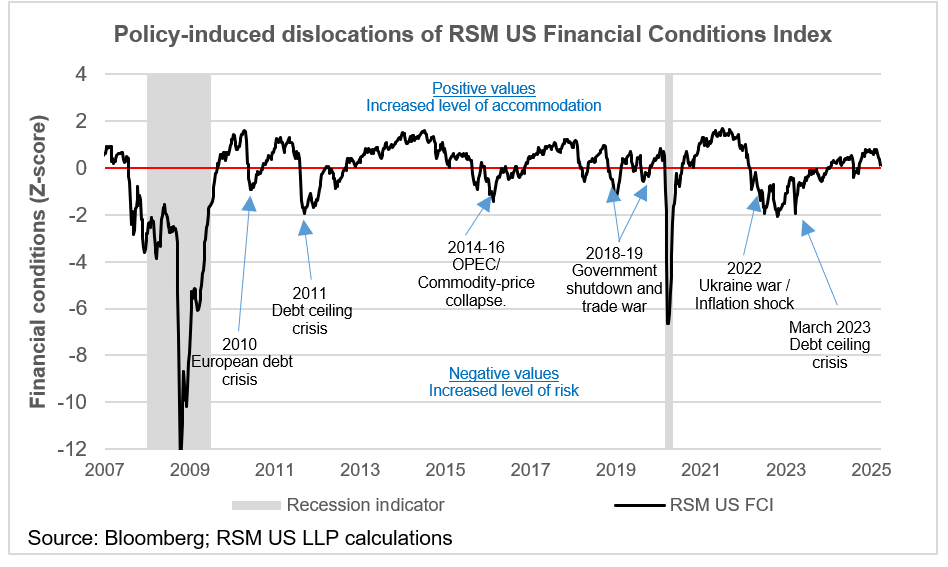

Wall Street Alarm: Financial Stress Signals Deepen as U.S. Economic Landscape Shifts

Finance

2025-03-20 10:00:46

Market Turbulence Signals Growing Economic Uncertainty Investors are facing mounting challenges as financial markets experience increasing volatility and unpredictability. The current economic landscape is characterized by growing unease, with equity, bond, and money markets showing signs of significant strain. Recent market indicators suggest a complex and potentially challenging environment for investors and financial professionals. Uncertainty is creeping into multiple financial sectors, creating a sense of apprehension and cautious sentiment among market participants. The ongoing market fluctuations are driven by a combination of factors, including global economic pressures, geopolitical tensions, and shifting monetary policies. These dynamics are creating a perfect storm of financial complexity that is testing the resilience of traditional investment strategies. Investors and financial analysts are closely monitoring the evolving situation, seeking to understand and navigate the emerging market challenges. The increasing volatility serves as a stark reminder of the interconnected and dynamic nature of today's global financial ecosystem. As markets continue to wrestle with uncertainty, strategic adaptability and careful risk management have become more critical than ever for maintaining financial stability and potential growth. MORE...

Equipment Finance Confidence Plummets: Industry Braces for Economic Turbulence

Finance

2025-03-20 09:56:44

The equipment finance sector is experiencing a wave of uncertainty, as the latest March 2025 Equipment Finance Confidence Index signals a significant downturn. Industry leaders are grappling with mounting challenges that are casting shadows on the sector's near-term outlook. The sharp decline in the confidence index reflects a complex landscape of economic headwinds, with professionals expressing deep concerns about capital accessibility and potential growth trajectories. Executives across the industry are closely monitoring economic indicators and reassessing their strategic approaches in response to the evolving market dynamics. Key factors contributing to the index's decline include tightening credit markets, ongoing economic volatility, and increasing hesitation among businesses to make substantial equipment investments. These challenges are prompting a more cautious approach among financial leaders and equipment finance professionals. As the industry navigates these turbulent waters, stakeholders are seeking innovative strategies to maintain resilience and adapt to the changing economic environment. The March 2025 index serves as a critical barometer of the sector's current sentiment and potential future challenges. MORE...

Defense Boost: France Unveils €5 Billion War Chest to Fortify Military Capabilities

Finance

2025-03-20 09:46:29

France is launching an ambitious financial strategy to fortify its defense industry, with plans to mobilize a substantial 5 billion euros ($5.4 billion) through a combination of public and private investments. Finance Minister Eric Lombard unveiled the initiative on Thursday, signaling a strong commitment to strengthening the nation's defense sector's financial foundation. This strategic funding boost aims to enhance France's defense capabilities by providing critical capital to domestic defense companies. By attracting both public sector resources and private investment, the government seeks to bolster the technological innovation and competitive edge of its defense industrial base. The comprehensive financial plan underscores France's determination to maintain its strategic autonomy and technological leadership in the defense and aerospace sectors. With geopolitical tensions rising globally, this significant investment represents a proactive approach to national security and industrial resilience. Lombard's announcement highlights the French government's recognition of the defense industry's crucial role in maintaining national sovereignty and economic strength. The 5 billion euro injection is expected to fuel research, development, and modernization efforts across France's defense manufacturing landscape. MORE...

City Showdown: London Edges Closer to Dethroning New York in Financial Power Rankings

Finance

2025-03-20 09:08:07

London is making a remarkable comeback, edging closer to New York in the prestigious global financial centers ranking. This breakthrough signals a promising turn for Britain's financial sector, suggesting that strategic policy interventions are finally gaining traction and breathing new life into the country's banking and investment landscape. The latest index reveals a significant shift, with London demonstrating renewed vigor and competitive spirit. Policymakers' carefully crafted strategies appear to be paying off, hinting at a potential renaissance for the UK's financial services industry. This development not only boosts national confidence but also underscores London's enduring resilience and adaptability in the ever-evolving global financial ecosystem. As the city reclaims its position on the world stage, investors and financial experts are watching with keen interest, sensing the potential for a robust and reinvigorated financial hub that could rival the most established global financial centers. MORE...

Money Talks: Financial Sector Advertising Surges Despite Economic Headwinds

Finance

2025-03-20 08:56:04

In a revealing snapshot of New Zealand's financial landscape, Nielsen's latest research unveils a compelling narrative of advertising expenditure in the banking and investment sector. The financial services industry has invested a substantial $295.3 million in advertising, signaling a strategic response to complex economic challenges and rapidly changing consumer behaviors. As economic pressures mount and digital transformation accelerates, banks and investment firms are demonstrating remarkable adaptability. The significant ad spend reflects a proactive approach to connecting with consumers in an increasingly competitive and dynamic market environment. The data highlights how financial institutions are leveraging sophisticated marketing strategies to maintain visibility, build trust, and differentiate themselves amid uncertain economic conditions. From digital platforms to traditional media channels, these companies are investing strategically to communicate their value propositions and engage with potential customers. This substantial investment underscores the financial sector's commitment to innovation, customer engagement, and market resilience. As consumer preferences continue to evolve, these advertising efforts represent more than mere promotional activities—they are critical tools for navigating a complex and transforming financial ecosystem. MORE...

Green Finance Breakthrough: China Launches Sovereign Bonds in London's Market

Finance

2025-03-20 08:28:21

The potential strategic shift first came to light during the UK-China Economic and Financial Dialogue in January, marking a significant moment of diplomatic discussion. This initial flagging of the move signaled the beginning of a nuanced exploration between the two nations, highlighting the complex diplomatic and economic considerations at play. The dialogue provided a critical platform for both countries to candidly address emerging strategic perspectives, with the move representing a potential watershed moment in their bilateral relations. Diplomatic sources suggest that the January meeting was instrumental in bringing this potential strategic adjustment to the forefront of international discussions. By raising the issue during such a high-level economic forum, both the UK and China demonstrated their commitment to transparent communication and mutual understanding, even as they navigate potentially sensitive geopolitical terrain. The context of the Economic and Financial Dialogue underscored the importance of the move and its potential implications for future bilateral engagements. MORE...

Social Media's Dark Side: How Scammers Are Hijacking Your Digital Life

Finance

2025-03-20 08:00:26

Digital Sophistication: The New Face of Social Media Savvy In the ever-evolving landscape of online communication, a groundbreaking report has unveiled the remarkable intelligence and strategic prowess of modern social media users. Today's digital citizens are far from passive consumers; they are sophisticated navigators of complex online ecosystems. The latest research highlights an unprecedented level of digital acumen, revealing how users are employing increasingly nuanced and strategic approaches to their social media interactions. Gone are the days of simple, surface-level engagement. Instead, we're witnessing a generation of users who craft their online personas with precision, insight, and remarkable technological understanding. These digital natives are not just consuming content—they're analyzing, curating, and strategically presenting themselves in ways that demonstrate remarkable social and technological intelligence. Their tactics go beyond traditional communication, blending creativity, strategic thinking, and a deep understanding of digital platforms. As social media continues to transform, these sophisticated users are at the forefront, reshaping how we understand online interaction, personal branding, and digital communication. MORE...

Wages Surge: British Workers Outpace Inflation Ahead of Critical Rate Showdown

Finance

2025-03-20 07:30:45

In a highly anticipated move, financial experts predict the Bank will maintain its current interest rate at 4.5%, signaling a cautious approach to monetary policy. Market analysts suggest this decision reflects a strategic pause amid complex economic conditions, balancing inflationary pressures with the need for economic stability. The steady rate underscores the Bank's commitment to carefully monitoring economic indicators before making any significant shifts in its monetary stance. Investors and economists are closely watching this decision, which comes at a critical juncture for the financial landscape. The 4.5% rate represents a delicate equilibrium, aimed at supporting economic growth while keeping inflationary trends in check. This measured approach demonstrates the Bank's nuanced understanding of the current economic environment and its potential future trajectory. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421