Chips and Challenges: Astera Labs Reveals Q1 Financial Performance

Finance

2025-05-06 20:05:00

Astera Labs Delivers Impressive Q1 Financial Performance, Sees Strong Demand in AI Connectivity Solutions

Astera Labs, Inc. (Nasdaq: ALAB) has reported remarkable financial results for the first quarter of 2025, showcasing significant growth and momentum in the semiconductor connectivity market. The company achieved a quarterly revenue of $159.4 million, representing a substantial 13% quarter-over-quarter increase and an impressive 144% year-over-year surge.

Key Highlights:

- Robust demand for PCIe scale-up and Ethernet scale-out in custom ASIC platforms

- PCIe 6 connectivity portfolio positioned for major expansion in GPU-based rack-scale systems starting in Q2

The Santa Clara-based company continues to solidify its position as a global leader in semiconductor-based connectivity solutions for cloud and AI infrastructure, demonstrating strong market traction and technological innovation.

Investors and industry observers are closely watching Astera Labs as it capitalizes on the growing demand for advanced connectivity technologies in AI and cloud computing environments.

MORE...Breaking: Sarepta's Q1 2025 Reveals Game-Changing Financial Insights and Strategic Moves

Finance

2025-05-06 20:05:00

Sarepta Therapeutics Reports Strong Q1 2025 Financial Performance

Sarepta Therapeutics has demonstrated remarkable growth in the first quarter of 2025, with net product revenues soaring to an impressive $611.5 million. This represents a substantial 70% increase compared to the same period in the previous year, highlighting the company's robust market position and strategic success.

A significant contributor to this outstanding performance was ELEVIDYS, the company's flagship product. The innovative therapy generated net product revenues of $375.0 million during the quarter, underscoring its growing market acceptance and therapeutic potential.

Additionally, Sarepta continued to benefit from strategic partnerships, with royalty revenues from ELEVIDYS sales by Roche reaching $4.0 million in the first quarter. This collaboration not only provides a steady revenue stream but also demonstrates the broader industry recognition of the product's value.

MORE...City of Commerce Taps New Financial Mastermind Through TS Talent Solutions

Finance

2025-05-06 18:46:06

In a strategic move to strengthen its financial leadership, the City of Commerce partnered with TS Talent Solutions to recruit its next Finance Director. After a comprehensive 14-week search led by Executive Recruiter Christine Martin, the city successfully onboarded Alvaro Castellon to its executive team. Bringing a wealth of expertise to his new role, Castellon arrives with an impressive 13-year background in comprehensive financial management. His extensive experience promises to bring valuable insights and strategic financial planning to the City of Commerce's administrative operations. MORE...

Samsung Unleashes Green Dot's Financial Tech in Digital Wallet Revolution

Finance

2025-05-06 18:17:44

Green Dot, a pioneering digital banking platform, has forged a strategic partnership with tech giant Samsung to enhance its digital wallet capabilities. This innovative collaboration aims to integrate Green Dot's cutting-edge embedded finance solutions, promising to revolutionize the mobile payment and financial services landscape. By combining Green Dot's robust financial technology with Samsung's expansive ecosystem, the partnership seeks to provide users with a more seamless, comprehensive digital banking experience. The integration will likely offer enhanced features, improved financial management tools, and potentially more convenient payment options for Samsung device users. This alliance represents a significant step forward in the ongoing convergence of technology and financial services, highlighting the growing trend of embedded finance in the digital marketplace. Consumers can anticipate a more integrated and user-friendly approach to managing their financial transactions through this strategic partnership. MORE...

AI Titans Clash: Elon Musk's xAI and Palantir Forge Groundbreaking Financial AI Alliance

Finance

2025-05-06 18:02:30

xAI and Palantir Join Forces to Revolutionize AI in Financial Services In a groundbreaking collaboration announced on Tuesday, May 6th, xAI has partnered with Palantir Technologies to explore cutting-edge artificial intelligence applications within the financial services sector. This strategic alliance aims to unlock innovative ways financial institutions can leverage advanced AI technologies to transform their operations and decision-making processes. The partnership represents a significant milestone in the ongoing integration of artificial intelligence across complex financial ecosystems. By combining xAI's sophisticated machine learning capabilities with Palantir's robust data analytics platform, the collaboration promises to deliver unprecedented insights and operational efficiencies for financial services firms. While specific details of the partnership remain under wraps, industry experts anticipate that this collaboration could potentially reshape how financial institutions approach data analysis, risk management, and customer service strategies. The joint effort signals a bold step forward in demonstrating AI's transformative potential in one of the world's most data-driven industries. As artificial intelligence continues to evolve, partnerships like this one between xAI and Palantir are likely to become increasingly important in driving technological innovation and competitive advantage across financial services. MORE...

Financial Champions: Leaders Credit Union Honored with Prestigious Tennessee Education Award

Finance

2025-05-06 17:14:10

Leaders Credit Union Shines Bright, Clinching Prestigious Financial Education Award In a remarkable achievement, Leaders Credit Union has been honored with the esteemed Desjardins Adult Financial Education Award by the Tennessee Credit Union League. This prestigious recognition highlights the credit union's exceptional commitment to empowering adults through comprehensive financial education and literacy programs. The award celebrates Leaders Credit Union's innovative approach to helping community members develop crucial financial skills, demonstrating their dedication to improving financial well-being beyond traditional banking services. By providing valuable resources, workshops, and educational initiatives, the credit union has proven itself as a leader in financial empowerment. This accolade not only underscores the organization's commitment to community development but also reinforces its mission to support and educate individuals in making informed financial decisions. Leaders Credit Union continues to set a high standard for financial education in Tennessee, making a meaningful difference in the lives of its members and the broader community. MORE...

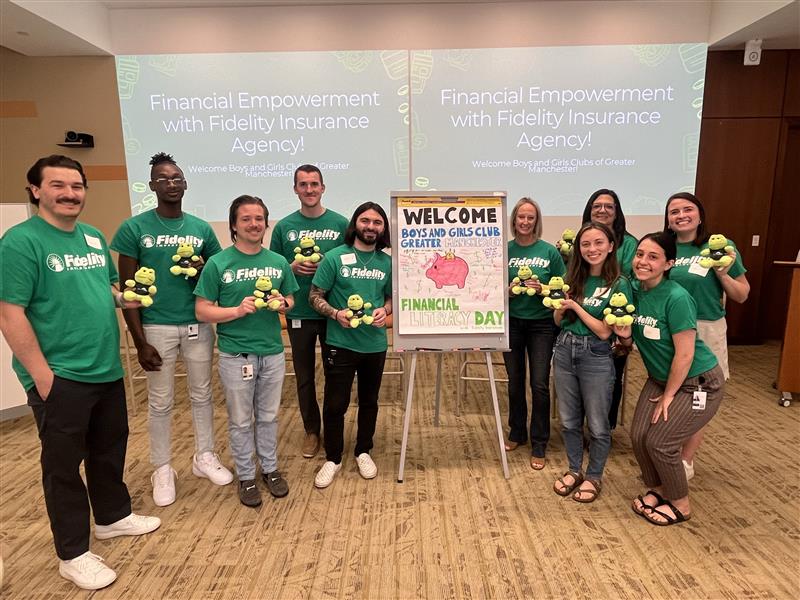

Money Matters: How Teens Are Learning Financial To Master Their Financial

Finance

2025-05-06 16:34:52

At Fidelity, we believe in empowering our community through comprehensive financial education. Our commitment goes beyond traditional banking—we're dedicated to providing accessible, meaningful financial guidance that helps individuals build stronger, more confident financial futures. By sharing knowledge, resources, and practical insights, we aim to support people from all walks of life in making informed and strategic financial decisions. MORE...

Kremlin's Financial Lifeline: Russia Dips into Reserves to Prop Up 2025 Budget

Finance

2025-05-06 16:09:13

Russia is set to dip into its fiscal reserves, drawing out a substantial 447 billion roubles (equivalent to $5.51 billion), which represents 14% of its remaining liquid assets, to stabilize the national budget for 2025. This strategic financial move comes in response to a dramatic threefold surge in the country's budgetary deficit, as revealed by the finance minister on Tuesday. The unprecedented budget adjustment highlights the complex economic challenges facing Russia, signaling a proactive approach to managing fiscal pressures. By tapping into its reserves, the government aims to maintain financial stability and mitigate the impact of recent economic fluctuations. The significant withdrawal from fiscal reserves underscores the government's commitment to balancing economic priorities while navigating an increasingly complex financial landscape. This decision reflects the ongoing economic adaptations Russia is implementing in response to global economic shifts and domestic financial requirements. MORE...

Fiscal Forecast: Watertown Council Unveils 2024 Budget Insights and Financial Pulse

Finance

2025-05-06 15:52:00

During Monday evening's city council meeting, Watertown's financial future took center stage as Finance Officer and Interim City Manager Kristen Bobzien presented the preliminary 2024 financial statements. The City Council carefully reviewed and provisionally approved the comprehensive fiscal overview, signaling a positive step in the city's financial planning and transparency. Bobzien's detailed presentation provided council members with a comprehensive look at the city's projected financial landscape for the upcoming year, highlighting key budgetary considerations and potential economic strategies. The preliminary approval represents an important milestone in Watertown's ongoing commitment to responsible fiscal management. MORE...

Financial Titans: CSUF Students Crush Irvine Investment Challenge

Finance

2025-05-06 15:51:54

In an impressive display of financial acumen, Cal State Fullerton's Titan Capital Management team made waves at the inaugural Irvine Investment and Trading Group Stock Pitch Challenge. Students Mateo Garcia and Kishan Patel emerged victorious, outperforming an impressive field of 33 teams from 17 prestigious academic institutions across Southern California and North America. The high-stakes competition drew talented investment-focused students from top-tier universities, including powerhouse programs like Duke University. Garcia and Patel's exceptional stock pitch not only showcased their deep understanding of financial markets but also highlighted the exceptional training provided by Cal State Fullerton's College of Business and Economics. This groundbreaking event underscores the growing importance of practical investment skills in today's competitive academic and professional landscapes, providing students with a unique platform to demonstrate their strategic thinking and financial expertise. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421