Money Matters: 5 Genius Strategies to Reclaim Your Financial Peace in Chaotic Times

Finance

2025-05-01 09:00:51

The dawn of Donald Trump's second presidential term sent shockwaves through the economic landscape, fundamentally challenging long-held assumptions about the United States' financial ecosystem. In a whirlwind first 100 days, the administration unleashed a series of unprecedented policy shifts that left investors, business leaders, and everyday consumers scrambling to recalibrate their expectations. What emerged was a dramatically transformed economic narrative—one that defied conventional wisdom and rewrote the rulebooks of traditional economic strategy. From trade policies to regulatory frameworks, Trump's approach was anything but predictable. Wall Street watched with a mixture of anticipation and apprehension as sweeping changes reshaped investment strategies and market dynamics. Businesses found themselves navigating an entirely new terrain, forced to adapt quickly to rapidly evolving economic directives. Consumers, meanwhile, experienced direct and immediate impacts on everything from purchasing power to job market opportunities. The economic blueprint of the nation was being redrawn in real-time, with each policy announcement sending ripples through multiple sectors. These first 100 days were more than just a political transition—they represented a fundamental reimagining of how economic governance could look in a rapidly changing global landscape. The Trump administration had effectively turned economic expectations on their head, creating a new paradigm that would be studied and debated for years to come. MORE...

Green Hiring Hangover: Finance Chiefs Regret ESG Staffing Spree

Finance

2025-05-01 09:00:12

Financial institutions are dramatically shifting their approach to Environmental, Social, and Governance (ESG) hiring, signaling a significant strategic pivot from the enthusiastic recruitment surge of recent years. Top industry recruiters are witnessing a nuanced transformation as banks and investment firms recalibrate their ESG talent acquisition strategies. Where once companies aggressively expanded their ESG teams, believing these roles represented the future of corporate responsibility, they are now taking a more measured and strategic approach. The initial wave of expansive hiring has given way to a more selective and targeted recruitment process. Experts suggest this course correction stems from a combination of factors, including economic uncertainties, evolving regulatory landscapes, and a more pragmatic assessment of ESG's role in corporate strategy. Financial firms are now focusing on quality over quantity, seeking professionals who can deliver tangible value and measurable impact. This shift doesn't necessarily mean a retreat from ESG principles, but rather a more sophisticated and integrated approach to sustainable business practices. Companies are looking to embed ESG considerations more deeply into their core operations rather than treating them as a separate, standalone function. MORE...

Tourism Boom: Thailand Forecasts Record 36.5 Million International Visitors in 2024

Finance

2025-05-01 08:34:20

Thailand's tourism outlook has been adjusted downward, with the finance ministry revising its expectations for international visitor numbers in 2023. In a recent announcement, officials scaled back their projected foreign tourist arrivals from 38.5 million to 36.5 million, signaling potential challenges in the country's tourism recovery. The revised forecast reflects ongoing uncertainties in the global travel landscape, potentially stemming from economic fluctuations, travel restrictions, or changing tourist preferences. Despite the reduction, the new projection still represents a significant rebound for Thailand's tourism sector, which was severely impacted by the COVID-19 pandemic in recent years. This adjustment underscores the delicate nature of tourism forecasting and the continued adaptation required in the post-pandemic travel environment. The finance ministry's updated estimate provides a more conservative yet realistic view of Thailand's anticipated visitor numbers for the year. MORE...

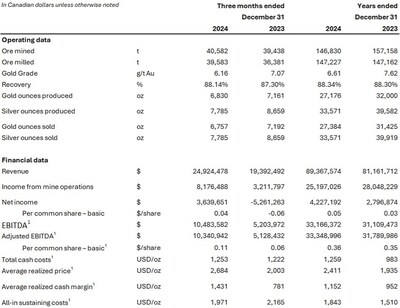

Soma Gold Unveils Stellar Financial Performance: Breaking Down 2024's Fiscal Triumph

Finance

2025-05-01 08:30:00

Soma Gold Corp. Releases Comprehensive Financial Reporting for 2023 and 2024 Soma Gold Corp. (TSXV: SOMA) is excited to announce the availability of its detailed financial documentation, providing investors and stakeholders with a transparent view of the company's financial performance. The comprehensive financial statements and Management's Discussion and Analysis (MD&A) for the fiscal years ending December 31, 2023, and 2024, are now accessible to the public. Investors can now review these critical financial documents through two convenient channels: 1. SEDAR+: The official platform for comprehensive corporate financial disclosures 2. Soma Gold Corp.'s official website: Offering direct access to the company's financial insights This release underscores Soma Gold Corp.'s commitment to transparency and timely communication with its shareholders and the investment community. MORE...

Open Finance Veteran Dan Murphy Joins FDATA North America as Strategic Consultant

Finance

2025-05-01 08:20:55

In a strategic move to advance Open Finance initiatives, FDATA North America and Allon Advocacy have brought on board Dan Murphy, a seasoned expert with an impressive background at the Consumer Financial Protection Bureau (CFPB). Murphy's extensive experience is expected to provide valuable insights and guidance on critical Open Finance policy matters. Murphy, who previously worked at the CFPB, brings a wealth of regulatory knowledge and deep understanding of financial technology landscapes. His appointment signals a significant step for both organizations in navigating the complex regulatory environment surrounding Open Finance and consumer financial data sharing. By leveraging Murphy's expertise, FDATA North America and Allon Advocacy aim to strengthen their advocacy efforts and contribute to the ongoing development of Open Finance frameworks that prioritize consumer protection and financial innovation. MORE...

Climate Crisis Funding: Why the Global South is Stepping Up Where Western Nations Falter

Finance

2025-05-01 08:15:00

In the face of reduced climate development funding from the United States and Europe, Chinese President Xi Jinping has made a bold commitment: China will not waver in its climate action efforts. Despite global economic challenges, Xi emphasized the nation's unwavering dedication to environmental progress and sustainable development. His declaration signals China's continued leadership in global climate initiatives, even as other major economies appear to be scaling back their investments and commitments. MORE...

Wall Street's Hidden Gem: Why Synchrony Financial Is Catching Investors' Eyes

Finance

2025-05-01 08:08:13

Diving Deep into Market Value: Synchrony Financial's Position Among Undervalued Stocks In our recent exploration of the most intriguing investment opportunities, we unveiled a comprehensive list of the 10 Lowest Price-to-Earnings (PE) Ratio Stocks within the S&P 500. Today, we turn our analytical lens to Synchrony Financial (NYSE:SYF) and its compelling standing among the market's most undervalued gems. The financial landscape has been particularly turbulent recently, with tech giants experiencing a seismic shift. The renowned Magnificent Seven tech stocks have witnessed a staggering $1.8 trillion evaporation in market capitalization, sending ripples of uncertainty through investor portfolios. Against this backdrop of market volatility, Synchrony Financial emerges as a potential beacon of value for discerning investors seeking opportunities in an unpredictable economic environment. Our in-depth analysis aims to shed light on its unique market positioning and potential for growth. Stay tuned as we unpack the nuances of Synchrony Financial's performance and its strategic place in the current investment ecosystem. MORE...

Breaking: Axos Financial Surges with Robust Loan Expansion in Q3, Signals Strategic Momentum

Finance

2025-05-01 07:19:28

Axos Financial Inc (AX) Demonstrates Strong Performance Amid Market Challenges Axos Financial has showcased impressive financial resilience, highlighting significant growth in key areas while strategically managing potential market headwinds. The company's latest financial report reveals a compelling narrative of expansion and strategic positioning. Net loan growth emerged as a standout performer, underscoring the bank's ability to effectively expand its lending portfolio. Simultaneously, the company reported a substantial increase in book value per share, signaling robust financial health and potential for future value creation. While celebrating these achievements, Axos Financial remains cognizant of ongoing challenges. The bank is carefully navigating complex market dynamics, particularly in net interest margin and operating expenses. Management appears committed to maintaining a balanced approach, optimizing operational efficiency without compromising growth potential. Investors and market analysts will likely view these results as a testament to Axos Financial's strategic adaptability and financial discipline. The company continues to demonstrate its capacity to generate value in an increasingly competitive banking landscape. As the financial sector evolves, Axos Financial stands poised to leverage its strengths and address potential market complexities with a proactive and measured approach. MORE...

TRTX Defies Market Headwinds: Robust Loan Portfolio Signals Resilient Q1 Performance

Finance

2025-05-01 07:11:48

TPG RE Finance Trust Inc (TRTX) Demonstrates Resilience and Strategic Growth in Challenging Market Landscape In a testament to its robust business model, TPG RE Finance Trust Inc has successfully navigated through complex global market conditions, delivering solid financial performance and strategic progress. The company has showcased remarkable adaptability and financial strength, standing out in an increasingly competitive real estate investment trust (REIT) sector. Despite widespread economic uncertainties, TRTX has maintained a strategic approach to its investment portfolio, leveraging its deep market expertise and proactive management strategies. The company's recent earnings report highlights its ability to generate consistent returns while implementing forward-thinking initiatives that position it for long-term success. Key highlights of TRTX's performance include: • Stable financial results that exceed market expectations • Strategic asset management and portfolio diversification • Continued focus on high-quality real estate investments • Effective risk mitigation strategies Investors and market analysts are increasingly optimistic about TPG RE Finance Trust's potential to continue delivering value in an evolving economic environment. The company's commitment to innovation and strategic growth remains a significant differentiator in the competitive real estate investment landscape. MORE...

Profits Surge: Company Breaks Records in First Quarter Earnings Report

Finance

2025-05-01 06:31:00

Spar Nord Delivers Strong Financial Performance in Early 2025 The Danish banking sector has witnessed a robust start to the year, with Spar Nord reporting an impressive profit after tax of 491 million Danish kroner and achieving a solid return on equity of 14.0%. Despite challenges in the current financial landscape, the bank has demonstrated resilience and strategic financial management. The bank's financial results reflect the complex interest rate environment, with a notable impact from declining interest rates. The reduced return on the bank's substantial excess liquidity has led to a moderate decrease in net interest income compared to the previous year. This adjustment in net interest income is the primary factor behind the 136 million kroner reduction in core income when compared to the same period last year. While the changing economic conditions present challenges, Spar Nord's strong performance underscores its ability to navigate market fluctuations and maintain financial stability. The bank's strategic approach and disciplined financial management continue to position it favorably in the competitive banking sector. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421