Trump's Latest Move: Will Women's Economic Freedom Take a Hit?

Finance

2025-04-24 18:05:38

In a significant move to address financial fairness, the White House has issued a groundbreaking executive order focusing on the Equal Credit Opportunity Act. Originally designed to combat sex-based credit discrimination, this latest directive aims to further strengthen protections for consumers seeking financial opportunities.

The executive order represents a critical step toward ensuring that individuals are not unfairly disadvantaged when applying for credit, loans, or other financial services based on their gender. By reinforcing the principles of the original legislation, the White House is sending a clear message about the importance of equitable access to financial resources.

This proactive approach highlights the ongoing commitment to eliminating discriminatory practices in the financial sector and promoting a more inclusive economic landscape. The order is expected to provide additional safeguards for consumers and create more transparent lending practices across various financial institutions.

MORE...

Profits Surge: C&F Financial Reveals Strong Q1 Earnings Performance

Finance

2025-04-24 18:00:00

C&F Financial Corporation Delivers Strong First Quarter Performance in 2025

TOANO, Va. - C&F Financial Corporation (NASDAQ: CFFI) announced today a robust financial performance for the first quarter of 2025, showcasing significant growth in consolidated net income. The regional banking leader reported a substantial increase in earnings, with net income rising to $5.4 million, compared to $3.4 million in the same period last year.

Financial Highlights

| Financial Metric |

Q1 2025 |

Q1 2024 |

| Consolidated Net Income (in thousands) |

$5,400 |

$3,400 |

The impressive year-over-year growth reflects the bank's strategic initiatives and strong market positioning. Investors and stakeholders can look forward to continued momentum as C&F Financial Corporation maintains its commitment to delivering value and financial excellence.

MORE...

Breaking: Flashy Finance Seals Landmark Infrastructure Partnership with Gaming Titan Good Game Group

Finance

2025-04-24 17:50:00

Web3-Native Finance Platform Expands Creator Ecosystem with Social Audio and Gaming Acquisitions

San Francisco, CA, April 24, 2025 (GLOBE NEWSWIRE)

Flashy Finance, the emerging financial infrastructure layer for internet-native culture and creator economies, announced a major expansion of its ecosystem. The company has completed two strategic acquisitions and entered into a global infrastructure licensing partnership with Good Game G. to enhance its platform's capabilities and reach.

Key Highlights:

- Strategic acquisitions in social audio and gaming sectors

- Global infrastructure licensing partnership established

- Aim to power a more interactive and engaging creator economy

The acquisitions and partnership are designed to create a more fluent and interactive experience for creators and fans, positioning Flashy Finance at the forefront of Web3-native financial platforms.

MORE...

Trade War Tensions Escalate: Beijing Strikes Back as Trump Signals Breakthrough in Negotiations

Finance

2025-04-24 17:17:12

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...

Transatlantic Trade Tensions: Germany's Finance Chief Signals Diplomatic Hope Over U.S. Tariff Standoff

Finance

2025-04-24 17:11:06

Despite the tensions created by President Donald Trump's controversial tariff policies, the transatlantic bond between Europe and the United States remains resilient. Joerg Kukies, the acting German finance minister, emphasized that the fundamental trust between the two economic powerhouses has not been fundamentally undermined.

In a statement that signals diplomatic optimism, Kukies suggested that while trade disagreements have strained relations, the deep-rooted strategic partnership between Europe and the U.S. continues to withstand current challenges. His remarks underscore a commitment to maintaining constructive dialogue and economic cooperation, even in the face of significant policy differences.

The finance minister's comments reflect a nuanced approach to international relations, acknowledging tensions while simultaneously working to preserve the long-standing alliance between Europe and the United States. This diplomatic stance highlights the importance of maintaining open communication and seeking common ground, even during periods of economic and political friction.

MORE...

Wall Street's Winning Streak: Tech Surge Propels Markets to Triple-Day Triumph

Finance

2025-04-24 16:47:06

Wall Street experienced a positive surge today, with U.S. stocks climbing higher as investors grew increasingly optimistic about potential trade negotiations between the United States and China. The market's upbeat mood was fueled by emerging signals suggesting that President Trump is actively pursuing a comprehensive trade agreement with Beijing.

Investors closely monitored the latest developments, sensing a potential breakthrough in the ongoing trade tensions. The market's enthusiasm reflected growing hopes that diplomatic efforts might soon lead to a meaningful resolution between the world's two largest economies. Traders and analysts alike interpreted the day's momentum as a promising sign of potential economic cooperation and reduced international trade barriers.

The stock market's resilience demonstrated investors' cautious optimism, with key indices responding positively to the hints of potential diplomatic progress. As negotiations continue, market participants remain hopeful that a balanced and mutually beneficial trade deal could be on the horizon.

MORE...

Breaking Barriers: How Blended Finance is Reshaping Global Investment Strategies

Finance

2025-04-24 16:46:06

A groundbreaking analysis by British International Investment (BII) and Boston Consulting Group (BCG) has emerged as a significant milestone in the evolving landscape of blended finance. This collaborative research provides critical insights into how strategic financial approaches can drive sustainable development and economic growth in emerging markets.

The study offers a comprehensive examination of blended finance mechanisms, highlighting their potential to unlock substantial private capital and address complex developmental challenges. By combining public and private funding sources, this innovative approach demonstrates remarkable potential for creating meaningful economic impact where traditional investment models have fallen short.

Key findings from the research underscore the transformative power of blended finance in mobilizing critical resources for sectors ranging from infrastructure and renewable energy to healthcare and education. The analysis not only validates the effectiveness of this financial strategy but also provides a robust framework for future investment decisions.

Experts from BII and BCG have meticulously mapped out the strategic opportunities and potential challenges, offering stakeholders a nuanced understanding of how blended finance can serve as a powerful tool for sustainable economic development. This research represents a crucial step forward in reimagining financial solutions for global challenges.

MORE...

Financial Mastermind: Andy Steers John Lewis Partnership Towards Strategic Growth

Finance

2025-04-24 16:43:23

Andy Mounsey has been skillfully navigating an interim leadership role since the latter part of 2024, bringing dynamic expertise and strategic vision to his current position. His temporary appointment has been marked by a commitment to excellence and a proactive approach to organizational management. Throughout this interim period, Mounsey has demonstrated remarkable adaptability and leadership capabilities, effectively bridging critical operational gaps and maintaining organizational momentum.

The interim role has allowed Mounsey to showcase his professional versatility and deep understanding of the organization's core objectives. His temporary stewardship has been characterized by innovative problem-solving and a keen ability to drive forward-thinking initiatives, despite the inherent challenges of an interim leadership position.

As he continues to serve in this capacity, Mounsey remains focused on delivering strategic outcomes and ensuring organizational stability during this transitional period. His dedication and professional acumen have been instrumental in maintaining continuity and progress within the organization.

MORE...

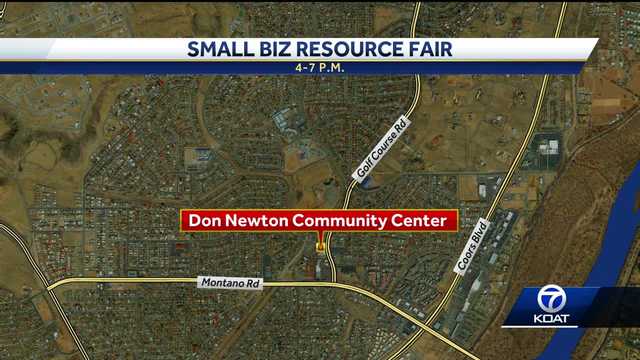

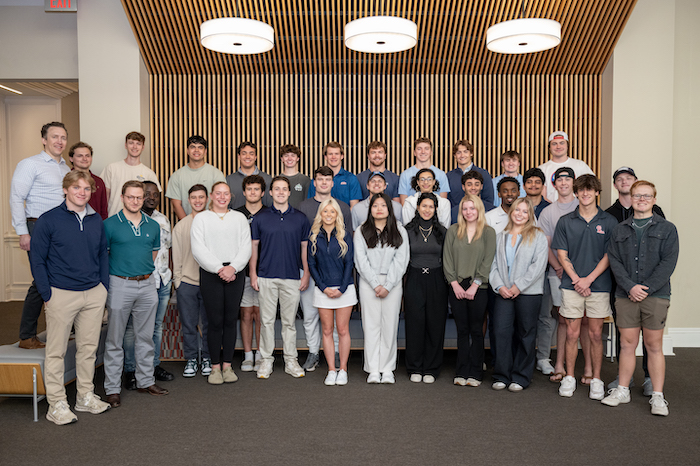

Future Finance Leaders: Campus Workshop Transforms Student Skills

Finance

2025-04-24 16:41:27

Finance Students Gain Insider Insights at Wall Street Prep Seminar

Aspiring financial professionals at the University of Mississippi's School of Business Administration recently took a significant step towards career success by participating in the fourth annual Wall Street Prep Seminar. On April 11th, the event brought industry experts directly to campus, offering students an invaluable opportunity to bridge the gap between academic learning and real-world financial expertise.

The seminar featured seasoned finance professionals who shared their practical knowledge, providing students with a rare glimpse into the inner workings of the financial world. Attendees from finance and related programs had the chance to learn cutting-edge strategies, network with industry leaders, and gain critical insights that extend far beyond traditional classroom instruction.

By connecting students with top-tier financial professionals, the Wall Street Prep Seminar continues to be a cornerstone event for those looking to jumpstart their careers in finance, investment, and business strategy.

MORE...

Homebuyers Rejoice: Mortgage Rates Dip in Surprise Weekly Shift

Finance

2025-04-24 16:34:18

Mortgage Rates Dip Amid Market Turbulence: What Homebuyers Need to Know

In a surprising turn of events, mortgage rates have softened this week, defying the market's volatile landscape shaped by ongoing trade tensions and shifting interest rate dynamics. Yahoo Finance Senior Reporter Claire Boston provides an insightful breakdown of the latest financial trends and emerging real estate data.

New research from Redfin reveals a compelling narrative: home prices are experiencing a decline in 11 major metropolitan areas across the United States. This trend offers potential opportunities for prospective homebuyers navigating the current real estate market.

Boston's expert analysis sheds light on the nuanced factors influencing mortgage rates and housing prices, providing valuable context for investors and homeowners alike. The fluctuating economic environment continues to create both challenges and opportunities in the real estate sector.

For more in-depth market insights and expert commentary, viewers are encouraged to explore additional coverage on Wealth, where comprehensive financial analysis awaits.

MORE...