Urban Resurrection: South Africa's Bold Bid to Tap Development Finance Powerhouses

Finance

2025-04-04 05:00:00

South Africa is embarking on an ambitious urban transformation journey, leveraging international financial support to breathe new life into its deteriorating cities. With a substantial $1 billion loan already secured from the World Bank, the nation is now actively pursuing additional funding from leading global development finance institutions to accelerate its urban regeneration efforts. The country's strategic approach aims to revitalize urban landscapes, addressing infrastructure challenges and creating more vibrant, sustainable metropolitan areas. By seeking comprehensive financial backing from top-tier international development organizations, South Africa demonstrates its commitment to comprehensive urban renewal and economic revitalization. This proactive initiative signals a significant step towards modernizing urban environments, potentially attracting further investment and improving living conditions for millions of residents across the nation's key metropolitan regions. MORE...

Climate Ambitions Hanging by a Thread: Developing Nations Demand Global Financial Lifeline

Finance

2025-04-04 04:52:06

Climate Action Hangs in the Balance: Developing Nations Demand Financial Support The path to achieving global climate targets is fraught with challenges, particularly for developing countries that are increasingly vulnerable to the impacts of climate change. A critical turning point has emerged, with nations like India emphasizing that meaningful progress hinges on robust financial commitments from developed countries. At the heart of the matter lies a stark reality: developing economies cannot effectively combat climate change without substantial and reliable funding from the Global North. This year's UN climate conference will serve as a pivotal moment, with the success of international climate negotiations fundamentally dependent on whether wealthy nations will honor their financial pledges. The stakes are incredibly high. Developing countries require significant resources to transition to green technologies, adapt to changing environmental conditions, and mitigate the severe consequences of global warming. Without adequate financial support, these nations risk being left behind in the global fight against climate change. As the international community prepares for crucial climate discussions, the message is clear: genuine collaboration and financial solidarity are essential. The commitment of developed countries to support emerging economies will not only determine the success of climate targets but also demonstrate a genuine global commitment to addressing one of the most pressing challenges of our time. MORE...

Market Rollercoaster: Expert Warns Oklahoma Investors to Stay Calm Amid Stock Slide

Finance

2025-04-04 03:00:13

In a dramatic market shake-up, the Dow Jones Industrial Average plummeted by a staggering 1,679 points, sending shockwaves through the financial landscape. The sharp decline comes in direct response to new tariffs announced by the Trump administration, triggering widespread investor concern. Despite the market's turbulent performance, local financial experts are urging calm. An Oklahoma-based financial strategist is offering reassuring advice to residents, emphasizing the importance of maintaining a level-headed approach during market volatility. The strategist warns against knee-jerk reactions, reminding investors that market fluctuations are a natural part of economic cycles. While the sudden drop may seem alarming, prudent investors should focus on long-term financial goals rather than making impulsive decisions based on short-term market movements. Oklahomans are advised to review their investment portfolios, consult with financial advisors, and remain patient as the market navigates through these uncertain times. The key message is clear: don't panic, stay informed, and make calculated financial decisions. MORE...

Breaking: Troy Finance Panel Clears Path for Affordable Housing Boost

Finance

2025-04-04 02:56:03

In a proactive move to tackle housing challenges, Troy's finance committee convened on Thursday to address critical urban development issues. The committee unanimously approved several key resolutions aimed at revitalizing the city's housing landscape, with a particular focus on improving deteriorating residential properties. A significant point of discussion was the John P. Taylor Apartments, a complex that has long been in need of substantial renovation and care. Committee members expressed their commitment to transforming these aging buildings and enhancing living conditions for residents. The proposed resolutions signal a strategic approach to urban renewal, demonstrating the city's dedication to creating safer, more sustainable housing options for Troy's residents. By targeting specific degrading structures, the finance committee hopes to not only improve individual properties but also contribute to the broader community's quality of life. This initiative represents a promising step forward in Troy's ongoing efforts to address housing challenges and promote urban development. MORE...

Trade War Tremors: Expert Reveals Survival Guide for Investors in Turbulent Economic Landscape

Finance

2025-04-04 01:02:17

Wall Street Trembles: Market Plunges as Trade Tensions Escalate In a dramatic turn of events, the Dow Jones Industrial Average experienced a steep decline of over 3% on April 3, sending shockwaves through the financial markets. The sharp downturn came on the heels of President Donald Trump's announcement of aggressive new tariffs, sparking widespread concern among investors and business leaders. Financial experts are now scrambling to provide guidance for investors navigating these turbulent economic waters. The sudden market volatility has left many businesses on edge, with executives expressing growing anxiety about the potential long-term implications of the escalating trade tensions. As uncertainty looms, investors and business owners are closely monitoring the situation, seeking strategies to protect their assets and mitigate potential economic risks. The unexpected market movement serves as a stark reminder of the delicate balance of global trade and the profound impact of political decisions on financial markets. MORE...

Market Mayhem: The Counterintuitive 401(k) Strategy Experts Swear By

Finance

2025-04-04 00:36:48

In the midst of President Donald Trump's aggressive trade tariffs causing waves of uncertainty in financial markets, personal finance experts are offering crucial advice to investors: stay calm and resist the urge to make impulsive decisions about your retirement savings. The current economic volatility can trigger anxiety, especially when it comes to your 401(k) retirement account. However, financial professionals strongly recommend against immediately checking your investment portfolio or making hasty financial moves that could potentially harm your long-term financial strategy. Market fluctuations are a natural part of investing, and knee-jerk reactions often lead to poor financial choices. Instead, experts suggest maintaining a steady, disciplined approach to your retirement investments. This means keeping a long-term perspective and avoiding emotional responses to short-term market turbulence. Remember, your 401(k) is designed as a long-term investment vehicle. Temporary market disruptions should not derail your carefully planned retirement strategy. Take a deep breath, consult with a financial advisor if needed, and trust in the resilience of your diversified investment portfolio. MORE...

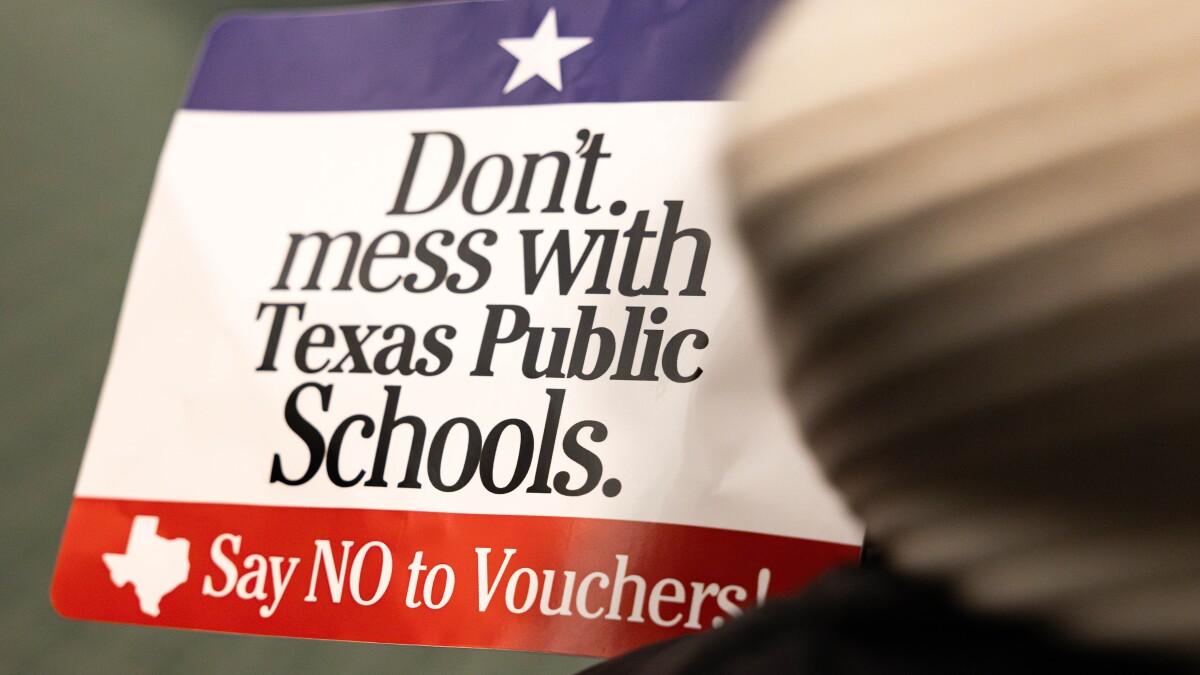

Texas Education Funding Showdown: Voucher Plan Advances in House Battle

Finance

2025-04-04 00:23:17

In a significant move for education reform, the Texas House Public Education Committee has advanced a groundbreaking school finance proposal that could reshape the state's educational landscape. Alongside this sweeping financial overhaul, the committee also approved a controversial measure that would establish a program enabling parents to redirect public education funds toward private school tuition. The proposed legislation represents a potentially transformative approach to school funding and parental educational choice. By allowing families to use public funds for private school education, the bill aims to provide more flexibility and options for Texas parents seeking alternative educational paths for their children. This development signals a potentially major shift in how educational resources are allocated and highlights the ongoing debate about school choice and public education funding in Texas. The committee's actions suggest a willingness to explore innovative approaches to addressing the diverse educational needs of students across the state. As the proposal moves forward, it is likely to spark intense discussion among educators, policymakers, and parents about the potential impacts on public and private education systems. MORE...

Budget Battles: Inside Washington's High-Stakes Financial Showdown

Finance

2025-04-04 00:00:00

In a promising start to the new year, the Washington County Commission convened its inaugural finance meeting on Wednesday morning, diving deep into a comprehensive review of the previous year's financial performance. County Auditor Matthew Livengood took center stage, presenting detailed financial reports that offered a transparent look into the county's fiscal health. Livengood's presentation meticulously broke down the county's financial landscape, highlighting key metrics including the overall balance, revenue streams, and sales tax collections. The auditor's treasure balance report provided commissioners and attendees with a clear snapshot of the county's economic standing, revealing critical insights into its financial stability and potential future investments. The meeting marked an important moment of fiscal reflection and forward-planning, demonstrating the commission's commitment to transparent and responsible financial management. By carefully examining the previous year's financial data, county leaders are positioning themselves to make informed decisions that will benefit the community in the coming months. MORE...

Tariff Tango: Expert Tips to Shield Your Finances from Trump-Era Trade Tensions

Finance

2025-04-03 23:55:18

Michelle Singletary Joins The Lead: A Financial Journalism Powerhouse

CNN is thrilled to announce the addition of Michelle Singletary, a renowned financial columnist and expert, to the dynamic team of The Lead. With her extensive experience and insightful commentary, Singletary brings a wealth of knowledge in personal finance and economic reporting.

As a highly respected voice in financial journalism, Singletary has built a remarkable reputation through her syndicated column "The Color of Money" in The Washington Post. Her work has consistently provided practical, accessible financial advice to millions of readers, helping them navigate complex economic landscapes.

Her joining The Lead represents a significant enhancement to the program's financial coverage, promising viewers more in-depth, nuanced analysis of economic trends and personal finance strategies. Singletary's unique ability to break down complex financial concepts into understandable insights will be a valuable asset to the show's audience.

Viewers can look forward to Singletary's expert perspectives, practical advice, and engaging storytelling as she becomes an integral part of The Lead's reporting team.

MORE...Market Tremors: Trump Tariff Shock Sends Wall Street into Uncertain Trading Day

Finance

2025-04-03 23:47:27

Wall Street braced for volatility as stock futures tumbled following President Trump's unexpected announcement of sweeping reciprocal tariffs, triggering immediate market turbulence. The dramatic declaration sent shockwaves through financial markets, causing investors to quickly reassess their positions and brace for potential economic repercussions. Traders and analysts watched nervously as the futures market reflected growing uncertainty, with major indices showing significant downward pressure. The sudden tariff announcement threatened to disrupt carefully balanced international trade relationships and sparked concerns about potential economic retaliation from global trading partners. Investors scrambled to understand the full implications of the proposed tariffs, with many moving to protect their portfolios from potential market volatility. The unexpected policy shift underscored the ongoing tensions in global trade and highlighted the potential for rapid market shifts in an increasingly unpredictable economic landscape. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421