Banking Boom: European Lenders Ride Highest Wave of Success Since 2008 Crash

Finance

2025-03-28 08:03:08

European Banking Stocks Continue Remarkable Surge in 2023

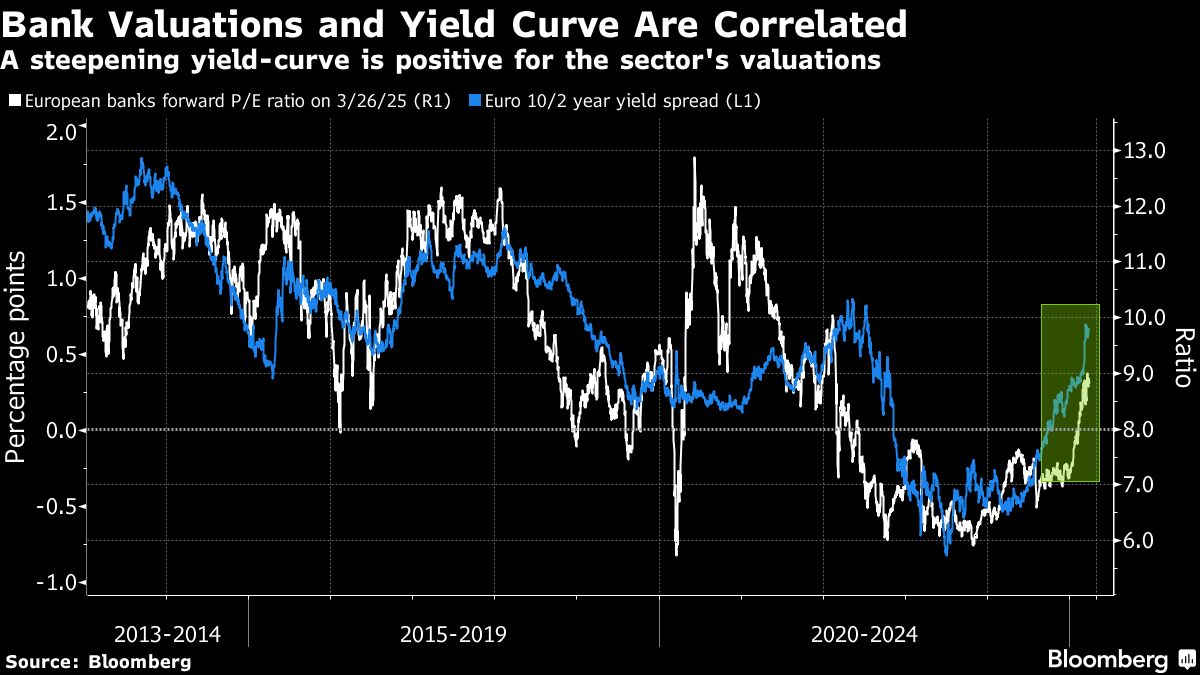

European banking stocks are experiencing an extraordinary rally that shows no signs of slowing down, marking one of the most impressive financial performances in recent years. The Stoxx 600 Banks Index has delivered a stunning 25% increase in 2023, representing its strongest quarterly performance since 2020.

This remarkable growth reflects renewed investor confidence in the European banking sector, driven by improving economic conditions, strategic restructuring, and potential interest rate increases. Financial institutions across the continent are demonstrating resilience and adaptability in a complex economic landscape.

Investors and market analysts are closely watching this trend, seeing it as a potential indicator of broader economic recovery and stability in European financial markets. The sustained momentum suggests that banks have successfully navigated challenging post-pandemic conditions and are positioning themselves for future growth.

Key factors contributing to this impressive rally include:

- Improved banking sector profitability

- Stronger capital reserves

- Positive economic outlook

- Potential for higher interest rates

As the year progresses, market experts will be monitoring whether this exceptional performance can be maintained and what implications it might have for the broader European economic landscape.

MORE...Unicorn Powerhouse: Inside Innovate Finance's Bold Vision for Embedded Finance Revolution

Finance

2025-03-28 08:00:00

YouLend Elevates Embedded Finance Strategy with Innovate Finance Unicorn Council Membership In a strategic move that underscores its commitment to transforming small business financing, YouLend has welcomed its Chief Commercial Officer to the prestigious Innovate Finance Unicorn Council. This milestone represents a significant step in the company's mission to revolutionize embedded financial solutions for emerging enterprises. The council membership signals YouLend's growing influence in the global financial technology landscape, highlighting the company's innovative approach to providing scalable, accessible financing options. By joining this elite group, YouLend reinforces its dedication to driving meaningful change in how small businesses access critical financial resources. With an unwavering focus on developing cutting-edge embedded finance solutions, YouLend is perfectly positioned to meet the increasing global demand for flexible, technology-driven financial services. The company's strategic vision continues to push boundaries, offering small businesses unprecedented opportunities for growth and financial empowerment. As the financial technology sector evolves, YouLend remains at the forefront, committed to delivering transformative solutions that support entrepreneurial success and economic resilience. MORE...

Wall Street Pulse: Spero Therapeutics Confronts Financial Headwinds in Q4 Earnings Reveal

Finance

2025-03-28 07:03:38

Spero Therapeutics Inc (SPRO) Navigates Challenging Financial Landscape While Pushing Forward with Promising Antibiotic Innovation Spero Therapeutics has reported a notable decline in revenue, yet remains steadfast in its commitment to advancing medical innovation. The company's strategic focus continues to center on its lead product candidate, tebipenem HBr, which is currently progressing through a critical Phase 3 clinical trial. Despite the financial headwinds, management remains optimistic about the potential of tebipenem HBr to address significant unmet medical needs in antibiotic treatment. The ongoing pivotal trial represents a key milestone in the company's development pipeline, showcasing Spero's resilience and dedication to breakthrough therapeutic solutions. Investors and healthcare professionals are closely watching the progress of this promising antibiotic candidate, which could potentially offer new hope in combating challenging bacterial infections. The company's ability to maintain forward momentum during challenging financial periods underscores its strategic vision and scientific expertise. As Spero Therapeutics continues to navigate the complex pharmaceutical landscape, the advancement of tebipenem HBr remains a beacon of potential breakthrough in antibiotic research and development. MORE...

Unlock Financial Freedom: The Salary Sacrifice Hack That Boosts Your Retirement and Income

Finance

2025-03-28 06:00:31

Salary Sacrifice: The Smart Financial Strategy Boosting Retirement Savings

In a revealing episode of Yahoo Finance Future Focus, host Brian McGleenon delves into the world of salary sacrifice with Susan Hope, a Workplace Savings Specialist from Scottish Widows. Contrary to its intimidating name, salary sacrifice isn't about taking a pay cut—it's a strategic financial maneuver that can actually enhance your take-home pay and supercharge your retirement savings.

Hope breaks down the mechanics of salary exchange, revealing a clever approach that allows employees to redirect a portion of their pre-tax salary directly into their pension. The magic happens in the tax calculations: by reducing taxable income, employees can simultaneously lower their National Insurance contributions while potentially increasing their overall financial wellness.

The strategy offers remarkable flexibility. Employees can choose to either reinvest their savings for immediate financial benefit or channel funds into growing their pension pot over time. However, Hope cautions that this approach isn't universal—it may not be ideal for workers earning near the national living wage.

For eligible participants, the advantages extend far beyond simple pension growth. The salary sacrifice method can lead to reduced student loan repayments, enhanced tax relief, and a more strategic approach to personal finance.

Employers also stand to gain significantly. By implementing salary sacrifice, companies can reduce their National Insurance costs and potentially improve workforce retention by demonstrating a commitment to employee financial health.

In an era of rising living costs and economic uncertainty, salary sacrifice emerges as a sophisticated financial tool—a win-win strategy that promises benefits for both employees and employers alike.

MORE...Breakthrough Allergy Treatment: DBV Technologies Secures $306.9M to Revolutionize Peanut Patch Therapy

Finance

2025-03-28 02:30:00

DBV Technologies Secures Substantial Financing to Propel Viaskin® Peanut Patch Toward FDA Approval

In a significant milestone for allergy treatment innovation, DBV Technologies has announced a groundbreaking financing arrangement that will provide up to $306.9 million (€284.5 million) to advance its promising Viaskin® Peanut Patch through the critical stages of regulatory approval and potential commercial launch.

The comprehensive financing package includes an immediate up-front investment of $125.5 million (€116.3 million), with the potential to secure an additional $181.4 million (€168.2 million) contingent upon the full exercise of warrants. This strategic funding ensures that DBV Technologies is comprehensively resourced to complete its Biologics License Application (BLA) submission to the Food and Drug Administration (FDA).

This financial breakthrough positions DBV Technologies to potentially revolutionize peanut allergy treatment, bringing hope to millions of patients who struggle with this challenging condition. The company remains committed to advancing its innovative therapeutic approach through rigorous regulatory processes.

MORE...Cannabis Startup Canadabis Boosts Financing Haul to $4.5M in Strategic Funding Surge

Finance

2025-03-27 23:41:00

CanadaBis Capital Inc. Expands Investment Opportunity with Increased Convertible Debenture Offering CanadaBis Capital Inc. (TSXV: CANB) is excited to announce a significant expansion of its previously announced brokered private placement, responding to overwhelming investor enthusiasm. The company has now increased its offering to up to 4,500 unsecured convertible debentures, priced at $1,000 each, potentially generating gross proceeds of up to $4.5 million. Driven by strong market interest, this enhanced financing round represents a strategic move by CanadaBis to capitalize on current investor appetite. Research Capital Corporation has been appointed as the sole agent and bookrunner for this promising financial initiative, underlining the offering's credibility and potential. The increased allocation demonstrates CanadaBis's confidence in its financial strategy and ability to attract robust investor support in the current market landscape. MORE...

Social Security's Hidden Truth: What This Financial Guru Wants You to Understand About Taxes

Finance

2025-03-27 22:41:20

When the organization first launched in 1935, the world looked dramatically different. "Back then, the average life expectancy hovered around the mid-60s," explained Masserant. "Today, we've seen a remarkable transformation, with life expectancy now reaching the mid-80s." This significant increase reflects not just medical advancements, but also profound changes in healthcare, nutrition, and overall quality of life over the past eight decades. MORE...

Latin American Growth Surge: CAF Unleashes $1.45 Billion Development Boost

Finance

2025-03-27 21:56:00

As a dynamic development bank, we represent a powerful collaborative effort spanning 20 shareholder countries across Latin America, the Caribbean, Spain, and Portugal. Our unique financial ecosystem is further strengthened by the strategic participation of 13 private banking partners, creating a robust network dedicated to driving economic growth and sustainable development in our regions. MORE...

Financial Fiasco: NC Central's $45 Million Accounting Maze Unraveled

Finance

2025-03-27 21:31:30

In response to the recent investigative report, North Carolina Central University (NCCU) leadership has taken a proactive stance. University officials openly acknowledged the report's findings and expressed a strong commitment to enhancing institutional transparency and accountability. The administration pledged to implement comprehensive improvements in resource management, demonstrating their dedication to addressing the concerns raised in the comprehensive review. By embracing these recommendations, NCCU aims to strengthen its operational integrity and rebuild trust within the academic community. Leadership emphasized that moving forward, they will prioritize clear communication, rigorous financial oversight, and ethical governance. This commitment signals a significant turning point for the institution, reflecting a genuine desire to learn from past challenges and create a more robust and responsible organizational framework. The university's willingness to confront the report's insights head-on underscores its commitment to continuous improvement and maintaining the highest standards of institutional excellence. MORE...

Wall Street Showdown: Robinhood Challenges Banking Giants in High-Stakes Financial Duel

Finance

2025-03-27 21:30:31

Robinhood's Vlad Tenev is setting his sights on disrupting traditional banking, bringing the same innovative spirit that revolutionized stock trading to the world of personal finance. The company's co-founder and CEO is looking to expand Robinhood's reach beyond its popular trading platform, targeting customers who have long been underserved by conventional banking institutions. Leveraging the company's tech-driven approach, Tenev aims to create a more accessible and user-friendly banking experience that resonates with younger, digitally-savvy consumers. This strategic move comes as Robinhood continues to seek new ways to grow and diversify its financial services offerings. The initiative represents a bold next step for the fintech company, which has already transformed how millions of people approach investing. By challenging traditional banking models, Robinhood hopes to provide more transparent, affordable, and intuitive financial solutions that appeal to a new generation of customers looking for alternatives to legacy banking systems. While details are still emerging, the move signals Robinhood's ambition to become a comprehensive financial platform that goes far beyond its original stock trading roots. Tenev's vision appears to be creating a more integrated and user-friendly approach to personal finance that could potentially reshape how people manage their money. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421