Green Finance Revolution: BTG Pactual's Groundbreaking Sustainability Loan Clinches Top Global Honor

Finance

2025-04-14 11:45:00

In a groundbreaking achievement, BTG Pactual Timberland Investment Group (BTG Pactual TIG) has been honored with Environmental Finance's 2025 Sustainability-Linked Loan of the Year award. The prestigious recognition highlights a collaborative effort between BTG Pactual TIG, Conservation International, and the International Finance Corporation (IFC). The award celebrates an innovative financing approach that strategically links financial incentives to sustainable reforestation efforts across Latin America. Conservation International played a crucial role as the impact adviser for this transformative project, helping to design a loan package that promotes environmental restoration and economic development. The IFC's loan package represents a pioneering model in sustainable finance, demonstrating how financial institutions can drive meaningful environmental change while supporting economic growth in the region. By creating a direct connection between financial performance and ecological impact, this initiative sets a new standard for sustainability-driven investments. This recognition underscores the growing importance of innovative financial mechanisms that prioritize environmental sustainability and support large-scale conservation efforts in Latin America. MORE...

Mortgage Tech Innovator Slashes $530M in Debt, Unlocks $265M in AI-Powered Growth Strategy

Finance

2025-04-14 11:30:00

Better Home & Finance Holding Company (NASDAQ: BETR; BETRW) Announces Significant Debt Restructuring, Streamlining Financial Position In a strategic financial maneuver, Better.com, the innovative AI-powered home finance leader, has successfully negotiated a comprehensive debt restructuring that will substantially improve its balance sheet. The company, which has already distinguished itself by funding over $100 billion in mortgages through its cutting-edge Tinman™ AI platform, has reached an agreement with its lender to retire approximately $530 million in outstanding convertible notes. The restructuring deal involves a carefully crafted transaction that includes a one-time cash payment of $110 million and the issuance of $155 million in new senior secured debt. This strategic approach demonstrates Better.com's commitment to financial optimization and long-term stability in the competitive home finance market. By proactively managing its debt structure, Better.com continues to showcase its financial agility and forward-thinking approach to corporate finance, positioning itself for continued growth and innovation in the AI-driven home lending landscape. MORE...

Breaking Ground: Inside Ohio's Agricultural Economic Landscape

Finance

2025-04-14 11:00:45

Navigating Agricultural Finance: Insights from Ohio Farm Bureau Podcast Join us for an illuminating discussion on the current agricultural lending landscape as experts from Ag Credit dive deep into the financial challenges facing farmers in 2025. This must-listen podcast provides a comprehensive look at how economic conditions are reshaping agricultural financing and impacting farmers across Ohio. Our featured guests will unpack the complex financial terrain that borrowers are currently navigating, offering critical insights into: • Current lending trends • Economic pressures affecting agricultural credit • Strategies for financial resilience • The broader impact on Ohio's farming community Whether you're a seasoned farmer, an agricultural professional, or simply interested in understanding the economic pulse of rural Ohio, this podcast promises to deliver valuable perspectives on the state of agriculture and its financial ecosystem. Tune in to gain expert knowledge, understand emerging challenges, and discover how the Ohio Farm Bureau is supporting farmers through these dynamic economic times. MORE...

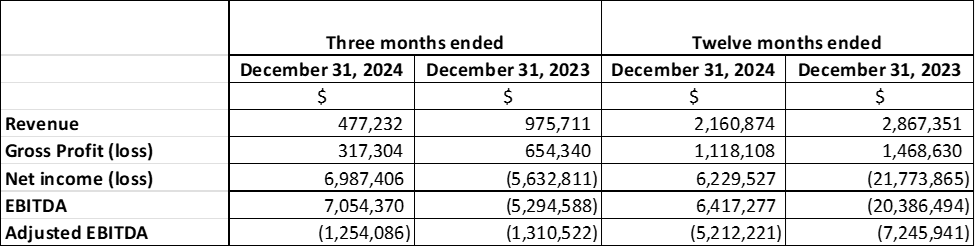

Breaking: AmeriTrust Reveals Robust Financial Performance in 2024 Annual Report

Finance

2025-04-14 11:00:00

Toronto, Ontario - AmeriTrust Financial Technologies Inc. (TSXV:AMT, OTCQB:AMTFF, Frankfurt:1ZVA) is making significant strides in the automotive finance technology sector today. The innovative fintech company has officially filed critical documentation that signals an important strategic move in its ongoing mission to transform automotive financial services. As a leading platform specializing in cutting-edge automotive finance solutions, AmeriTrust continues to demonstrate its commitment to innovation and market leadership. The recent filing represents another milestone in the company's ambitious growth strategy, positioning itself at the forefront of financial technology disruption. Investors and industry observers are closely watching the company's progressive developments, recognizing AmeriTrust's potential to reshape how automotive financing is approached in today's rapidly evolving digital landscape. The company remains dedicated to leveraging advanced technological platforms to create more efficient, transparent, and accessible financial services for automotive consumers and businesses alike. Further details about this strategic filing will be communicated in subsequent official announcements from the company's leadership team. MORE...

Wells Fargo's Q1 Earnings: Lending Resilience Meets Equipment Finance Headwinds

Finance

2025-04-14 10:29:49

Wells Fargo Navigates Challenging Financial Waters with Resilient Q1 Performance In a revealing first-quarter financial snapshot, Wells Fargo demonstrated remarkable stability amid a complex economic environment, with earnings holding steady while equipment finance lending shows signs of measured caution. The bank's latest results underscore the nuanced challenges facing the financial sector as economic uncertainties continue to shape lending strategies. The quarter's performance highlights a strategic approach to lending, with Wells Fargo adopting a more conservative stance in equipment finance. This measured approach reflects broader market uncertainties, including fluctuating interest rates, economic volatility, and shifting business investment landscapes. While earnings remained robust, the softer loan growth signals a prudent risk management strategy. Financial analysts interpret this approach as a calculated response to the current economic climate, where businesses are increasingly deliberate about capital investments and expansion plans. The bank's ability to maintain steady earnings despite constrained loan growth demonstrates its financial resilience and adaptive capabilities. Investors and market watchers are closely monitoring how Wells Fargo will continue to navigate these challenging financial currents in the coming quarters. As the economic landscape evolves, Wells Fargo's Q1 results provide a compelling glimpse into the delicate balance between maintaining financial strength and responding to market dynamics. MORE...

The Invisible Hand: How Adam Smith's Ideas Still Shape Global Economics and Power

Finance

2025-04-14 10:00:08

Adam Smith, the pioneering economist of the 18th century, revolutionized our understanding of economic systems through his groundbreaking concept of the "invisible hand." This powerful metaphor wasn't just an abstract economic theory, but a profound insight into how markets naturally self-regulate and create prosperity. Smith's vision went beyond simple economic transactions. He proposed that individual self-interest, when channeled through free markets, could paradoxically benefit society as a whole. Entrepreneurs and traders, each pursuing their own goals, would inadvertently contribute to the greater economic good - as if guided by an unseen force. The "invisible hand" suggests that market participants, driven by personal motivation, create a complex and dynamic economic ecosystem. Without centralized control, these individual actions collectively generate wealth, distribute resources, and drive innovation. It's a concept that transformed economic thinking, emphasizing the power of individual choice and voluntary exchange. While Smith's metaphor might sound almost mystical, it represents a rational explanation of how free markets can efficiently allocate resources and create economic value. His insights continue to influence economic policy and understanding to this day, making him a foundational figure in modern economic thought. MORE...

Warren Buffett's Secret Vault: 3 Stocks That Could Turn $3,000 into a Lifetime of Wealth

Finance

2025-04-14 09:41:00

In the dynamic world of financial investments, three standout companies have consistently demonstrated strong potential for long-term growth: Ally Financial, Moody's, and Visa. These industry leaders offer investors compelling opportunities across different sectors of the financial landscape. Ally Financial stands out as a robust financial services powerhouse, with a strategic focus on digital banking and innovative consumer solutions. The company has successfully transformed its business model, leveraging technology to create seamless customer experiences and drive sustainable revenue growth. Moody's Corporation brings unparalleled expertise in financial analytics and risk assessment. As a global leader in credit ratings and financial intelligence, the company provides critical insights that investors and businesses rely on. Its consistent performance and essential role in global financial markets make it an attractive long-term investment option. Visa continues to dominate the global payments ecosystem, benefiting from the ongoing digital transformation of financial transactions. With its extensive network and strategic positioning in the rapidly evolving fintech landscape, Visa demonstrates remarkable resilience and growth potential. Investors seeking stable, forward-looking investments would be wise to consider these three companies. Their strong market positions, innovative approaches, and consistent financial performance make them compelling choices for building a diversified and robust investment portfolio. MORE...

Wall Street's Hidden Powerhouse: How Houlihan Lokey Drives Corporate Finance Innovation

Finance

2025-04-14 09:39:12

In the dynamic landscape of mergers and acquisitions during the Trump 2.0 era, industry veterans Jay Novak and Larry DeAngelo offer a compelling perspective on the shifting corporate terrain. Their insights reveal a complex interplay of political influence, strategic repositioning, and economic opportunity. Novak, a seasoned M&A strategist, argues that the Trump administration's deregulatory approach has created unprecedented opportunities for corporate consolidation. "We're witnessing a remarkable period of strategic realignment," he explains, "where companies can leverage policy changes to create transformative business combinations." DeAngelo adds nuance to this perspective, highlighting how geopolitical tensions and trade policy uncertainties have prompted companies to seek vertical and horizontal integration as a risk mitigation strategy. The potential for protectionist policies has pushed businesses to reconsider their structural approaches to growth and market expansion. Key trends emerging from their analysis include: • Increased cross-sector merger activities • Strategic repositioning in technology and manufacturing sectors • Enhanced due diligence processes reflecting geopolitical complexities The duo emphasizes that successful M&A in this environment requires more than financial acumen—it demands a sophisticated understanding of political dynamics, regulatory landscapes, and global economic shifts. As the business world continues to navigate the intricate post-Trump economic ecosystem, Novak and DeAngelo remain optimistic about the potential for innovative corporate strategies that can thrive amid uncertainty. MORE...

Indonesia's Bold Economic Gambit: Courting US Investors with Financial Firepower

Finance

2025-04-14 09:20:21

Indonesia is gearing up for a critical diplomatic mission to Washington, aiming to forge strategic partnerships in trade, investment, and financial sectors. The week-long negotiations are strategically designed to prevent or soften potential tariff challenges from one of its most significant economic partners. Senior Indonesian officials are preparing to engage in high-stakes discussions that could reshape bilateral economic relations. By proactively addressing potential trade barriers, Indonesia hopes to protect its economic interests and maintain a robust commercial relationship with the United States. The talks will focus on exploring mutually beneficial agreements that could strengthen economic ties, reduce potential friction points, and create new opportunities for collaboration across multiple sectors. With careful diplomacy and strategic negotiation, Indonesia seeks to secure a favorable economic landscape that supports both nations' growth and prosperity. MORE...

Miami's Skyline Rises: Grand Hyatt Secures Massive $392M Construction Boost

Finance

2025-04-14 09:18:14

A groundbreaking financial arrangement has paved the way for an ambitious 800-room hotel development, setting the stage for a transformative project slated for completion in late 2027. This strategic financing marks a significant milestone, propelling the expansive hospitality venture forward and promising to reshape the local landscape with a state-of-the-art accommodation destination. The newly secured funding will enable immediate project commencement, ensuring that construction can proceed smoothly and the ambitious timeline remains on track. Investors and developers are optimistic about the project's potential to not only provide premium lodging options but also stimulate economic growth in the surrounding area. With construction expected to break ground in the near future, this landmark hotel promises to be a game-changing addition to the local hospitality sector, offering cutting-edge amenities and world-class accommodations for travelers and business professionals alike. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421