Tech Titans and Global Leaders Converge: Abu Dhabi Hosts Groundbreaking Summit on Future Technology Governance

Finance

2025-03-31 15:34:00

Justice and Tech: Pioneering Responsible AI Governance in the Digital Future

The Advanced Technology Research Council (ATRC) is set to make a groundbreaking statement in technological governance with its inaugural Governance of Emerging Technologies Summit (GETS). This landmark event will convene global thought leaders, policymakers, and technology experts at the luxurious St. Regis Saadiyat Island Resort in Abu Dhabi on May 5-6, 2025.

GETS represents a critical milestone in addressing the complex intersection of technological innovation, ethical considerations, and responsible governance. By bringing together diverse perspectives from around the world, the summit aims to chart a comprehensive roadmap for managing emerging technologies in an increasingly digital global economy.

The summit will explore critical themes surrounding artificial intelligence, technological ethics, and the future of responsible innovation, positioning Abu Dhabi at the forefront of global technology governance discussions.

MORE...Tesla's Rollercoaster: Musk's Political Tightrope and Trump Tariff Tremors Shake Investor Confidence

Finance

2025-03-31 15:33:04

Tesla's stock took a significant hit on Monday, tumbling 6% and dragging down the broader tech sector in a challenging trading session. The electric vehicle giant's sharp decline sent ripples through the market, contributing to a broader pullback in Big Tech stocks. Investors were particularly sensitive to the downturn, with Tesla's performance reflecting ongoing concerns about electric vehicle demand, production challenges, and the competitive landscape. The stock's retreat highlighted the volatility that has characterized the tech market in recent months. The sell-off wasn't isolated to Tesla alone, as other major technology companies also experienced notable declines. This market movement underscores the interconnected nature of tech stocks and the delicate balance of investor sentiment in the current economic environment. Analysts are closely watching how Tesla will navigate these market headwinds, particularly in light of recent pricing strategies and global economic uncertainties. The company's ability to maintain its market leadership in the electric vehicle space remains a critical focus for investors and market watchers alike. MORE...

Wall Street Cheers: Discover Financial Surges as Interim CEO Steadies the Ship

Finance

2025-03-31 15:25:04

Discover Financial Services' stock experienced a significant boost today after the company announced that interim CEO J. Michael Shepherd will continue to lead the organization until the completion of Capital One Financial's acquisition. Shepherd's commitment provides stability and continuity during this critical transition period, reassuring investors and stakeholders about the smooth progression of the merger. The decision by Shepherd to remain at the helm underscores the strategic importance of ensuring a seamless integration process between Discover and Capital One. His extended leadership will help maintain operational momentum and guide the company through this transformative corporate transaction. Investors responded positively to the news, reflecting confidence in Shepherd's leadership and the potential synergies of the upcoming merger. The stock's surge indicates market optimism about the company's future and the strategic value of this high-profile acquisition. MORE...

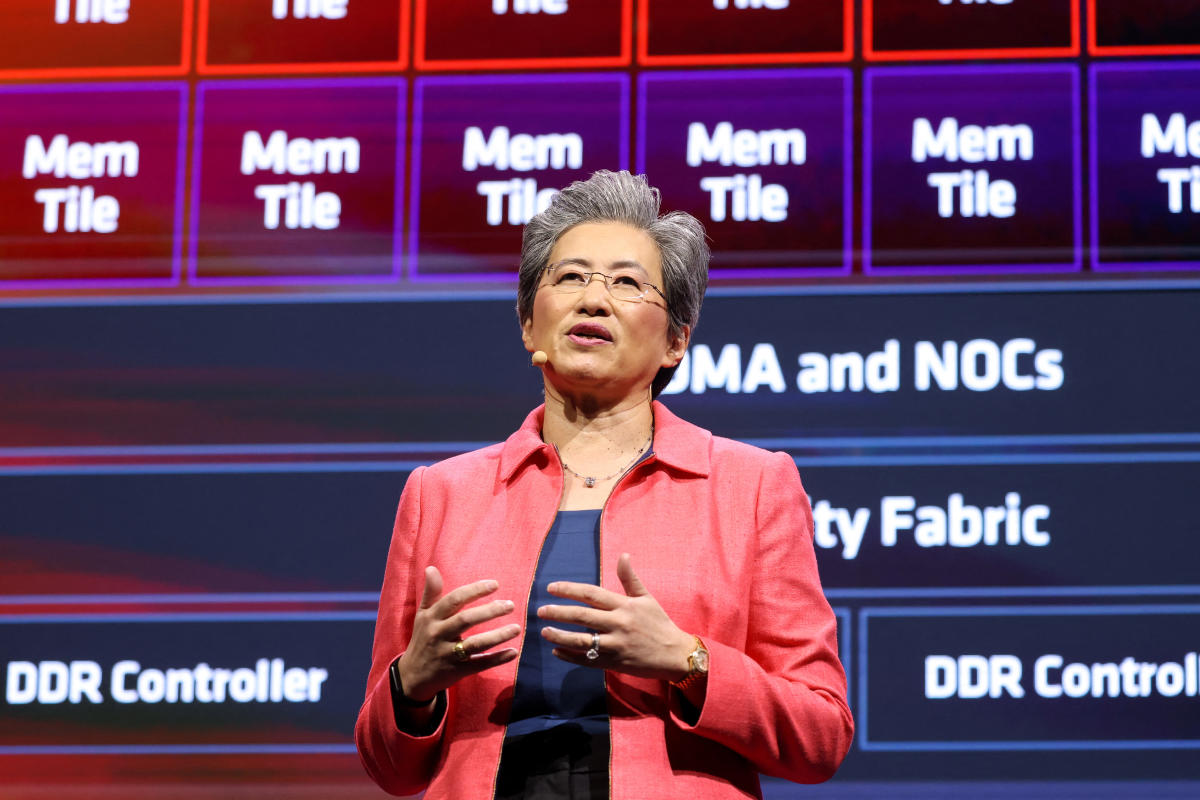

AI's Rocket Fuel: AMD Chief Reveals Explosive Infrastructure Demand

Finance

2025-03-31 15:16:46

In a bold statement that challenges the growing pessimism in the tech industry, AMD's CEO Lisa Su is standing firm against the narrative of an AI slowdown. While some analysts have been predicting a cooling in artificial intelligence investments, Su remains remarkably optimistic about the sector's future. During a recent industry conference, Su emphasized that the AI revolution is far from losing momentum. She pointed to AMD's robust pipeline of AI-focused technologies and the increasing demand from cloud providers, enterprise customers, and emerging markets. "The potential of AI is just beginning to unfold," Su declared, highlighting the company's strategic investments in cutting-edge semiconductor technologies. AMD's approach goes beyond mere rhetoric. The company has been aggressively developing high-performance AI chips and accelerators that are designed to meet the growing computational demands of advanced AI models. Su believes that while the initial AI hype may have stabilized, the fundamental technological transformation is still in its early stages. The tech industry has been watching closely as companies navigate the complex landscape of AI development. Su's confident stance suggests that AMD sees significant opportunities ahead, positioning the company as a key player in the ongoing AI revolution. With strategic investments, innovative product lines, and a clear vision for AI's potential, Lisa Su is sending a powerful message: the AI journey is just getting started, and AMD is ready to lead the way. MORE...

Half a Century Strong: Ferguson Wellman's Bold Mission to Empower Investors Through Financial Education

Finance

2025-03-31 15:00:00

Ferguson Wellman Capital Management Marks 50 Years with Financial Literacy Push

PORTLAND, Ore. - As Ferguson Wellman Capital Management commemorates its golden anniversary in 2025, the employee-owned investment firm is taking a bold step to address a critical national challenge: financial education.

The firm is launching a comprehensive initiative aimed at improving financial literacy across diverse communities, responding to alarming data from the World Economic Forum. Recent studies indicate that financial literacy among U.S. adults has stagnated around 50% over the past eight years, with a concerning 2% decline in the most recent two-year period.

Particularly striking is the persistent gap in financial knowledge among women, who continue to lag behind in financial understanding and confidence.

"Our 50-year milestone is more than a celebration of our firm's success," said a spokesperson for Ferguson Wellman. "It's an opportunity to give back and empower individuals with the financial knowledge they need to make informed decisions."

The new initiative promises targeted educational programs, workshops, and resources designed to enhance financial understanding across different age groups and demographics.

MORE...Momenta Finance Unleashes Game-Changing Asset Funding Solution for UK Small Businesses

Finance

2025-03-31 14:31:17

Empowering Small Businesses: Flexible Funding Solution Unlocks Equipment Investment Potential Small and medium-sized enterprises (SMEs) can now access a game-changing funding solution that provides up to £250,000 to support critical equipment purchases. This innovative financial offering gives businesses the opportunity to upgrade their operational capabilities, invest in cutting-edge technology, and drive growth without straining their cash flow. The flexible funding solution is designed to address the unique challenges faced by SMEs, offering a streamlined approach to acquiring essential equipment. Whether you're looking to modernize your manufacturing tools, upgrade office technology, or expand your operational infrastructure, this funding option provides the financial flexibility needed to turn business aspirations into reality. Key benefits include: • Rapid access to funds up to £250,000 • Tailored repayment options • Minimal paperwork and quick approval process • Support for a wide range of equipment investments Don't let financial constraints hold your business back. Explore this innovative funding solution and unlock your company's full potential today. MORE...

Driving into the Future: How 2025 Vehicle Excise Duty Shake-Up Will Reshape Motor Finance

Finance

2025-03-31 14:19:59

Transforming Vehicle Financing: New Taxes and Rates Reshape Automotive Landscape

The automotive financing ecosystem is undergoing significant changes, with recent policy adjustments promising to dramatically alter how consumers approach vehicle purchases and ownership. A combination of increased first-year registration rates, innovative electric vehicle (EV) taxation, and refined expensive car supplements are set to create a complex new financial environment for car buyers.

First-year registration rates have seen a notable increase, signaling a strategic shift in government revenue collection and automotive market dynamics. This change will directly impact consumers' initial vehicle purchase costs, potentially influencing buying decisions and market trends.

Electric vehicle taxation represents another critical development. As governments worldwide push for sustainable transportation, new tax structures are emerging to both incentivize EV adoption and generate necessary infrastructure funding. These nuanced policies aim to balance environmental goals with economic considerations.

The Expensive Car Supplement adjustments introduce an additional layer of complexity to high-end vehicle purchases. These modifications are designed to create a more progressive taxation system that addresses luxury vehicle market segments while potentially redistributing automotive-related revenues.

Consumers and automotive industry stakeholders must carefully navigate these evolving financial landscapes, understanding how these interconnected changes will impact vehicle ownership costs and market strategies in the coming years.

MORE...TikTok Teeters on the Brink: The Countdown to a Potential Digital Shutdown

Finance

2025-03-31 14:16:45

TikTok faces a critical deadline as the United States government sets a dramatic ultimatum: sell the popular social media platform or face a nationwide shutdown. The Biden administration has given ByteDance, TikTok's Chinese parent company, until April 5th to divest its ownership, or the app will be banned across the United States. This high-stakes showdown stems from national security concerns, with lawmakers arguing that TikTok could potentially share user data with the Chinese government. The potential ban has sent shockwaves through the tech industry and the millions of users who rely on the platform for entertainment, communication, and content creation. If ByteDance fails to sell TikTok to an approved U.S. company by the deadline, the app could be removed from app stores and blocked from operating within the country. Major tech companies and potential buyers are closely watching the situation, with speculation mounting about potential acquirers who could meet the government's stringent requirements. The countdown to April 5th has created uncertainty for TikTok's 170 million U.S. users and content creators, who are anxiously awaiting the platform's fate. As the deadline approaches, the tech world remains on the edge of its seat, wondering whether TikTok will survive this unprecedented challenge. MORE...

Market Mavens Slash Stock Predictions as Trump's Tariff Tremors Shake Wall Street

Finance

2025-03-31 14:06:03

Wall Street's Crystal Ball Dims: Tariffs Cast Shadow on 2025 Market Outlook As economic forecasters peer into the future of the S&P 500, a growing sense of caution is emerging among top strategists. The potential reimplementation of Trump-era tariffs is sending ripples of concern through financial markets, with experts increasingly skeptical about potential returns in the coming year. The looming trade barriers are expected to create significant headwinds for economic growth, prompting Wall Street analysts to recalibrate their previously optimistic projections. These potential tariffs threaten to disrupt global supply chains, increase production costs, and potentially slow down corporate earnings—key factors that could dampen investor enthusiasm. Investors and market watchers are now carefully monitoring the potential economic implications, understanding that trade policies can have far-reaching consequences on market performance. The uncertainty surrounding these potential tariffs is creating a more conservative approach among financial strategists, who are tempering their expectations for the S&P 500's performance in 2025. As the landscape continues to evolve, market participants are advised to stay nimble and prepared for potential shifts in the economic environment. MORE...

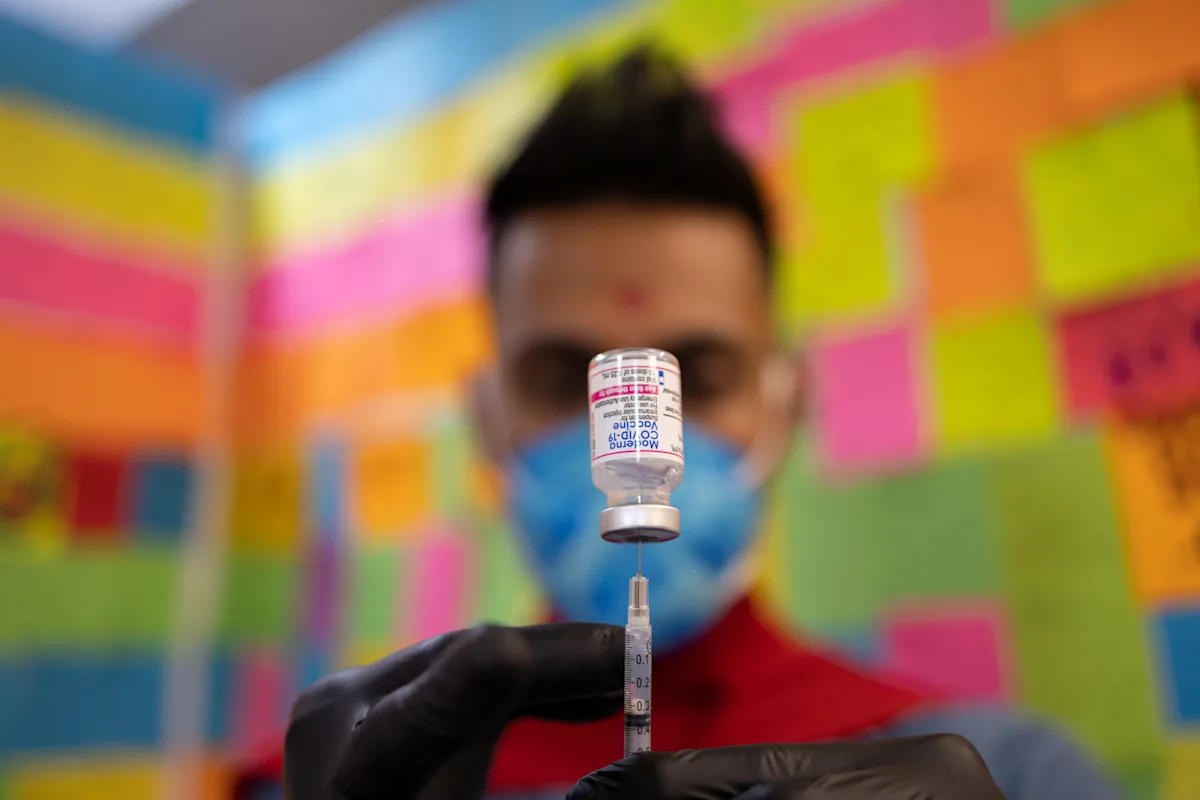

Biotech Shockwave: Top FDA Official's Sudden Exit Rattles Moderna's Market Momentum

Finance

2025-03-31 14:00:10

Wall Street is on edge following the unexpected resignation of Peter Marks, a key official at the Food and Drug Administration (FDA). Marks' departure has sparked uncertainty and raised questions about the agency's leadership and future direction. As one of the FDA's most prominent executives, Marks played a critical role in guiding the agency through complex regulatory challenges, particularly during the COVID-19 pandemic. His sudden exit has left investors and industry experts speculating about who will step into this crucial leadership position and what potential changes might accompany the transition. The pharmaceutical and healthcare sectors are closely watching the selection process, understanding that the next appointee could significantly impact drug approvals, medical device regulations, and overall healthcare innovation. Marks' resignation creates a leadership vacuum that could have ripple effects across the regulatory landscape. While the specific reasons for Marks' departure remain unclear, his exit underscores the dynamic and often unpredictable nature of high-stakes regulatory roles. Wall Street will be monitoring developments closely, hoping for a swift and strategic replacement that can maintain the FDA's critical oversight and momentum. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421