Warren Buffett's Berkshire: Crushing the Market's Expectations

Finance

2025-05-05 14:45:00

In a landmark announcement that sent ripples through the financial world, Warren Buffett, the legendary investor and long-time CEO of Berkshire Hathaway, revealed his succession plan at the company's annual shareholders meeting. At 94 years old, Buffett will step down at the end of the year, passing the torch to Greg Abel, currently the chair of Berkshire Hathaway Energy. For decades, Berkshire Hathaway's stock has been a beacon of consistent performance, outpacing the S&P 500 with remarkable resilience. Buffett's investment prowess has transformed the company from a struggling textile manufacturer into a global conglomerate with an enviable track record of success. As investors and market watchers eagerly anticipate the leadership transition in 2026, analysts like Madison Mills are closely examining what Abel's stewardship might mean for the company's future. Buffett's shoes are undoubtedly large to fill, given his iconic status in the investment world and his ability to generate extraordinary returns for shareholders. The changing of the guard represents a pivotal moment for Berkshire Hathaway, signaling both an end of an era and the potential for continued innovation and strategic growth under new leadership. Investors will be watching closely to see how Abel will honor Buffett's legendary investment philosophy while charting his own course for the company. For more expert insights and in-depth market analysis, stay tuned to the latest financial news and expert commentary. MORE...

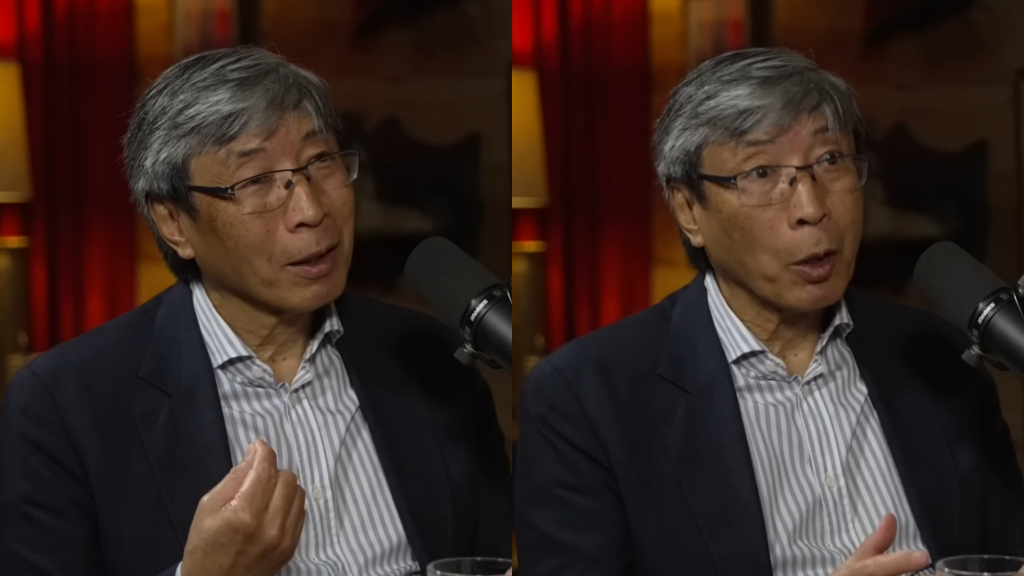

Subscriber Exodus: How LA Times' Conservative Pivot Triggered Financial Freefall in 2024

Finance

2025-05-05 14:37:23

The Los Angeles Times is facing significant financial challenges, with mounting losses that have raised eyebrows in the media industry. Under the ownership of Dr. Patrick Soon-Shiong, the prestigious newspaper hemorrhaged approximately $50 million in 2024, following a substantial $30 million loss in the previous year. These financial struggles have been closely intertwined with a series of controversial editorial decisions that appear to have alienated the paper's traditional readership. The most notable shifts include the introduction of conservative writers and a dramatic political realignment that culminated in the unexpected withdrawal of the newspaper's presidential endorsement for Kamala Harris in October. The most striking consequence of these changes came in January, when the paper saw an exodus of nearly 23,000 digital subscribers—a significant blow to its already fragile financial ecosystem. This mass unsubscription suggests that readers are deeply sensitive to perceived shifts in the newspaper's political stance and editorial direction. As the Los Angeles Times navigates these turbulent waters, questions loom about the sustainability of its current strategy and the potential long-term impact on one of America's most storied metropolitan newspapers. MORE...

Breaking Free: How Local Financial Hubs Are Transforming Residents' Money Mindsets

Finance

2025-05-05 14:00:52

Orange County is breaking new ground in financial wellness by becoming the first local government in Florida to establish a Financial Empowerment Center. This innovative program provides free, personalized financial counseling to county residents and employees, offering support in both English and Spanish. The groundbreaking initiative is a collaborative effort between Orange County Government and the Cities for Financial Empowerment Fund, designed to empower individuals with the knowledge and tools needed to improve their financial health. By offering one-on-one counseling sessions at no cost, the center aims to help community members make informed financial decisions, manage debt, and build a more secure financial future. Residents can now access professional financial guidance that was previously out of reach, making financial education and support more accessible than ever before in Orange County. MORE...

Market Surge Masks Tariff Tensions: Investors Navigate Uncertain Economic Waters

Finance

2025-05-05 13:46:06

Market Momentum Pauses: Stock Futures Retreat After Impressive Winning Streak Stock futures are showing a slight pullback as the new week begins, following the S&P 500's most impressive winning streak since 2004. The recent market rally has been fueled by promising signs of easing trade tensions, but challenges remain on the horizon. Michael O'Rourke, chief market strategist at JonesTrading, offers a nuanced perspective on the current market dynamics. While the recent optimism is encouraging, he cautions that unresolved tariff issues could potentially disrupt investor confidence and market sentiment. Investors are closely monitoring the delicate balance between trade negotiations and market performance. The pullback in stock futures serves as a reminder that market gains are not guaranteed, and ongoing economic uncertainties continue to play a significant role in shaping investment strategies. For deeper insights and expert analysis of the latest market movements, tune in to more episodes of Morning Brief and stay informed about the evolving financial landscape. MORE...

Wall Street Trembles: Markets Dive as Trade Tensions Threaten Economic Calm Ahead of Fed's Critical Week

Finance

2025-05-05 13:31:04

After an exhilarating rally that saw the S&P 500 reach new heights, investors might be bracing for a potential market breather. Major index futures are showing signs of a possible pullback, suggesting that the recent record-breaking momentum could be taking a momentary pause. The remarkable surge that propelled the market to unprecedented levels appears to be losing some steam, with futures indicating a potential cooling-off period. Traders and analysts are closely watching the market dynamics, wondering if this is a natural consolidation phase following the impressive gains or a more significant shift in market sentiment. While the recent performance has been nothing short of spectacular, the slight dip in futures hints at the market's inherent volatility and the constant ebb and flow of investor confidence. Investors should remain vigilant and prepared for potential short-term fluctuations as the market continues to navigate through these exciting times. MORE...

The Jedi Way to Wealth: 6 Money Hacks Learned from a Galaxy Far, Far Away

Finance

2025-05-05 13:30:08

6 Powerful Financial Wisdom Lessons from the Star Wars Galaxy

The Star Wars universe isn't just about epic space battles and lightsaber duels—it's also a treasure trove of financial insights that can transform how we approach money management. From the shrewd strategies of smugglers to the economic decisions of galactic leaders, these iconic characters offer surprisingly practical financial lessons.

1. Han Solo: The Art of Strategic Risk-Taking

Han Solo teaches us that calculated risks can lead to significant rewards. As a skilled smuggler, he demonstrates that sometimes stepping out of your comfort zone and making bold financial moves can pay off—but always with careful planning and a backup strategy.

2. Lando Calrissian: Diversification and Adaptability

Lando's ability to navigate different economic landscapes shows the importance of diversifying investments and being adaptable. His career spans from gambling to managing Cloud City, proving that flexibility is key to financial success.

3. Darth Vader: Long-Term Investment and Patience

Despite his villainous nature, Darth Vader embodies the principle of long-term commitment. His patient approach to achieving goals mirrors sound investment strategies—staying focused and persistent, even when immediate results aren't visible.

4. Jabba the Hutt: Understanding Business and Negotiation

While not a role model in ethics, Jabba demonstrates the importance of strong negotiation skills and understanding complex business ecosystems. His ability to create a vast criminal enterprise shows how strategic networking can drive financial success.

5. Princess Leia: Emergency Preparedness

As a rebel leader, Leia always has contingency plans—a crucial financial lesson. Having an emergency fund and backup strategies can help navigate unexpected economic challenges and maintain financial stability.

6. Yoda: Wisdom in Spending and Value

Yoda's minimalist lifestyle teaches us that true wealth isn't about accumulation, but about understanding value. His philosophy suggests that mindful spending and focusing on what truly matters can lead to greater financial contentment.

While these lessons come from a fictional universe, they reflect timeless financial principles that can guide real-world money management. The Star Wars saga reminds us that financial wisdom transcends galaxies—it's about strategy, adaptability, and understanding the deeper value of resources.

MORE...Wall Street's Crystal Ball: What to Expect When LPL Financial Unveils Q1 Earnings

Finance

2025-05-05 13:15:44

Diving Deeper: LPL Financial's Quarterly Performance Insights

When assessing LPL Financial's (LPLA) quarterly performance, savvy investors know that looking beyond simple top-line and bottom-line estimates provides a more comprehensive view of the company's financial health.

As we approach the quarter ending March 2025, investors should pay close attention to several key metrics that could reveal the true pulse of LPL Financial's operational strength:

- Revenue Trajectory: Examining potential growth patterns and revenue streams

- Operational Efficiency: Analyzing cost management and margin improvements

- Client Asset Management: Tracking changes in assets under management and client acquisition rates

- Strategic Investments: Understanding how recent strategic initiatives might impact quarterly performance

By delving deeper than surface-level numbers, investors can gain a more nuanced understanding of LPL Financial's potential quarterly performance and long-term strategic positioning in the financial services landscape.

While official numbers will provide definitive insights, preliminary analysis suggests a potentially robust quarter with promising indicators of continued growth and operational resilience.

MORE...Cash Conservatism: Finance Chiefs Navigate Stormy Economic Waters

Finance

2025-05-05 12:30:00

In the Face of Economic Uncertainty: How Financial Leaders Are Navigating Turbulent Business Landscapes As global markets continue to experience unprecedented volatility, forward-thinking financial leaders are proactively reimagining their strategic approaches to maintain resilience and competitive edge. The current economic climate demands innovative solutions and adaptive strategies that can withstand complex challenges. Businesses across industries are confronting a perfect storm of economic pressures, including unpredictable trade dynamics and persistent inflationary trends. These challenges are compelling financial executives to develop more agile and robust financial frameworks that can quickly respond to rapidly changing market conditions. Key strategic adaptations include: • Diversifying supply chain networks • Implementing advanced risk management technologies • Developing more flexible financial forecasting models • Investing in digital transformation initiatives By embracing these forward-looking strategies, organizations are not merely surviving but positioning themselves to thrive in an increasingly complex global economic environment. The most successful companies are those demonstrating remarkable adaptability and strategic foresight. MORE...

Fairfax Financial Soars: Q1 2025 Earnings Surge to Nearly $1 Billion

Finance

2025-05-05 12:20:20

Property and casualty insurance operations experienced robust growth, with net premiums written surging by an impressive 8.4% to reach $6.77 billion. This significant increase highlights the sector's strong performance and expanding market presence, reflecting growing demand for comprehensive insurance coverage and the industry's resilience in a dynamic economic landscape. MORE...

Cummins Hits Brakes on 2025 Outlook: Tariff Turbulence Derails Financial Projections

Finance

2025-05-05 12:20:11

In a stark reflection of the current economic landscape, Cummins has decided to withhold its revenue and profitability projections for the remainder of 2025, citing mounting uncertainties in the market. The company's cautious approach underscores the complex challenges facing the industrial sector. The North American trucking industry finds itself at a critical juncture, grappling with an already saturated equipment market and additional complications from unpredictable import tariff policies. These dynamic economic conditions are creating significant headwinds for manufacturers and logistics providers. Adding to the industry's volatility, General Motors recently made a strategic retreat by withdrawing its annual financial forecast. The automotive giant also suspended its planned $2 billion share buyback program in the first half of the year, signaling a conservative approach to financial management amid uncertain economic conditions. These developments highlight the growing prudence among major corporations as they navigate an increasingly complex and unpredictable business environment. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421