Retirement Countdown: The Insider Secrets Your Financial Advisor Doesn't Want You to Miss

Finance

2025-02-19 23:23:00Content

Thinking About Retiring in 2025? Hold That Resignation Letter!

So, you've got 2025 circled on your calendar as your big retirement year? Before you start daydreaming about endless golf sessions and tropical vacations, pump the brakes for a moment. Retirement planning isn't as simple as walking into your manager's office and declaring your departure.

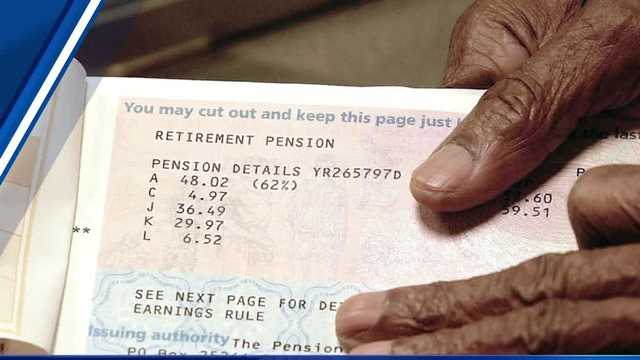

Careful preparation is key to a smooth transition from full-time work to your golden years. You'll want to consider multiple factors like your financial readiness, healthcare costs, retirement savings, and lifestyle expectations. Have you thoroughly assessed your retirement nest egg? Are your investments diversified enough to support your desired standard of living?

Take time to crunch the numbers, consult with financial advisors, and create a comprehensive retirement strategy. Your future self will thank you for the meticulous planning and thoughtful approach. Remember, a successful retirement isn't just about leaving work—it's about creating a fulfilling and financially secure next chapter of your life.

Retirement Reality Check: Why 2025 Might Not Be Your Golden Year

Navigating the complex landscape of retirement planning requires more than just a calendar and wishful thinking. As professionals approach their anticipated retirement milestone, a multitude of financial, personal, and economic factors converge to challenge even the most meticulously crafted exit strategies from the workforce.Unlock the Hidden Truths of Retirement Timing That Could Transform Your Financial Future

The Economic Landscape: More Than Meets the Eye

The retirement landscape in 2025 presents a labyrinth of economic complexities that demand careful navigation. Inflation rates, market volatility, and global economic shifts create an unpredictable environment for potential retirees. Financial experts warn that simply marking a year on the calendar is far from a comprehensive retirement strategy. Deeper analysis reveals that individual financial health is intrinsically linked to broader economic trends. Retirement planning requires a holistic approach that considers multiple variables, including personal savings, investment portfolios, healthcare costs, and potential income streams beyond traditional retirement funds.Personal Readiness: Beyond Financial Calculations

Retirement isn't merely a financial decision but a profound life transition that encompasses psychological and emotional preparedness. Many professionals mistakenly focus solely on monetary aspects, overlooking the critical mental and emotional dimensions of leaving the workforce. Psychological research suggests that successful retirement requires more than financial stability. Individuals must cultivate a sense of purpose, develop meaningful post-career activities, and maintain social connections that provide fulfillment and mental stimulation. The transition demands careful introspection and strategic planning beyond traditional financial metrics.Healthcare Considerations: The Silent Retirement Disruptor

Healthcare costs represent a potentially devastating factor in retirement planning that many individuals underestimate. The rising cost of medical care, coupled with increasing life expectancy, creates a complex financial challenge that can quickly derail retirement expectations. Comprehensive healthcare planning involves understanding Medicare limitations, potential long-term care needs, and the increasing costs of medical treatments. Professionals approaching retirement must develop a nuanced strategy that accounts for potential health-related expenses that could significantly impact their financial stability.Workplace Dynamics and Retirement Flexibility

The modern workplace has transformed dramatically, offering unprecedented flexibility that challenges traditional retirement concepts. Many organizations now provide phased retirement options, consulting roles, and part-time opportunities that blur the lines between full-time employment and retirement. This evolving landscape presents both opportunities and challenges. Professionals can potentially extend their careers, maintain income streams, and remain professionally engaged while gradually transitioning away from full-time work. The rigid retirement model of previous generations has given way to more dynamic and personalized career exit strategies.Strategic Financial Recalibration

Successful retirement planning in 2025 demands a sophisticated approach to financial management. This involves continuous portfolio reassessment, diversification of income sources, and adaptive investment strategies that can withstand economic uncertainties. Experts recommend a multi-pronged approach that includes robust emergency funds, strategic investment allocations, and flexible income generation methods. The most successful retirees view their financial plan as a living document, subject to regular review and modification based on changing personal and economic circumstances.RELATED NEWS

Finance

Wall Street's Wild Ride: When Bulls and Bears Clash in Today's Market Frenzy

2025-04-09 22:05:49

Finance

Fintech Disruptor: Upstart's Stunning Market Performance Defies Wall Street Expectations

2025-02-26 14:40:12