Inside Aflac's Strategy: How Brad Dyslin Is Navigating Japan's Shifting Investment Landscape

Finance

2025-03-18 21:21:27

In the dynamic world of global finance, Aflac's strategic approach to investment is capturing attention, particularly in the Japanese market. Brad Dyslin, a key executive at Aflac, recently shared insights into the company's innovative investment strategies and adaptive approach to changing market landscapes. Dyslin's perspective offers a nuanced view of how Aflac is navigating the complex investment terrain in Japan, demonstrating remarkable agility in a rapidly evolving financial ecosystem. The insurance giant has been carefully recalibrating its investment portfolio, responding to shifting economic conditions and emerging market opportunities. At the heart of Aflac's strategy is a sophisticated approach to asset allocation. The company is not merely reacting to market changes but proactively positioning itself to capitalize on emerging trends. Dyslin emphasizes the importance of strategic flexibility, allowing Aflac to maintain a robust and resilient investment framework. The Japanese market presents unique challenges and opportunities, and Aflac has shown remarkable skill in understanding and leveraging these dynamics. By maintaining a balanced and forward-looking investment strategy, the company continues to demonstrate its commitment to long-term growth and financial stability. Investors and industry observers are taking note of Aflac's approach, recognizing the company's ability to blend traditional financial wisdom with innovative investment techniques. Dyslin's insights provide a compelling narrative of how global insurance companies can successfully navigate complex international markets. As the financial landscape continues to evolve, Aflac's strategic approach under Dyslin's guidance serves as a compelling case study in adaptive investment management. The company's commitment to strategic allocation and market responsiveness positions it as a leader in the global insurance and investment sector. MORE...

Financial Safety Net: 5 Genius Strategies to Build Your Emergency Fund Like a Pro

Finance

2025-03-18 20:50:16

Many investors unknowingly fall into the trap of portfolio complexity, accumulating a maze of investment accounts and an overwhelming number of holdings. This financial clutter, which I call "portfolio sprawl," can create unnecessary complexity and potentially dilute investment performance. The encouraging news is that streamlining your investment strategy is not only possible but relatively straightforward. With some strategic planning and focused effort, you can transform your complex investment landscape into a sleek, minimalist portfolio with fewer accounts and more targeted holdings. By simplifying your investment approach, you can gain greater clarity, reduce management overhead, and potentially improve your overall investment effectiveness. A lean, well-organized portfolio allows for more precise tracking, easier rebalancing, and a clearer view of your financial goals. MORE...

Stilettos and Tariffs: Saskatchewan's Finance Minister Steps Up Budget Day Fashion

Finance

2025-03-18 20:30:26

In a quirky budgetary tradition that has become his personal hallmark, Saskatchewan's Finance Minister Jim Reiter once again stepped into the spotlight—quite literally—by donning a fresh pair of shoes for the provincial budget presentation. This year, however, his footwear selection carried a subtle yet significant political statement. While selecting his new pair of dress shoes, Reiter deliberately steered clear of footwear manufactured in the United States and China, subtly highlighting the ongoing tensions in the international trade landscape. His sartorial choice serves as a symbolic gesture, reflecting the complex geopolitical dynamics that continue to shape economic relationships between nations. The minister's shoe shopping ritual, now an anticipated pre-budget event, not only ensures he looks sharp for the fiscal announcement but also provides a nuanced commentary on the current state of global trade tensions. By consciously avoiding products from these two economic powerhouses, Reiter transforms a simple wardrobe decision into a quiet act of diplomatic and economic commentary. MORE...

Climate Finance Insider: How Mark Carney's Shocking Pivot Undermines Global Trust

Finance

2025-03-18 20:21:58

In a stunning twist of political fate, Mark Carney—a globally renowned expert in climate finance—has ascended to the role of Prime Minister of Canada. However, his first major policy move has shocked many of his supporters: the immediate abolition of the carbon tax. Carney, previously celebrated for his groundbreaking work in sustainable economics and climate strategy, has seemingly pivoted dramatically from his long-standing environmental advocacy. The sudden cancellation of the carbon tax represents a radical departure from his previous public stance and raises significant questions about his political priorities. As a former Governor of the Bank of England and the Bank of Canada, Carney built an international reputation as a leading voice in climate-focused financial policy. His unexpected decision to dismantle the carbon pricing mechanism has left climate activists and environmental policy experts bewildered and concerned about the potential implications for Canada's climate commitments. This unexpected political maneuver signals a complex and potentially transformative moment in Canadian environmental and economic policy, leaving many wondering about the deeper motivations behind Carney's surprising first act as Prime Minister. MORE...

Tech Tremors: Nvidia Stumbles, Nasdaq Slides as Wall Street Braces for Fed's Next Move

Finance

2025-03-18 20:03:44

As Wall Street braces for the Federal Reserve's crucial policy meeting, investors are locked in a heated debate about whether the recent market sell-off signals a potential turning point for stocks. The financial landscape is buzzing with speculation and anticipation, as traders and analysts carefully parse every potential signal that might indicate a market bottom. The current market volatility has created a palpable tension among investors, who are closely watching for signs of stabilization. Some market experts argue that the recent pullback may have created attractive buying opportunities, while others remain cautious about potential further downside risks. The Fed's upcoming meeting is expected to provide critical insights into the central bank's strategy for managing inflation and economic growth. Investors are eagerly awaiting any hints about future interest rate decisions and the potential impact on market sentiment. With uncertainty still lingering, the financial community remains split on whether this is a temporary correction or the beginning of a more significant market shift. The next few days could prove pivotal in determining the short-term trajectory of stock markets and investor confidence. MORE...

DeFi Revolution: Kraken Exec Predicts Massive Crypto Disruption

Finance

2025-03-18 20:03:06

In a compelling vision of the future of digital finance, Marco Santori, Senior Advisor at Kraken, sees stablecoins as a foundational technology that could revolutionize the cryptocurrency ecosystem. During a recent interview, Santori passionately argued that stablecoins are not just another digital asset, but a critical infrastructure that will enable groundbreaking innovations in the financial technology landscape. "Stablecoins are essentially the building blocks that will unlock the next wave of financial innovation," Santori explained. He predicts an imminent explosion in decentralized finance (DeFi), contingent upon the widespread and stabilized adoption of these digital currencies. By providing a reliable and consistent value proposition, stablecoins could bridge the gap between traditional financial systems and the dynamic world of cryptocurrency. Santori's insights suggest that as stablecoins become more robust and widely accepted, they will serve as a catalyst for unprecedented growth and transformation in the digital financial realm, potentially reshaping how we understand and interact with money in the digital age. MORE...

Breaking: Nu Crowned Global Finance Innovator by Fast Company's Prestigious Rankings

Finance

2025-03-18 19:53:00

Nubank Soars to New Heights: Recognized as a Global Innovation Leader In a remarkable achievement, Nubank has once again proven its innovative prowess by securing a top spot on Fast Company's World's Most Innovative Companies list for 2025. The digital financial services giant not only maintained its reputation for groundbreaking solutions but also dramatically improved its ranking, climbing an impressive 19 positions from the previous year. This year's recognition is particularly noteworthy, with Nubank claiming the #1 position in the Finance and Personal Finance category and securing an outstanding 3rd place in the overall global ranking. The annual list, renowned for highlighting businesses that are reshaping industries, has once again acknowledged Nubank's commitment to transformative financial technology. As one of the world's largest digital financial platforms, Nubank continues to demonstrate its ability to drive innovation and create cutting-edge solutions that challenge traditional financial services. This is the fifth consecutive time the company has been featured on Fast Company's prestigious list, solidifying its status as a true innovator in the global financial technology landscape. MORE...

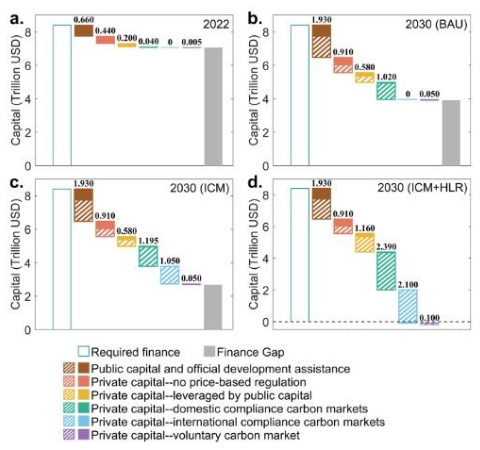

Climate Cash: How Diverse Strategies Could Unlock the $1.3 Trillion Green Investment Puzzle

Finance

2025-03-18 19:51:36

Climate Finance Takes a Leap Forward: Unpacking the New Global Funding Commitment By Suzi Kerr and Juan Pablo Hoffmaister, Environmental Defense Fund Experts In a landmark moment at COP29 in Baku, global leaders made a significant stride in climate finance by establishing the New Collective Quantified Goal (NCQG). This groundbreaking agreement sets an ambitious target of mobilizing $1.3 trillion to support developing nations in their fight against climate change and sustainable development efforts. The commitment represents a critical turning point in international climate cooperation, signaling a renewed global dedication to addressing the urgent challenges posed by climate change. By setting a clear, quantifiable financial goal, countries are demonstrating their collective resolve to support vulnerable regions in building resilience and transitioning to low-carbon economies. As climate experts, we recognize the transformative potential of this agreement and its potential to accelerate meaningful climate action worldwide. The NCQG is not just a financial pledge, but a powerful statement of global solidarity and shared responsibility in confronting one of the most pressing challenges of our time. MORE...

Breaking: Top Female Finance Leaders Set to Be Honored in Prestigious 2025 Asia Awards

Finance

2025-03-18 19:41:00

Exciting Creative Opportunity: Submit Your Work for Upcoming Singapore Event

Calling all creative minds! Mark your calendars and prepare to showcase your talent. The highly anticipated event is set to take place on May 29 in the vibrant city of Singapore, and now is your chance to be part of something extraordinary.

Don't miss the crucial submission deadline of April 15. This is your opportunity to share your innovative ideas, groundbreaking projects, or artistic expressions with a dynamic audience in one of Asia's most inspiring cultural hubs.

Whether you're an emerging artist, a seasoned professional, or a passionate creator, this is your moment to shine. Submit your best work before the deadline and potentially be featured in this exciting event that promises to celebrate creativity and innovation.

Act now – time is of the essence!

MORE...Bond Strategy Alert: Extend Duration, But Watch Credit Risks Closely

Finance

2025-03-18 19:15:41

As the Federal Reserve prepares for its crucial March Federal Open Market Committee (FOMC) meeting in Washington, D.C., investors are eagerly anticipating how potential tariffs and economic complexities might influence the central bank's economic outlook and bond market dynamics. Charles Schwab's Chief Fixed Income Strategist, Kathy Jones, brings expert insights to the table, offering a comprehensive analysis of the multifaceted factors that could significantly impact bond investment durations. Her anticipated appearance on The Morning Brief promises to shed light on the intricate economic landscape. Market watchers are particularly focused on Fed Chair Jerome Powell's upcoming press conference, where his tone and commentary could provide critical signals about monetary policy direction. Jones is expected to offer nuanced perspectives on what investors should expect from Powell's statements and their potential market implications. For those seeking deeper understanding of current market movements and expert analysis, The Morning Brief continues to be an essential resource for investors navigating these complex financial waters. Stay tuned for Kathy Jones' invaluable insights into bond market trends and Federal Reserve strategies. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421