Retail Titans Clash: The Shocking Stock Performance Showdown Between Walmart and Costco

Finance

2025-04-20 16:01:09

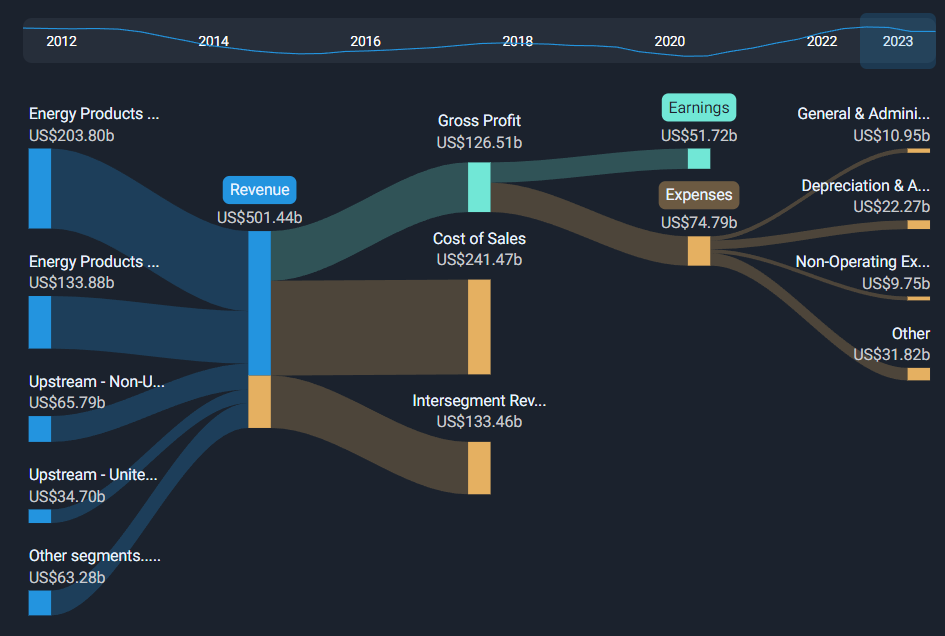

In the competitive landscape of retail giants, Walmart and Costco stand out as powerhouse brands that have revolutionized shopping experiences for millions of consumers. These retail behemoths have built their reputations on a foundation of value, offering an extensive array of products at prices that make budget-conscious shoppers cheer. Beyond simply selling merchandise, both companies have mastered the art of providing exceptional value. Their strategic approach goes far beyond mere price tags, creating comprehensive shopping ecosystems that benefit not just individual consumers, but entire communities. From bulk purchasing options to innovative supply chain management, Walmart and Costco have transformed how Americans think about retail shopping. What sets these retailers apart is their commitment to delivering quality products at unbeatable prices. Whether you're a family looking to stretch your grocery budget or a small business seeking cost-effective supplies, these retailers have consistently proven their ability to meet diverse consumer needs. Their business models demonstrate that affordability doesn't have to come at the expense of product quality or customer satisfaction. By continuously adapting to changing market dynamics and consumer preferences, Walmart and Costco have not just survived but thrived in an increasingly competitive retail environment. Their success story is a testament to the power of strategic pricing, wide product selection, and a deep understanding of consumer expectations. MORE...

Navigating Market Storms: Your Retirement Survival Guide to Financial Resilience

Finance

2025-04-20 16:00:40

Navigating Market Turbulence: A Financial Blueprint for Savvy Investors In the unpredictable world of investing, volatility can be a source of anxiety for many. Enter Brian Walsh, SoFi's head of advice and planning, affectionately known as Dr. Money, who offers a strategic approach to weathering market storms. Walsh's financial blueprint provides investors with a comprehensive strategy to manage market fluctuations effectively. By implementing a thoughtful and proactive approach, individuals can transform market uncertainty from a source of stress into an opportunity for financial growth. Key insights from Dr. Money reveal that successful investing isn't about avoiding volatility, but about developing a resilient financial strategy that can adapt to changing market conditions. His method emphasizes diversification, long-term planning, and maintaining a calm perspective when markets become turbulent. Whether you're a seasoned investor or just starting your financial journey, Walsh's approach offers practical wisdom for maintaining financial stability in an ever-changing economic landscape. MORE...

War Chest Depleted: IDF Seeks Massive Funding Boost for Gaza Campaign

Finance

2025-04-20 15:50:55

Israel's military faces a substantial financial challenge as it seeks an additional $2.6 billion to support its expanded operations in Gaza. The proposed funding increase has sparked intense debate within the government, with the Finance Ministry raising serious concerns about potential economic repercussions. Military leaders argue that the extra funds are critical to sustaining ground operations and maintaining strategic capabilities in the ongoing conflict. However, financial officials warn that such a significant budget expansion could trigger deeper government spending cuts or potentially increase national deficits. The funding request highlights the complex economic pressures Israel is experiencing while managing a multifaceted military campaign. The Finance Ministry's strong opposition underscores the delicate balance between military needs and fiscal responsibility, creating a high-stakes financial and strategic dilemma for the government. As negotiations continue, the proposed $2.6 billion allocation represents more than just a monetary figure—it symbolizes the broader challenges of funding military operations while preserving economic stability in a time of intense regional tension. MORE...

Trade War Tremors: Beauty, Gaming, and Chinatown Businesses Brace for Trump Tariff Tsunami

Finance

2025-04-20 15:22:53

Trump's Tariff Saga: A Deep Dive into Trade War Dynamics

In the ever-evolving landscape of international trade, former President Donald Trump's tariff policies continue to spark intense debate and economic scrutiny. The controversial trade strategy that defined much of his administration's economic approach remains a hot-button issue in financial circles.

The Tariff Backdrop

Trump's aggressive trade stance, particularly targeting China, sent shockwaves through global markets and reshaped international economic relationships. His sweeping tariffs were designed to protect American industries and challenge what he perceived as unfair trade practices by international competitors.

Economic Ripple Effects

The tariffs created a complex web of economic consequences, impacting everything from consumer prices to global supply chains. Manufacturers, farmers, and everyday Americans felt the direct and indirect effects of these trade policies, leading to heated discussions about their long-term economic implications.

Ongoing Implications

Even after leaving office, Trump's tariff legacy continues to influence trade negotiations and economic strategies. Policymakers and economists remain divided on the effectiveness and lasting impact of this unprecedented approach to international trade.

As the global economic landscape continues to shift, the debate surrounding Trump's tariff policies remains as relevant and contentious as ever.

MORE...Wall Street Comes to Boston: Finance Museum Set to Transform Seaport's Cultural Landscape

Finance

2025-04-20 14:50:31

Boston's Cultural Landscape Expands: Museum of American Finance Secures Prestigious Exhibit Space In an exciting development for the city's museum scene, the Museum of American Finance, a distinguished affiliate of the Smithsonian Institution, has recently secured a significant 10-year lease for a new exhibit space. This strategic move promises to bring innovative financial history displays and educational experiences to Boston's cultural landscape. The museum, known for its commitment to preserving and presenting the rich narrative of American financial heritage, is poised to create an engaging and immersive environment for visitors. By establishing this long-term lease, the institution demonstrates its dedication to expanding public understanding of economic history and financial innovation. While specific details about the exhibit space remain forthcoming, the museum's reputation for compelling and educational exhibits suggests that Boston residents and visitors can anticipate a fascinating new cultural destination in the near future. MORE...

Earnings Estimates Decoded: Navigating Market Chaos with Confidence

Finance

2025-04-20 13:30:37

When calendar year estimates come into play, what was once a forward-looking conversation about potential earnings can swiftly transform into a retrospective analysis of past financial performance. The shift from projecting future potential to examining historical results provides a dynamic perspective on a company's financial trajectory. By anchoring discussions in specific calendar year data, stakeholders gain a more concrete understanding of an organization's financial journey. This approach allows for a nuanced examination of earnings, revealing not just numbers, but the story behind the financial metrics. The transition from speculative forecasts to documented achievements offers a clearer, more transparent view of a company's economic health and performance. It transforms abstract predictions into tangible evidence of financial success or challenges. MORE...

Money Moves: Your Financial Roadmap from 20s to Golden Years

Finance

2025-04-20 13:00:27

Navigating Investment Strategies Across Life Stages: Expert Insights from Nationwide In an illuminating discussion on Wealth, Kevin Jestice, Head and Senior Vice President of Nationwide Investment Management Group, joins host Brad Smith to provide invaluable portfolio allocation advice tailored to investors at different life stages. Jestice breaks down critical investment strategies that can help individuals make informed financial decisions, offering nuanced guidance on how to optimize investment portfolios from early career to retirement. His expert perspective sheds light on adapting investment approaches to match personal financial goals and changing life circumstances. For those seeking deeper market insights and professional analysis, the full interview promises to deliver comprehensive understanding of current market dynamics and strategic investment planning. Don't miss this opportunity to gain expert knowledge that could transform your investment approach. Tune in to more compelling content on Wealth for continued financial education and market expertise. MORE...

First Financial Bankshares Delivers Steady Performance: Q1 2025 Earnings Meet Wall Street's Gaze

Finance

2025-04-20 12:50:15

First Financial Bankshares Delivers Strong Q1 2025 Performance

First Financial Bankshares (NASDAQ:FFIN) has reported impressive financial results for the first quarter of 2025, showcasing robust growth and financial strength across key metrics.

Highlights of Financial Performance

- Revenue Surge: The bank achieved a remarkable 13% revenue increase, reaching US$145.5 million in the first quarter

- Strategic Growth: Demonstrates the company's effective business strategies and market positioning

- Consistent Expansion: Continues the bank's trend of steady financial performance and shareholder value creation

Investors and analysts are viewing these results as a positive indicator of First Financial Bankshares' continued resilience and potential in the competitive banking sector.

The company remains committed to delivering exceptional financial services and maintaining its strong market presence.

MORE...Market Mood Shift: Why This Stock Pullback Isn't Cause for Panic

Finance

2025-04-20 12:30:15

In the complex world of global trade, uncertainty surrounding tariffs continues to create significant challenges for businesses and markets. Clarity is not just desirable—it's essential for economic stability and strategic planning. Tariff policies have become increasingly unpredictable, leaving companies struggling to make informed decisions about international trade. The lack of transparent guidelines creates a ripple effect of economic uncertainty, impacting everything from supply chain management to pricing strategies. Businesses need a clear roadmap. Consistent and predictable tariff frameworks would enable companies to: • Make more accurate financial forecasts • Plan long-term international investments • Develop more resilient global strategies • Reduce economic volatility Policymakers must prioritize creating transparent, stable tariff regulations that provide businesses with the confidence to invest, expand, and innovate. By establishing more predictable trade policies, we can foster a more robust and adaptable global economic environment. The bottom line is simple: markets thrive on certainty, and tariff clarity is a critical component of economic growth and international trade success. MORE...

Chemung Financial Soars: Surprise Earnings Surge Beats Wall Street Predictions

Finance

2025-04-20 12:03:13

Chemung Financial Reports First Quarter 2025 Financial Performance

Chemung Financial Corporation (NASDAQ: CHMG) has unveiled its financial results for the first quarter of 2025, revealing a nuanced financial landscape marked by strategic challenges and ongoing market adaptations.

Key Financial Highlights

- Revenue: The company reported revenues of $24.6 million, reflecting a modest 4.5% decline compared to the same period last year

- The slight downturn underscores the competitive banking environment and potential macroeconomic headwinds

Despite the revenue reduction, Chemung Financial remains committed to its core strategic objectives, focusing on operational efficiency and customer-centric banking solutions.

Investors and analysts will be closely monitoring the company's subsequent quarters to assess its resilience and growth potential in an evolving financial services landscape.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421