The $6,000 Parental Lifeline: How 'Dollar-for-Dollar' Deals Are Reshaping Australian Family Finances

Finance

2025-04-05 20:00:14

In a world where many parents follow conventional parenting paths, Kate and Brett are charting a unique course for their young son's future. Breaking away from traditional approaches, this forward-thinking couple is taking proactive steps to give their child an extraordinary head start in life. While most parents wait for traditional milestones, Kate and Brett are implementing innovative strategies to nurture their son's potential from an incredibly early age. They believe in empowering their child through early education, personalized learning experiences, and strategic skill development. Their approach goes beyond typical parental expectations, focusing on holistic growth that encompasses cognitive, emotional, and social development. By investing time, resources, and creative thinking into their son's early years, they're setting the stage for a future filled with opportunities and potential. From customized learning programs to exposure to diverse experiences, Kate and Brett are demonstrating that parenting is not just about nurturing, but about strategically preparing children for an increasingly competitive and complex world. Their commitment reflects a modern parenting philosophy that views childhood as a critical window for laying strong foundational skills and capabilities. As their son grows, it's clear that Kate and Brett's unconventional approach could provide him with significant advantages, challenging traditional notions of child-rearing and educational development. MORE...

Wall Street Trembles: Trump Tariffs Spark Market Meltdown - Local Expert Reveals Survival Strategy

Finance

2025-04-05 19:17:05

Wall Street experienced a significant market pullback today as President Donald Trump's latest tariff announcements triggered sharp declines across major stock indices. The Dow Jones Industrial Average plummeted 5.5%, while the tech-heavy NASDAQ saw an even steeper drop of 5.8%. Despite the dramatic market reaction, renowned financial expert Chad Olivier remains optimistic. He suggests that the current market volatility is merely a temporary setback and emphasizes that the underlying economic fundamentals remain robust. Olivier believes investors should view this as a short-term fluctuation rather than a long-term trend. The sudden market downturn underscores the sensitive relationship between trade policy and investor sentiment, highlighting how geopolitical decisions can quickly impact financial markets. While the immediate impact appears dramatic, experts like Olivier are advising calm and perspective. MORE...

Trade Tensions Spark Alarm: Is the Debt Specter Rising Again?

Finance

2025-04-05 19:00:00

The Leveraged Finance Market Grinds to a Halt: Banks Face Potential Debt Gridlock The financial landscape is experiencing a significant disruption as leveraged finance deals come to an abrupt standstill. Market volatility has created a challenging environment where investment banks may find themselves in a precarious position, potentially holding onto substantial committed debt for corporate acquisitions. The current market conditions echo past financial challenges, reminiscent of periods when banks were left carrying substantial financial risk. Investors and financial institutions are now closely watching the unfolding scenario, wondering how these market dynamics will resolve. With deal momentum slowing and market uncertainty rising, banks are confronting the real possibility of being stuck with substantial debt commitments. This situation could lead to complex financial negotiations and potential restructuring efforts across various sectors. The ripple effects of this market freeze could be far-reaching, potentially impacting corporate strategies, merger and acquisition plans, and overall financial market sentiment. Financial experts are advising caution and strategic reassessment in these unpredictable market conditions. As the landscape continues to evolve, stakeholders are bracing for potential shifts in leveraged finance strategies and waiting to see how financial institutions will navigate these turbulent waters. MORE...

Rocket Companies Soars: Investors Celebrate 40% Surge After Surprise Dividend Bombshell

Finance

2025-04-05 18:41:55

Rocket Companies (NYSE:RKT) is making bold strategic moves that are capturing investors' attention and driving significant market momentum. The company has unveiled an ambitious plan involving the acquisition of both Mr. Cooper Group and Redfin, complemented by a special dividend and transformative corporate governance changes. These strategic initiatives have already yielded impressive results, with the company's share price surging an remarkable 40% over the past quarter. The comprehensive approach signals a clear commitment to expansion, shareholder value, and long-term growth in the competitive financial services landscape. Notably, Rocket Companies has demonstrated remarkable financial resilience, posting substantial earnings growth in Q4 2024 that stands in stark contrast to the broader market's downward trends. This performance underscores the company's strategic agility and potential to outperform even in challenging economic environments. The proposed acquisitions and corporate restructuring reflect a forward-thinking approach, positioning Rocket Companies as a dynamic player ready to reshape the real estate and financial technology sectors. Investors and market analysts are closely watching these developments, anticipating the potential ripple effects across the industry. MORE...

Trumps Cash In: Family Fortunes Flourish Amid Financial Chaos

Finance

2025-04-05 18:24:00

Amidst market volatility, the atmosphere was electric at the Saudi-backed LIV Golf tournament and the high-profile fundraiser, both hosted at Donald Trump's prestigious properties in Florida. The events unfolded at the Doral resort and Mar-a-Lago, showcasing a vibrant social scene that continued despite the day's financial turbulence. The gatherings highlighted Trump's ongoing connections with both sporting and political circles, drawing attention to his influential network even as economic indicators suggested broader challenges in the financial landscape. MORE...

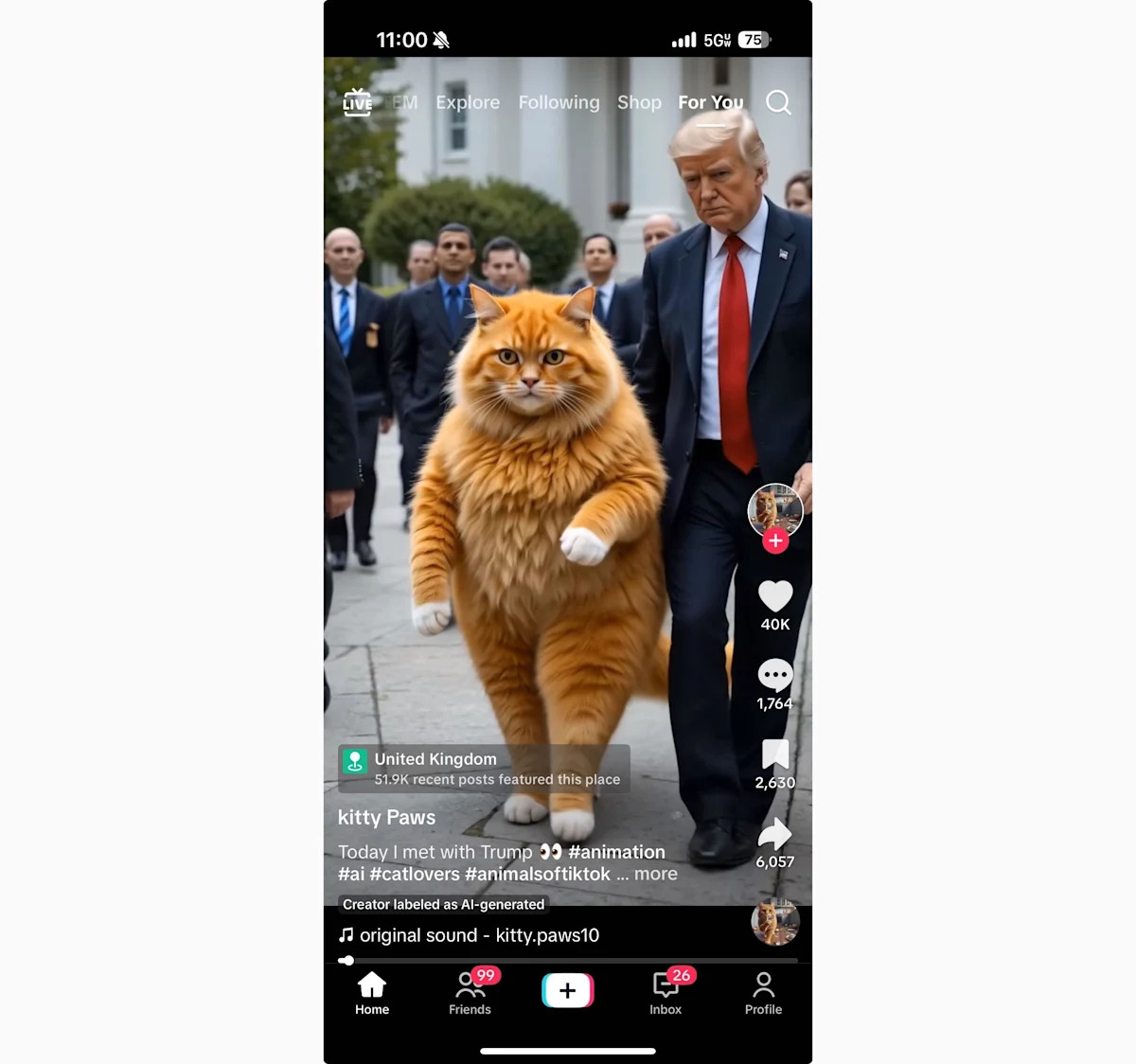

Scroll Smarter: Cutting Through the AI Noise on Social Media

Finance

2025-04-05 18:01:33

Reclaiming Your Social Media: A Guide to Cutting Through AI-Generated Noise

Social media platforms are currently experiencing an unprecedented flood of AI-generated content that threatens to overwhelm genuine human interaction. From repetitive memes to nonsensical posts, artificial intelligence is rapidly transforming our digital landscapes into cluttered, impersonal spaces.

Understanding the AI Content Explosion

The rise of advanced language models and image generation tools has made it easier than ever for users and businesses to create massive amounts of content with minimal effort. While this technology offers incredible potential, it's simultaneously creating a digital ecosystem saturated with low-quality, algorithmically produced material.

Practical Strategies to Clean Your Feed

- Curate Your Follows: Regularly audit the accounts you follow, removing those that consistently share AI-generated content.

- Use Platform Filters: Many social media sites now offer content filtering options to reduce algorithmic noise.

- Engage with Authentic Creators: Prioritize and interact with accounts that demonstrate genuine, human-driven creativity.

By taking proactive steps, you can transform your social media experience from a cluttered digital wasteland to a meaningful, engaging platform.

MORE...Wall Street Surprise: Principal Financial Bounces Back, Investors Remain Cautiously Optimistic

Finance

2025-04-05 17:44:49

Principal Financial Group Delivers Robust Q4 Performance, Signals Strong Investor Confidence Principal Financial Group (NasdaqGS:PFG) has emerged from the fourth quarter of 2024 with impressive financial results, showcasing a remarkable rebound in both net income and revenue. The financial services powerhouse not only exceeded market expectations but also demonstrated strategic financial management through key shareholder-friendly initiatives. The company's latest financial report reveals substantial year-over-year growth, highlighting its resilience in a dynamic market landscape. In a move that underscores management's optimism, Principal Financial announced an increased first-quarter 2025 dividend and launched a significant share buyback program, signaling strong confidence in the company's future prospects. Despite these positive corporate actions, the stock experienced a 6.38% decline over the past quarter, a movement that appears to be in line with broader market trends. Investors and analysts are closely monitoring the company's strategic positioning and potential market opportunities. The combination of robust earnings, enhanced shareholder returns, and strategic financial planning positions Principal Financial Group as a noteworthy player in the financial services sector, promising continued growth and potential value for investors. MORE...

Wall Street Whiplash: Corning's Stock Tumbles Despite Bullish Earnings Outlook

Finance

2025-04-05 17:42:48

In a turbulent week for technology stocks, Corning (NYSE:GLW) experienced a significant 15% stock price decline, outpacing the broader market's 10% downturn amid escalating U.S.-China trade tensions. The company's innovative strides, including the groundbreaking CorningGlassWorks AI Solutions and advanced Gorilla Glass Ceramic, were momentarily eclipsed by the market's heightened sensitivity to global trade uncertainties. Despite the challenging market conditions, Corning demonstrated resilience through strategic initiatives. The company's recent quantum computing partnership with Xanadu and an optimistic earnings guidance offered a glimmer of hope for investors seeking long-term potential. However, the immediate market sentiment remained cautious, reflecting the complex geopolitical landscape and its impact on technology sector investments. Investors and analysts are closely monitoring Corning's ability to navigate these turbulent waters, with particular interest in how the company's technological innovations might offset the current market headwinds. The coming weeks will be crucial in determining whether Corning can maintain its competitive edge and restore investor confidence in its strategic vision. MORE...

Trade Tensions Escalate: Trump's 10% Tariff Drops, Musk Pushes for Transatlantic Trade Revolution

Finance

2025-04-05 17:30:36

Trump's Tariff Saga: A Comprehensive Timeline of Trade Tensions

In the complex world of international trade, few topics have been as controversial and impactful as former President Donald Trump's tariff policies. Yahoo Finance brings you an in-depth exploration of the dramatic trade battles that reshaped global economic relationships during his administration.

The Tariff Strategy Unveiled

Trump's approach to international trade was anything but conventional. From the moment he entered office, he signaled a dramatic shift in America's trade strategy, targeting countries like China, Mexico, and Canada with unprecedented tariff measures. These weren't just economic policies; they were bold political statements that sent shockwaves through global markets.

Key Highlights of the Tariff Landscape

- China Trade War: Massive tariffs targeting hundreds of billions in Chinese goods

- Steel and Aluminum Tariffs: Global levies that challenged international trade norms

- USMCA Negotiations: Reworking trade agreements with key North American partners

Each tariff announcement became a high-stakes game of economic chess, with immediate ripple effects on stock markets, international relations, and domestic industries. Businesses, economists, and politicians watched closely as each new policy unfolded.

The Economic Impact

While supporters praised Trump's aggressive trade stance as protecting American jobs and industries, critics argued that the tariffs ultimately increased costs for consumers and created uncertainty in global markets. The real-world consequences were complex and far-reaching.

Stay tuned to Yahoo Finance for the most up-to-date and comprehensive coverage of these transformative trade policies that continue to shape our economic landscape.

MORE...Trade War Tactics: Expert Investors' Secret Playbook for Weathering Trump-Era Economic Turbulence

Finance

2025-04-05 16:50:10

Navigating Financial Turbulence: A Survival Guide for Americans During Trade War Tensions As the economic landscape shifts dramatically under President Trump's controversial tariff policies, Americans are feeling the ripple effects across the nation. With trade tensions escalating and market uncertainties mounting, financial experts are stepping forward to provide crucial guidance for protecting personal finances during these challenging times. The current trade war has created a complex economic environment that can feel overwhelming for many households. However, strategic planning and informed decision-making can help individuals weather the storm and maintain financial stability. Key strategies recommended by financial advisors include: 1. Diversifying investment portfolios 2. Building an emergency savings fund 3. Reducing unnecessary discretionary spending 4. Monitoring personal debt levels 5. Staying informed about economic developments By adopting a proactive approach and understanding how global trade policies impact personal economics, Americans can transform potential financial challenges into opportunities for resilience and smart money management. While the current economic climate may seem unpredictable, knowledge and preparation remain the most powerful tools for maintaining financial health and security. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421