Cosmic Crossroads: Gemini's Pivotal Day Unfolds - Career Shifts, Financial Whispers, and Romantic Surprises Revealed

Finance

2025-05-05 02:32:55

Gemini Horoscope: Unlocking Professional Potential and Financial Prosperity

Dear Gemini, today presents an extraordinary opportunity for remarkable career advancement and financial growth. The celestial alignment is casting a powerful spotlight on your professional aspirations, empowering you to take bold and strategic steps towards your goals.

Your natural communication skills and intellectual agility will be your greatest assets today. Expect unexpected opportunities to emerge that could significantly boost your career trajectory. Trust your intuitive insights and don't hesitate to showcase your unique talents to key decision-makers.

Financially, the stars suggest a promising landscape. You may encounter innovative ways to enhance your income or receive recognition for your recent hard work. Stay open to creative financial strategies and be prepared to seize potential investment opportunities that align with your long-term objectives.

Networking will play a crucial role in your success today. Engage with colleagues, mentors, and professional contacts with confidence and authenticity. Your charm and wit will help you forge meaningful connections that could lead to exciting professional collaborations.

Remember, Gemini, your adaptability and quick thinking are your superpowers. Embrace today's potential with enthusiasm and watch as your professional and financial horizons expand.

MORE...Wall Street Braces: Markets Pause After Historic Rally as Investors Await Fed Signals and Earnings Bombshell

Finance

2025-05-05 01:00:05

After an exhilarating rally that saw the S&P 500 reach new heights, investors might be bracing for a potential market breather. Major index futures are showing signs of a possible pullback, suggesting that the recent record-breaking momentum could be taking a momentary pause. The remarkable surge that propelled the market to unprecedented levels appears to be losing some steam, with futures indicating a potential cooling-off period. Traders and analysts are closely watching the market dynamics, wondering if this is a natural consolidation phase following the impressive gains or a more significant shift in market sentiment. While the recent performance has been nothing short of spectacular, the slight dip in futures hints at the market's inherent volatility and the constant ebb and flow of investor confidence. Investors should remain vigilant and prepared for potential short-term fluctuations as the market continues to navigate through these exciting times. MORE...

Money Matters: Local Educator Steven Novosel Transforms Philly Classrooms with Financial Wisdom

Finance

2025-05-05 00:55:05

From Basketball Courts to Classroom Lessons: A Journey in Financial Education Steven Novosel is transforming the lives of Philadelphia students by empowering them with crucial financial literacy skills. A 2009 Shippensburg University graduate in applied mathematics and former student assistant men's basketball coach, Novosel has leveraged his educational background to make a meaningful impact in the classroom. Now working as a secondary math teacher, Novosel is dedicated to equipping young learners with the financial knowledge they need to navigate an increasingly complex economic landscape. By bridging mathematical concepts with real-world financial skills, he is helping students develop a solid foundation for future financial success. His unique approach combines academic rigor with practical insights, ensuring that students not only understand mathematical principles but also learn how to apply them to personal finance, budgeting, and smart financial decision-making. MORE...

Financial Relief Unleashed: Australians Set to Receive Massive Cash Injection

Finance

2025-05-05 00:31:27

Financial Relief Arrives: Massive Cost-of-Living Support Set to Boost Australian Households Australians can breathe a sigh of relief as a substantial wave of financial support is about to wash over the nation. With billions of dollars in cost-of-living assistance on the horizon, households across the country are set to receive much-needed economic breathing room. The upcoming relief package promises significant support across multiple fronts. From targeted cash payments to strategic tax offsets, the government is taking decisive action to help citizens navigate the current economic challenges. Families, pensioners, and workers can expect meaningful financial assistance that could provide a critical buffer against rising living expenses. Key highlights of the support include: • Direct cash payments to eligible households • Targeted tax relief for low and middle-income earners • Energy bill subsidies • Support for pensioners and social security recipients While the exact details are still being finalized, experts suggest the relief could provide substantial financial reprieve for millions of Australians struggling with increased living costs. This timely intervention aims to ease the pressure on household budgets and provide some economic stability during uncertain times. Stay tuned for more specific information about how you can benefit from these upcoming support measures. MORE...

From Pioneers to Prophets: How Index Fund Innovators Are Reshaping Wall Street

Finance

2025-05-05 00:00:00

Pioneers of the Efficient Market Hypothesis: Challenging Financial Orthodoxy

In the mid-20th century, a group of visionary financial researchers embarked on a revolutionary journey to understand the true nature of financial markets. These pioneers—including Eugene Fama, Harry Roberts, and Paul Samuelson—faced significant skepticism and resistance as they challenged traditional investment wisdom.

The efficient market hypothesis (EMH) emerged as a groundbreaking concept that fundamentally questioned how financial markets actually operate. These researchers proposed that markets are inherently rational, with stock prices reflecting all available information almost instantaneously. This radical idea directly contradicted the prevailing belief that skilled investors could consistently outperform the market.

Challenges Faced by Early Researchers

The pioneers encountered numerous obstacles in their pursuit of financial truth:

- Entrenched financial institutions resisted their revolutionary theories

- Traditional investment professionals viewed their research as a threat to established practices

- Limited computational power made comprehensive market analysis challenging

- Lack of comprehensive historical financial data hindered extensive research

Despite these challenges, these intellectual trailblazers persevered. Their rigorous academic research gradually transformed understanding of financial markets, ultimately laying the groundwork for modern investment strategies like index funds and passive investing.

Their work demonstrated that markets are far more complex and efficient than previously imagined, challenging generations of investors to rethink their fundamental assumptions about financial decision-making.

MORE...Customer Revolt: 20% of Financial Services Clients Slam Brands with Scathing Online Reviews

Finance

2025-05-04 23:01:00

In a revealing survey of consumer preferences, nearly one-third of respondents demonstrated a discerning approach to selecting financial service providers. These potential customers are not willing to make a switch without careful consideration, setting a high bar for their future financial partner. Specifically, they indicated that they would only transition to a new financial institution if it boasted an impressive four-star rating or higher. This finding highlights a growing trend of consumer sophistication, where individuals are increasingly relying on reputation and peer reviews to guide their financial decisions. The four-star threshold suggests that customers are looking for more than just basic service—they want proven excellence, reliability, and a track record of customer satisfaction before committing to a new financial relationship. For financial service providers, this insight underscores the critical importance of maintaining a stellar reputation and consistently delivering high-quality services that meet and exceed customer expectations. MORE...

Wingspire Soars: Massive $350M Credit Boost Fuels Financial Expansion

Finance

2025-05-04 22:28:56

Wingspire Equipment Finance has successfully secured a substantial $350 million credit facility, marking a significant milestone in the company's strategic expansion. This new warehouse line, provided by banking giants Bank of America and Wells Fargo, will empower Wingspire to enhance its financial support for middle-market and sponsor-backed companies. The credit facility, extended to a wholly-owned subsidiary of Wingspire Equipment Finance, represents a robust financial commitment that will enable the company to broaden its lending capabilities and support a wider range of businesses seeking flexible equipment financing solutions. By securing this substantial credit line, Wingspire demonstrates its commitment to driving growth and providing innovative financial services to businesses across various sectors. The new facility positions the company to more effectively meet the evolving financing needs of its target market. MORE...

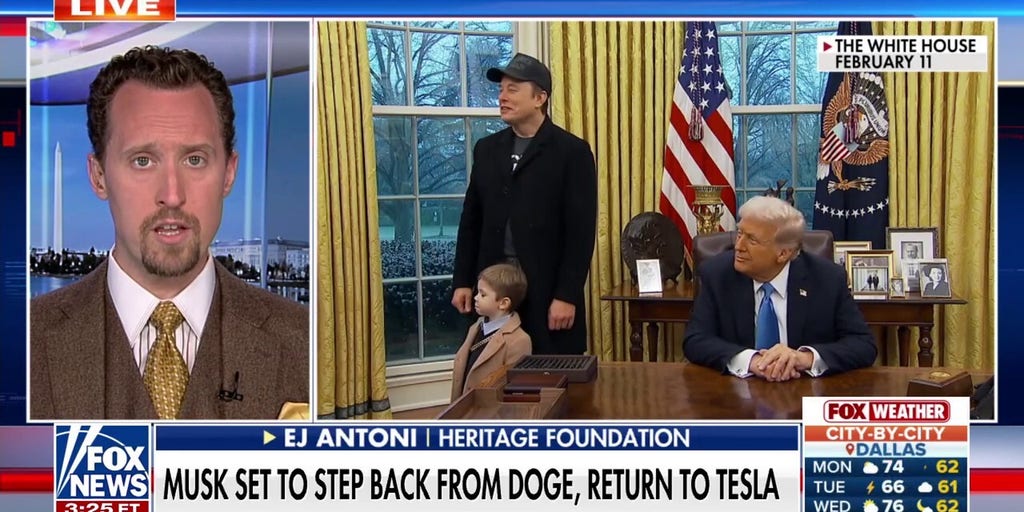

Dogecoin Revelations: Economist Exposes 'Shocking' Daily Discoveries

Finance

2025-05-04 20:24:11

In a recent appearance on 'Fox Report', Unleash Prosperity senior fellow EJ Antoni offered insights into the significant developments surrounding Dogecoin (DOGE) and its ongoing efforts to expose potential financial irregularities. Antoni highlighted the cryptocurrency's progress in bringing transparency to light, while also noting the anticipated shift in leadership dynamics. The discussion comes at a pivotal moment, with Elon Musk preparing to step back from his current role, adding an intriguing layer of complexity to the ongoing narrative. Antoni's commentary suggests that DOGE's investigative efforts are gaining momentum, potentially uncovering what he describes as "clear fraud" within the financial ecosystem. As the cryptocurrency landscape continues to evolve, this latest revelation promises to shed new light on the intricate world of digital finance and the ongoing quest for accountability. Investors and industry observers are closely watching these developments, anticipating the potential implications for the broader financial market. MORE...

Fiscal Fury: Vero Beach Residents Erupt in Heated Demand for City Hall Transparency

Finance

2025-05-04 20:19:58

Tensions Flared as Vero Beach Residents Demand Accountability at Fiery Town Hall Meeting Passion and frustration filled the air on Friday as concerned citizens packed the local community center, challenging city leaders to provide clarity on financial matters and critical infrastructure plans. The packed town hall meeting became a platform for residents to voice their growing concerns about transparency and the city's strategic direction. Residents peppered city officials with pointed questions, seeking detailed explanations about ongoing and proposed projects. The atmosphere was charged with a palpable sense of urgency, as community members demanded comprehensive insights into how their tax dollars are being allocated and what future developments are on the horizon. The heated discussion underscored the community's deep desire for open communication and responsible governance, signaling a pivotal moment in Vero Beach's civic engagement. MORE...

Money Mistakes Haunting Americans: The Top Financial Regrets Revealed

Finance

2025-05-04 19:31:04

Unexpected Facts That Will Blow Your Mind

Prepare to be amazed! The world is full of fascinating tidbits and surprising information that can completely reshape how we understand reality. From mind-bending scientific discoveries to quirky historical facts, some revelations are so extraordinary that they'll make you question everything you thought you knew.

Did you know that honey never spoils? Archaeologists have discovered edible honey in ancient Egyptian tombs that's thousands of years old! Or consider this: a single bolt of lightning contains enough energy to toast 100,000 slices of bread. These are just the tip of the iceberg when it comes to incredible facts that sound almost too strange to be true.

Some discoveries challenge our perception of the world in ways we never expected. For instance, octopuses have three hearts and blue blood, while the human brain generates enough electricity to power a small light bulb. The universe is packed with wonder, and each surprising fact is a reminder of how extraordinary our world truly is.

Whether you're a trivia enthusiast or simply curious about the world around you, these unexpected facts are guaranteed to spark your imagination and leave you wanting to learn more. Get ready to be surprised, delighted, and utterly amazed!

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421