Green Revolution: Valor Carbon Unveils Climate Strategy in Kazakhstan's Renewable Frontier

Finance

2025-04-22 06:54:23

Valor Carbon Illuminates the Path to Sustainable Energy in Kazakhstan In a groundbreaking statement, Valor Carbon has stepped forward to shed light on the critical role of Renewable Energy Certificates (RECs) and climate finance in Kazakhstan's sustainable development journey. The company is positioning itself as a key player in transforming the nation's energy landscape, emphasizing the importance of innovative financial mechanisms in driving environmental progress. Renewable Energy Certificates have emerged as a powerful tool for supporting clean energy initiatives, allowing organizations to invest in and support renewable energy production beyond their immediate geographical constraints. For Kazakhstan, this represents a significant opportunity to accelerate its transition to a more sustainable energy ecosystem. The company's insights highlight the complex interplay between financial innovation and environmental stewardship. By leveraging climate finance strategies, Kazakhstan can unlock new pathways for renewable energy development, creating economic opportunities while simultaneously addressing critical climate challenges. Valor Carbon's expertise brings a nuanced understanding of how financial instruments like RECs can catalyze meaningful environmental change. Their approach goes beyond traditional energy solutions, offering a forward-thinking perspective on sustainable development that could potentially reshape Kazakhstan's energy infrastructure. As the global community continues to seek innovative approaches to climate action, Valor Carbon's commentary provides a compelling narrative about the potential of strategic financial mechanisms in driving meaningful environmental progress. MORE...

Pakistan's Economic Pivot: Finance Minister Signals Major US Trade Expansion

Finance

2025-04-22 05:51:21

In a strategic move to enhance bilateral trade relations, Pakistan's Finance Minister Muhammad Aurangzeb has signaled the country's commitment to expanding economic ties with the United States. The minister outlined an ambitious plan to increase purchases of American goods and systematically dismantle non-tariff trade barriers, aiming to counterbalance the challenging tariff landscape imposed during the Trump administration. Aurangzeb's proactive approach demonstrates Pakistan's eagerness to create a more favorable trade environment with the United States. By targeting non-tariff obstacles and seeking to boost American product imports, the country hopes to forge a more balanced and mutually beneficial economic partnership. This diplomatic and economic strategy could potentially open new avenues for trade and collaboration between the two nations, signaling a forward-looking approach to international commerce. The initiative reflects Pakistan's determination to adapt to changing global trade dynamics and position itself as a flexible and attractive trading partner for the United States. As international economic relationships continue to evolve, such strategic moves could prove crucial in strengthening diplomatic and economic ties. MORE...

Global Finance Leaders Brace for Trump's Economic Showdown

Finance

2025-04-22 04:56:10

Dive into the pulse of European politics and policy with Bloomberg's Brussels Edition—your essential daily guide to the pivotal developments shaping the European Union. Our carefully curated briefing cuts through the complexity, delivering insights that matter most from the epicenter of continental decision-making. Whether you're a policy wonk, business leader, or global observer, this is your front-row seat to the strategic conversations and critical movements unfolding in Brussels. Each day, we distill the most significant political, economic, and regulatory news, providing context and analysis that goes beyond the headlines. From breakthrough negotiations to emerging trends, our expert team brings you a comprehensive yet concise overview of what's driving the European agenda right now. Stay informed, stay ahead—welcome to the Brussels Edition. MORE...

Market Jitters: Asian Stocks Waver in Shadow of Wall Street's Dramatic Selloff

Finance

2025-04-22 04:38:27

Asian financial markets displayed a cautious tone on Wednesday, reflecting ongoing uncertainty surrounding U.S. investment landscapes and the lingering tensions of the U.S.-China trade conflict. The region's key indices showed mixed performance, with investors treading carefully amid global economic uncertainties. Japan's benchmark Nikkei 225 experienced a modest decline, dropping 0.3% to settle at 34,174.38, signaling the market's subdued sentiment. Meanwhile, Australia's S&P/ASX 200 remained virtually stable, registering a marginal gain of less than 0.1% and closing at 7,820.20. The hesitant trading patterns underscored the complex geopolitical and economic challenges facing investors, as they continue to navigate the intricate dynamics of international trade and investment strategies. MORE...

Walmart's Flipkart Plots Strategic Homecoming: Singapore Exit Signals India-First Approach

Finance

2025-04-22 04:15:28

A growing trend is emerging among Indian startups, as companies that previously established bases abroad for financial advantages are now strategically returning to their home country. These entrepreneurs are drawn back by India's promising initial public offering (IPO) landscape and a regulatory environment that restricts dual listings. E-commerce giant Flipkart, which began its journey in 2007 as a modest online bookstore, exemplifies this shift. The company has since transformed into a formidable competitor to Amazon in the Indian market. In a recent statement, Flipkart explained their relocation, noting that the move "represents a natural evolution, aligning our holding structure with our core operations." The migration of startups from financial hubs like Singapore and the United States back to India signals a growing confidence in the domestic market. Entrepreneurs are recognizing the potential for growth, investment opportunities, and a more streamlined regulatory framework that supports their business expansion goals. This trend not only reflects the maturation of India's startup ecosystem but also underscores the country's increasing attractiveness as a global business destination. As more companies choose to root themselves in their home market, they are contributing to a vibrant and dynamic entrepreneurial landscape. MORE...

Trade Showdown: India's Tariff Tug-of-War Could Unlock E-Commerce Giants' Full Potential

Finance

2025-04-22 04:14:18

The Trump administration is gearing up to challenge India's ecommerce regulations, seeking to open up the country's massive $125 billion digital marketplace to major American online retailers like Amazon and Walmart. According to a recent Financial Times report, U.S. officials are preparing to press Prime Minister Narendra Modi's government for a more equitable playing field in upcoming trade negotiations. Insider sources, including industry executives and lobbyists, reveal that the comprehensive trade talks will extend beyond ecommerce, potentially impacting sectors ranging from automotive to agricultural products. The U.S. is strategically positioning itself to break down barriers that currently limit foreign retailers' access to India's rapidly growing digital economy. This diplomatic push underscores the Trump administration's aggressive approach to international trade, seeking to create more opportunities for American businesses in one of the world's most promising emerging markets. The proposed changes could significantly reshape India's ecommerce landscape, potentially offering unprecedented market access for global online retail giants. MORE...

Money Talks: How Chelsea's Financial Wizardry Keeps the Spending Spree Alive

Finance

2025-04-22 04:12:58

Chelsea's Financial Paradox: Massive Losses, No Premier League Penalties

In a stunning financial revelation, Chelsea Football Club has hemorrhaged an eye-watering £1.291 billion at the operating level over the past decade, yet remarkably remains unscathed by Premier League Profitability and Sustainability Rules (PSR). This seemingly impossible scenario highlights the complex financial mechanisms that govern football club accounting. Despite astronomical losses that would typically trigger severe financial sanctions, Chelsea has navigated these regulatory waters with remarkable skill. The club's unique financial strategy, bolstered by significant ownership investment and strategic player trading, has allowed them to absorb massive operational deficits without triggering the Premier League's financial watchdogs. This intricate financial dance demonstrates the nuanced ways top-tier football clubs can manage their economic challenges while maintaining competitive status. While other clubs might crumble under such substantial financial strain, Chelsea has managed to turn potential fiscal disaster into a testament of financial resilience, showcasing how strategic investment and clever accounting can shield a football institution from traditional financial constraints. MORE...Money, Metrics, and Madness: Decoding Football's Financial Playbook

Finance

2025-04-22 04:02:43

Decoding Football Finance: Key Terms Every Fan Should Know

The world of football has become increasingly complex, with financial jargon now playing a crucial role in understanding the beautiful game. Whether you're a die-hard fan or a casual observer, these essential financial terms will help you navigate the modern football landscape.

Transfer Budget

Think of this as a club's shopping fund. It's the amount of money a team has available to buy new players, essentially their transfer war chest. Clubs carefully manage this budget, balancing ambition with financial responsibility.

Wage Bill

This is the total amount a club spends on player salaries. In today's football, a hefty wage bill can be as important as transfer spending. Top players command astronomical salaries that can make or break a club's financial strategy.

Financial Fair Play (FFP)

A set of regulations designed to prevent clubs from spending beyond their means. It's like a financial referee, ensuring that teams can't simply buy success by accumulating massive debts. Clubs must balance their spending with their income, creating a more sustainable football ecosystem.

Player Amortization

Don't let this complex term intimidate you. It's essentially how clubs spread the cost of a player's transfer fee over the length of their contract. Imagine buying an expensive guitar and paying it off in installments – that's amortization in football.

Commercial Revenue

This is the money clubs generate through sponsorships, merchandise, and other business activities. In the modern game, a club's commercial prowess can be just as important as what happens on the pitch.

Understanding these terms gives you a deeper insight into the financial mechanics driving modern football. It's not just about goals and glory anymore – it's also about smart financial management.

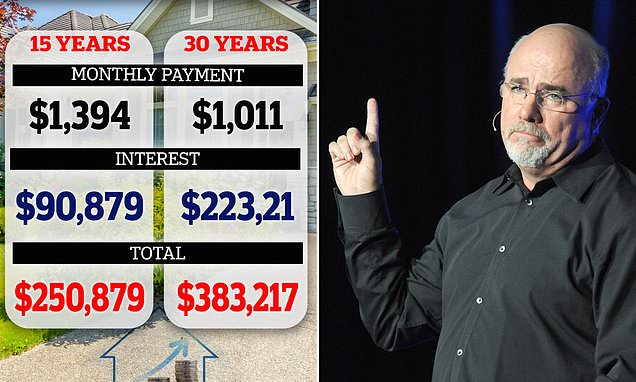

MORE...Mortgage Minefield: The Hidden Cost Bomb Experts Don't Want You to Know

Finance

2025-04-22 03:50:07

Financial guru Dave Ramsey has a critical warning for homebuyers: beware of a common mortgage pitfall that could derail your financial future. When shopping for a home loan, many consumers make a costly mistake that can burden them for decades. Ramsey emphasizes the importance of avoiding adjustable-rate mortgages (ARMs), which might seem attractive initially but can quickly become a financial nightmare. These loans may start with temptingly low interest rates, but they're designed to fluctuate, potentially causing your monthly payments to skyrocket unexpectedly. Instead, Ramsey recommends sticking with a traditional 15-year fixed-rate mortgage. This approach offers stability, predictability, and the opportunity to build equity faster. By choosing a fixed-rate mortgage, homebuyers can protect themselves from market volatility and unexpected payment increases. The key takeaway? Don't be seduced by seemingly low initial rates. Look for a mortgage that provides long-term financial security and peace of mind. A stable, fixed-rate mortgage isn't just a loan—it's a foundation for your financial well-being. Homebuyers should carefully evaluate their options, consult with financial advisors, and prioritize a mortgage strategy that aligns with their long-term financial goals. Remember, the right mortgage can be a powerful tool in building wealth and securing your financial future. MORE...

Money Smarts: How Kids Are Mastering Financial Skills Through Innovative State Program

Finance

2025-04-22 03:28:38

Ohio Launches Financial Education Initiative for Young Learners

As Financial Literacy Month takes center stage this April, the Ohio Department of Commerce is stepping up to empower the next generation of financially savvy citizens. The department is rolling out an innovative program designed to support organizations dedicated to teaching children critical money management skills.

Recognizing that financial education is crucial from an early age, state officials are committed to providing resources that help young Ohioans develop a strong foundation in personal finance. By partnering with local educational organizations, the department aims to equip children with the knowledge and tools they need to make smart financial decisions in the future.

This initiative underscores the importance of financial literacy as a key life skill, helping children understand concepts like saving, budgeting, and responsible spending long before they enter the complex world of adult financial management.

Parents, educators, and community leaders are encouraged to take advantage of this opportunity to support financial education for Ohio's youth.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421