Streaming Supremacy: Netflix Crowned Champion as Wall Street Analyst Signals Bullish Breakthrough

Finance

2025-03-17 16:25:31

Netflix Soars as Wall Street Analysts Boost Confidence Shares of streaming giant Netflix experienced a significant surge today after receiving a bullish upgrade from a prominent Wall Street analyst. The positive momentum comes as the company continues to demonstrate resilience and strategic growth in the competitive streaming landscape. The upgrade, which highlights Netflix's strong content lineup and innovative market positioning, has reignited investor enthusiasm. Analysts point to the company's recent success in original programming and international expansion as key drivers of potential future growth. Investors are closely watching Netflix's ability to maintain its leadership in the streaming market, particularly as competition from other platforms intensifies. The stock's upward movement reflects growing confidence in the company's long-term strategy and ability to adapt to changing entertainment consumption trends. With this latest vote of confidence from Wall Street, Netflix appears poised to continue its impressive performance and maintain its status as a streaming industry powerhouse. MORE...

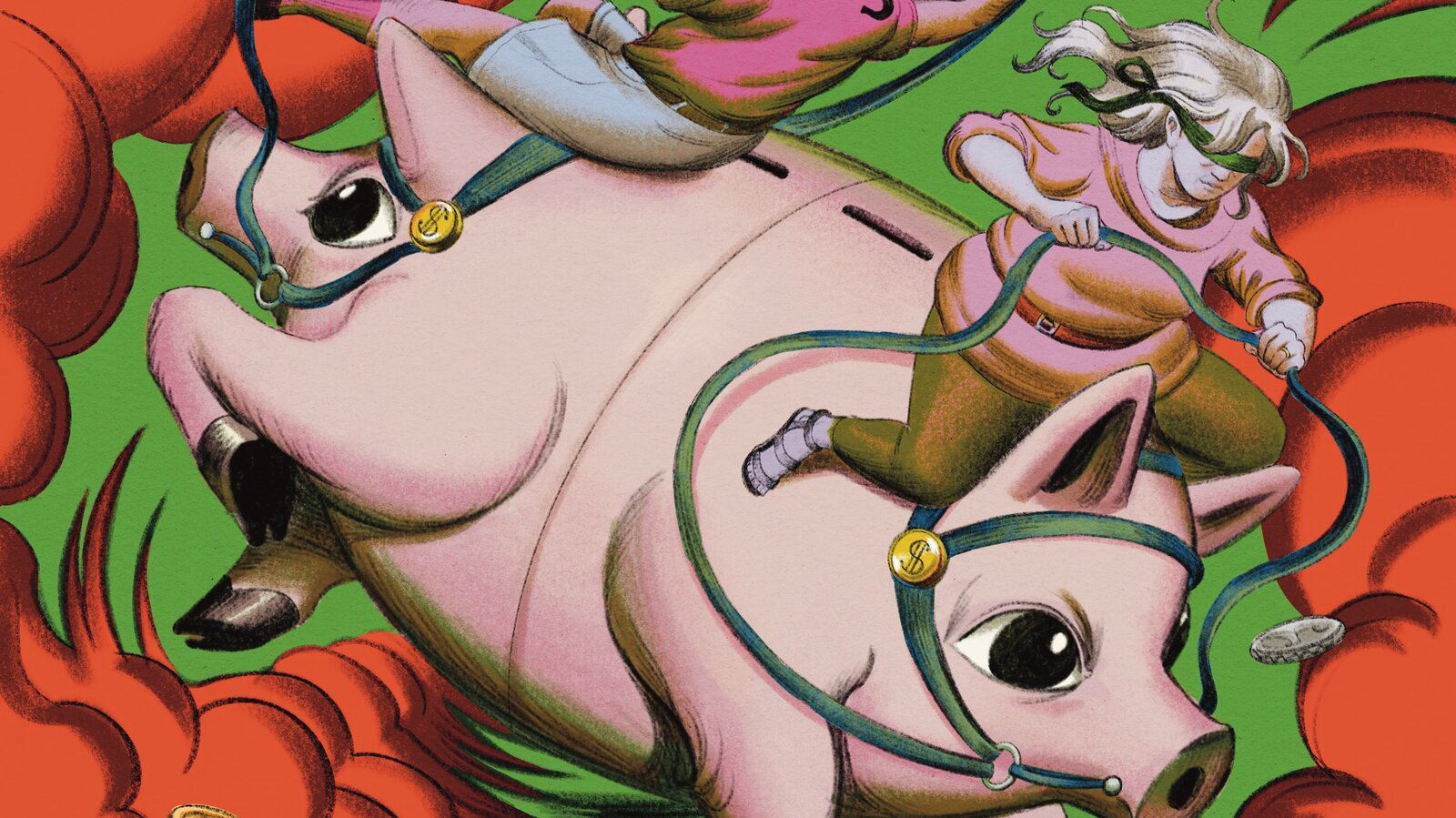

Wall Street Whiplash: How Trump's Team Is Playing Mind Games with Market Investors

Finance

2025-03-17 16:00:53

Wall Street is buzzing with a critical question: Has the legendary "Trump put" vanished, or is it simply biding its time? Investors are carefully analyzing the shifting political landscape, wondering whether the market's previous safety net provided by former President Donald Trump's investor-friendly policies has truly disappeared. The so-called "Trump put" was a phenomenon where markets could reliably count on pro-business policies, tax cuts, and regulatory rollbacks that typically boosted stock prices. Now, with a new administration and changing economic dynamics, traders are reassessing their expectations and strategic approaches. Market sentiment remains cautious yet curious. Some analysts argue that the protective market mechanism might be temporarily suspended rather than permanently eliminated. Others believe the fundamental dynamics that once supported this market phenomenon have fundamentally transformed. Investors are closely watching policy signals, economic indicators, and potential legislative changes that could hint at the future of market support mechanisms. The uncertainty creates both challenges and opportunities for those willing to navigate the evolving financial terrain. As the economic landscape continues to shift, one thing remains clear: the days of predictable market interventions are becoming increasingly complex and nuanced. MORE...

Market Shake-Up: Tech Giants and Biotech Stocks Driving Today's Trading Frenzy

Finance

2025-03-17 16:00:36

Wall Street experienced a nuanced trading session today, as U.S. stock markets displayed mixed performance. Encouraging retail sales data helped temper ongoing anxieties surrounding international trade tensions, providing a glimmer of optimism for investors navigating a complex economic landscape. The midday market activity reflected a delicate balance between cautious sentiment and underlying economic resilience. Positive consumer spending indicators offered a counterpoint to the persistent concerns about potential tariff impacts, suggesting that the U.S. economy continues to demonstrate remarkable adaptability in the face of global economic challenges. Investors are closely monitoring these developments, weighing the potential implications for corporate earnings and broader market sentiment. The interplay between retail performance and trade dynamics continues to be a critical focal point for market participants seeking to understand the current economic trajectory. MORE...

Turbocharging Small Business Loans: How Banks Are Revolutionizing SBA Lending with Smart Financial Tech

Finance

2025-03-17 15:54:40

Revolutionizing Small Business Lending: How Cutting-Edge Financial Technology is Transforming SBA Loans In the dynamic world of small business financing, a groundbreaking financial spreading technology is emerging as a game-changer, promising to streamline the SBA lending process for both financial institutions and borrowers. This innovative approach is set to dramatically enhance efficiency, reduce processing times, and create a more seamless lending experience. By leveraging advanced digital tools and sophisticated data analysis, this new technology simplifies the complex loan application and evaluation process. Lenders can now quickly assess financial health, analyze risk, and make more informed lending decisions with unprecedented speed and accuracy. Small business owners benefit from faster approvals, more transparent assessments, and reduced administrative hurdles. The technology's intelligent algorithms can rapidly parse financial statements, cross-reference multiple data sources, and provide comprehensive insights that traditional manual methods could never achieve. This means more precise risk assessment, potentially lower interest rates, and increased access to critical funding for small businesses across various industries. As financial technology continues to evolve, this breakthrough in SBA lending represents a significant step toward a more responsive, efficient, and user-friendly lending ecosystem that empowers entrepreneurs and supports economic growth. MORE...

Green Energy Milestone: Quinbrook Secures Massive Funding for UK's Largest Solar Venture

Finance

2025-03-17 15:28:28

A robust financial package totaling £238.5 million has been secured through a strategic collaboration between Lloyds Bank and NatWest. The comprehensive financing arrangement includes a substantial £218.5 million term loan and an additional £20 million VAT facility, providing substantial financial support for the project's strategic objectives. MORE...

Tesla's Bold China Move: Free Self-Driving Trial Sparks Stock Rollercoaster

Finance

2025-03-17 15:22:48

Tesla's stock is taking another hit today, continuing a challenging streak that has investors and market watchers closely monitoring the electric vehicle giant's performance. The recent downturn reflects mounting pressures on the company, including production challenges, increased competition in the EV market, and broader economic uncertainties. Investors are growing increasingly cautious about Tesla's near-term prospects, with the stock experiencing significant volatility in recent weeks. Factors contributing to the decline include softening demand, potential margin pressures, and concerns about the company's aggressive expansion strategies. Despite these short-term challenges, Tesla remains a pivotal player in the electric vehicle revolution, with innovative technology and a strong brand presence. However, the current market sentiment suggests that the company will need to demonstrate resilience and strategic adaptability to regain investor confidence. Analysts are closely watching Tesla's upcoming financial reports and production numbers, which could provide crucial insights into the company's ability to navigate the current economic landscape and maintain its competitive edge in the rapidly evolving automotive technology sector. MORE...

Breaking: How Embedded Finance Is Revolutionizing Business Purchasing

Finance

2025-03-17 15:19:49

Blurring the Lines: When Personal and Professional Worlds Converge Traditionally, workplace wisdom has championed a clear separation between personal and professional spheres. However, in today's interconnected digital landscape, the boundaries are becoming increasingly fluid, especially when it comes to financial interactions and payment experiences. Modern professionals are seeking seamless, intuitive payment solutions that transcend traditional workplace constraints. The emerging trend suggests that employees and freelancers alike want payment platforms that feel natural, personalized, and integrated into their daily lives. Gone are the days of rigid, impersonal compensation systems. Now, workers desire payment technologies that understand their unique needs, offer flexibility, and provide a sense of immediacy and convenience. Whether you're a remote worker, a gig economy participant, or a traditional employee, the expectation is for financial transactions to be as smooth and effortless as possible. This shift represents more than just a technological evolution—it's a cultural transformation in how we perceive work, compensation, and personal financial management. The future of payments is not about maintaining strict boundaries, but about creating holistic, user-centric experiences that respect individual preferences and lifestyles. MORE...

AI Revolution: How Finance is Transforming at Breakneck Speed

Finance

2025-03-17 14:47:28

In the rapidly evolving landscape of financial technology, Lauren Clement, a forward-thinking executive at Prudential Financial, is pondering a transformative question: Could emerging artificial intelligence breakthroughs fundamentally reshape the industry's long-standing approach to AI-driven strategies? As cutting-edge AI technologies continue to advance at an unprecedented pace, traditional methods of leveraging artificial intelligence are being challenged. Clement recognizes that the next wave of AI innovations might not just incrementally improve existing processes, but potentially revolutionize how financial institutions analyze data, assess risks, and make strategic decisions. The potential for disruption is significant. New AI models are demonstrating capabilities that go far beyond current applications, suggesting that the financial sector may be on the cusp of a technological paradigm shift. Clement's insights reflect a growing awareness among industry leaders that adaptability and openness to radical technological transformation will be key to staying competitive in an increasingly AI-driven world. MORE...

Silicon Valley's New Alchemy: How AI and Blockchain Are Rewriting the Rules of Venture Capital

Finance

2025-03-17 14:42:32

Capital Convergence: Revolutionizing Technology, Finance, and Social Impact

In an era of rapid global transformation, capital convergence is emerging as a powerful catalyst for innovation across multiple sectors. This groundbreaking approach is reshaping how investors, technologists, and social entrepreneurs collaborate to drive meaningful change.

During a recent TheCUBE podcast, guest host Elliott Donnelley provided unique insights into this dynamic landscape. He highlighted how strategic capital investments are breaking traditional boundaries, creating unprecedented opportunities for technological advancement and social impact.

The convergence of capital is not just about financial returns—it's about creating holistic solutions that address complex global challenges. By integrating technology, finance, and social consciousness, forward-thinking investors are developing strategies that generate both economic value and positive societal transformation.

As industries continue to evolve, capital convergence represents a promising frontier where innovation, purpose, and profit intersect, promising a more integrated and responsive approach to global development.

MORE...War Costs Soar: Israel's Massive $30 Billion Defense Expenditure Reshapes Regional Conflict Landscape

Finance

2025-03-17 14:09:00

In a stark revelation of the economic toll of ongoing military operations, Israel's Finance Ministry disclosed on Monday that the country has expended a staggering 112 billion shekels—equivalent to approximately $31 billion—on military conflicts in Gaza and Lebanon throughout 2024. The substantial financial commitment underscores the significant economic strain of Israel's current military engagements, highlighting the immense resources being channeled into defense and conflict management. This unprecedented expenditure reflects the complex geopolitical challenges facing the nation and the substantial cost of maintaining military operations in volatile regions. The ministry's report provides a sobering glimpse into the economic implications of sustained military activities, demonstrating the considerable financial burden that national security demands in times of regional tension and conflict. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421