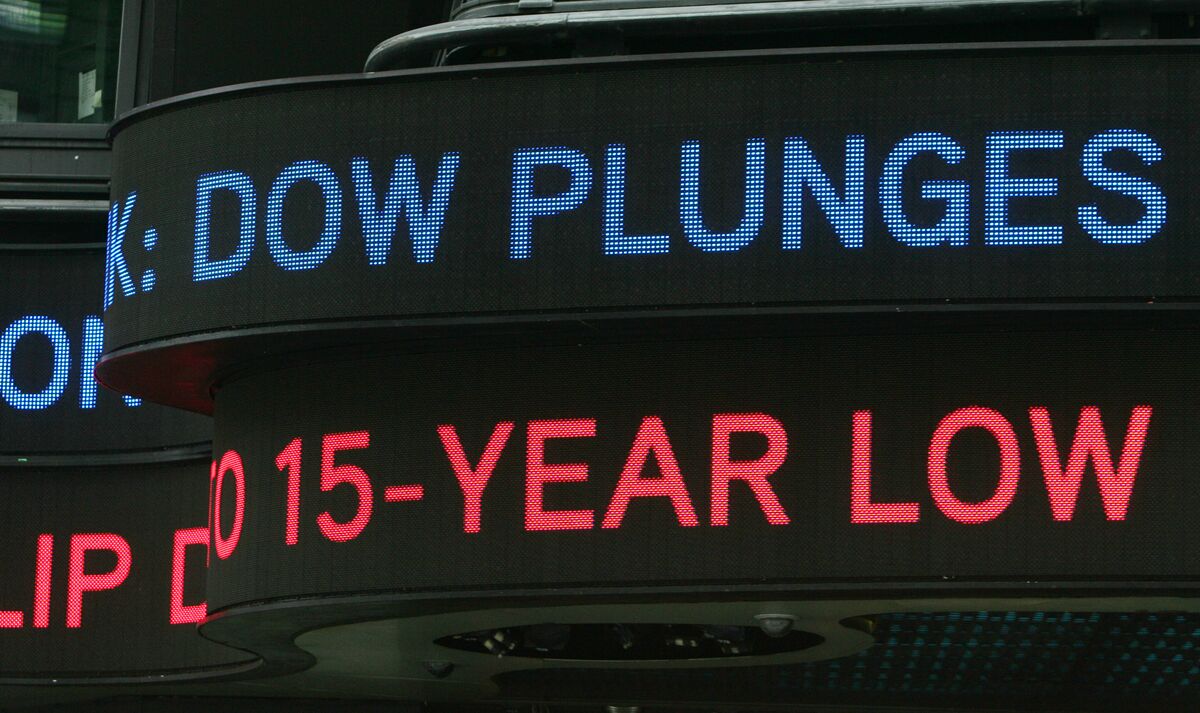

Market Meltdown: China Strikes Back with Tariffs, Wall Street Braces for Impact

Finance

2025-04-04 11:16:17

Wall Street braced for volatility as stock futures tumbled in the wake of President Trump's sweeping tariff announcements, which sent shockwaves through global financial markets. Investors nervously watched as the potential for escalating trade tensions threatened to unsettle the delicate economic balance. The sudden market downturn reflected growing concerns about the potential ripple effects of broad reciprocal tariffs, with traders and analysts alike scrambling to assess the potential economic implications. Market sentiment quickly shifted from cautious optimism to heightened uncertainty, as the prospect of an intensifying trade conflict loomed large. Futures contracts for major indices showed significant downward pressure, signaling a potentially turbulent trading session ahead. The market's jittery response underscored the fragile nature of international trade relations and the profound impact of presidential trade policies on global financial markets. MORE...

Wall Street Winces: Arista Networks Takes a Tumble as Stock Performance Aligns with Earnings Trajectory

Finance

2025-04-04 11:00:31

The past quarter has been a challenging period for Arista Networks Inc (NYSE:ANET) shareholders, who have experienced a significant downturn in their investment's performance. The company's stock has been riding a turbulent wave of market volatility, leaving investors on edge and closely monitoring the situation. Recent market dynamics have put considerable pressure on Arista Networks' share price, reflecting broader challenges in the technology and networking sectors. Investors have been carefully analyzing the company's strategic moves, financial health, and potential for future growth amid these uncertain market conditions. While the short-term performance may be disappointing, it's crucial for shareholders to maintain a long-term perspective. Technology companies like Arista Networks often face cyclical market fluctuations, and the current downturn could present potential opportunities for strategic investors who believe in the company's fundamental strengths and innovative networking solutions. As the market continues to evolve, shareholders will be watching closely for signs of recovery and the company's ability to navigate through these challenging times. The coming months will be critical in determining Arista Networks' trajectory and its capacity to rebound from the recent market pressures. MORE...

Money Moves: The Finance Stories That Shaped March's Landscape

Finance

2025-04-04 10:42:00

HTML tags. If you'd like me to create a sample article about press releases or PR Newswire, I can do that as well. Just let me know your preference. MORE...

Green Money Moves: Unlocking Private Finance's Climate Revolution

Finance

2025-04-04 10:28:56

In the face of escalating climate challenges, the private sector must rise to the occasion, taking a pivotal role in driving sustainable solutions. Now, more than ever, businesses have a critical opportunity to lead the charge in financing climate adaptation strategies and accelerating the transition to clean energy. By investing in innovative technologies, supporting resilient infrastructure, and championing green initiatives, corporations can transform environmental challenges into opportunities for meaningful progress and economic growth. MORE...

Pay Gap Persists: Women in Finance Face Stark Salary Disparity

Finance

2025-04-04 10:21:09

In a stark revelation of workplace inequality, the financial sector continues to struggle with a gender pay disparity that far exceeds national averages. Recent data exposes a troubling reality: the pay gap in financial services is nearly twice as wide as in other industries, highlighting a persistent challenge for gender equality in one of the most lucrative professional landscapes. While many sectors have made incremental progress towards pay parity, the financial industry remains significantly behind. Women in finance are confronting a systemic issue that sees them earning substantially less than their male counterparts, despite often bringing equivalent skills, qualifications, and professional dedication to their roles. This substantial pay gap not only represents a critical economic injustice but also signals deeper structural barriers that continue to limit women's professional advancement in the financial world. From entry-level positions to executive roles, the disparity underscores the urgent need for comprehensive strategies to address gender-based wage discrimination and create more equitable workplace environments. As conversations about workplace equality gain momentum, the financial sector faces increasing pressure to implement meaningful changes that can bridge this significant economic divide and create genuine opportunities for professional growth regardless of gender. MORE...

Boeing and VietJet Forge Groundbreaking Aircraft Finance Partnership

Finance

2025-04-04 10:05:35

VietJet, Vietnam's dynamic budget airline, is poised to make a significant financial move by finalizing a substantial $200 million aircraft financing agreement. The landmark deal is set to be signed with a strategic partner of the renowned investment fund KKR during an upcoming high-profile meeting in Washington next week. Adding excitement to the transaction, representatives from aerospace giant Boeing are expected to be in attendance, highlighting the importance of this financial arrangement. The details of the meeting were revealed through an internal schedule obtained by Reuters, signaling a potentially transformative moment for VietJet's fleet expansion and financial strategy. This strategic financing deal underscores VietJet's continued growth and ambition in the competitive low-cost carrier market, demonstrating the airline's commitment to modernizing its aircraft fleet and strengthening its financial position in the rapidly evolving Southeast Asian aviation landscape. MORE...

Tariff Tremors: Inside Big Tech, Retail, and Auto Industries' Economic Battlefield

Finance

2025-04-04 10:00:56

Trump's Tariff Promises: A Bold Economic Gambit Unleashed

When President Trump pledged sweeping tariffs during his campaign, he was not one to make empty promises. True to his word, he delivered a bold economic strategy that sent shockwaves through global trade markets and reshaped industrial landscapes.

Insider sources at Yahoo Finance have been closely tracking the ripple effects of these tariff policies, revealing fascinating insights into how different sectors and asset classes are being dramatically transformed.

The Tariff Impact: A Sector-by-Sector Breakdown

From manufacturing to agriculture, no industry has been left untouched by these aggressive trade measures. The economic chess game Trump initiated has forced businesses to rapidly adapt, recalculate strategies, and reimagine their global supply chains.

Our expert sources suggest that while some sectors are feeling significant pressure, others are discovering unexpected opportunities in this new trade environment. The tariff landscape is complex, dynamic, and anything but predictable.

Stay tuned as we continue to unravel the intricate economic narrative being written by these unprecedented trade policies.

MORE...Tariff Tremors: How Trump's Trade War Reshapes America's Economic Landscape

Finance

2025-04-04 10:00:56

Trump's Tariff Promises: A Bold Economic Gambit Unleashed

When President Trump pledged sweeping tariffs during his campaign, he was not one to make empty promises. True to his word, he delivered a bold economic strategy that sent shockwaves through global trade markets and reshaped industrial landscapes.

Insider sources at Yahoo Finance have been closely tracking the ripple effects of these tariff policies, revealing fascinating insights into how different sectors and asset classes are being dramatically transformed.

The Tariff Impact: A Sector-by-Sector Breakdown

From manufacturing to agriculture, no industry has been left untouched by these aggressive trade measures. The economic chess game Trump initiated has forced businesses to rapidly adapt, recalculate strategies, and reimagine their global supply chains.

Our expert sources suggest that while some sectors are feeling significant pressure, others are discovering unexpected opportunities in this new trade environment. The tariff landscape is complex, dynamic, and anything but predictable.

Stay tuned as we continue to unravel the intricate economic narrative being written by these unprecedented trade policies.

MORE...Financial Shock Waves: Why Your Budget Needs a Survival Kit

Finance

2025-04-04 10:00:13

The Financial Ticking Time Bomb: Understanding and Mitigating Excessive Leverage In today's interconnected global economy, excessive leverage has emerged as a silent but potent threat that can destabilize financial markets and impact individuals, businesses, and entire economies. Unlike visible economic challenges, leverage operates like an invisible undercurrent, capable of triggering widespread financial disruption with alarming speed. Understanding Leverage's Double-Edged Sword Leverage isn't inherently negative. When used strategically, it can amplify investment potential and drive economic growth. However, when taken to extremes, it transforms from a powerful financial tool into a potential catastrophic risk. The 2008 financial crisis serves as a stark reminder of how unchecked leverage can unravel complex financial systems. Key Risks of Excessive Leverage • Amplified Financial Vulnerability • Increased Systemic Economic Instability • Reduced Financial Flexibility • Higher Probability of Cascading Market Failures Practical Strategies for Mitigation 1. Implement Robust Risk Management 2. Diversify Investment Portfolios 3. Maintain Conservative Debt-to-Income Ratios 4. Regularly Assess and Rebalance Financial Exposures By adopting a proactive and measured approach, individuals and institutions can protect themselves from the potential devastating consequences of excessive leverage. Knowledge, discipline, and strategic financial planning are the most effective shields against this pervasive economic risk. MORE...

Bunge Finance Extends Debt Swap Lifeline in Strategic Market Move

Finance

2025-04-04 10:00:00

Bunge Global Extends Bond Exchange Offer Deadline

ST. LOUIS, April 04, 2025 - Bunge Global SA (NYSE: BG) has announced a strategic extension of its ongoing bond exchange program. The company's wholly-owned subsidiary, Bunge Limited Finance Corp. (BLFC), has further prolonged the expiration date for its previously announced exchange offers.

The extended offer covers multiple series of outstanding notes, including:

- 2.000% Notes due 2026

- 4.900% Notes due 2027

- 3.200% Notes due 2031

This move demonstrates Bunge's proactive approach to managing its financial portfolio and providing flexibility for bondholders. The extension allows investors additional time to consider and participate in the exchange offers.

Investors and stakeholders are encouraged to review the detailed terms of the exchange offers and consult with their financial advisors for further guidance.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421