Market Volatility Signals: S&P 500 Forecast Spreads Wide as Investors Brace for Uncertainty

Finance

2025-03-22 10:00:25

As the financial landscape of 2025 unfolds, investors find themselves navigating a complex and unpredictable stock market. The early days of the year have been marked by notable volatility, with stocks struggling to find a clear direction. Amidst this uncertainty, Wall Street analysts are presenting a diverse array of forecasts that range from cautiously optimistic to deeply pessimistic. The current market climate is generating intense speculation and debate. Experts are offering predictions that, while seemingly contradictory, all carry a sense of plausibility. Some analysts point to underlying economic indicators that suggest potential recovery, while others warn of potential challenges that could further destabilize market performance. Investors are advised to approach the year with careful strategy, keeping a close eye on emerging trends and maintaining a balanced, diversified portfolio. The wide spectrum of expert opinions underscores the importance of adaptability and informed decision-making in these uncertain financial times. As the year progresses, market watchers will be closely monitoring economic signals, corporate performance, and global events that could potentially shift the stock market's trajectory. The only certainty, it seems, is the continued unpredictability of the financial landscape in 2025. MORE...

Money Moves: Unlock 4.50% APY with Today's Top CD Rates – Investors Take Note!

Finance

2025-03-22 10:00:16

Unlock the Best CD Rates: Your Guide to Smart Savings

Are you looking to maximize your savings and earn competitive returns? Dive into today's top Certificate of Deposit (CD) rates and discover how you can make your money work harder for you. Our expert team has carefully curated a selection of the most attractive CD offers currently available in the market.

Whether you're a seasoned investor or just starting to explore low-risk investment options, understanding current CD rates can help you make informed financial decisions. From short-term to long-term CDs, we'll help you navigate the landscape of potential opportunities that can boost your savings strategy.

Don't let your money sit idle – explore the best CD rates today and take the first step towards smarter, more profitable saving!

MORE...Financial Survival Guide: 5 Bulletproof Strategies to Outsmart an Impending Economic Meltdown

Finance

2025-03-22 10:00:00

Navigating Economic Uncertainty: Protecting Your Financial Future

As storm clouds gather on the economic horizon, many Americans are feeling increasingly anxious about the potential of a recession. With mass layoffs sweeping across industries, escalating trade tensions, and grocery prices continuing to climb, financial uncertainty has become more than just a passing concern.

Understanding the Warning Signs

Recent economic indicators suggest we're standing at a critical crossroads. Tech giants are trimming their workforce, manufacturing sectors are experiencing volatility, and consumer spending is showing signs of strain. These aren't just isolated incidents, but potential harbingers of broader economic challenges.

Practical Strategies to Safeguard Your Finances

- Build an Emergency Fund: Aim to save 3-6 months of living expenses to provide a financial cushion during uncertain times.

- Diversify Your Income: Consider side hustles or freelance opportunities to create multiple revenue streams.

- Review and Trim Expenses: Conduct a thorough audit of your monthly spending and identify areas where you can cut back.

- Invest Strategically: Maintain a balanced investment portfolio that can weather market fluctuations.

Looking Ahead with Confidence

While economic uncertainty can be daunting, proactive planning and smart financial management can help you navigate potential challenges. By staying informed, adaptable, and strategic, you can protect your financial well-being and emerge stronger, regardless of economic conditions.

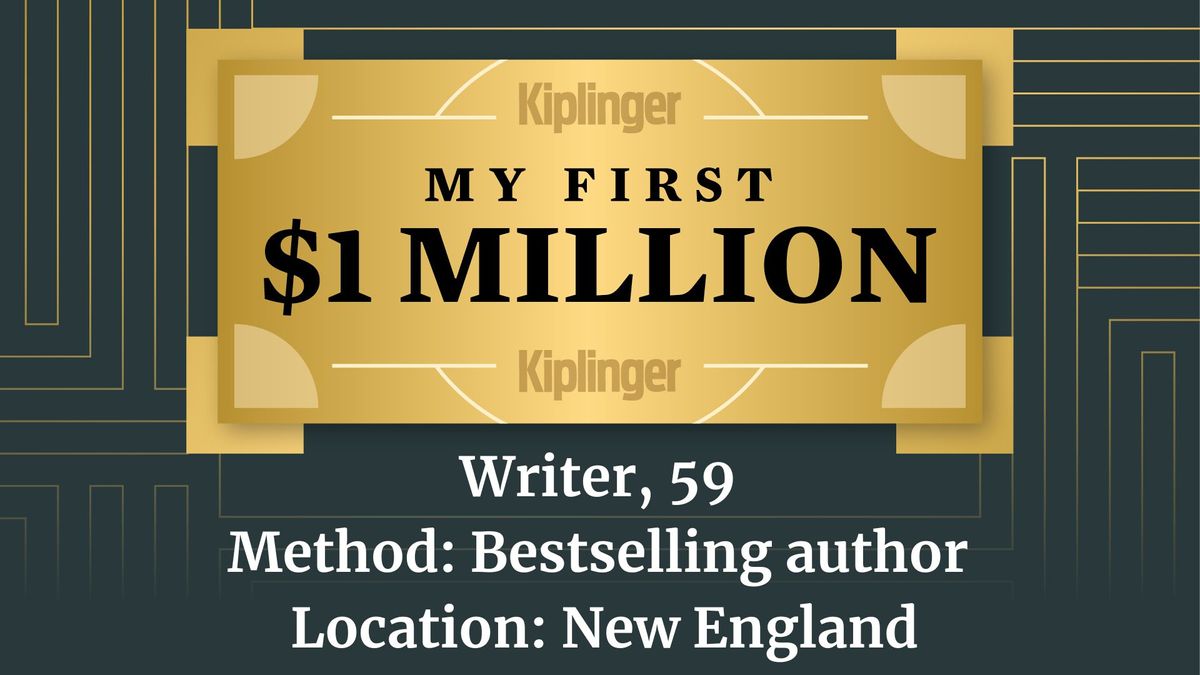

MORE...From Blank Page to Breakthrough: How a 59-Year-Old Wordsmith Cracked the Million-Dollar Code

Finance

2025-03-22 10:00:00

Cracking the Code: How Millionaires Make Their First Million

Have you ever found yourself wondering about the secret pathways to extraordinary financial success? Kiplinger's groundbreaking "My First $1 Million" series is about to pull back the curtain and reveal the fascinating stories behind remarkable wealth creation.

This exclusive investigative series goes beyond simple numbers, diving deep into the personal journeys, strategic decisions, and innovative thinking that transform ordinary individuals into millionaires. From tech entrepreneurs to savvy investors, each story offers unique insights into the art and science of building substantial wealth.

Get ready to be inspired, educated, and motivated as we uncover the real-world strategies that turn ambitious dreams into financial reality. Whether you're an aspiring entrepreneur, an investment enthusiast, or simply curious about wealth creation, these stories will provide you with invaluable perspectives on achieving financial success.

Stay tuned as Kiplinger takes you on an extraordinary journey through the personal narratives of those who've successfully crossed the million-dollar threshold.

MORE...Finance Board Blocks Stamford's YMCA Property Deal: Warns of Potential 'Financial Sinkhole'

Finance

2025-03-22 09:00:00

I apologize, but there seems to be an incomplete or missing original article content in your request. Without the original text, I cannot rewrite it. Could you please provide the full original article text that you would like me to rewrite? Once I have the complete text, I'll be happy to help you rewrite it in a more fluent and engaging manner, formatted within HTML body tags. If you'd like me to generate a sample rewrite, I would need more context about the specific topic or content you're referring to. Could you share more details? MORE...

From Fringe to Powerful: Bezalel Smotrich's Controversial Ascent in Israeli Politics

Finance

2025-03-21 22:05:24

In the complex political landscape of Israel, Bezalel Smotrich has emerged as a pivotal figure, rapidly ascending to become one of the most powerful politicians alongside Prime Minister Benjamin Netanyahu. As the country's finance minister, Smotrich has captured national attention with his controversial yet influential political stance. A key member of the far-right Religious Zionism party, Smotrich has transformed from a marginal political figure to a central player in Israel's government. His rise reflects the shifting dynamics of Israeli politics, where ideological hardliners have gained significant ground in recent years. Smotrich's political influence extends far beyond traditional financial ministerial duties. He has become a vocal advocate for conservative policies, challenging established political norms and pushing for more right-wing approaches to governance. His strategic positioning within Netanyahu's coalition has allowed him to wield unprecedented power and shape national discourse. As Israel navigates complex internal and external challenges, Smotrich represents a new generation of political leadership that is reshaping the country's political landscape. His rapid ascent underscores the ongoing transformation of Israeli politics and the growing influence of ideologically driven politicians. MORE...

Wall Street's Mood Plummets: Insider Strategies for Navigating Market Despair

Finance

2025-03-21 21:38:36

Despite Market Uncertainties, Wall Street Strategist Sees Continued Bull Market Potential In the face of mounting concerns about President Donald Trump's trade tariffs and economic recovery challenges, Julian Emanuel, senior managing director of equity, derivatives, and quantitative strategy at EVERCORE ISI, remains optimistic about the stock market's trajectory. Emanuel argues that current market volatility should not deter investors, suggesting that short-term downturns present strategic buying opportunities. His bullish perspective offers a counterpoint to the prevailing anxieties surrounding market fluctuations and economic unpredictability. While the Dow Jones Industrial Average (^DJI), NASDAQ Composite (^IXIC), and S&P 500 (^GSPC) have experienced turbulent periods, Emanuel believes the underlying market fundamentals remain strong. Investors are advised to view potential market pullbacks as chances to strategically enhance their investment portfolios. For more in-depth market insights and expert analysis, viewers are encouraged to explore additional segments of Market Domination Overtime, where top financial professionals provide comprehensive market perspectives. MORE...

Market Pulse: Lululemon's Earnings Spark Investor Curiosity Amid PCE Data Reveal

Finance

2025-03-21 21:01:11

Economic Insights and Corporate Earnings Take Center Stage in Late March 2025 Investors and market watchers are in for an exciting week as the final days of March 2025 promise a wealth of economic data and corporate financial reports. The upcoming week is packed with key indicators and earnings releases that could provide valuable insights into the current economic landscape. Tuesday, March 25, kicks off with critical economic indicators, including the latest consumer confidence reading and home price index. Gamers and investors alike will be keeping an eye on GameStop's earnings report, which is also scheduled for the same day. The economic spotlight continues on Thursday, March 27, with the highly anticipated revised fourth-quarter 2024 GDP figures. This update will offer a more refined look at the previous quarter's economic performance. The week concludes on Friday, March 28, with the release of February's Personal Consumption Expenditures (PCE) index, a crucial measure of consumer spending and inflation trends. Corporate earnings enthusiasts will be tracking reports from several notable companies, including: • Lululemon • Dollar Tree • Chewy • KB Homes • Intuitive Machines These releases promise to provide a comprehensive snapshot of various sectors and their current economic health. MORE...

Wall Street Rebounds: S&P 500 Breaks Free from Losing Streak in Market Rollercoaster

Finance

2025-03-21 20:00:58

Wall Street Awaits Market Signals as Fed's Mixed Messages Spark Investor Curiosity Investors held their breath on Wednesday as U.S. stock futures hovered near neutral territory, carefully parsing the nuanced signals emerging from the Federal Reserve's latest policy decision. The central bank's choice to maintain current interest rates has left market participants in a state of cautious anticipation, trying to decode the underlying economic implications. The Fed's recent communication presented a complex narrative, with hints of potential future monetary policy shifts that have traders and analysts closely examining every word. While the decision to hold rates steady provides a temporary sense of stability, the underlying economic indicators suggest a landscape of continued uncertainty. Market participants are now keenly watching for additional context that might provide clearer guidance on the Fed's near-term strategy. The delicate balance between managing inflation and supporting economic growth remains at the forefront of investors' concerns, creating an atmosphere of measured speculation across trading floors. As the day unfolds, investors will be meticulously analyzing every economic signal, seeking insights that could potentially move market sentiment and inform their investment strategies in this intricate financial environment. MORE...

Market Tremors: Why Top Financial Guru Isn't Hitting the Panic Button

Finance

2025-03-21 19:54:36

In a recent appearance on 'Making Money', RIA Advisors' Chief Investment Officer Lance Roberts offered a nuanced perspective on the current stock market volatility. Breaking down the recent market lows, Roberts challenged the narrative that Trump-era tariffs are the primary culprit behind the market's struggles. Roberts delved deep into the complex economic landscape, providing investors with insights that go beyond surface-level explanations. He argued that while trade tensions have played a role, the market's performance is influenced by a multitude of interconnected factors that require a more sophisticated analysis. The seasoned financial expert emphasized the importance of looking beyond simplistic blame narratives and understanding the broader economic context. His commentary shed light on the intricate dynamics driving market fluctuations, offering viewers a more comprehensive understanding of the current financial environment. By dissecting the market's recent performance, Roberts demonstrated why knee-jerk reactions and oversimplified explanations fall short of capturing the true economic picture. His expert analysis provides investors with a more thoughtful and nuanced approach to understanding market trends and potential challenges ahead. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421