Investors Bail: The Alarming Trend Threatening U.S. Market Stability

Finance

2025-04-21 13:34:25

Wall Street Braces for Volatility as Political Tensions Escalate U.S. stock futures are experiencing significant pressure Monday morning, reflecting growing market unease amid rising political uncertainties. The financial landscape is being shaped by mounting speculation about potential leadership changes at the Federal Reserve, with renewed discussions surrounding President Trump's potential plans to remove Chairman Jerome Powell. Yahoo Finance Senior Reporter Josh Schafer provides critical insights into the emerging "Sell America" trade, highlighting the complex dynamics driving market sentiment. The current market climate suggests investors are closely monitoring political developments that could dramatically impact economic stability and monetary policy. The futures market is showing notable downward movement across key indices, including the S&P 500 (ES=F), Nasdaq (NQ=F), and Dow Jones Industrial Average (YM=F). These fluctuations underscore the market's sensitivity to political rhetoric and potential institutional disruptions. For deeper analysis and expert perspectives on the latest market movements, viewers are encouraged to explore additional segments of the Morning Brief series, which offers comprehensive coverage of evolving financial landscapes. MORE...

Wall Street Trembles: Trump's Trade War and Fed Criticism Spark Market Meltdown

Finance

2025-04-21 13:33:11

Wall Street Braces for High-Stakes Week: Tech Earnings and Trade Tensions Take Center Stage Investors are gearing up for a pivotal week that promises to be a rollercoaster of market-moving events. All eyes are fixed on two critical fronts: the unfolding drama of President Trump's aggressive tariff strategies and the much-anticipated earnings reports from tech giants that could reshape market sentiment. The week ahead is set to be a pressure cooker of economic uncertainty, with market participants closely monitoring every development in the ongoing trade tensions and preparing for potential market-shifting revelations from Silicon Valley's biggest players. Tech earnings reports are expected to provide crucial insights into the health of the technology sector and potentially signal broader economic trends. As traders and analysts hold their collective breath, the interplay between international trade policies and corporate performance will likely create significant market volatility. Investors are advised to stay nimble and prepared for rapid shifts in market dynamics. MORE...

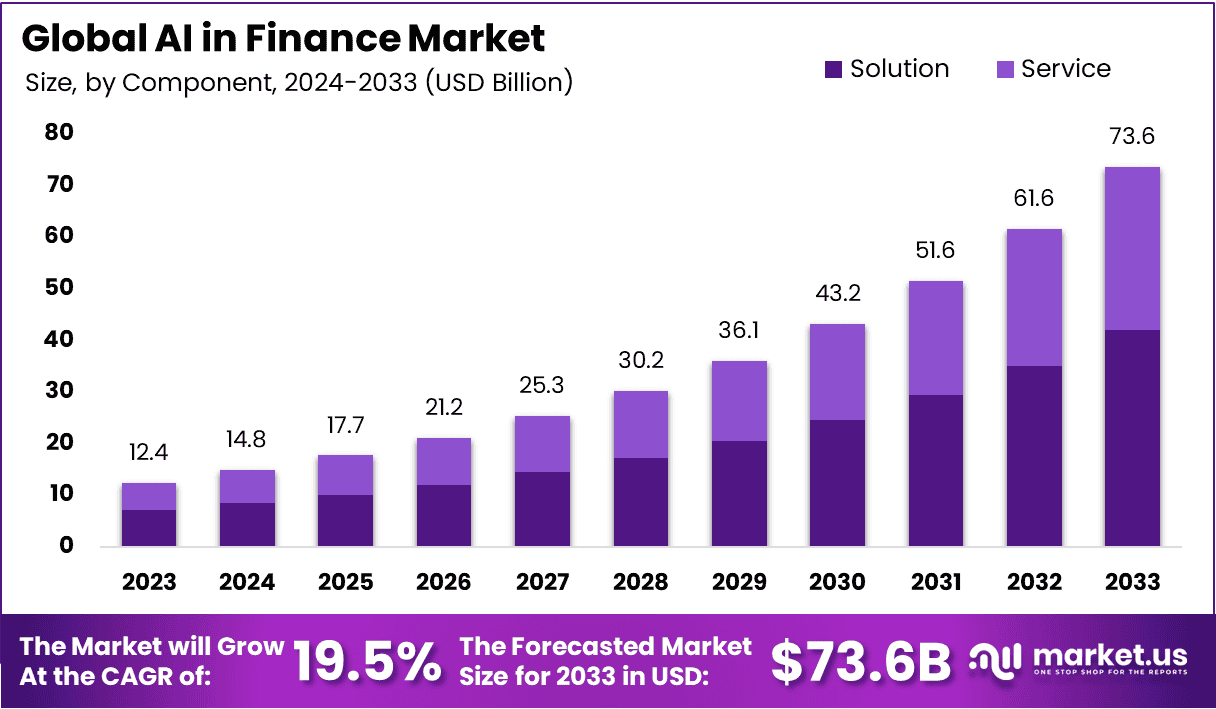

Wall Street's AI Revolution: How Trade Tensions Could Reshape Financial Technology by 2025

Finance

2025-04-21 13:10:18

AI in Finance: Navigating Market Growth and Global Trade Dynamics

The artificial intelligence (AI) finance market is poised for remarkable transformation, with projections indicating substantial growth and innovative developments through 2025-2034. As global economic landscapes evolve, the intersection of AI technology and financial services is creating unprecedented opportunities and challenges.

Market Trajectory and Technological Advancements

The forecast period reveals a compelling narrative of technological disruption, where AI is set to revolutionize traditional financial processes. Key drivers include enhanced predictive analytics, automated decision-making, and sophisticated risk management strategies that are reshaping the financial ecosystem.

US Tariff Impacts and Strategic Implications

Recent trade policies and tariff regulations are significantly influencing the AI finance market's development. Financial institutions are adapting their technological investments and strategic frameworks to navigate the complex global economic environment, leveraging AI as a critical tool for resilience and competitive advantage.

Key Market Highlights:

- Projected exponential growth in AI financial technologies

- Increased investment in machine learning and predictive modeling

- Enhanced risk assessment and fraud detection capabilities

- Strategic adaptations to evolving trade and economic landscapes

As the market continues to mature, stakeholders can anticipate a dynamic landscape of innovation, technological integration, and transformative financial solutions.

MORE...Green Revolution: UK Unleashes Powerful Carbon Credit Marketplace to Supercharge Climate Investment

Finance

2025-04-21 13:08:09

In a bold move to accelerate climate action, the United Kingdom is set to transform voluntary carbon and nature credit markets. The government's strategic initiative aims to unlock significant climate finance and create a more robust framework for environmental investment. By developing comprehensive guidelines and market standards, the UK seeks to enhance the credibility and transparency of carbon and nature credits. This approach is designed to attract more investors, corporations, and stakeholders committed to sustainable development and carbon reduction efforts. The proposed plans will focus on establishing clear mechanisms that ensure the integrity of carbon credits, promoting high-quality environmental projects, and providing a reliable pathway for businesses to offset their carbon emissions. This forward-thinking strategy underscores the UK's commitment to leading global efforts in combating climate change and supporting innovative green solutions. Experts believe these market improvements could potentially accelerate private sector investment in critical environmental initiatives, creating a more dynamic and effective approach to addressing global climate challenges. MORE...

Financial Veteran Joins Burke & Herbert: Accounting Leadership Shakeup Signals Strategic Growth

Finance

2025-04-21 13:00:00

Experienced Financial Leader Strengthens Banking Accounting Team

Our organization is thrilled to announce the addition of a distinguished Certified Public Accountant (CPA) with deep regional banking expertise to lead our accounting operations. This strategic hire brings extensive financial leadership experience from the Mid-Atlantic banking sector.

As our new Chief Accounting Officer (CAO), this seasoned professional will be instrumental in enhancing our financial reporting processes and implementing robust risk control strategies. With a proven track record of navigating complex financial landscapes, they are poised to drive operational excellence and financial integrity.

Their comprehensive background in regional banking and strategic financial management promises to elevate our accounting practices and provide critical insights into our financial performance. We are confident that their expertise will contribute significantly to our organization's continued growth and success.

Stay tuned for more details about this exciting leadership addition to our team.

MORE...Finance Veteran Joins Ziff Davis: Supercharging M&A Strategy with Seasoned Leadership

Finance

2025-04-21 13:00:00

Strategic Powerhouse: Ziff Davis Bolsters Leadership with Top-Tier Tech M&A Expert

Ziff Davis has made a significant strategic move by recruiting a seasoned Morgan Stanley banker with an impressive 18-year track record in technology mergers and acquisitions. This high-profile hire signals the company's ambitious plans for expansion and growth in the competitive tech landscape.

The new executive brings a wealth of experience and a proven track record of navigating complex technology transactions. With nearly two decades of expertise in strategic deal-making at a prestigious investment bank, this leader is poised to drive Ziff Davis's next phase of corporate development.

By bringing aboard such a distinguished professional, Ziff Davis demonstrates its commitment to accelerating strategic growth and identifying transformative opportunities in the rapidly evolving technology sector. This strategic recruitment underscores the company's forward-thinking approach and determination to remain at the forefront of technological innovation and corporate strategy.

MORE...Market Tremors: Trump's Tariff Tirade and Fed Critique Rattle Wall Street Futures

Finance

2025-04-21 12:24:09

Wall Street Braces for High-Stakes Week: Tech Earnings and Trade Tensions Take Center Stage Investors are gearing up for a pivotal week that promises to be a rollercoaster of market-moving events. All eyes are fixed on two critical fronts: the unfolding drama of President Trump's aggressive tariff strategies and the much-anticipated earnings reports from tech giants that could reshape market sentiment. The week ahead is set to be a pressure cooker of economic uncertainty, with market participants closely monitoring every development in the ongoing trade tensions and preparing for potential market-shifting revelations from Silicon Valley's biggest players. Tech earnings reports are expected to provide crucial insights into the health of the technology sector and potentially signal broader economic trends. As traders and analysts hold their collective breath, the interplay between international trade policies and corporate performance will likely create significant market volatility. Investors are advised to stay nimble and prepared for rapid shifts in market dynamics. MORE...

Money Matters: Americans Overwhelmingly Back High School Financial Literacy

Finance

2025-04-21 12:00:40

Americans Overwhelmingly Support Financial Education in High Schools

In a groundbreaking survey commissioned by the American Bankers Association Foundation, an impressive 90% of U.S. adults have voiced strong support for integrating financial education into high school curricula. This nonprofit organization, dedicated to empowering bankers to provide critical financial literacy resources, has highlighted a growing national consensus on the importance of preparing young students for financial independence.

Currently, twenty-seven states have taken a proactive approach by mandating standalone personal finance courses for all high school students. These states recognize that equipping teenagers with essential money management skills is crucial in today's complex economic landscape.

The survey results underscore a widespread belief that financial education is no longer a luxury, but a necessity for young Americans preparing to navigate their economic futures. By teaching critical skills like budgeting, investing, and understanding credit, schools can help students build a strong foundation for long-term financial success.

MORE...Breaking: Student Loan Debt Relief Decoded - 5 Game-Changing Forgiveness Programs Teachers Can't Afford to Miss

Finance

2025-04-21 11:35:26

Navigating Financial Challenges: Teachers' Struggle with Student Loan Debt and Community Service America's dedicated educators are facing an increasingly complex financial landscape, balancing their passion for teaching with the heavy burden of student loan debt. Teachers across the nation are finding themselves caught between their commitment to students and the financial pressures of substantial educational loans. Fortunately, hope is on the horizon. A range of federal and state-level loan forgiveness programs have emerged to provide relief for these hardworking professionals. These innovative programs recognize the critical role teachers play in shaping future generations and offer meaningful financial support. From public service loan forgiveness to state-specific educator relief initiatives, teachers now have multiple pathways to potentially reduce or eliminate their student loan obligations. These programs not only provide financial breathing room but also acknowledge the invaluable contribution teachers make to communities nationwide. As the educational landscape continues to evolve, these loan forgiveness opportunities represent a beacon of hope for educators striving to balance their professional dedication with personal financial well-being. MORE...

Market Tremors: Trump's Trade Tensions and Fed Critique Spark Wall Street Selloff

Finance

2025-04-21 11:20:14

Wall Street Braces for High-Stakes Week: Tech Earnings and Trade Tensions Take Center Stage Investors are gearing up for a pivotal week that promises to be a rollercoaster of market-moving events. All eyes are fixed on two critical fronts: the unfolding drama of President Trump's aggressive tariff strategies and the much-anticipated earnings reports from tech giants that could reshape market sentiment. The week ahead is set to be a pressure cooker of economic uncertainty, with market participants closely monitoring every development in the ongoing trade tensions and preparing for potential market-shifting revelations from Silicon Valley's biggest players. Tech earnings reports are expected to provide crucial insights into the health of the technology sector and potentially signal broader economic trends. As traders and analysts hold their collective breath, the interplay between international trade policies and corporate performance will likely create significant market volatility. Investors are advised to stay nimble and prepared for rapid shifts in market dynamics. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421