Money Talks: Inside the Financial Battle for Amarillo's City Council Seats

Finance

2025-04-28 21:42:44

The race for city council is heating up, with campaign spending soaring to nearly $1 million in April alone. Candidates and special interest groups are pulling out all the stops, investing heavily in what promises to be a fiercely contested election. The substantial financial commitment underscores the high stakes and intense competition for these crucial local government positions. Campaign finance reports reveal a dramatic influx of funds, highlighting the growing importance of this municipal election. From targeted advertising to grassroots outreach, every dollar is being strategically deployed to win voter support and secure a seat at the council table. As the election approaches, residents can expect an increasingly intense campaign landscape, with candidates and their supporters working tirelessly to make their voices heard and sway public opinion. MORE...

Senate Finance Weighs Controversial Healthcare Cuts Proposed by House Budget

Finance

2025-04-28 21:40:12

State lawmakers grappled with potential healthcare cuts during a tense Senate Finance Committee hearing on Monday, as a proposed House budget threatens to disrupt critical health services across New Hampshire. The proposed budget could dramatically impact everything from newborn health screenings to elder care at the Glencliff Home, raising serious concerns about the state's commitment to comprehensive healthcare. At the heart of the debate is a potential dismantling of the state's 50-year-old family planning program, a service that has been a lifeline for countless New Hampshire residents. Senators listened intently as healthcare advocates and community leaders testified about the far-reaching consequences of these proposed budget cuts. The hearing highlighted the delicate balance between fiscal constraints and essential healthcare services, with lawmakers wrestling with difficult decisions that could affect vulnerable populations across the state. From the earliest moments of life to the twilight years, the proposed budget threatens to reshape New Hampshire's healthcare landscape in ways that could have long-lasting implications for residents of all ages. MORE...

Financial Shadows: Lawmakers Demand Transparency in White House Tariff Dealings

Finance

2025-04-28 20:54:53

A group of Democratic lawmakers is ramping up pressure on the Biden administration to shed light on potential financial dealings by former Trump administration officials. The lawmakers are particularly interested in uncovering financial transactions that may have preceded President Trump's unexpected 90-day pause on a critical policy matter. The congressional Democrats are calling for transparency, arguing that a comprehensive review of financial records could reveal potential conflicts of interest or improper influences that might have shaped decision-making during the previous administration. Their request underscores a growing concern about the potential intersection of personal financial interests and governmental policy-making. By demanding a detailed disclosure of these financial transactions, the lawmakers hope to provide the public with a clearer understanding of the motivations and potential external pressures that may have influenced high-ranking officials during the Trump era. This push for accountability reflects a broader commitment to governmental transparency and ethical governance. The White House has yet to respond formally to the lawmakers' request, leaving many questions unanswered about the potential financial activities that might have preceded the controversial policy pause. MORE...

Border Business Battleground: How Financial Tracking Is Squeezing California's Economic Lifeline

Finance

2025-04-28 20:14:24

In a continuing trend of financial monitoring, the government has expanded its surveillance capabilities by lowering the transaction reporting threshold. This latest to move transactions over $200 represents a gradual but significant erosion of financial privacy for everyday Americans. What was once considered a minor administrative change now signals a broader pattern of increasing financial oversight. The new reporting requirement means that more routine financial now be scrutcapturing a much widerder range of personal financial activities. Consumers and privacy advocates are increasingly concerned about the incremental nature of these surveillance expansions. Each small adjustment seems designed to normalize more extensive tracking of individual financial transactions, raising important questions about personal privacy and the boundaries of government monitoring. While proponents argue these measures help prevent financial crimes, critics see them as part of a troubling trend of diminishing financial autonomautonomy. personal economic freedom The shift represents another step in a growing system of financial transparency that some view could asreaching original intended purpose. MORE...

Wall Street's Winning Streak: Tech Titans Set to Spark Market Rally

Finance

2025-04-28 20:04:51

Wall Street Braces for Tech Earnings Rollercoaster as Market Sentiment Wavers Investors held their breath on Monday as U.S. stock markets navigated a landscape of uncertainty, with all eyes fixed on the upcoming wave of Big Tech earnings reports. The financial landscape trembled with anticipation, as major technology companies prepare to unveil their financial performance, potentially setting the tone for the market's near-term trajectory. The day's trading session was characterized by cautious fluctuations, reflecting the market's delicate balance between optimism and apprehension. Traders and analysts alike are eagerly awaiting insights from tech giants, whose quarterly results could provide crucial signals about the broader economic landscape and investor sentiment. As the week unfolds, the spotlight will intensify on key technology firms, whose financial disclosures are expected to offer a comprehensive view of the sector's health and potential future trends. The market remains poised on the edge of anticipation, ready to react to each earnings revelation with heightened sensitivity. MORE...

Money Smarter, Not Harder: How Apple's AI Could Transform Your Financial Future

Finance

2025-04-28 19:40:48

Unlock the Power of Apple Intelligence: Your Personal AI Revolution Apple has just unleashed a game-changing technological marvel that's set to transform how you interact with your devices. Apple Intelligence isn't just another tech feature—it's a sophisticated personal AI system seamlessly integrated across your iPhone, iPad, Mac, and Apple Vision Pro. Imagine having an intelligent digital assistant that understands your unique needs, anticipates your preferences, and streamlines your daily digital experience. This cutting-edge AI technology goes beyond simple commands, offering personalized insights, intelligent recommendations, and intuitive support that adaps to your individual workflow and lifestyle. Whether you're a professional seeking productivity enhancements, a creative looking to streamline your process, or a tech enthusiast eager to explore the latest innovations, Apple Intelligence promises to revolutionize the way you engage with technology. It's not just an upgrade—it's a glimpse into the future of personal computing. Get ready to experience a smarter, more intuitive digital world right at your fingertips. MORE...

Wall Street Insider: Curran's Bold Moves Shake Up LA's Financial Landscape

Finance

2025-04-28 19:20:04

J.P. Morgan Private Bank Welcomes Karl Curran as New Vice President Karl Curran has expanded his impressive international banking career by joining J.P. Morgan Private Bank's Pasadena office as a Vice President and Banker. Drawing from a rich professional background that spans multiple global financial centers, Curran brings a wealth of international experience to his new role. Throughout his career, Curran has developed a sophisticated understanding of global financial markets, having worked in prestigious financial hubs including Hong Kong, Tokyo, London, and New York. His diverse geographical expertise positions him as a valuable asset to the J.P. Morgan Private Bank team, offering clients nuanced insights and strategic financial guidance. With his extensive international banking experience and proven track record, Curran is poised to contribute significantly to the bank's continued growth and success in the Pasadena market. MORE...

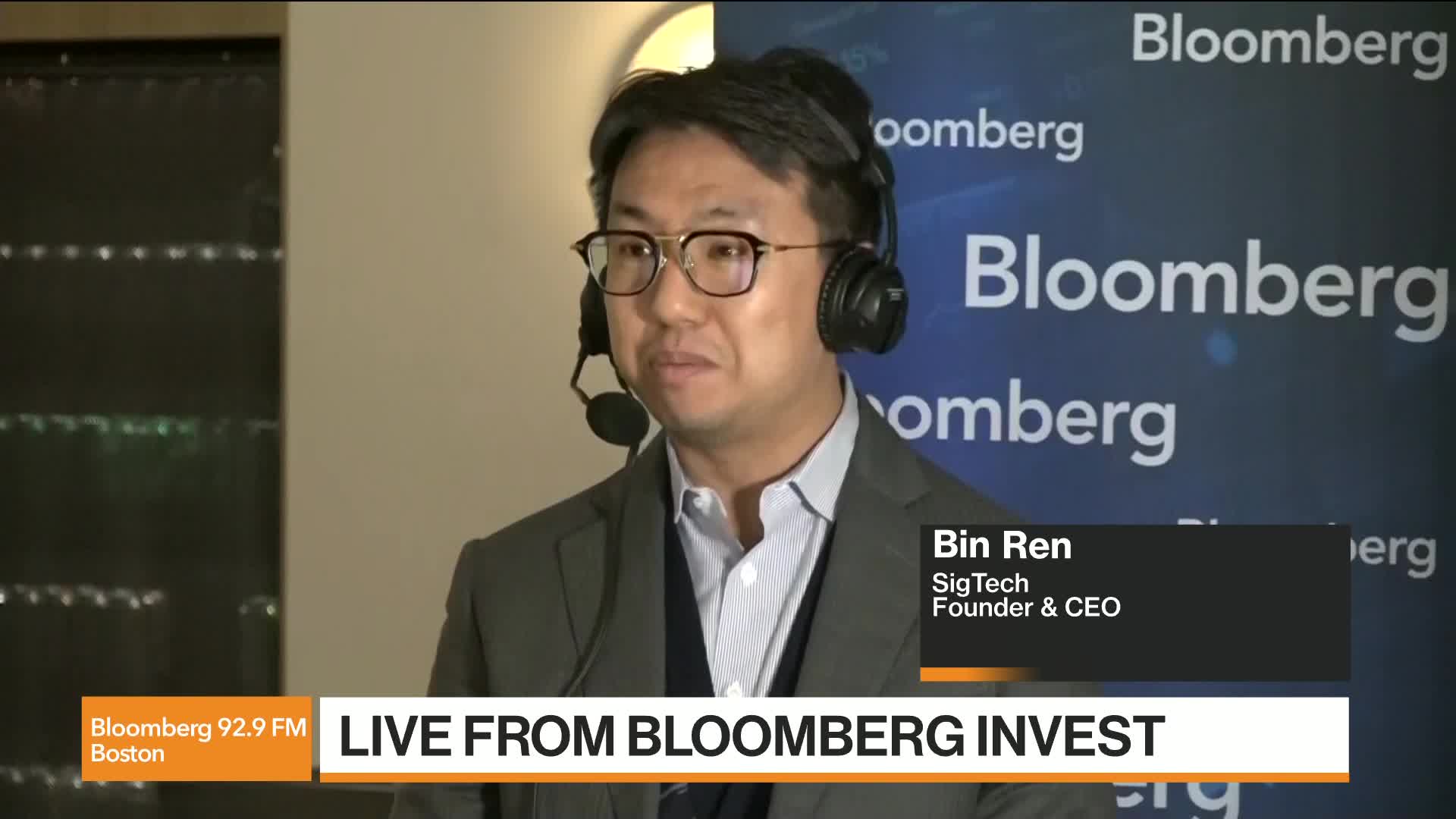

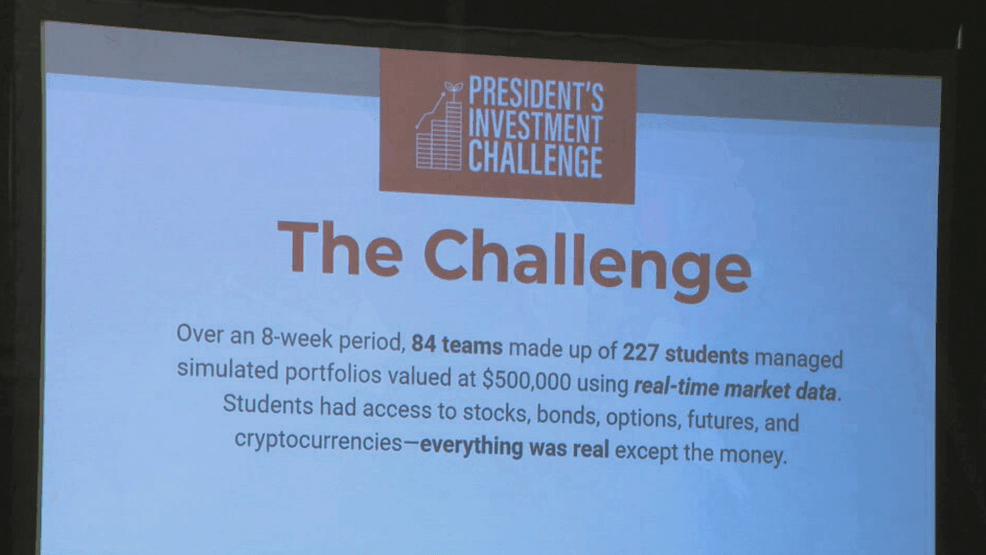

Wall Street Meets Campus: UNLV Students Battle in High-Stakes Investment Showdown

Finance

2025-04-28 19:19:18

Innovative Learning Takes Flight: UNLV Students Dive into Virtual Financial Simulation This semester, students at the University of Nevada, Las Vegas (UNLV) are breaking new ground in financial education through an immersive virtual learning experience. The cutting-edge program challenges participants to test their financial acumen in a dynamic, risk-free digital environment. By engaging with this interactive simulation, students gain hands-on experience in making strategic financial decisions, managing investments, and navigating complex economic scenarios. The virtual platform provides a unique opportunity for learners to apply theoretical knowledge to practical, real-world financial challenges without real-world consequences. The initiative represents UNLV's commitment to providing forward-thinking, experiential learning opportunities that prepare students for the increasingly complex financial landscape of the 21st century. Through this innovative approach, students are not just learning about finance—they're actively experiencing its intricacies and nuances. MORE...

Canadians Unleash Fierce Backlash to Trump's Remarks, Manitoba's Finance Chief Declares

Finance

2025-04-28 19:05:20

In a recent development highlighting cross-party solidarity, Manitoba's Finance Minister Adrien Sala addressed the unified Canadian response to recent comments about Canadian sovereignty and trade relations. The political landscape has demonstrated remarkable cohesion as Canadian politicians from various parties stand together in defending the nation's interests. Sala's comments reflect the broader Canadian sentiment of maintaining national dignity and protecting international trade relationships, particularly in the context of recent controversial statements. The unified reaction underscores Canada's commitment to presenting a strong, collective front when faced with external challenges. While specific details from the Bloomberg source were not extensively elaborated, the core message remains clear: Canada's political spectrum remains resolute in protecting its economic and sovereign interests, regardless of external provocations. The incident serves as a powerful reminder of Canada's political maturity and ability to present a unified national stance in the face of potential diplomatic tensions. MORE...

FBIZ Crushes Q1 Expectations: Financial Services Giant Signals Robust Growth Ahead

Finance

2025-04-28 19:00:32

First Business Financial Services Inc (FBIZ) Demonstrates Resilience with Impressive Financial Growth In a testament to its strategic prowess and operational efficiency, First Business Financial Services Inc has reported a remarkable 23% surge in pre-tax earnings, successfully navigating through challenging market conditions and economic uncertainties. Despite facing significant headwinds in the equipment finance sector, the company has showcased its ability to adapt and maintain strong financial performance. The impressive earnings growth highlights FBIZ's robust business model and management's skill in steering the organization through complex economic landscapes. By leveraging innovative strategies and maintaining operational discipline, the company has not only weathered potential challenges but has also positioned itself for continued success in a competitive financial services environment. Investors and market analysts are likely to view this financial achievement as a positive indicator of the company's resilience and potential for future growth. First Business Financial Services Inc continues to demonstrate its commitment to delivering value and maintaining financial strength, even in the face of sector-specific and macroeconomic challenges. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421