Cash is King: How Veteran Traders Outsmart Market FOMO Panic

Finance

2025-04-18 13:55:41Content

In the dynamic world of investing, cash isn't just a passive holding—it's a strategic tool that can provide both flexibility and opportunity. Veteran Wall Street trader Kenny Polcari offers a nuanced perspective, emphasizing that while cash is a valuable asset, investors shouldn't become too comfortable with large cash reserves.

Polcari warns that parking money in cash for extended periods can actually hinder wealth creation. Smart investors understand that cash should be viewed as a dynamic resource—a strategic position that allows for quick market moves and potential investment opportunities, rather than a long-term parking spot for funds.

The key is balance: maintaining enough liquidity to seize opportunities while ensuring that your money is actively working to generate returns. Cash can serve as a buffer during market volatility, but it should not become a permanent investment strategy.

Savvy investors know that strategic deployment of cash—whether into stocks, bonds, real estate, or other investment vehicles—is crucial for long-term financial growth. By keeping cash as a tool rather than a destination, investors can maximize their potential for building wealth.

Unlocking Wealth: The Strategic Power of Cash Management in Investment Portfolios

In the dynamic world of financial investments, understanding the nuanced role of cash is paramount for savvy investors seeking to optimize their wealth-building strategies. The traditional perception of cash as a mere passive asset is rapidly evolving, revealing a complex landscape of strategic opportunities and potential pitfalls that demand sophisticated financial acumen.Mastering Your Financial Destiny: Beyond Conventional Investment Wisdom

The Psychological and Strategic Dimensions of Cash Allocation

Cash represents far more than a simple monetary instrument in an investment portfolio. Seasoned financial experts recognize it as a dynamic tool that provides flexibility, security, and strategic positioning. Unlike static investment approaches, intelligent cash management requires a multifaceted understanding of market dynamics, personal risk tolerance, and emerging economic trends. Investors must view cash not as a stagnant resource but as a fluid asset capable of adapting to changing market conditions. The ability to rapidly deploy capital during opportune moments can significantly enhance long-term financial performance. This requires a nuanced approach that balances liquidity, potential returns, and risk mitigation strategies.Navigating the Complexity of Cash Performance and Wealth Accumulation

While holding excessive cash can potentially erode purchasing power due to inflation, maintaining a strategic cash reserve offers numerous advantages. Professional investors understand that cash provides a critical buffer against market volatility, enables quick investment opportunities, and serves as a psychological safety net during uncertain economic periods. The key lies in striking a delicate balance between cash holdings and active investments. Sophisticated investors develop dynamic allocation strategies that adjust cash percentages based on market conditions, personal financial goals, and broader economic indicators. This approach transforms cash from a passive asset into an active component of a comprehensive wealth management strategy.Advanced Cash Management Techniques for Modern Investors

Contemporary investment strategies emphasize the importance of diversified cash management techniques. High-yield savings accounts, money market funds, and short-term treasury securities offer alternatives to traditional cash storage methods. These instruments provide marginally better returns while maintaining liquidity and minimal risk. Technological advancements and financial innovations have further expanded cash management possibilities. Fintech platforms and sophisticated investment tools now enable investors to optimize cash allocations with unprecedented precision, leveraging real-time data and algorithmic insights to make informed decisions.Psychological Resilience and Financial Decision-Making

Beyond numerical calculations, effective cash management requires significant psychological discipline. Investors must cultivate emotional intelligence to resist impulsive decisions driven by market hysteria or personal anxiety. A strategic approach involves maintaining a long-term perspective while remaining adaptable to short-term fluctuations. Professional traders like Kenny Polcari emphasize the importance of viewing cash as a strategic asset rather than a passive holding. This mindset shift enables investors to approach cash management with greater sophistication, recognizing its potential as a powerful financial instrument that can be strategically deployed to enhance overall investment performance.Future-Proofing Your Investment Strategy

As global economic landscapes continue to evolve, cash management strategies must become increasingly nuanced and adaptive. Emerging technologies, geopolitical shifts, and changing market dynamics will require investors to develop more sophisticated approaches to maintaining and utilizing cash reserves. The most successful investors will be those who can seamlessly integrate advanced technological tools, deep market understanding, and psychological resilience into their cash management strategies. By treating cash as a dynamic, strategic asset, investors can unlock new dimensions of financial potential and build more robust, flexible investment portfolios.RELATED NEWS

Finance

Elon Musk Signals Major Shift: Tesla Shares Surge as DOGE Investment Set to Plummet

2025-04-23 13:47:28

Finance

Cybersecurity Giant CrowdStrike Smashes Financial Targets in Q4 and Fiscal 2025 Blowout

2025-03-04 21:10:00

Finance

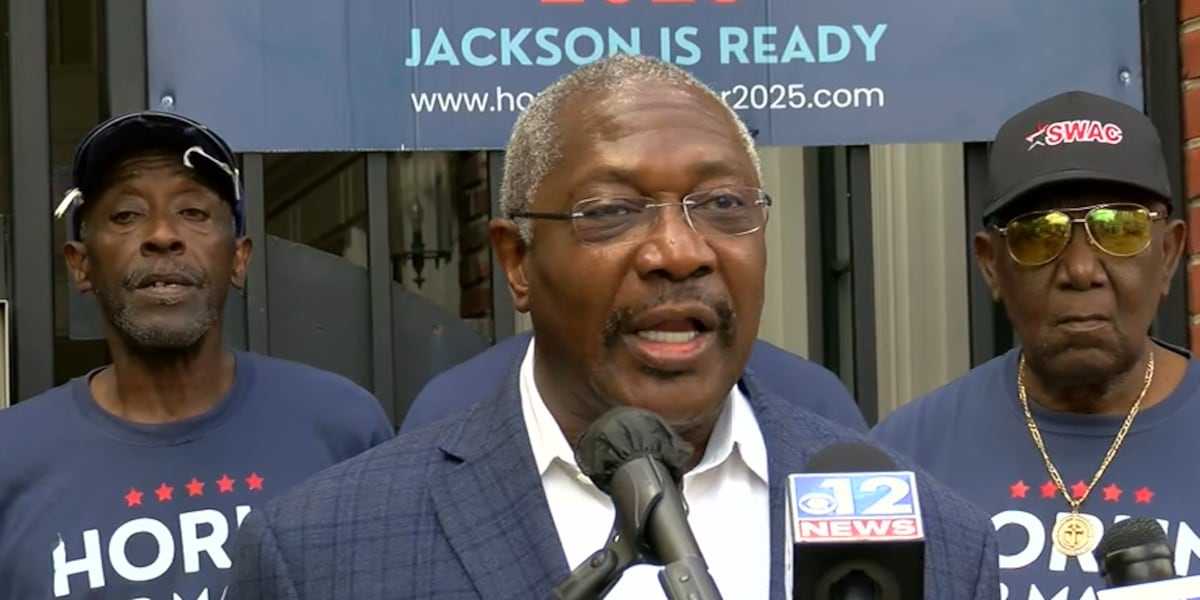

Campaign Cash Surge: Jackson Mayoral Hopeful Doubles Fundraising Before Critical Runoff

2025-04-16 20:35:47