Precision Bearings Giant RBC Crushes Earnings Expectations, Stock Soars

Finance

2025-04-18 14:31:34Content

Navigating Market Challenges: Wasatch Global Investors Shares Insights on Small Cap Growth Strategy

Wasatch Global Investors recently unveiled its comprehensive first-quarter 2025 investor letter for the Small Cap Growth Strategy, offering a candid look at the current market landscape. The investment firm's analysis reveals a challenging quarter for U.S. stocks, marked by significant market headwinds.

Investors faced a complex economic environment as potential tariff implications and anticipated government funding reductions created uncertainty. The market sentiment was further dampened by softer economic indicators that tested investor confidence. The Russell 2000® index reflected these broader market pressures, highlighting the nuanced challenges facing small-cap investments.

The detailed investor letter provides a deep dive into the strategic approach and market perspectives of Wasatch Global Investors, offering valuable insights for those tracking small-cap growth opportunities. Interested stakeholders can access the full report through the firm's official channels, gaining a comprehensive understanding of the current investment landscape.

As market dynamics continue to evolve, Wasatch Global Investors remains committed to providing transparent and strategic guidance for investors navigating these complex financial terrains.

Market Tremors: Navigating the Turbulent Landscape of Small-Cap Investments in 2025

In the ever-evolving world of financial markets, investors find themselves at a critical crossroads, where economic indicators, geopolitical tensions, and strategic investment decisions converge to create a complex and challenging investment environment. The first quarter of 2025 has emerged as a pivotal moment for small-cap investors, demanding unprecedented levels of strategic insight and analytical acumen.Unraveling the Economic Puzzle: Small-Cap Stocks in a Volatile Marketplace

The Macroeconomic Landscape: Challenges and Opportunities

The contemporary investment ecosystem presents a multifaceted challenge for discerning investors. Economic dynamics have become increasingly intricate, with government policy, international trade tensions, and fiscal strategies creating a labyrinthine environment for small-cap investment strategies. Wasatch Global Investors' recent analysis reveals a nuanced perspective on market volatility, highlighting the delicate balance between risk mitigation and potential growth opportunities. Sophisticated investors are now required to develop more robust analytical frameworks that transcend traditional investment methodologies. The interplay between tariff implementations, potential government funding adjustments, and broader economic indicators demands a holistic approach to investment decision-making.Decoding Market Signals: Technological and Economic Intersections

The Russell 2000® index has become a critical barometer for understanding the small-cap investment landscape. Recent market fluctuations underscore the importance of adaptive investment strategies that can rapidly respond to emerging economic signals. Technological advancements and data analytics have transformed how investors interpret market trends, providing unprecedented insights into potential investment opportunities. Investors must now cultivate a more sophisticated understanding of market dynamics, leveraging advanced predictive models and comprehensive economic analysis. The ability to discern subtle market signals has become a crucial competitive advantage in the increasingly complex investment ecosystem.Strategic Resilience: Navigating Economic Uncertainties

The current economic environment demands a reimagining of traditional investment approaches. Small-cap investors are increasingly required to develop more nuanced strategies that can withstand rapid market transformations. This necessitates a multidimensional approach that combines rigorous financial analysis, technological insight, and a deep understanding of global economic trends. Wasatch Global Investors' strategic framework emphasizes the importance of adaptability and comprehensive market research. By developing more sophisticated investment methodologies, investors can potentially mitigate risks while identifying emerging opportunities in a volatile market landscape.The Future of Small-Cap Investments: Emerging Trends and Perspectives

As we progress through 2025, the small-cap investment ecosystem continues to evolve at an unprecedented pace. Investors must remain vigilant, continuously updating their analytical frameworks and investment strategies to maintain a competitive edge. The intersection of technological innovation, economic policy, and global market dynamics creates a complex but potentially rewarding investment environment. The most successful investors will be those who can synthesize complex economic information, adapt quickly to changing market conditions, and maintain a forward-looking perspective that transcends traditional investment paradigms.RELATED NEWS

Finance

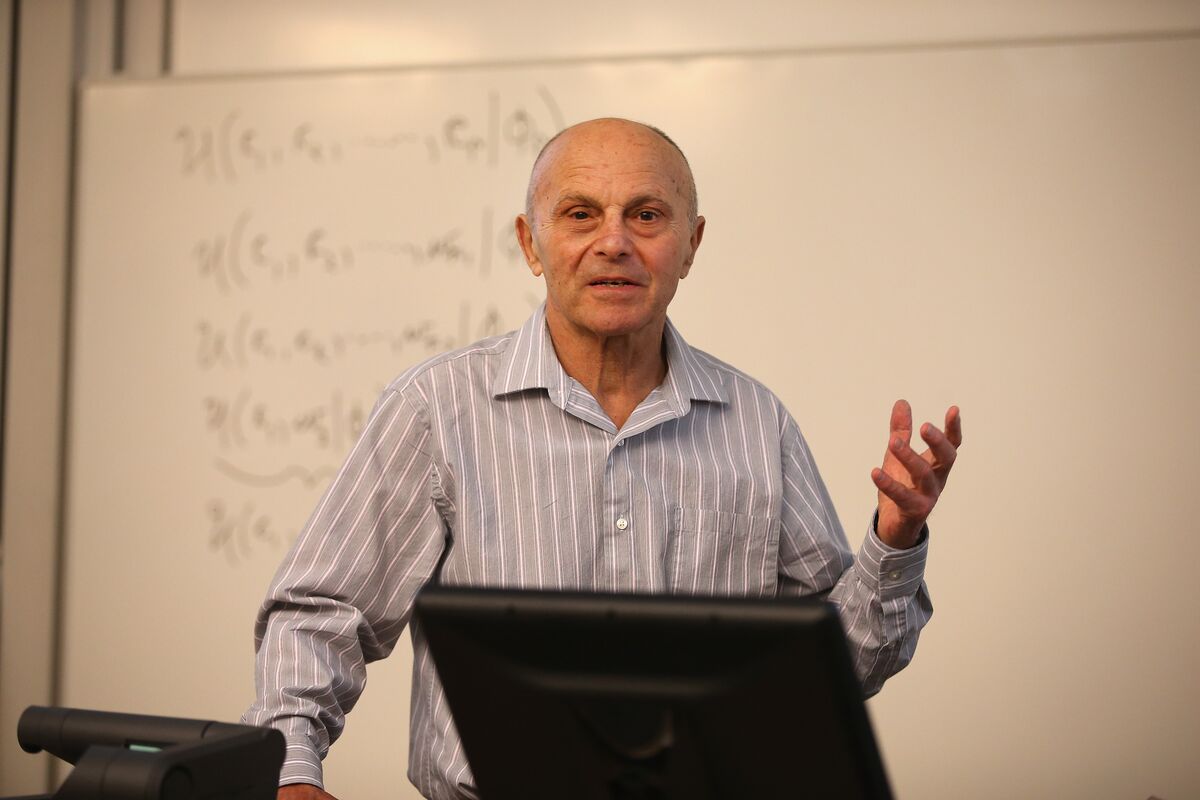

From Theory to Triumph: How Fama and Booth Revolutionized Financial Thinking

2025-03-06 09:00:01