Weathering the Storm: SES Pushes Back Against Moody's Credit Crackdown

Finance

2025-02-18 19:59:28Content

SES Moves Swiftly to Calm Investor Concerns Following Credit Rating Shift

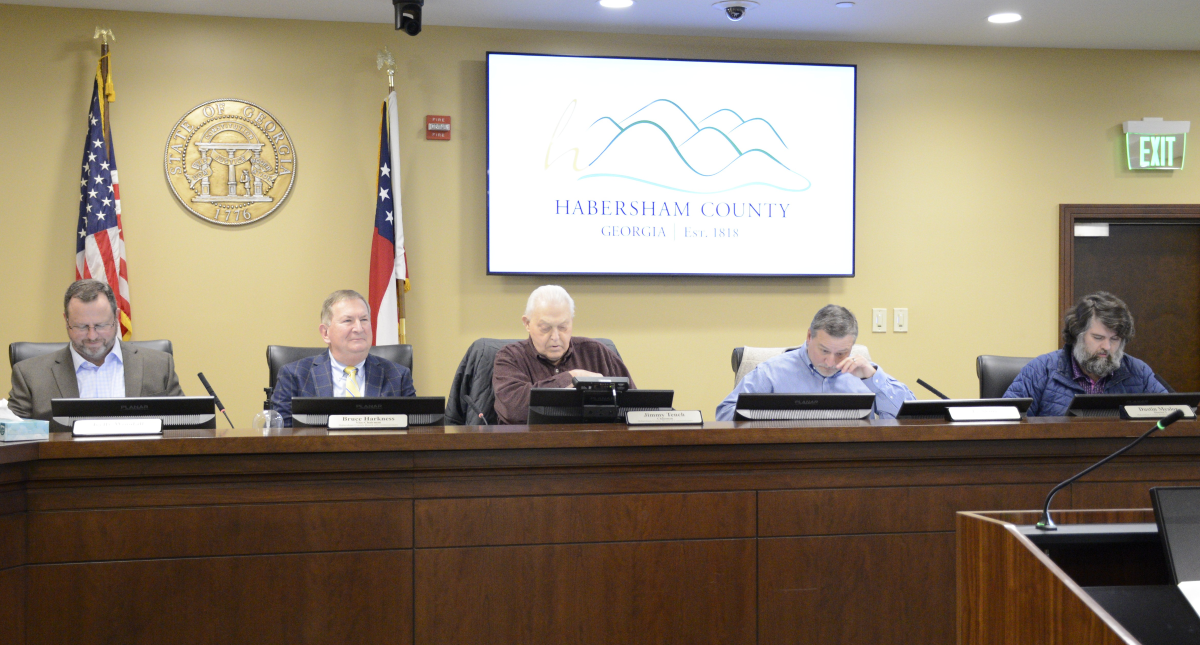

Luxembourg-based satellite operator SES took decisive action on February 18th to address market anxieties after Moody's unexpectedly adjusted its financial outlook from stable to negative. The company promptly launched a comprehensive communication strategy designed to reassure shareholders and demonstrate its robust financial positioning.

In response to the credit rating agency's downgrade, SES leadership moved quickly to provide transparency and confidence, signaling their commitment to maintaining strong financial health and strategic resilience. The proactive approach aims to mitigate potential investor concerns and underscore the company's ongoing stability in a dynamic telecommunications landscape.

By addressing the rating change head-on, SES demonstrates its agility and dedication to maintaining investor trust during potentially uncertain market conditions. The satellite operator's swift communication reflects its strategic approach to financial management and commitment to clear, immediate stakeholder engagement.

Financial Turbulence: SES Navigates Challenging Waters After Credit Rating Shift

In the dynamic world of global satellite communications, SES finds itself at a critical juncture, facing unprecedented financial scrutiny following a significant credit rating adjustment that has sent ripples through the industry's investment landscape.Navigating Uncertainty: A Satellite Giant's Strategic Resilience

The Moody's Downgrade: Unpacking the Financial Implications

The recent Moody's outlook modification represents more than a mere numerical adjustment; it signals a profound reassessment of SES's financial trajectory. Investors and market analysts are keenly observing the Luxembourg-based satellite operator's response to this challenging evaluation. The transition from a stable to a negative outlook demands a comprehensive strategic recalibration, challenging SES to demonstrate its financial robustness and adaptive capabilities. Financial experts suggest that such downgrades often stem from complex macroeconomic factors, including technological disruption, market volatility, and evolving communication infrastructure landscapes. SES must now articulate a compelling narrative of financial stability and strategic innovation to restore investor confidence.Strategic Communication and Investor Confidence

In the aftermath of the Moody's decision, SES's communication strategy becomes paramount. The company's immediate response on February 18th was not merely a defensive maneuver but a calculated effort to transparently address market concerns. By proactively engaging with investors, SES aims to mitigate potential negative perceptions and showcase its underlying financial strength. The satellite operator's leadership must now craft a nuanced communication approach that balances transparency with strategic optimism. This involves detailed financial presentations, clear articulation of future growth strategies, and demonstrable steps toward operational efficiency and market adaptation.Technological Innovation as a Financial Resilience Strategy

Beyond financial metrics, SES's future hinges on its technological innovation capabilities. The satellite communication sector is experiencing unprecedented transformation, driven by emerging technologies like 5G, Internet of Things (IoT), and advanced telecommunications infrastructure. By positioning itself at the forefront of technological advancement, SES can potentially counteract the negative market sentiment. Investment in cutting-edge satellite technologies, exploring new market segments, and developing flexible communication solutions could serve as powerful counterarguments to the Moody's downgrade.Global Market Dynamics and Competitive Landscape

The Moody's outlook adjustment occurs against a complex global market backdrop. Geopolitical tensions, shifting communication needs, and rapid technological evolution create a multifaceted environment for satellite operators. SES must navigate these intricate dynamics with strategic precision. Comparative analysis with global competitors becomes crucial. How are other satellite communication companies responding to similar market challenges? What unique value propositions can SES develop to differentiate itself and attract long-term investor interest?Financial Restructuring and Operational Optimization

A negative credit outlook demands comprehensive internal review and potential restructuring. This might involve reevaluating operational costs, exploring strategic partnerships, divesting non-core assets, and implementing rigorous financial discipline. The company's ability to demonstrate agile financial management, coupled with a clear, forward-looking strategy, will be instrumental in rebuilding market confidence. Investors will be looking for concrete evidence of SES's commitment to financial sustainability and growth potential.RELATED NEWS

Finance

Trailblazers Unveiled: Capturing the Moments of Latin America's Finance Queens

2025-03-12 18:26:58