Dividend Dynamo: Bank of America's Hidden Potential Revealed

Finance

2025-02-17 02:16:33Content

Bank of America: A Top Dividend Stock in the Financial Sector for 2024

As the financial markets continue to evolve in 2024, investors are keenly searching for robust dividend stocks that offer both stability and growth. Our recent comprehensive analysis highlighted the top 12 financial sector dividend stocks, and Bank of America Corporation (NYSE:BAC) emerges as a standout performer worth serious consideration.

In a year where financial stocks have been leading market performance, Bank of America has positioned itself as a compelling investment opportunity. The bank's strategic approach to dividend investing, combined with its strong market presence, makes it an attractive option for income-focused investors.

Our in-depth research explores how Bank of America compares to other leading financial sector dividend stocks, examining key factors such as dividend yield, financial health, and potential for future growth. Investors looking to diversify their portfolio with a reliable financial sector stock will find valuable insights in this comprehensive analysis.

Stay tuned as we break down the critical elements that make Bank of America a top contender in the current dividend stock landscape.

Financial Frontiers: Navigating Bank of America's Strategic Dividend Landscape in 2024

In the dynamic world of financial investments, understanding the nuanced strategies of banking giants like Bank of America has become increasingly critical for investors seeking robust dividend opportunities. As market landscapes shift and economic indicators evolve, discerning investors are constantly searching for strategic entry points that promise sustainable returns and long-term growth potential.Unlock the Secrets of Smart Financial Investing – Where Opportunity Meets Strategy!

The Dividend Ecosystem: Bank of America's Strategic Positioning

Bank of America Corporation stands at a pivotal moment in the financial sector's transformative journey. Unlike traditional banking models, the institution has strategically repositioned itself to leverage technological innovations and adaptive financial strategies. The bank's dividend performance reflects a sophisticated approach to shareholder value, integrating digital transformation with robust financial fundamentals. Investors observing Bank of America's trajectory will notice a nuanced strategy that extends beyond conventional dividend distribution. The corporation has demonstrated remarkable resilience in navigating complex economic landscapes, utilizing advanced risk management techniques and innovative financial products to maintain consistent dividend yields.Market Dynamics and Competitive Landscape

The financial sector in 2024 presents a complex ecosystem of opportunities and challenges. Bank of America has distinguished itself by implementing forward-thinking strategies that transcend traditional banking paradigms. By integrating artificial intelligence, machine learning, and predictive analytics, the bank has created a sophisticated framework for identifying and capitalizing on emerging market trends. Comparative analysis reveals that Bank of America's dividend strategy is not merely about maintaining consistent payouts but about creating a comprehensive value proposition for investors. The bank's approach involves strategic capital allocation, technological investment, and adaptive financial modeling that positions it distinctively within the competitive financial landscape.Technological Innovation and Dividend Performance

Technological disruption has become a defining characteristic of modern financial institutions. Bank of America has embraced this transformation, leveraging cutting-edge technologies to optimize operational efficiency and enhance shareholder returns. The bank's digital infrastructure allows for more precise risk assessment, streamlined operational processes, and more strategic dividend management. By investing heavily in technological capabilities, Bank of America has created a robust ecosystem that supports sustainable dividend growth. The integration of advanced data analytics enables the bank to make more informed investment decisions, ultimately translating into more reliable and potentially higher dividend yields for shareholders.Economic Indicators and Future Projections

Analyzing Bank of America's dividend potential requires a comprehensive understanding of broader economic indicators. The bank's strategic positioning reflects a deep understanding of macroeconomic trends, regulatory environments, and global financial dynamics. Investors can observe a calculated approach that balances risk mitigation with growth opportunities. Emerging economic indicators suggest a promising landscape for financial sector investments. Bank of America's adaptive strategies position it uniquely to capitalize on these opportunities, offering investors a potentially attractive combination of stability and growth through its dividend offerings.Risk Management and Dividend Sustainability

Sustainable dividend performance is intrinsically linked to sophisticated risk management strategies. Bank of America has developed a comprehensive risk assessment framework that goes beyond traditional financial modeling. By implementing advanced predictive technologies and maintaining a diversified investment portfolio, the bank ensures a more stable and potentially lucrative dividend strategy. The institution's approach to risk management demonstrates a forward-thinking methodology that considers multiple economic scenarios, technological disruptions, and potential market volatilities. This holistic perspective provides investors with increased confidence in the bank's long-term dividend sustainability.RELATED NEWS

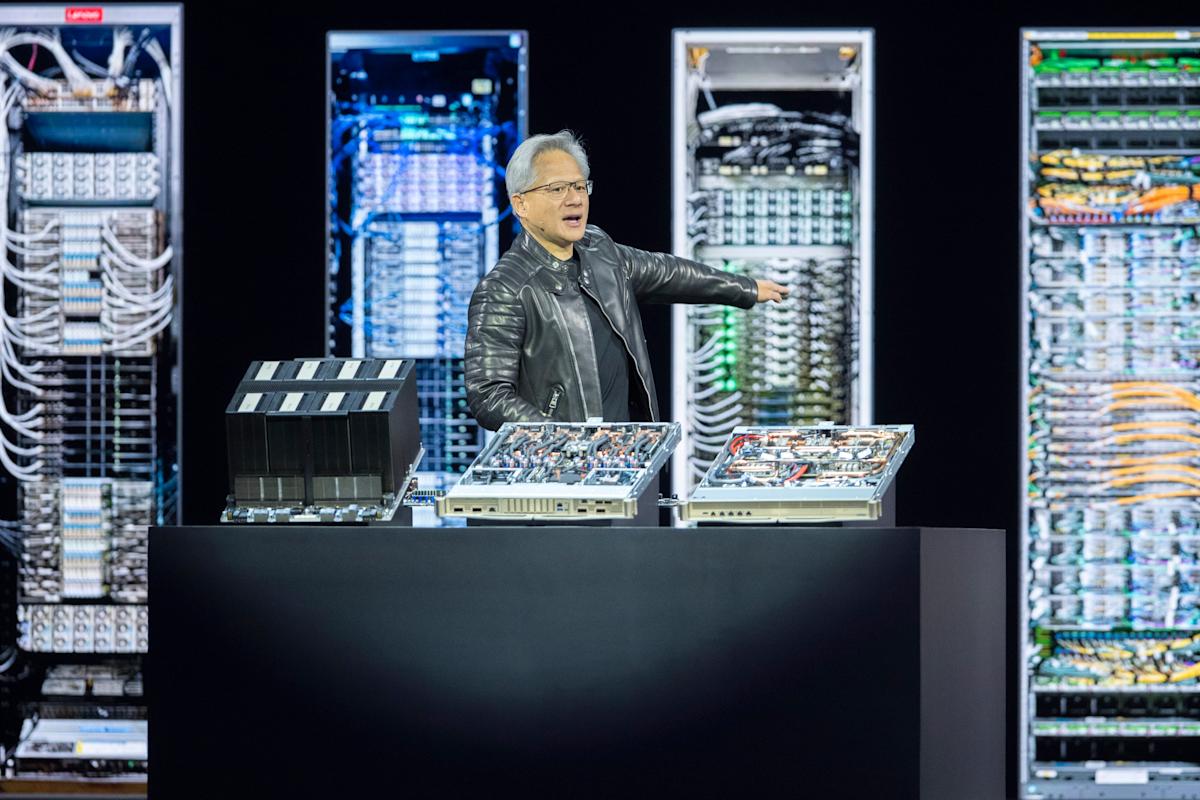

Nvidia's Market Meltdown: $250B Vanishes as Trump's Tech Blockade Strikes Chip Giant