Inside Edward Jones: Whistleblower Exposes Hidden DEI Strategy Amid Corporate Silence

Finance

2025-04-04 13:00:00Content

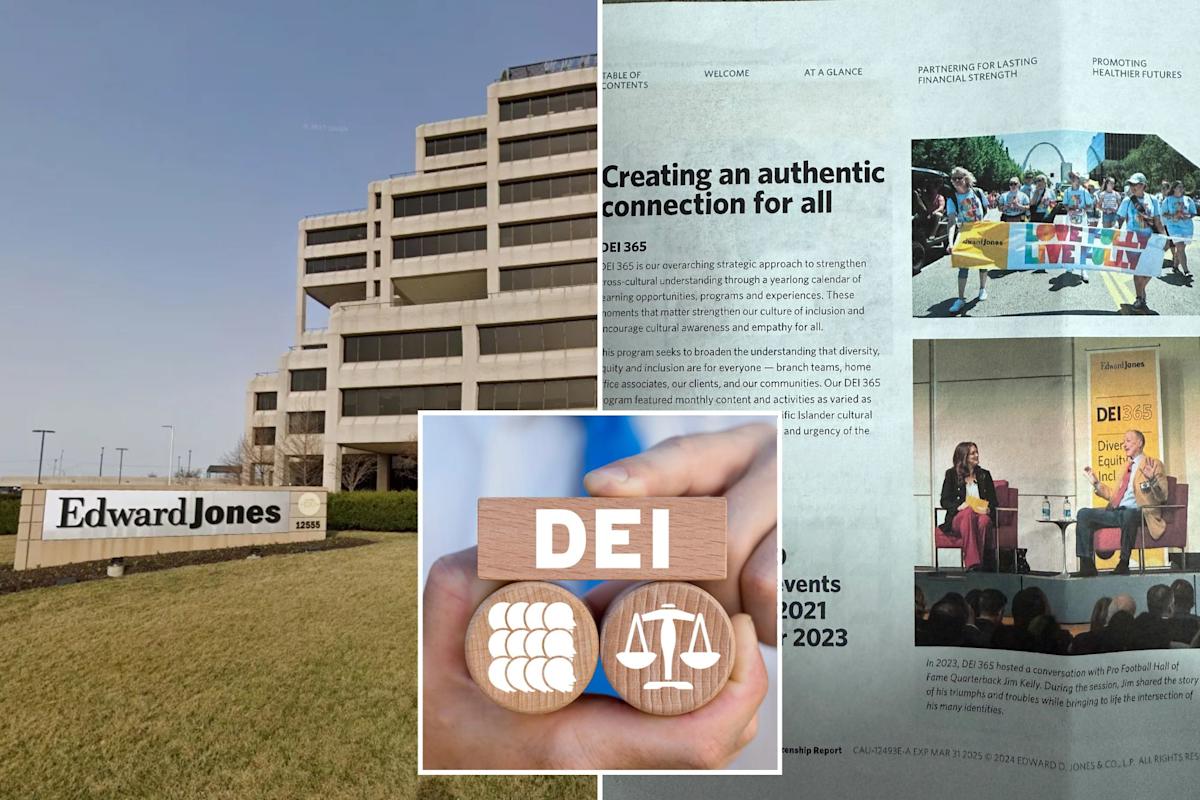

In a revealing exclusive, leaked documents obtained by the New York Post shed light on a broader corporate trend beyond Costco, highlighting how major financial institutions like Edward Jones are strategically maintaining and even expanding their diversity, equity, and inclusion (DEI) initiatives in anticipation of potential political shifts.

The confidential files suggest that despite changing political landscapes, companies are recommitting to workplace diversity programs, signaling a robust corporate commitment to fostering inclusive environments. Edward Jones, a prominent financial services firm, appears to be at the forefront of this strategic approach, demonstrating that DEI efforts remain a critical priority for progressive organizations.

These leaked documents provide a rare glimpse into corporate decision-making processes, revealing how businesses are navigating complex social and political dynamics while staying true to their core values of equality and representation in the workplace.

Corporate Diversity Dynamics: Unveiling the Hidden Strategies of Financial Institutions

In the rapidly evolving landscape of corporate America, financial institutions are navigating complex terrain of workplace diversity and inclusion, revealing intricate strategies that extend far beyond traditional human resources practices. The intersection of corporate policy, social responsibility, and organizational transformation presents a compelling narrative of institutional adaptation in an increasingly interconnected world.Transforming Workplace Culture: A Deep Dive into Institutional Change

The Emerging Paradigm of Corporate Diversity Initiatives

Financial institutions are experiencing a profound metamorphosis in their approach to workplace diversity. Beyond mere compliance, organizations like Edward Jones are implementing comprehensive strategies that fundamentally reimagine organizational culture. These initiatives represent more than checkbox exercises; they constitute a holistic reimagining of talent acquisition, professional development, and institutional identity. The contemporary corporate landscape demands nuanced approaches that recognize individual differences while simultaneously creating cohesive organizational environments. Sophisticated diversity programs now integrate psychological insights, data-driven methodologies, and strategic human capital management to create genuinely inclusive workplace ecosystems.Institutional Strategies and Implementation Mechanisms

Modern financial institutions are developing multifaceted approaches to diversity and inclusion that transcend traditional recruitment practices. These strategies involve sophisticated talent pipeline development, unconscious bias training, mentorship programs, and comprehensive leadership development initiatives designed to cultivate diverse talent from entry-level positions through executive leadership. Data analytics play a crucial role in these transformative processes. Organizations are leveraging advanced metrics to track representation, measure inclusion effectiveness, and identify systemic barriers that might impede equitable professional advancement. This approach represents a significant departure from historical diversity management practices.Economic and Organizational Performance Implications

Research consistently demonstrates that diverse organizations outperform their more homogeneous counterparts. Financial institutions recognize that diversity is not merely a moral imperative but a strategic competitive advantage. By cultivating diverse perspectives, organizations can enhance innovation, improve decision-making processes, and develop more comprehensive solutions to complex challenges. The economic rationale for diversity extends beyond abstract social considerations. Empirical evidence suggests that companies with robust diversity and inclusion strategies experience improved financial performance, enhanced employee engagement, and stronger brand reputation in an increasingly global marketplace.Technological Integration and Future Perspectives

Emerging technologies are revolutionizing diversity and inclusion strategies. Artificial intelligence, machine learning algorithms, and advanced analytics are being deployed to identify and mitigate potential biases in recruitment, performance evaluation, and promotional processes. These technological interventions represent a sophisticated approach to addressing systemic inequities, providing organizations with unprecedented insights into their institutional dynamics. By leveraging data-driven methodologies, financial institutions can create more transparent, equitable professional environments that genuinely celebrate individual differences.Challenges and Ongoing Transformation

Despite significant progress, financial institutions continue to face complex challenges in implementing comprehensive diversity strategies. Resistance to change, deeply ingrained institutional cultures, and systemic barriers represent ongoing obstacles that require sustained, strategic interventions. Successful organizations recognize that diversity and inclusion represent continuous journeys rather than destination points. They remain committed to ongoing learning, adaptation, and institutional transformation, understanding that true inclusivity demands persistent effort, genuine commitment, and a willingness to challenge existing paradigms.RELATED NEWS

Finance

Rupiah Plunges: Indonesian Currency Hits Dramatic 25-Year Low in Economic Tremor

2025-03-25 02:24:55

Finance

Global Markets on Edge: Germany's Finance Chief Signals Ongoing Economic Turbulence

2025-04-11 06:53:29

Finance

Behind the Scenes: Ambulance Board Tackles Critical Funding and Fleet Upkeep Challenges

2025-04-23 10:00:06