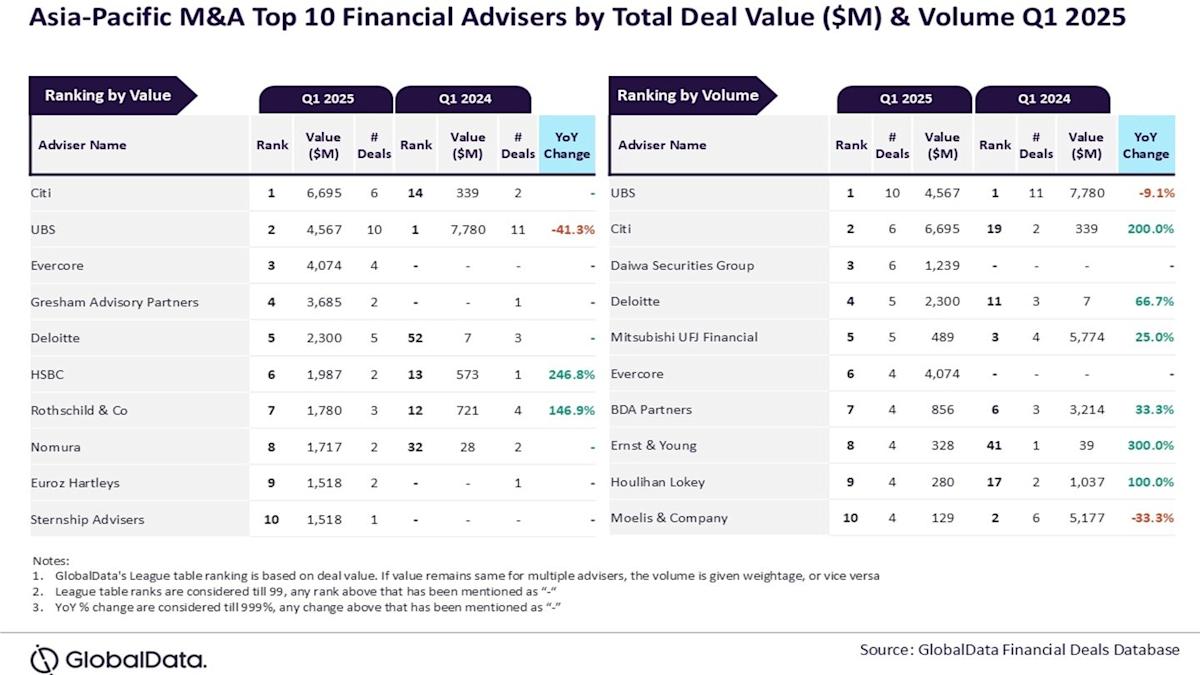

Financial Titans Dominate: Citi and UBS Surge Ahead in Asia-Pacific M&A Advisory Landscape

Finance

2025-04-16 14:39:58Content

In a standout performance this quarter, UBS emerged as the top investment banking leader, demonstrating its market prowess by successfully advising on an impressive 10 transactions. The Swiss banking giant's strategic deal-making and financial expertise positioned it at the forefront of the industry, showcasing its ability to navigate complex financial landscapes and deliver exceptional value to clients.

UBS's remarkable achievement highlights the bank's robust deal-making capabilities and its strong presence in the global financial advisory market. By securing the highest deal volume, the bank has reinforced its reputation as a premier financial institution capable of executing sophisticated and high-stakes transactions across various sectors.

The bank's success underscores its deep market insights, extensive network, and skilled team of financial professionals who consistently drive strategic business opportunities. This quarter's performance is a testament to UBS's continued commitment to excellence in investment banking and its ability to create significant value for its clients and shareholders.

Financial Titans Reshape Global Investment Landscape: UBS Emerges as Dominant Force in Strategic Transactions

In the ever-evolving world of global financial services, investment banking continues to demonstrate remarkable resilience and strategic complexity. The intricate dance of mergers, acquisitions, and strategic advisory services represents a critical mechanism through which corporations transform, grow, and reposition themselves in an increasingly competitive marketplace.Navigating the Complex Terrain of High-Stakes Financial Negotiations

The Emergence of UBS as a Transaction Powerhouse

The financial landscape has witnessed a remarkable transformation, with UBS establishing itself as an unparalleled leader in strategic transaction advisory. By orchestrating an impressive portfolio of ten distinct transactions during the most recent quarter, the Swiss banking giant has solidified its position at the pinnacle of global investment banking. These transactions represent more than mere numerical achievements; they symbolize sophisticated strategic interventions that reshape corporate ecosystems and drive economic momentum. The depth and breadth of UBS's transactional expertise extend far beyond simple numerical metrics. Each negotiated deal reflects intricate understanding of market dynamics, nuanced risk assessment, and strategic foresight. The bank's ability to navigate complex financial terrains demonstrates a level of institutional knowledge that transcends conventional advisory services.Strategic Implications of High-Volume Transaction Management

Transaction volume serves as a critical barometer measuring an investment bank's operational effectiveness and market influence. UBS's remarkable achievement of ten strategic transactions underscores its comprehensive capabilities in identifying, structuring, and executing complex financial maneuvers. These transactions are not merely isolated events but interconnected strategic interventions that reflect sophisticated institutional intelligence. The multifaceted nature of these transactions suggests a holistic approach to financial advisory. Each deal represents a carefully calibrated strategy, balancing risk mitigation, potential growth opportunities, and long-term organizational objectives. UBS's approach goes beyond traditional transactional frameworks, embedding deep analytical insights and forward-looking perspectives.Technological Innovation and Financial Advisory Convergence

Modern investment banking increasingly relies on technological sophistication to drive strategic decision-making. UBS has demonstrated remarkable prowess in integrating cutting-edge technological capabilities with traditional financial advisory services. Advanced data analytics, machine learning algorithms, and real-time market intelligence platforms enable the bank to develop nuanced, data-driven strategic recommendations. The convergence of technological innovation and financial expertise represents a paradigm shift in investment banking. By leveraging sophisticated analytical tools, UBS can provide clients with unprecedented insights, transforming raw data into actionable strategic intelligence. This approach transcends conventional advisory models, positioning the bank as a true strategic partner rather than a mere transactional intermediary.Global Market Dynamics and Strategic Positioning

The current global economic environment presents unprecedented challenges and opportunities. UBS's impressive transaction portfolio reflects a deep understanding of these complex market dynamics. By successfully navigating diverse economic landscapes, the bank demonstrates remarkable adaptability and strategic resilience. Each transaction represents a carefully orchestrated response to specific market conditions, reflecting nuanced understanding of regional economic variations, sector-specific challenges, and emerging global trends. The bank's ability to consistently deliver high-value strategic interventions across multiple markets underscores its sophisticated institutional capabilities.Future Outlook and Strategic Implications

As financial markets continue to evolve rapidly, UBS's performance signals a broader transformation in investment banking paradigms. The bank's strategic approach suggests a future where technological innovation, deep market insights, and sophisticated advisory services converge to create unprecedented value for corporate clients. The ten transactions completed during this quarter are not merely an endpoint but a launching pad for future strategic innovations. They represent a testament to UBS's commitment to redefining financial advisory services in an increasingly complex and interconnected global economy.RELATED NEWS

Finance

Financial Shakeup: Mexico's Top Money Chief Exits Amid Economic Turbulence

2025-03-07 19:17:19

Finance

Money Smarts 2.0: Navigating the AI Finance Revolution Without Losing Your Shirt

2025-03-17 03:18:28