Tariffs, Trade Wars, and Your Wallet: Unpacking the Economic Impact of Trump's Policies Ahead of the Federal Election

Finance

2025-04-16 13:00:09Content

As Canada Prepares for Election, Trade Tensions and Economic Uncertainty Loom Large

With national elections on the horizon, Canada finds itself navigating a complex economic landscape marked by escalating trade tensions and market volatility. The looming shadow of U.S. tariffs threatens to disrupt the country's economic stability, creating a challenging backdrop for political discourse and voter sentiment.

Amid these turbulent conditions, Canadians are bracing for a pivotal electoral moment that could reshape the nation's economic strategy and international trade relationships. The impact of ongoing trade disputes, particularly with the United States, has sent ripples through financial markets and raised concerns about potential economic slowdown.

Join us today at noon for an exclusive personal finance Q&A, where expert analysts will break down the economic implications, discuss market strategies, and provide insights into how these developments might affect your financial planning and investment decisions.

Stay informed, stay prepared – your financial future depends on understanding the current economic landscape.

Economic Tremors: Canada's Political Landscape Amid Global Trade Tensions

In an era of unprecedented economic volatility, Canada finds itself at a critical crossroads where political dynamics and international trade pressures converge to create a complex and challenging environment. The upcoming electoral process promises to be a pivotal moment that could reshape the nation's economic trajectory and global positioning.Navigating Uncertain Waters: A Nation's Economic Resilience Tested

The Geopolitical Chessboard of Trade and Tariffs

The contemporary economic landscape is increasingly characterized by intricate geopolitical maneuvers that transcend traditional diplomatic boundaries. Donald Trump's controversial tariff policies have sent rippling economic shockwaves across North America, fundamentally challenging established trade relationships and forcing nations like Canada to reassess their strategic economic approaches. These tariffs represent more than mere economic instruments; they are sophisticated political weapons that can dramatically alter international economic dynamics. Canadian policymakers and economic strategists are now compelled to develop nuanced, multifaceted responses that balance national economic interests with diplomatic considerations. The potential impact of these trade tensions extends far beyond immediate financial metrics, potentially influencing long-term investment patterns, industrial competitiveness, and international economic relationships.Electoral Implications and Economic Strategy

The imminent Canadian electoral process emerges as a critical juncture where economic policy and political representation intersect. Voters are increasingly sophisticated in their understanding of complex economic challenges, demanding comprehensive and transparent strategies from potential leadership candidates. The ability to articulate clear, pragmatic approaches to navigating international trade complexities has become a fundamental prerequisite for political credibility. Economic resilience requires more than reactive policies; it demands proactive, forward-thinking approaches that anticipate potential global economic shifts. Canadian political parties must demonstrate their capacity to develop robust economic frameworks that can withstand external pressures while maintaining domestic economic stability.Market Volatility and Investor Confidence

The current economic environment presents a multifaceted challenge for investors and market participants. Tariff-induced uncertainties create an atmosphere of heightened risk perception, potentially influencing investment strategies and capital allocation decisions. Financial markets are demonstrating increased sensitivity to geopolitical developments, with even minor policy announcements capable of triggering significant market movements. Canadian financial institutions and investors must develop sophisticated risk management strategies that can effectively navigate these turbulent economic waters. This requires a combination of agile decision-making, comprehensive market analysis, and a willingness to adapt rapidly to changing economic conditions.Technological Innovation as an Economic Buffer

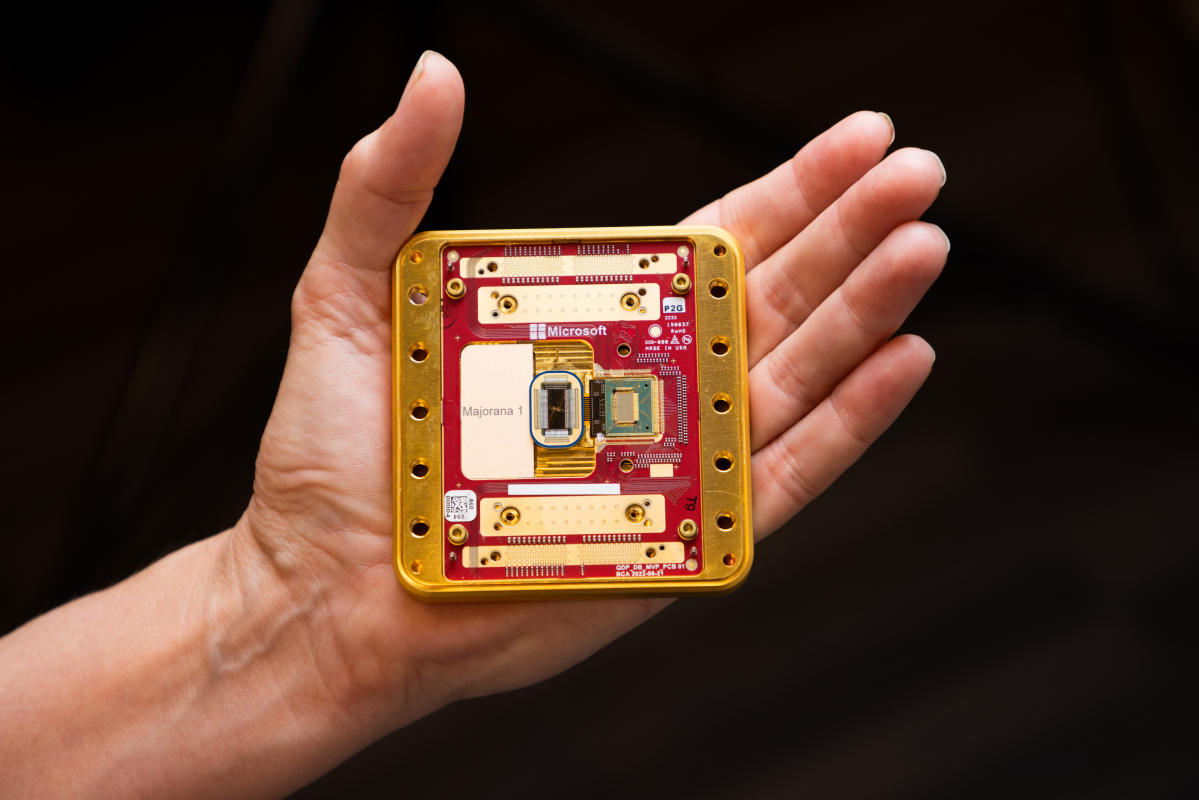

In response to external economic pressures, Canada is increasingly positioning technological innovation as a critical strategic asset. By investing in cutting-edge research, developing advanced technological ecosystems, and supporting entrepreneurial initiatives, the nation seeks to create economic resilience that transcends traditional trade dependencies. The technology sector represents a potential transformative force that could help Canada diversify its economic portfolio and reduce vulnerability to external trade disruptions. Emerging fields such as artificial intelligence, clean energy technologies, and advanced manufacturing offer promising pathways for economic adaptation and growth.Global Competitiveness and Strategic Positioning

The current economic landscape demands a holistic approach to national competitiveness. Canada must simultaneously manage immediate economic challenges while developing long-term strategic capabilities that position the nation favorably in the global economic ecosystem. This requires a delicate balance between protecting domestic economic interests and maintaining openness to international collaboration. Successful navigation of these complex dynamics will depend on sophisticated diplomatic engagement, strategic economic planning, and a commitment to fostering innovation and adaptability.RELATED NEWS

Finance

Tech's Financial Frontier: Why Treasurers Are Calling for Deeper Collaboration

2025-04-24 08:00:01

Finance

Contractor Cash Boost: Porter Capital Injects $3.5M to Supercharge Business Expansion

2025-04-17 11:30:00