Market Pulse: FTSE 100 Braces for ECB's Rate Verdict - Will Investors Feel the Squeeze?

Finance

2025-04-17 08:32:55Content

In a bold move to stimulate economic recovery, the European Central Bank (ECB) is poised to deliver its seventh interest rate cut this year, signaling a proactive approach to combat economic challenges. The anticipated rate reduction comes at a critical time, as the Eurozone economy grapples with mounting pressures, including the potential fallout from escalating US tariffs.

Policymakers are strategically positioning themselves to provide much-needed economic relief, recognizing the fragile state of the region's financial landscape. The consecutive rate cuts reflect a determined effort to boost economic growth, encourage lending, and provide a lifeline to businesses struggling in an increasingly complex global market.

The ECB's decision underscores the delicate balancing act facing economic leaders: navigating international trade tensions while attempting to protect domestic economic interests. With each rate cut, the central bank aims to inject confidence and momentum into an economy that has been treading water amid global uncertainties.

As the financial world watches closely, this latest intervention could prove pivotal in preventing a potential economic downturn and setting the stage for future recovery.

Economic Tremors: European Central Bank's Strategic Rate Cut Amidst Global Trade Tensions

In the intricate landscape of global economic policy, the European Central Bank (ECB) stands at a critical crossroads, preparing to implement a pivotal monetary strategy that could reshape the continent's economic trajectory. As international trade dynamics become increasingly complex and unpredictable, policymakers are navigating a delicate balance between stimulating economic growth and mitigating potential risks.Navigating Uncertain Economic Waters: A Decisive Monetary Intervention

The Monetary Policy Landscape

The European Central Bank's impending rate cut represents a nuanced response to multifaceted economic challenges confronting the Eurozone. Economists and financial analysts have been closely monitoring the institution's strategic maneuvers, recognizing that this seventh consecutive rate reduction signals a profound commitment to economic revitalization. The decision emerges against a backdrop of sluggish economic performance, characterized by diminished industrial output, constrained consumer spending, and escalating international trade tensions. Underlying this monetary intervention is a complex web of economic indicators suggesting systemic vulnerabilities. Structural challenges within European economies, compounded by external pressures such as potential United States tariff implementations, have created an environment demanding aggressive yet calculated monetary policy responses. The ECB's leadership recognizes that traditional economic stimulation methods require innovative approaches in an increasingly interconnected global financial ecosystem.Global Trade Dynamics and Economic Resilience

The potential imposition of US tariffs introduces an additional layer of complexity to the ECB's strategic calculus. These trade barriers threaten to disrupt established economic relationships, potentially undermining European manufacturing sectors and international supply chains. By preemptively adjusting interest rates, the central bank aims to create a protective economic buffer, enhancing the Eurozone's capacity to absorb and mitigate potential external shocks. Financial experts argue that this rate cut represents more than a mere technical adjustment; it symbolizes a sophisticated risk management strategy. By reducing borrowing costs, the ECB seeks to encourage corporate investment, stimulate consumer spending, and maintain economic momentum despite challenging global circumstances. The approach reflects a delicate balance between proactive intervention and measured restraint.Technological and Structural Economic Transformations

Beyond immediate monetary considerations, the ECB's decision reflects broader technological and structural economic transformations. Digital innovation, shifting global trade patterns, and emerging economic models necessitate adaptive monetary policies. The rate cut can be interpreted as a strategic response to these evolving dynamics, signaling the central bank's commitment to fostering economic resilience and innovation. Technological disruptions and automation are fundamentally reshaping industrial landscapes, creating both challenges and opportunities for European economies. By maintaining flexible monetary policies, the ECB demonstrates an understanding of these complex interdependencies, positioning the Eurozone to capitalize on emerging economic paradigms.Socioeconomic Implications and Future Outlook

The monetary intervention extends beyond abstract economic metrics, carrying profound socioeconomic implications. Reduced borrowing costs potentially translate into increased employment opportunities, enhanced business investments, and improved living standards for European citizens. However, the strategy is not without potential risks, requiring continuous monitoring and adaptive policymaking. Financial analysts emphasize that while the rate cut represents a critical intervention, it is not a panacea for all economic challenges. Sustainable economic growth demands comprehensive strategies encompassing fiscal policy, structural reforms, and international cooperation. The ECB's approach signals a holistic understanding of these interconnected economic dynamics.RELATED NEWS

Finance

Wall Street Reveals: Q4 2024 Financial Scorecard Breaks Records and Defies Expectations

2025-03-29 00:00:00

Finance

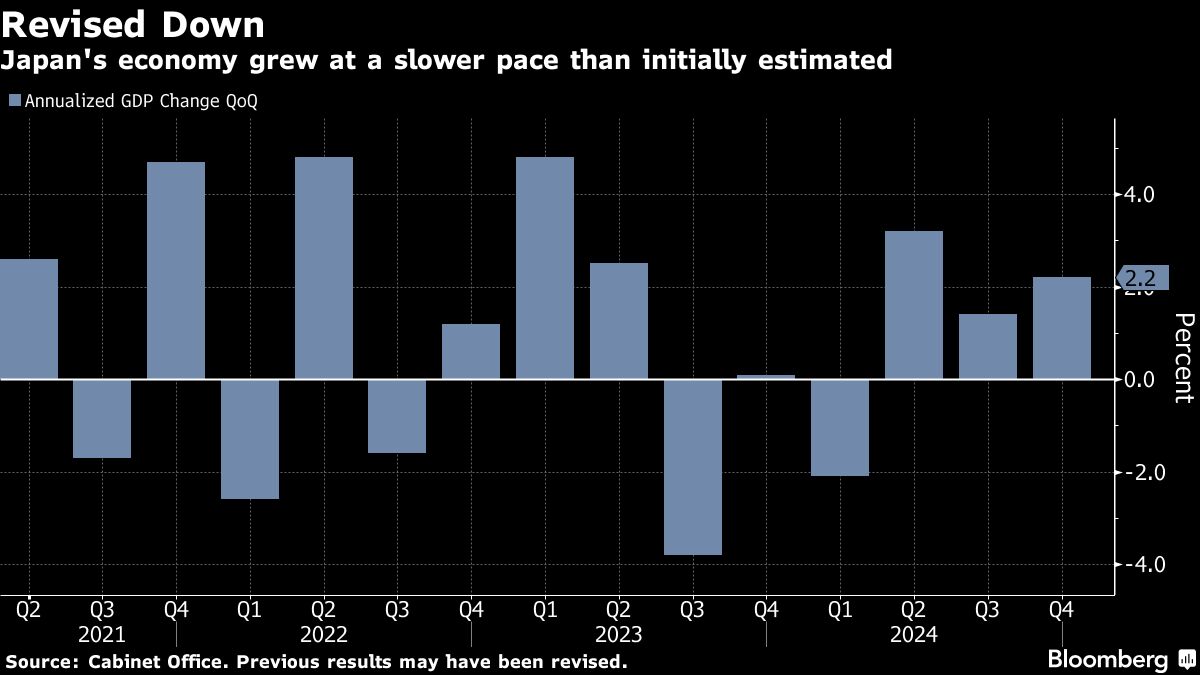

Japan's Economic Outlook Stumbles: Growth Forecast Slashed Before Central Bank Showdown

2025-03-11 00:09:04

Finance

Breaking Glass Ceilings: Asia's Top Female Finance Leaders Revealed for 2025 Awards

2025-04-28 10:47:36