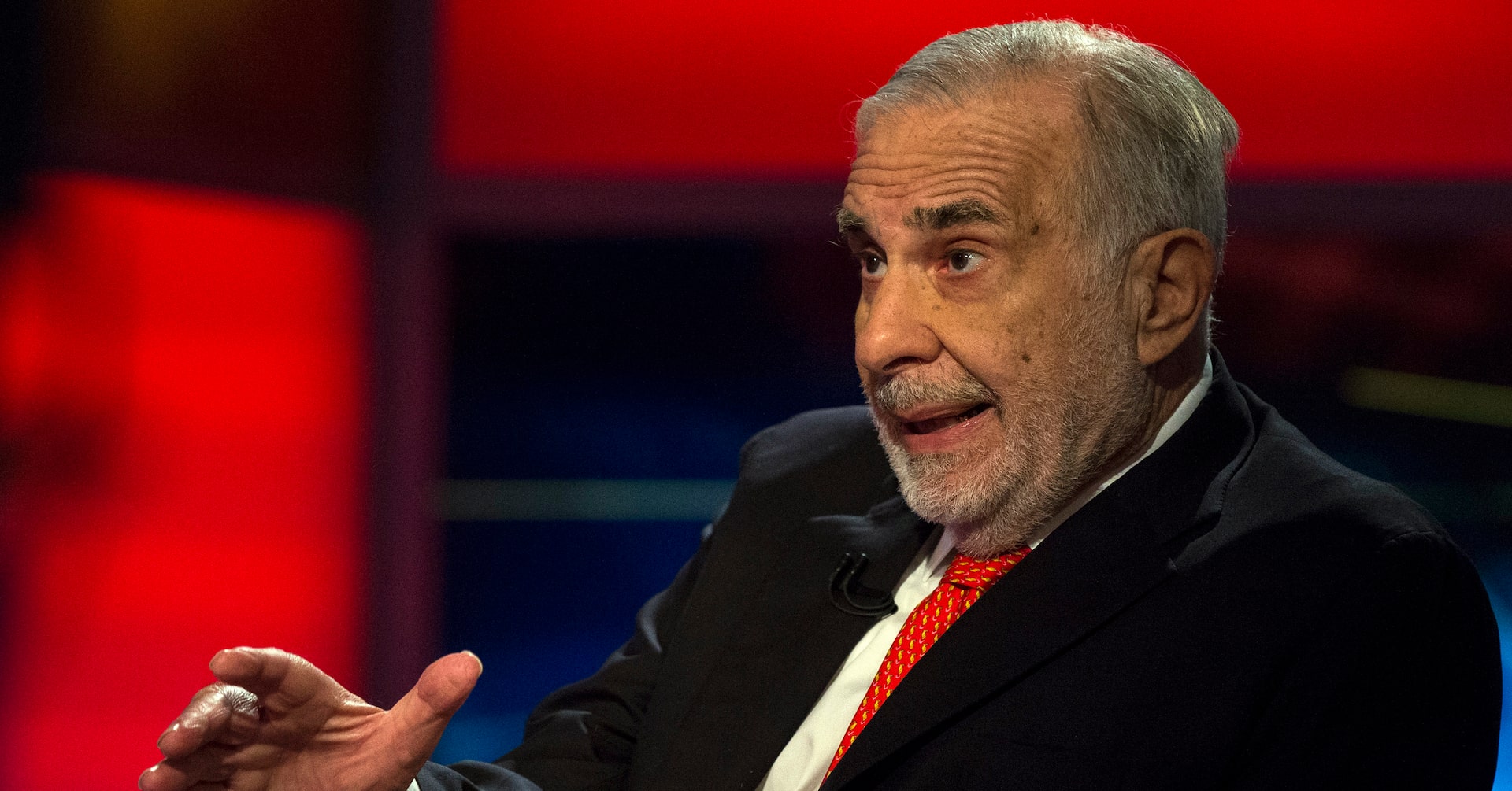

Icahn's Massive Stake: Billionaire Investor Amasses Over One-Third of Bausch Health's Shares

Health

2025-04-22 12:54:08Content

Billionaire activist investor Carl Icahn has significantly deepened his stake in Bausch Health, with his total economic exposure now reaching approximately 34% of the company's common shares, according to a recent corporate filing. The disclosure, made public on Tuesday, underscores Icahn's continued strategic interest in the healthcare company and potentially signals his confidence in its future prospects.

Icahn, known for his aggressive investment strategies and ability to influence corporate decision-making, has been a notable presence in Bausch Health's ownership landscape. This substantial economic exposure suggests he maintains a strong belief in the company's potential for growth and value creation.

The filing provides investors and market watchers with insight into Icahn's ongoing investment strategy, highlighting his significant financial commitment to the healthcare firm. As a seasoned investor with a reputation for driving corporate changes, Icahn's substantial stake could potentially influence Bausch Health's strategic direction in the coming months.

Icahn's Strategic Maneuver: Unveiling the Bausch Health Investment Landscape

In the dynamic world of corporate investments, billionaire activist investor Carl Icahn has once again captured market attention with his significant economic positioning in Bausch Health, signaling a potentially transformative strategic move that could reshape the healthcare investment ecosystem.Navigating the Complex Terrain of Healthcare Investments

The Strategic Significance of Icahn's Market Position

Carl Icahn's substantial economic exposure represents more than a mere financial transaction. His calculated approach to Bausch Health demonstrates a nuanced understanding of healthcare sector dynamics. By strategically acquiring a 34% economic stake in the company's common shares, Icahn is positioning himself as a potential catalyst for organizational transformation. The investment landscape reveals a complex interplay of financial strategy and corporate governance. Icahn's historical reputation as an activist investor suggests that this move is unlikely to be passive. His involvement typically signals potential restructuring, strategic realignment, or value optimization strategies that could fundamentally alter Bausch Health's operational trajectory.Decoding the Economic Implications

Bausch Health's filing provides a transparent snapshot of Icahn's substantial market involvement. The 34% economic exposure represents a significant commitment that goes beyond traditional investment paradigms. This level of engagement implies a deep-seated belief in the company's potential and a willingness to influence its strategic direction. Investors and market analysts are closely monitoring this development, recognizing that Icahn's interventions have historically triggered substantial corporate transformations. His investment approach often involves identifying undervalued assets, implementing operational efficiencies, and unlocking hidden shareholder value.Market Dynamics and Investor Sentiment

The healthcare sector continues to experience unprecedented volatility, with investors seeking strategic opportunities amidst complex regulatory and technological landscapes. Icahn's investment in Bausch Health emerges as a calculated response to these intricate market conditions. His economic exposure suggests a comprehensive assessment of the company's potential, considering factors such as market positioning, technological innovation, and potential for strategic restructuring. The investment reflects a sophisticated understanding of healthcare industry trends and the potential for value creation through strategic interventions.Potential Ripple Effects in Corporate Governance

Icahn's significant economic stake is likely to generate substantial discussions within Bausch Health's corporate governance framework. His historical approach often involves actively engaging with management, proposing strategic recommendations, and potentially advocating for leadership or structural changes. The market anticipates potential strategic shifts, operational optimizations, and potential corporate restructuring initiatives. Icahn's involvement typically signals a comprehensive review of the company's assets, operational efficiency, and long-term strategic vision.Future Outlook and Investment Implications

As the healthcare investment landscape continues to evolve, Icahn's strategic positioning in Bausch Health represents a fascinating case study of sophisticated investment methodologies. His approach transcends traditional investment strategies, offering a dynamic perspective on corporate value creation. Investors, analysts, and industry observers are keenly watching the potential developments emerging from this significant economic exposure. The intersection of Icahn's investment acumen and Bausch Health's operational potential creates a compelling narrative of strategic corporate transformation.RELATED NEWS

Health

Guardant Health Soars: TD Cowen Boosts Price Target in Bullish Market Bet

2025-02-22 14:20:17

Health

Health Crisis Looms: How Conservative Triumph Might Unravel Germany's Medical Workforce

2025-02-25 11:16:41

Health

Wellness Revolution: Discover Your Path to Optimal Health at Community Expo

2025-05-06 18:41:17