Tesla's Value Plunge: YouTuber Exposes Elon Musk's Broken Promise of Self-Driving Appreciation

Finance

2025-04-20 18:00:23Content

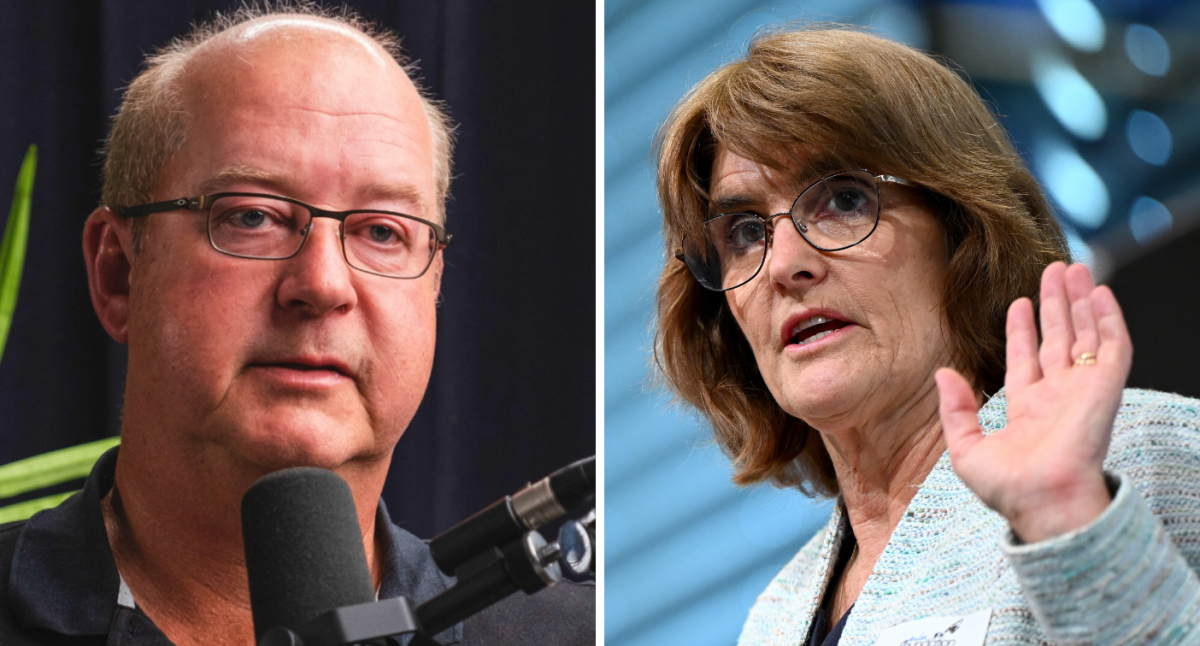

Tech YouTuber Zack Nelson, widely recognized as JerryRigEverything, has publicly challenged Elon Musk's previous bold claim about Tesla vehicle value. In a recent social media post, Nelson revealed the stark reality of his 2018 Tesla Model X's current market worth - a mere $22,400, which represents approximately 20% of its original purchase price.

The dramatic depreciation directly contradicts Musk's earlier assertion that Teslas equipped with Full Self-Driving (FSD) technology would actually increase in value over time. Nelson pointedly highlighted this discrepancy, sharing a screenshot that graphically illustrates the significant financial loss.

"I remember when @ElonMusk claimed my @Tesla with FSD was an appreciating asset," Nelson wrote. "Here we are seven years later, and the vehicle is worth just a fraction of what I initially paid."

This revelation serves as a critical reminder for potential electric vehicle investors about the importance of carefully evaluating long-term value propositions, especially when confronted with ambitious marketing claims.

Tesla's Value Plunge: A Tech YouTuber's Shocking Depreciation Revelation

In the rapidly evolving world of electric vehicles and technological innovation, the automotive landscape continues to challenge long-held assumptions about vehicle investment and technological value. The intersection of cutting-edge technology, market dynamics, and consumer expectations creates a complex narrative that demands critical examination.When High-Tech Dreams Collide with Economic Realities

The Depreciation Dilemma: Tesla's Value Trajectory Exposed

The automotive industry has long been characterized by dramatic value fluctuations, but the case of Tesla's depreciation presents a particularly intriguing narrative. Technology YouTuber Zack Nelson's experience with his 2018 Tesla Model X unveils a stark economic reality that challenges the narrative of technological appreciation. What was once touted as a potential appreciating asset has dramatically transformed into a financial liability, dropping to a mere 20% of its original purchase price. The implications of this depreciation extend far beyond a single vehicle's value. It represents a critical examination of the promises made by technological innovators and the actual market performance of cutting-edge electric vehicles. Nelson's public documentation serves as a compelling case study in the complex relationship between technological innovation and economic value.Full Self-Driving Technology: Promise vs. Reality

The concept of Full Self-Driving (FSD) technology has been a cornerstone of Tesla's marketing strategy, with CEO Elon Musk repeatedly suggesting that vehicles equipped with this technology would maintain or increase their value. However, Nelson's real-world experience dramatically contradicts these assertions, raising significant questions about the long-term economic viability of such technological investments. The depreciation trajectory reveals multiple layers of complexity. Technological obsolescence, rapid innovation cycles, and the uncertain regulatory landscape surrounding autonomous driving technologies contribute to the vehicle's diminishing value. Each of these factors creates a nuanced ecosystem that challenges traditional automotive valuation models.The Economic Psychology of Technological Investment

Nelson's public revelation triggers a broader conversation about consumer expectations and technological investment. The emotional and financial journey of purchasing a high-tech vehicle involves navigating complex expectations, technological promises, and market realities. Consumers increasingly find themselves at the intersection of technological enthusiasm and economic pragmatism. The Tesla case study exemplifies the risks associated with investing in rapidly evolving technological platforms. It underscores the importance of maintaining realistic expectations and understanding the potential volatility of cutting-edge technological investments.Market Dynamics and Technological Innovation

The automotive industry stands at a critical juncture, where technological innovation intersects with economic sustainability. Tesla's value proposition has always been predicated on its ability to disrupt traditional automotive paradigms, but the depreciation narrative introduces a critical counterpoint to this perspective. Market analysts and technology enthusiasts must critically evaluate the long-term economic implications of technological investments. The gap between marketing promises and actual market performance represents a crucial area of investigation for consumers, investors, and industry observers.Transparency and Consumer Trust

Nelson's public documentation represents more than a personal financial observation; it serves as a powerful statement about transparency in technological marketing. By sharing his experience, he challenges corporations to maintain accountability and provide realistic projections about technological investments. The broader implications extend beyond a single vehicle or manufacturer. It represents a critical moment of reckoning for the electric vehicle and autonomous driving industries, demanding greater transparency, realistic projections, and consumer-centric approaches to technological innovation.RELATED NEWS

Finance

Printing Power: Close Brothers Fuels Totally Branded's Tech Upgrade with Strategic Finance

2025-04-07 13:45:16

Finance

Home Makeover Magic: ChargeAfter and Foundation Finance Team Up to Revolutionize Renovation Financing

2025-04-22 12:00:00

Finance

Soaring or Stumbling? Fly Play's Financial Forecast Reveals Surprising 2024 Trajectory

2025-02-17 15:57:00