Nvidia's Market Rollercoaster: Inside the High-Stakes Trading Week of April 14-18

Finance

2025-04-20 19:00:00Content

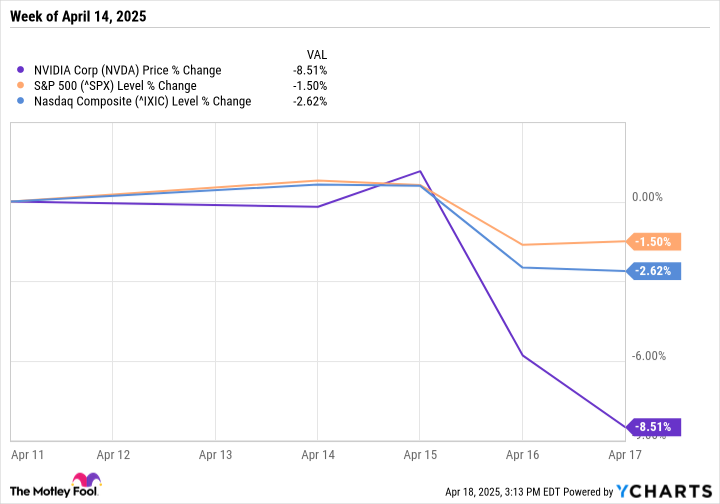

In a week marked by market volatility, Nvidia (NASDAQ: NVDA), the powerhouse behind cutting-edge AI semiconductor technology, experienced a notable stock price decline. The chipmaker's shares tumbled 8.5% during the shortened four-day trading week, which was abbreviated due to the Good Friday market closure.

By week's end, Nvidia's stock settled at $101.49 per share, reflecting the broader market sentiment surrounding tech and semiconductor stocks. The company wasn't alone in this downturn, as its key competitor Advanced Micro Devices (AMD) also saw a significant 6.3% drop during the same period.

This recent price movement highlights the ongoing dynamics and investor sentiment in the rapidly evolving artificial intelligence and semiconductor landscape, where Nvidia continues to be a prominent player driving technological innovation.

Tech Titans Tumble: Nvidia's Market Rollercoaster Reveals AI Chip Volatility

In the fast-paced world of technological innovation, semiconductor giants are experiencing unprecedented market fluctuations that send ripples through the investment landscape. The recent performance of Nvidia and its competitors highlights the delicate balance of technological advancement and market sentiment in the artificial intelligence semiconductor sector.Navigating the Turbulent Waves of Tech Investment

The Semiconductor Landscape: A Closer Look at Nvidia's Market Dynamics

Nvidia, a powerhouse in artificial intelligence chip manufacturing, has become a focal point for investors and technology enthusiasts alike. The company's recent stock performance reveals the intricate dance between technological innovation and market perception. During a shortened trading week, Nvidia experienced a significant downturn, with shares dropping by 8.5%, ultimately settling at $101.49 per share. The volatility reflects the complex ecosystem of the semiconductor industry, where technological breakthroughs and market sentiments intertwine to create a dynamic investment environment. Investors and analysts closely monitor such fluctuations, understanding that each percentage point represents millions in market capitalization and potential future growth.Competitive Landscape: Comparative Market Performance

Advanced Micro Devices (AMD), a direct competitor to Nvidia, also felt the market's tremors. The company's stock experienced a 6.3% decline during the same trading period, underscoring the broader challenges facing the AI chip manufacturing sector. This parallel downturn suggests systemic market pressures rather than company-specific issues. The synchronous decline points to larger economic factors influencing the technology sector. Investors must navigate a complex landscape of global supply chains, technological innovation, and macroeconomic trends that continuously reshape the semiconductor industry's competitive dynamics.Technological Innovation and Market Resilience

Despite the short-term market fluctuations, Nvidia continues to be a critical player in the artificial intelligence semiconductor market. The company's commitment to cutting-edge technological development remains unwavering, with ongoing investments in research and development that promise to push the boundaries of AI capabilities. The market's response to such technological leaders demonstrates the delicate balance between innovation and investor confidence. Each stock movement tells a story of technological potential, market perception, and the ongoing race to develop more powerful and efficient AI technologies.Future Outlook: Navigating Uncertainty

The semiconductor industry stands at a critical juncture, with artificial intelligence driving unprecedented technological transformation. Nvidia's recent market performance serves as a microcosm of the broader technological ecosystem, where innovation, market sentiment, and global economic factors converge. Investors and technology enthusiasts must remain adaptable, understanding that short-term market fluctuations are merely snapshots of a much larger and more complex technological narrative. The true measure of success lies not in daily stock movements, but in the long-term potential for groundbreaking technological advancement.RELATED NEWS

Finance

Lifeline Approved: Idaho Lawmakers Rescue Vocational Rehabilitation with Emergency Budget Boost

2025-03-28 22:28:42

Finance

Oklo's Financial Frontier: Breaking Down a Year of Bold Moves and Market Momentum in 2024

2025-03-24 20:05:00

Finance

Green Finance Revolution: BTG Pactual's Groundbreaking Sustainability Loan Clinches Top Global Honor

2025-04-14 11:45:00