Wall Street Mood Darkens: Business Leaders Brace for Economic Storm Reminiscent of 2008

Finance

2025-04-22 21:14:46Content

Corporate America's Economic Outlook Hits Lowest Point Since Financial Crisis

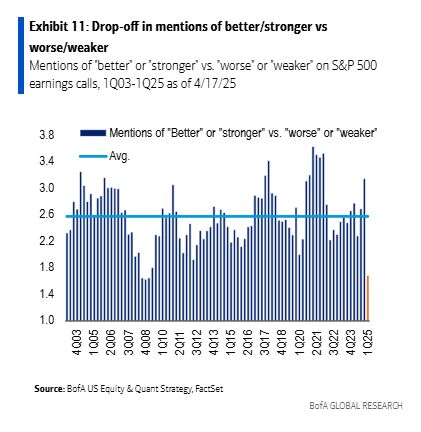

In a stark warning for investors, company executives are painting an increasingly gloomy picture of the economic landscape, signaling potential turbulence ahead. The current sentiment among business leaders echoes the dark days of the 2008 financial crisis, with corporate earnings calls revealing unprecedented levels of pessimism.

The mounting concerns stem largely from the ongoing trade tensions and economic uncertainty created by policy challenges. Executives are voicing deep apprehensions about the potential market impact, suggesting that the ripple effects of current economic policies could be far-reaching and significant.

Investors are now closely watching these corporate signals, trying to gauge the potential depth and duration of the economic challenges. The widespread negativity across corporate boardrooms serves as a critical barometer, hinting at potential market volatility and economic headwinds in the near future.

This unprecedented level of corporate pessimism isn't just a minor fluctuation—it represents a significant warning sign that could presage broader economic challenges. As companies adjust their strategies and expectations, the market may be on the brink of a substantial shift in economic dynamics.

Analysts and investors are advised to pay close attention to these corporate sentiment indicators, as they often provide early insights into potential economic trends and market movements.

Economic Uncertainty: Corporate America's Mounting Anxiety in the Shadow of Trade Tensions

In an era of unprecedented economic volatility, businesses across the United States are grappling with a complex landscape of international trade, political uncertainty, and market unpredictability. The current economic climate presents a challenging environment where corporate leaders must navigate intricate global dynamics while maintaining strategic resilience and financial stability.Navigating Turbulent Economic Waters: A Critical Analysis of Corporate Sentiment

The Psychological Landscape of Business Confidence

Corporate sentiment serves as a critical barometer for economic health, reflecting deeper systemic challenges and potential market transformations. Recent analyses reveal a profound sense of apprehension among business leaders, reminiscent of the psychological trauma experienced during the 2008 financial crisis. This pervasive uncertainty stems from multiple interconnected factors, including geopolitical tensions, trade policy volatility, and increasingly complex global economic relationships. The psychological impact of prolonged economic uncertainty cannot be understated. Executives are experiencing heightened levels of stress and strategic paralysis, with many organizations adopting conservative approaches to investment, expansion, and risk management. This defensive posture potentially creates a self-fulfilling prophecy of economic contraction.Trade Policy's Ripple Effect on Corporate Strategy

The ongoing trade tensions have fundamentally reshaped corporate strategic planning, compelling businesses to develop more adaptive and resilient operational models. Companies are increasingly diversifying supply chains, exploring alternative manufacturing locations, and implementing sophisticated risk mitigation strategies to counteract potential economic disruptions. Multinational corporations are particularly vulnerable, facing complex challenges in maintaining global competitiveness while navigating increasingly protectionist international trade environments. The uncertainty surrounding trade policies creates significant barriers to long-term planning and investment, forcing executives to develop more flexible and scenario-based strategic frameworks.Market Dynamics and Investor Perception

Investor confidence is intrinsically linked to corporate sentiment, with market reactions reflecting the collective psychological state of business leadership. The current economic landscape is characterized by heightened volatility, where traditional predictive models struggle to capture the nuanced interactions between geopolitical events, trade policies, and market performance. Financial analysts are closely monitoring earnings calls and corporate communications for subtle indicators of strategic thinking and potential economic shifts. The prevalence of cautious and sometimes pessimistic messaging suggests a broader systemic concern about future economic stability and growth potential.Technological Innovation as a Resilience Strategy

In response to economic uncertainty, many corporations are leveraging technological innovation as a primary mechanism for maintaining competitive advantage. Advanced data analytics, artificial intelligence, and machine learning are being deployed to enhance predictive capabilities, optimize operational efficiency, and create more adaptive business models. By investing in transformative technologies, organizations aim to build organizational resilience that transcends traditional economic constraints. This approach represents a proactive strategy for navigating uncertain economic terrain, potentially mitigating the negative impacts of external market disruptions.Global Economic Interconnectedness

The contemporary economic ecosystem is characterized by unprecedented levels of global interconnectedness, where localized economic events can rapidly propagate across international markets. Corporate leaders must develop sophisticated understanding of these complex interdependencies, recognizing that traditional geographical boundaries have become increasingly porous and fluid. This global economic complexity demands a more holistic and nuanced approach to strategic planning, one that incorporates diverse perspectives, cultural intelligence, and adaptive thinking. Successful organizations will be those capable of rapidly interpreting and responding to emerging economic signals with agility and strategic foresight.RELATED NEWS

Finance

EdTech Startup Lorien Finance Secures $2.25M to Revolutionize Global Learning Investments

2025-03-10 03:12:02

Finance

Whispers of Worry: Markets Quietly Brace for Potential Economic Downturn

2025-03-05 05:17:37