Trump Stands Firm: Fed Chair's Job Safe, Despite Past Tensions

Finance

2025-04-22 21:57:00Content

In a swift reversal of his earlier remarks, President Donald Trump reassured the financial markets on Tuesday by declaring he has no intention of removing Federal Reserve Chair Jerome Powell from his position. This statement comes just days after his previous comments suggesting potential termination sparked significant stock market volatility.

Speaking directly to reporters, Trump emphatically stated, "I have no intention of firing him," effectively calming investor concerns. The president's latest comments represent a notable shift from his previous stance, during which he had openly expressed frustration with the Federal Reserve's decision to pause interest rate cuts.

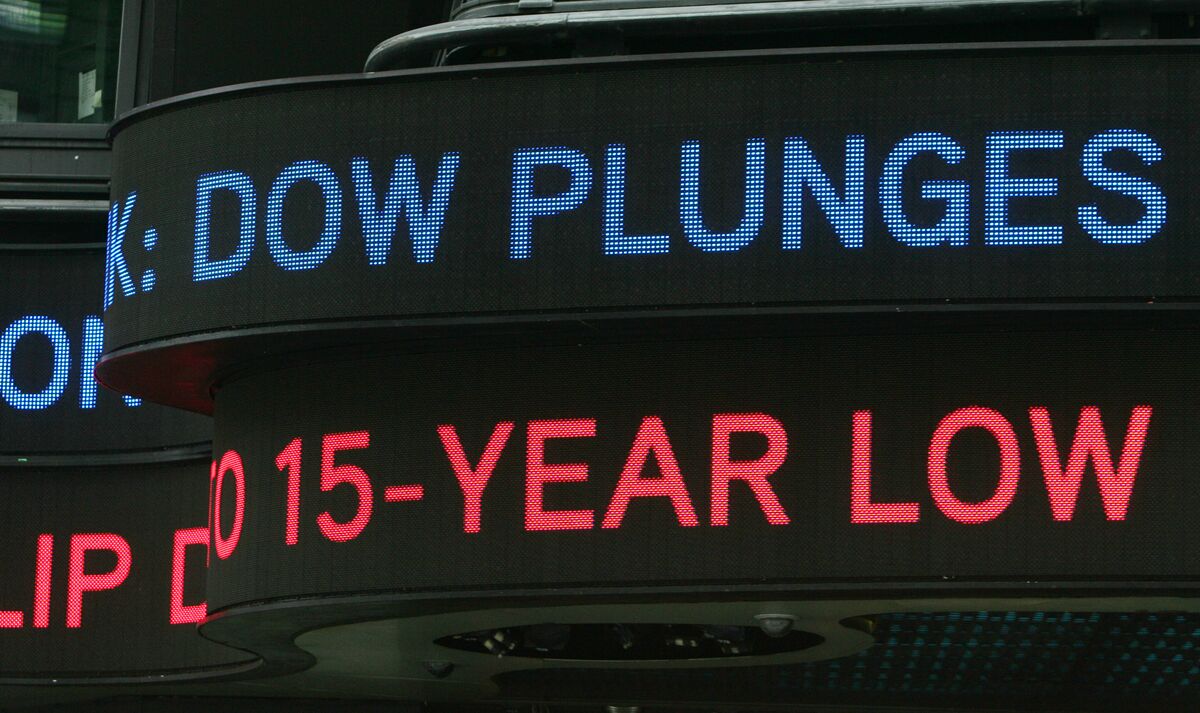

Trump's initial comments about potentially dismissing Powell had caused considerable unease on Wall Street, triggering a notable selloff that underscored the market's sensitivity to potential leadership changes at the central bank. By publicly reaffirming Powell's job security, the president appears to be attempting to restore confidence and stabilize financial markets.

The about-face highlights the complex and sometimes unpredictable nature of presidential communication regarding monetary policy and financial leadership.

Presidential Power Play: Trump's Delicate Dance with the Federal Reserve

In the intricate world of economic governance, the relationship between the White House and the Federal Reserve has always been a delicate balancing act. Recent developments have once again thrust this dynamic into the spotlight, revealing the complex interplay of political ambition and monetary policy that shapes the United States' economic landscape.When Presidential Frustration Meets Financial Diplomacy

The Tension of Monetary Policy

The corridors of financial power in Washington have been buzzing with speculation and tension surrounding President Donald Trump's volatile relationship with Federal Reserve Chair Jerome Powell. At the heart of this intricate drama lies a fundamental disagreement about monetary policy and interest rate management. Trump's public frustration with the Federal Reserve's decision-making has been a recurring theme throughout his presidency, creating unprecedented levels of scrutiny and public discourse about the traditionally independent central banking system. The president's approach to monetary policy represents a significant departure from historical presidential interactions with the Federal Reserve. Where previous administrations maintained a careful distance, Trump has been remarkably vocal about his expectations and disappointments. His critiques of Powell's leadership have ranged from subtle criticisms to outright public challenges, pushing the boundaries of the conventional relationship between the executive branch and the central bank.The Delicate Balance of Economic Influence

Behind the scenes, a complex negotiation of economic strategy has been unfolding. Trump's desire to influence interest rate decisions reflects a broader strategy of economic manipulation aimed at stimulating growth and maintaining market confidence. The president's public statements about potentially firing Powell have sent ripples through financial markets, demonstrating the profound impact of presidential rhetoric on economic sentiment. Financial experts have been closely analyzing these interactions, noting the potential long-term implications for market stability and institutional independence. The Federal Reserve's mandate to maintain economic stability requires a delicate balance between responding to economic conditions and resisting political pressure. Powell's measured responses to Trump's provocations have been viewed as a masterclass in diplomatic navigation.Market Reactions and Economic Implications

The stock market has been particularly sensitive to these political undercurrents. Each statement and potential policy shift creates immediate and sometimes dramatic market responses. Investors and economic analysts have been forced to parse every nuanced communication, understanding that the relationship between the White House and the Federal Reserve could significantly impact economic forecasts. Trump's recent public assurance that he has "no intention of firing" Powell represents a potential de-escalation of tensions. However, the financial community remains cautious, recognizing the unpredictable nature of presidential communication and the potential for sudden shifts in strategy. The ongoing dialogue between political leadership and monetary policy makers continues to be a fascinating study in governance and economic management.The Broader Context of Presidential Economic Influence

This ongoing saga highlights the complex mechanisms of economic governance in the United States. The Federal Reserve's independence is a cornerstone of the nation's financial system, designed to insulate monetary policy from short-term political considerations. Yet, the very public nature of recent interactions challenges traditional understandings of this relationship. Trump's approach represents a more interventionist model of presidential economic management, challenging long-standing norms of central bank independence. While some view this as a necessary modernization of economic governance, others see it as a potentially dangerous precedent that could undermine the institutional integrity of the Federal Reserve. As the economic landscape continues to evolve, the interactions between political leadership and monetary policy makers will undoubtedly remain a critical area of focus for economists, political scientists, and financial analysts alike.RELATED NEWS

Finance

Defence Dollars: Poland and UK Finance Chiefs Hold Crucial Talks on Military Funding

2025-03-20 05:14:48