Money Matters 101: How Teens Are Learning Real-World Financial Survival Skills

Finance

2025-04-23 01:35:02Content

Financial Literacy Comes Alive for Bay Area Students

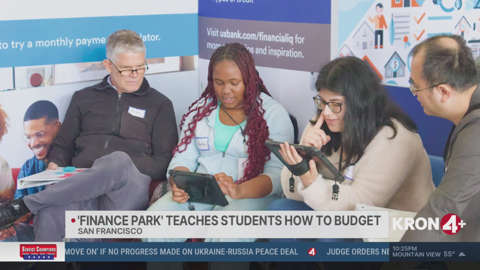

This April, Junior Achievement of Northern California is transforming financial education with its innovative Finance Park Pop-up program, bringing real-world financial skills directly into local classrooms. The interactive initiative has been making waves across the Bay Area, recently stopping at Thurgood Marshall Academic High School in San Francisco.

The program goes beyond traditional classroom learning, offering students a hands-on experience in understanding personal finance. By simulating real-life financial scenarios, students learn critical skills like budgeting, distinguishing between essential needs and discretionary wants, and making informed financial decisions.

Through engaging workshops and interactive sessions, students are gaining practical insights into money management that will serve them well beyond their school years. The Finance Park Pop-up not only educates but empowers young people to take control of their financial futures.

As Financial Literacy Month continues, this program stands as a beacon of practical education, preparing the next generation to navigate the complex world of personal finance with confidence and knowledge.

Empowering Young Minds: Financial Literacy Transforms Bay Area Classrooms

In an era where financial knowledge is paramount, educational initiatives are breaking new ground in preparing students for real-world economic challenges. The landscape of financial education is rapidly evolving, with innovative programs designed to equip young learners with critical money management skills that extend far beyond traditional classroom learning.Unlocking Financial Potential: Where Education Meets Real-World Expertise

The Financial Literacy Revolution in Northern California

Financial education has emerged as a critical component of modern academic curricula, with organizations like Junior Achievement of Northern California leading the charge in transformative learning experiences. The Finance Park Pop-up program represents a groundbreaking approach to financial education, bringing sophisticated economic concepts directly into high school classrooms. By creating immersive, interactive environments, these programs bridge the gap between theoretical knowledge and practical financial understanding. Students at schools like Thurgood Marshall Academic High School are experiencing a radical reimagining of financial learning. The program goes beyond traditional textbook approaches, offering hands-on experiences that simulate real-world financial decision-making. Participants engage with complex budgeting scenarios, learning to distinguish between essential needs and discretionary wants through dynamic, experiential learning modules.Transformative Learning Through Practical Experiences

The innovative approach of the Finance Park Pop-up challenges conventional educational methodologies. Local businesses collaborate directly with educational institutions, providing students with unprecedented insights into economic realities. These immersive experiences allow young learners to develop critical financial skills that are often overlooked in traditional academic settings. Participants navigate intricate financial landscapes, making simulated decisions that mirror real-world economic challenges. From understanding income allocation to managing unexpected expenses, students gain practical skills that will serve them throughout their lives. The program demonstrates a profound commitment to financial empowerment, recognizing that economic literacy is a fundamental life skill.Beyond the Classroom: Preparing Future Financial Leaders

The impact of such programs extends far beyond immediate financial understanding. By introducing complex economic concepts in engaging, accessible ways, educators are cultivating a generation of financially savvy individuals. Students learn to approach financial decisions with critical thinking, analytical skills, and a nuanced understanding of economic principles. Local businesses play a crucial role in this educational transformation, providing real-world context and expertise. Their involvement ensures that financial education remains relevant, practical, and directly connected to contemporary economic landscapes. The collaborative approach bridges the gap between academic learning and practical application, creating a holistic educational experience.Innovative Approaches to Financial Education

Junior Achievement's program represents a paradigm shift in financial literacy education. By creating interactive, immersive learning environments, the initiative challenges traditional educational approaches. Students are no longer passive recipients of information but active participants in their financial learning journey. The program's success lies in its ability to make complex financial concepts accessible and engaging. Through carefully designed simulations and interactive experiences, participants develop a comprehensive understanding of financial management. They learn to make informed decisions, understand economic trade-offs, and develop critical financial reasoning skills.Community Impact and Future Potential

The ripple effects of such financial literacy programs extend far beyond individual students. By empowering young learners with essential economic skills, these initiatives contribute to broader community economic resilience. Participants become informed consumers, potential investors, and future economic contributors who understand the nuanced complexities of financial decision-making. As financial landscapes continue to evolve, programs like the Finance Park Pop-up become increasingly crucial. They represent a forward-thinking approach to education, recognizing that financial literacy is not a luxury but a necessity in today's complex economic world.RELATED NEWS

Financial Triumph: Bairong Inc. Reveals Robust 2024 Earnings in Landmark Annual Report