Wall Street's AI Revolution: How Trade Tensions Could Reshape Financial Technology by 2025

Finance

2025-04-21 13:10:18Content

AI in Finance: Navigating Market Growth and Global Trade Dynamics

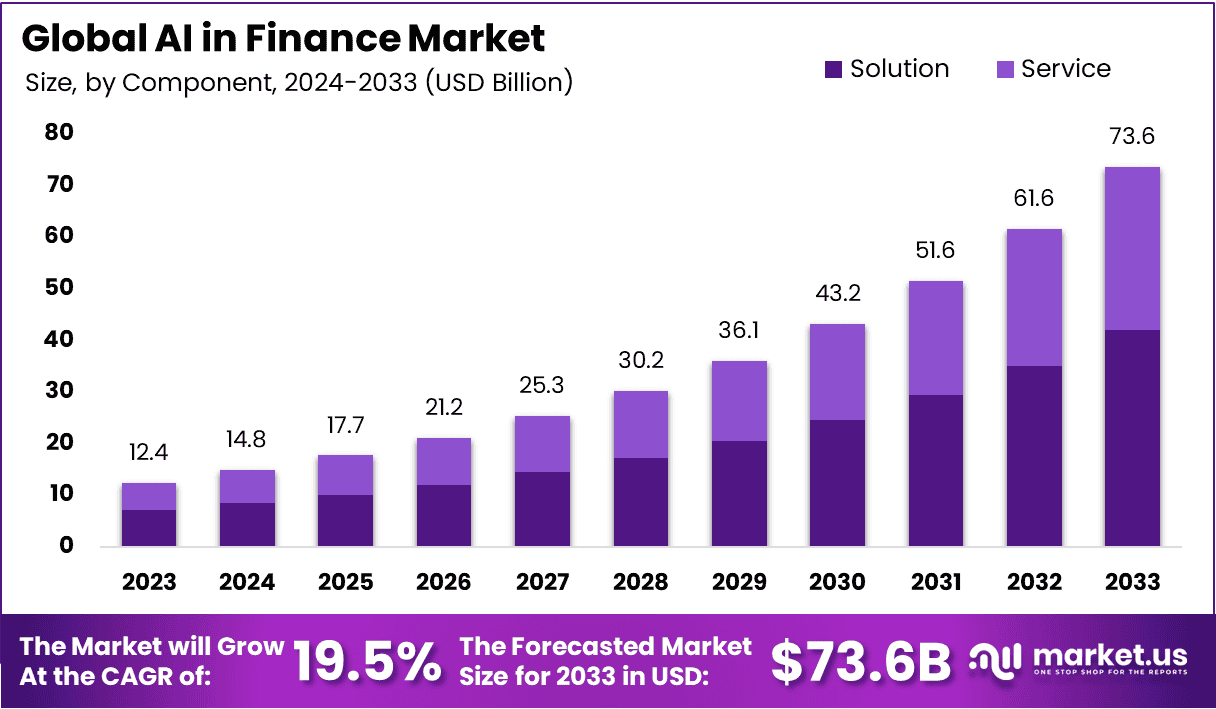

The artificial intelligence (AI) finance market is poised for remarkable transformation, with projections indicating substantial growth and innovative developments through 2025-2034. As global economic landscapes evolve, the intersection of AI technology and financial services is creating unprecedented opportunities and challenges.

Market Trajectory and Technological Advancements

The forecast period reveals a compelling narrative of technological disruption, where AI is set to revolutionize traditional financial processes. Key drivers include enhanced predictive analytics, automated decision-making, and sophisticated risk management strategies that are reshaping the financial ecosystem.

US Tariff Impacts and Strategic Implications

Recent trade policies and tariff regulations are significantly influencing the AI finance market's development. Financial institutions are adapting their technological investments and strategic frameworks to navigate the complex global economic environment, leveraging AI as a critical tool for resilience and competitive advantage.

Key Market Highlights:

- Projected exponential growth in AI financial technologies

- Increased investment in machine learning and predictive modeling

- Enhanced risk assessment and fraud detection capabilities

- Strategic adaptations to evolving trade and economic landscapes

As the market continues to mature, stakeholders can anticipate a dynamic landscape of innovation, technological integration, and transformative financial solutions.

Revolutionizing Finance: The Transformative Power of Artificial Intelligence in Global Markets

In an era of unprecedented technological disruption, artificial intelligence stands at the forefront of a financial revolution that promises to reshape how businesses, investors, and financial institutions operate. The convergence of advanced machine learning algorithms, big data analytics, and computational power is creating a seismic shift in the financial landscape, challenging traditional paradigms and unlocking extraordinary potential for innovation and strategic decision-making.Unleashing the Future: AI's Unprecedented Impact on Financial Ecosystems

The Technological Metamorphosis of Financial Services

The financial sector is experiencing a profound transformation driven by artificial intelligence technologies. Traditional banking models are being systematically dismantled and reconstructed through intelligent systems that can process complex data streams with remarkable precision. Machine learning algorithms now enable financial institutions to develop predictive models that anticipate market trends, assess risk with unprecedented accuracy, and create personalized financial strategies tailored to individual client needs. Financial organizations are increasingly deploying sophisticated AI-driven platforms that can analyze millions of data points simultaneously, generating insights that were previously impossible to extract. These intelligent systems leverage advanced neural networks and deep learning techniques to identify intricate patterns, detect potential fraud, and optimize investment portfolios with minimal human intervention.Economic Implications and Market Dynamics

The integration of artificial intelligence into financial markets represents a fundamental restructuring of economic interactions. Sophisticated algorithmic trading platforms can now execute complex transactions in microseconds, responding to global market fluctuations with superhuman speed and precision. These technological innovations are democratizing financial access, enabling smaller investors to compete with institutional players through intelligent, data-driven investment strategies. Emerging economies are particularly poised to benefit from AI-driven financial technologies. By reducing operational costs, minimizing human error, and providing more inclusive financial services, artificial intelligence is creating unprecedented opportunities for economic growth and financial empowerment across diverse global markets.Risk Management and Predictive Analytics

Artificial intelligence has revolutionized risk assessment methodologies, enabling financial institutions to develop more nuanced and dynamic risk management frameworks. Machine learning models can now analyze historical data, current market conditions, and potential future scenarios with remarkable complexity, providing financial decision-makers with comprehensive risk evaluations. These advanced predictive analytics go beyond traditional statistical models, incorporating real-time global economic indicators, geopolitical developments, and complex interdependencies that human analysts might overlook. By leveraging vast datasets and sophisticated algorithms, AI systems can generate probabilistic models that offer unprecedented insights into potential market disruptions and investment opportunities.Ethical Considerations and Regulatory Challenges

As artificial intelligence becomes increasingly embedded in financial ecosystems, critical ethical and regulatory questions emerge. Financial institutions must navigate complex challenges related to algorithmic transparency, data privacy, and potential systemic biases inherent in machine learning models. Regulatory frameworks are evolving to address these technological innovations, seeking to balance technological advancement with consumer protection and market stability. Governments and financial authorities worldwide are developing comprehensive guidelines to ensure responsible AI implementation, emphasizing transparency, accountability, and ethical considerations in algorithmic decision-making processes.Future Trajectory and Technological Evolution

The future of artificial intelligence in finance promises continued innovation and transformative potential. Emerging technologies such as quantum computing, advanced neural networks, and more sophisticated machine learning architectures are poised to further revolutionize financial services, creating increasingly intelligent and adaptive systems. Financial institutions that successfully integrate these technologies will gain significant competitive advantages, developing more responsive, personalized, and efficient financial products and services. The ongoing convergence of artificial intelligence, blockchain technologies, and advanced data analytics will continue to reshape the global financial landscape, offering unprecedented opportunities for growth, innovation, and economic empowerment.RELATED NEWS

Franklin Resources Unveils Stellar Financial Performance: Q4 and 2024 Earnings Surge Beyond Expectations

Money Moves: 5 Expert Strategies That Could Transform Your Financial Future