Market Turning Point: JPMorgan Signals End of Stock Market Downturn

Finance

2025-03-13 04:34:27Content

JPMorgan Signals Potential End to US Equity Market Correction

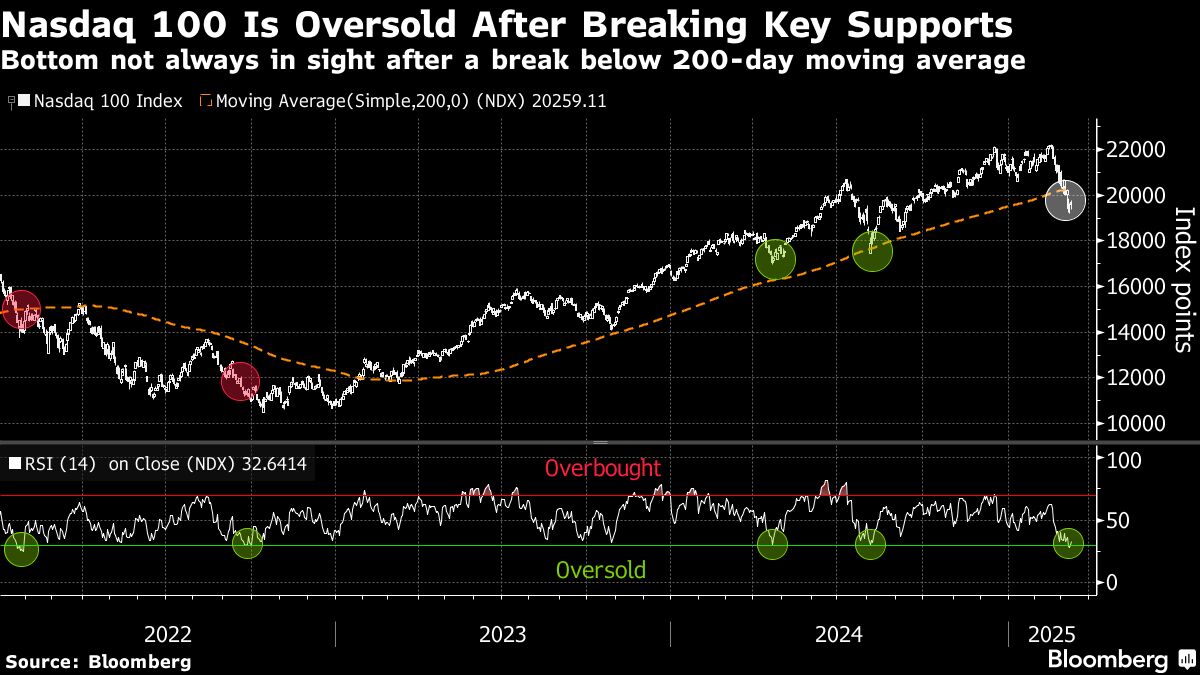

Financial experts at JPMorgan Chase & Co. suggest that the recent downturn in US equity markets may be reaching its conclusion, with promising indicators emerging from credit markets that hint at a reduced likelihood of an economic recession.

The investment banking giant's analysis points to stabilizing credit conditions as a key signal of potential market recovery. By closely examining credit market dynamics, JPMorgan's analysts believe investors might be witnessing the early stages of a market stabilization period.

This assessment comes at a critical time when investors have been anxiously monitoring economic indicators for signs of potential economic turbulence. The credit market's current state suggests a more optimistic outlook compared to previous predictions of widespread economic downturn.

While market volatility remains a concern, JPMorgan's insights offer a glimmer of hope for investors seeking reassurance in an uncertain financial landscape. The bank's research team recommends cautious optimism and continued close monitoring of economic trends.

Market Resilience: Navigating the Equity Correction Landscape

In the ever-evolving world of financial markets, investors are constantly seeking insights that can help them understand the complex dynamics of economic fluctuations. Recent analysis from leading financial institutions suggests a potential turning point in the current market correction, offering a glimmer of hope for those navigating the turbulent investment landscape.Decoding Market Signals: A Comprehensive Financial Outlook

Credit Markets: The Hidden Economic Barometer

Financial experts at JPMorgan Chase & Co. have uncovered compelling evidence that suggests the worst of the current equity market correction may be drawing to a close. The intricate world of credit markets provides a nuanced perspective on economic health, revealing subtle indicators that often escape casual observation. Unlike traditional market analysis, these credit market signals offer a more sophisticated lens through which to interpret potential economic trajectories. The complexity of credit markets extends far beyond simple numerical indicators. Sophisticated investors understand that these markets represent a sophisticated ecosystem of financial interactions, where risk assessment and economic sentiment converge. By carefully examining credit spreads, default probabilities, and lending behaviors, financial analysts can extract profound insights into the underlying economic dynamics.Recession Risk: A Multifaceted Assessment

The potential for economic downturn remains a critical concern for investors and economic strategists. JPMorgan's analysis suggests a more optimistic outlook, with credit market indicators pointing to a reduced probability of a severe recession. This assessment is not based on simplistic metrics but involves a comprehensive evaluation of multiple economic parameters. Economic resilience emerges from a complex interplay of factors, including corporate financial health, consumer spending patterns, and global economic trends. The current analysis indicates a more nuanced economic landscape, where traditional recession indicators may not tell the complete story. Investors are advised to look beyond surface-level interpretations and consider the deeper, more intricate economic signals.Equity Market Dynamics: Beyond Surface-Level Corrections

The ongoing equity market correction represents more than a mere numerical fluctuation. It reflects a broader recalibration of investor expectations, risk assessments, and economic projections. JPMorgan's insights suggest that this correction might be a natural market mechanism for realigning valuations and expectations. Sophisticated investors recognize that market corrections are not inherently negative but can represent opportunities for strategic repositioning. The current market environment demands a more dynamic approach to investment strategy, one that embraces complexity and seeks to understand the underlying economic narratives.Strategic Implications for Investors

Navigating the current market landscape requires a multifaceted approach that goes beyond traditional investment strategies. The reduced recession risk identified by credit market indicators suggests a potential environment of cautious optimism. However, prudent investors should maintain a balanced and diversified approach. The interconnected nature of global financial markets means that no single indicator can provide a complete picture. Successful investment strategies will require continuous monitoring, adaptability, and a deep understanding of the complex economic ecosystem. JPMorgan's analysis provides a valuable perspective, but it should be considered alongside other comprehensive economic assessments.RELATED NEWS

FinTech's Hot New Trend: How Embedded Finance is Reshaping Banking Deals