Trade War Tensions: Will Tariffs Make or Break Wall Street's Next Move?

Finance

2025-03-13 08:00:26Content

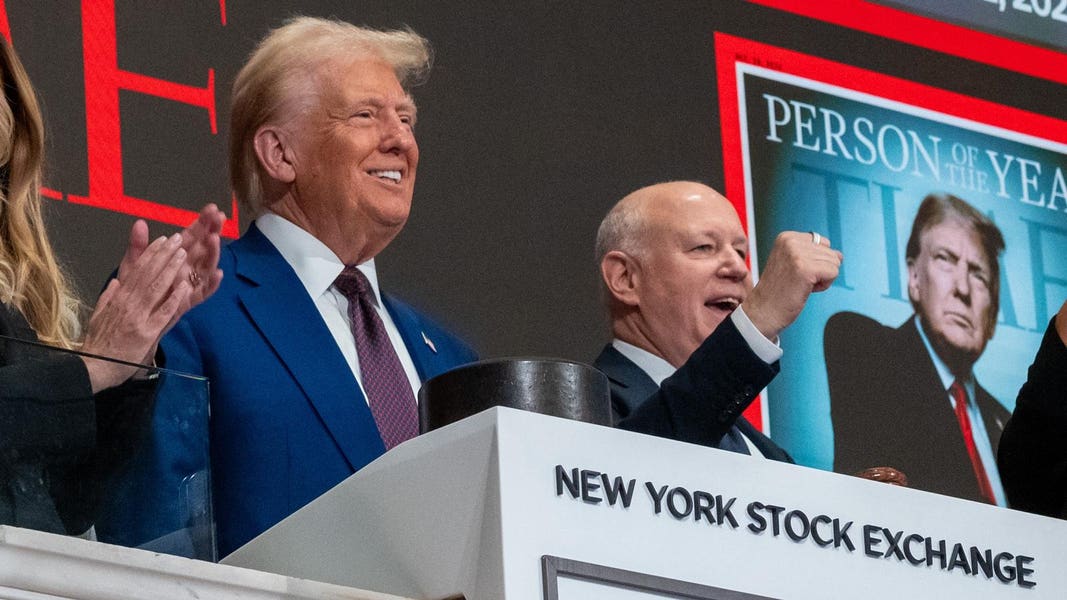

Market Volatility Surges as Trade Tensions Keep Investors on Edge

The stock market continues to ride a rollercoaster of uncertainty, with tariff negotiations sending daily shockwaves through investor sentiment. As global trade tensions simmer, market participants are desperately trying to forecast the potential impact of shifting trade policies on corporate bottom lines.

Each day brings a new wave of speculation, with investors carefully parsing every headline and diplomatic signal for clues about potential trade resolutions. The unpredictable nature of current tariff discussions has created a high-stakes guessing game, where even minor policy hints can trigger significant market swings.

Corporate leaders and financial strategists are working overtime to model potential scenarios, understanding that the ripple effects of trade policies could dramatically reshape profit margins and strategic planning. The ongoing uncertainty has transformed the investment landscape into a complex chess match, where anticipating policy moves has become as crucial as traditional financial analysis.

Market Tremors: How Global Trade Policies Are Reshaping Investor Strategies

In the complex landscape of global financial markets, investors find themselves navigating an increasingly unpredictable terrain where trade policies have become the primary catalyst for market volatility. The delicate interplay between international economic strategies and corporate performance has created a high-stakes environment where every policy announcement can trigger significant market reactions.Decoding the Economic Uncertainty: Trade Policies Redefining Investment Paradigms

The Geopolitical Chessboard of International Trade

The contemporary global economic landscape resembles a sophisticated chess match, where nations strategically maneuver trade policies to gain competitive advantages. Tariffs have emerged as powerful economic weapons, capable of instantaneously transforming market dynamics. Sophisticated investors are now required to develop nuanced understanding beyond traditional financial analysis, integrating geopolitical intelligence into their decision-making frameworks. Multinational corporations are experiencing unprecedented challenges as they attempt to forecast potential regulatory shifts. The unpredictability of trade negotiations creates a ripple effect across supply chains, investment strategies, and corporate risk management protocols. Companies must now develop adaptive strategies that can rapidly respond to evolving international economic conditions.Market Sentiment and Investor Psychology

Investor confidence has become increasingly sensitive to trade policy developments. Each tariff announcement or diplomatic negotiation can trigger immediate market reactions, causing significant portfolio volatility. Institutional and retail investors alike are compelled to develop more sophisticated risk assessment methodologies that can anticipate and mitigate potential economic disruptions. The psychological impact of trade policy uncertainty cannot be understated. Investors are constantly recalibrating their expectations, analyzing potential scenarios, and developing contingency plans. This heightened state of alertness has transformed traditional investment approaches, demanding more agile and informed decision-making processes.Technological Innovation and Economic Resilience

Emerging technologies are playing a crucial role in helping businesses and investors navigate complex trade environments. Advanced data analytics, artificial intelligence, and real-time global monitoring systems are providing unprecedented insights into potential market shifts. Companies that can leverage these technological capabilities are better positioned to anticipate and respond to rapidly changing trade dynamics. The integration of sophisticated technological tools enables more precise risk assessment and strategic planning. Investors are increasingly relying on complex algorithmic models that can process vast amounts of geopolitical and economic data, providing more nuanced investment strategies.Sectoral Impact and Strategic Repositioning

Different economic sectors are experiencing varied impacts from evolving trade policies. Manufacturing, technology, agriculture, and financial services are witnessing significant transformations in their operational and strategic approaches. Companies are increasingly diversifying their supply chains, exploring alternative markets, and developing more resilient business models. The global trade landscape is no longer characterized by traditional bilateral relationships but by complex, interconnected economic networks. Successful organizations are those that can quickly adapt, reallocate resources, and maintain operational flexibility in the face of uncertain regulatory environments.Future Outlook: Navigating Uncertainty

As global trade dynamics continue to evolve, investors must embrace a more holistic and adaptive approach to financial strategy. The ability to quickly interpret and respond to policy changes will become a critical competitive advantage. Continuous learning, technological integration, and geopolitical awareness will be essential skills for successful market participation. The ongoing transformation of international trade policies represents not just a challenge but an opportunity for innovative investors and corporations to reimagine their strategic approaches and develop more resilient economic frameworks.RELATED NEWS

Finance

Breaking: Your Wallet vs. the Housing Market - The Silent Financial Squeeze

2025-03-03 06:00:53

Finance

Wall Street's Silent Rebellion: How Financial Markets Are Putting Trump in Check

2025-03-01 11:30:00