From Forest to Finance: How Alto Mayo Is Rewriting Climate Action

Finance

2025-04-11 00:00:00Content

Bridging the Gap: How Strategic Catalytic Funding Can Accelerate Climate Solutions

In the urgent fight against climate change, innovative financing strategies can be the key to transforming ambitious goals into real-world progress. By strategically deploying catalytic funding in the early stages of climate projects and then gracefully stepping back to allow private capital to take the lead, we can unlock unprecedented potential for environmental transformation.

This approach is not just about providing initial financial support; it's about creating a catalyst for sustainable innovation. By carefully nurturing promising climate initiatives through their most vulnerable developmental stages, we can help breakthrough technologies and solutions gain the momentum they need to attract mainstream investment.

The power of this method lies in its ability to de-risk innovative projects, giving investors the confidence to step in and scale up promising climate solutions. It's a delicate dance of public and private sector collaboration that can turn bold climate ambitions into tangible, scalable results that have the potential to reshape our environmental future.

Catalyzing Climate Action: Transforming Ambition into Sustainable Investment Strategies

In the complex landscape of global climate finance, innovative approaches are emerging that bridge the gap between environmental aspirations and tangible economic transformation. The critical challenge facing modern investors and policymakers is not just recognizing the potential of sustainable development, but creating strategic mechanisms that can effectively mobilize capital and drive meaningful change.Unleashing Transformative Financial Solutions for a Sustainable Future

The Strategic Imperative of Early-Stage Climate Investments

Climate change represents an unprecedented global challenge that demands sophisticated financial engineering and visionary investment strategies. Traditional funding models often falter when confronting the intricate complexities of sustainable development projects. By implementing a nuanced approach that strategically deploys catalytic capital, investors can create powerful momentum for environmental innovations. The fundamental principle underlying this approach involves providing critical financial support during the most vulnerable stages of project development. These early interventions serve as crucial catalysts, enabling promising sustainable initiatives to overcome initial barriers and attract subsequent private sector investments. Such strategic positioning allows financial institutions to mitigate risks while simultaneously creating pathways for scalable climate solutions.Navigating the Ecosystem of Climate Finance

Understanding the intricate dynamics of climate finance requires a multifaceted perspective that transcends conventional investment paradigms. Successful strategies must integrate comprehensive risk assessment, technological innovation, and long-term environmental impact evaluation. Sophisticated investors are increasingly recognizing that climate-focused investments represent more than philanthropic endeavors—they are sophisticated economic opportunities with potential for substantial returns. By developing adaptive funding mechanisms that can flexibly respond to emerging technological and environmental challenges, financial institutions can position themselves at the forefront of sustainable economic transformation.Technological Innovation and Investment Synergies

The convergence of technological innovation and strategic investment creates unprecedented opportunities for addressing global environmental challenges. Cutting-edge technologies in renewable energy, carbon capture, and sustainable infrastructure require specialized funding approaches that can navigate complex developmental landscapes. Catalytic funding serves as a critical bridge, providing essential resources and credibility that enable promising projects to transition from conceptual stages to viable economic entities. This approach demands a nuanced understanding of technological potential, market dynamics, and environmental impact assessment.Risk Mitigation and Capital Attraction Strategies

Effective climate investment strategies must incorporate sophisticated risk management frameworks that can attract diverse capital sources. By demonstrating robust methodologies for project evaluation and long-term sustainability, investors can create compelling narratives that resonate with both public and private sector stakeholders. The process of stepping back and allowing private capital to assume primary investment roles represents a sophisticated financial strategy. This approach not only distributes risk but also signals market confidence, thereby creating positive feedback loops that can accelerate sustainable development initiatives.Global Perspectives on Climate Investment Dynamics

The global landscape of climate finance is characterized by increasing complexity and interconnectedness. Successful investment strategies must transcend traditional geographical and sectoral boundaries, embracing a holistic approach that recognizes the intricate relationships between environmental sustainability, technological innovation, and economic development. Collaborative frameworks that bring together diverse stakeholders—including governments, private investors, technological innovators, and environmental experts—can create powerful synergies capable of addressing complex global challenges.Future Trajectories of Sustainable Investment

As the world confronts escalating environmental challenges, the role of strategic, forward-thinking investment approaches becomes increasingly critical. The ability to transform ambitious climate goals into tangible, economically viable projects represents a pivotal frontier in global sustainable development. By continuously refining investment methodologies, embracing technological innovations, and maintaining a commitment to comprehensive impact assessment, financial institutions can play a transformative role in addressing some of humanity's most pressing environmental challenges.RELATED NEWS

Finance

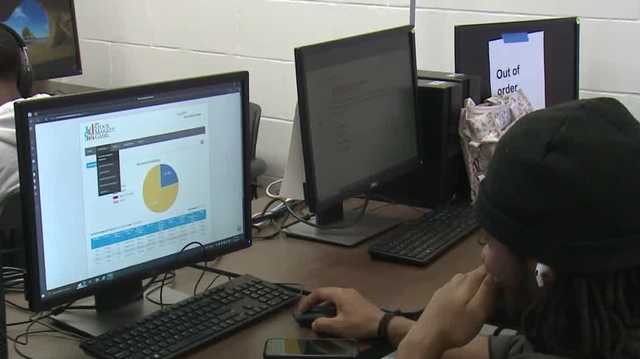

Money Smarts 101: Kentucky Takes Bold Step to Empower Students with Financial Education

2025-03-24 23:06:00