Trade War Escalates: China Slaps Massive 125% Tariff Hammer on US Goods

Finance

2025-04-11 08:11:55Content

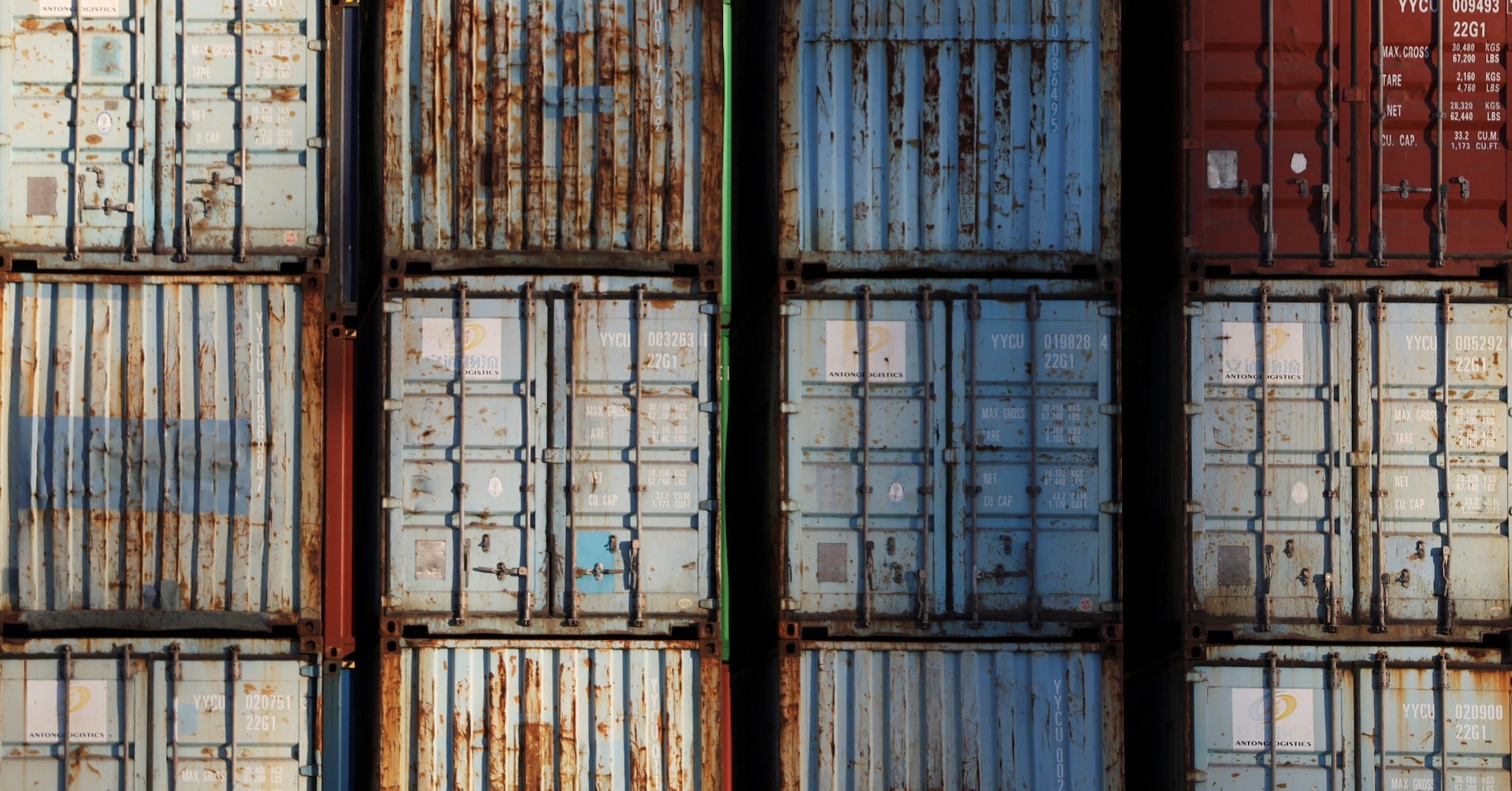

In a significant escalation of trade tensions, China has dramatically increased tariffs on U.S. goods, announcing a steep 125% levy starting this Saturday. This marks a substantial jump from the previously proposed 84% tariff rate, as confirmed by the Chinese Ministry of Finance on Friday.

The unexpected and aggressive tariff hike signals an intensifying economic standoff between the world's two largest economies. This move is likely to further strain the already delicate trade relations between the United States and China, potentially causing ripple effects across global markets.

Businesses and trade analysts are closely watching the development, anticipating potential disruptions in international commerce and supply chains. The sharp increase in tariffs could lead to higher prices for consumers and create additional challenges for companies operating in both countries.

As the trade war continues to evolve, market participants are bracing for potential retaliatory measures and the broader economic implications of this latest escalation.

Trade Tensions Escalate: China Strikes Back with Massive Tariff Increase on U.S. Goods

In a dramatic escalation of the ongoing economic confrontation between global superpowers, China has unveiled an unprecedented trade strategy that promises to reshape international commercial dynamics. The latest move signals a significant intensification of economic pressure that could have far-reaching implications for global markets and bilateral relations.Economic Warfare: China's Strategic Tariff Maneuver Sends Shockwaves Through Global Trade Landscape

The Tariff Transformation: Unpacking China's Bold Economic Strategy

The Chinese government's decision to dramatically increase tariffs represents a calculated and sophisticated response to ongoing trade tensions. By raising import duties from 84% to a staggering 125%, Beijing is sending an unequivocal message about its economic resilience and strategic positioning. This unprecedented tariff increase is not merely a punitive measure but a complex geopolitical chess move designed to challenge existing international trade paradigms. Economic analysts are closely examining the potential ripple effects of this decision. The exponential tariff increase could potentially disrupt established supply chains, force multinational corporations to reconsider their manufacturing and sourcing strategies, and create significant market uncertainties. The move demonstrates China's willingness to leverage its economic might as a diplomatic instrument.Global Economic Implications: Decoding the Broader Context

The tariff escalation goes beyond a simple bilateral trade dispute, representing a sophisticated geopolitical strategy with multifaceted implications. By implementing such aggressive economic measures, China is signaling its capacity to withstand and counteract external economic pressures. This approach challenges traditional assumptions about international trade negotiations and highlights the evolving nature of global economic diplomacy. Economists suggest that this strategy could potentially trigger a complex chain reaction across international markets. Multinational corporations might be compelled to diversify their supply chains, potentially accelerating trends of economic decoupling and regional economic realignment. The tariff increase could also incentivize domestic production within China and create opportunities for alternative international trading partnerships.Strategic Calculations: Understanding China's Economic Positioning

China's decision reflects a nuanced understanding of global economic dynamics. By implementing such a substantial tariff increase, the country is demonstrating its ability to exert economic pressure while simultaneously protecting domestic industries. This move suggests a long-term strategic approach that extends beyond immediate retaliatory actions. The tariff increase could potentially serve multiple objectives: protecting domestic manufacturers, creating leverage in ongoing trade negotiations, and signaling economic independence. It represents a sophisticated approach to international economic engagement that goes beyond traditional trade policy frameworks.Market Reactions and Future Projections

Financial markets are likely to experience significant volatility in response to this development. Investors, traders, and economic policymakers will be closely monitoring the potential cascading effects of China's bold economic maneuver. The tariff increase could potentially reshape international trade relationships, challenge existing economic alliances, and create new opportunities for economic collaboration. Experts predict that this move might accelerate existing trends of economic regionalization and potentially encourage more countries to develop robust domestic manufacturing capabilities. The long-term implications could fundamentally alter global trade architectures and economic interdependencies.RELATED NEWS

Finance

Market Mayhem: Why 'Equal' Doesn't Exist in Wall Street's Unpredictable Playground

2025-02-16 19:20:08

Finance

Wall Street's Hidden Blind Spot: Why Investors Might Be Underestimating Recession Risks

2025-04-19 12:30:20