Wall Street Titans Dominate: JP Morgan and Houlihan Lokey Crush Q1 M&A Advisory Landscape

Finance

2025-04-14 09:08:55Content

JP Morgan and Houlihan Lokey Dominate M&A Advisory Landscape in Q1 2025

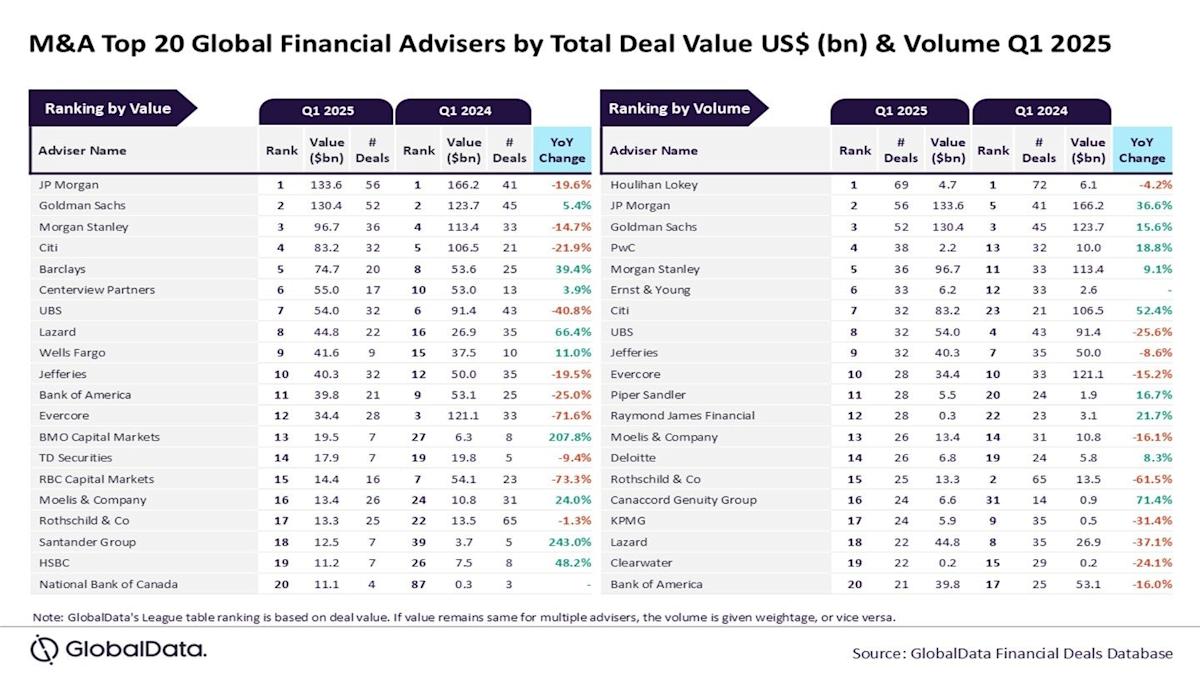

In a groundbreaking financial analysis, global research firm GlobalData has unveiled its latest league table, crowning JP Morgan and Houlihan Lokey as the undisputed champions of mergers and acquisitions (M&A) advisory for the first quarter of 2025.

The comprehensive ranking, which meticulously evaluates financial advisers based on both transaction value and volume, highlights the exceptional performance of these two powerhouse firms. By demonstrating remarkable strategic insight and deal-making prowess, JP Morgan and Houlihan Lokey have set a new benchmark in the competitive world of corporate financial advisory.

GlobalData's rigorous methodology provides a transparent and comprehensive view of the M&A advisory landscape, offering investors and industry professionals a critical lens into the most influential financial institutions driving corporate transformations.

As the global business ecosystem continues to evolve, these top-tier financial advisers play a pivotal role in shaping strategic corporate decisions and facilitating complex merger and acquisition strategies.

Financial Titans Dominate: The Unprecedented Rise of M&A Advisory Powerhouses in 2025

In the ever-evolving landscape of global financial services, the mergers and acquisitions (M&A) advisory sector continues to witness remarkable transformations, with industry giants strategically positioning themselves at the forefront of complex corporate transactions and strategic realignments.Navigating the Complex World of Corporate Dealmaking with Unparalleled Expertise

The Emergence of Elite Financial Advisory Landscape

The contemporary financial advisory ecosystem represents a sophisticated arena where strategic insight, technological innovation, and deep market understanding converge to create unprecedented value. JP Morgan and Houlihan Lokey have emerged as quintessential exemplars of this dynamic environment, demonstrating extraordinary capabilities in facilitating high-stakes corporate transactions. Their remarkable performance transcends traditional advisory roles, embodying a comprehensive approach that integrates sophisticated financial engineering, nuanced strategic analysis, and profound understanding of global economic dynamics. These institutions have effectively transformed the M&A advisory paradigm, offering clients not merely transactional support but holistic strategic guidance.Decoding the GlobalData League Table Methodology

GlobalData's rigorous evaluation framework provides an intricate lens through which financial advisory performance is meticulously assessed. The league table methodology encompasses multiple sophisticated metrics, including transaction value, complexity, strategic significance, and cross-sector impact. By analyzing comprehensive datasets spanning multiple economic sectors, GlobalData generates a multidimensional perspective that goes beyond simplistic numerical rankings. This approach enables a more nuanced understanding of each financial advisory firm's true capabilities, considering factors such as innovation, risk management, and strategic foresight.Strategic Implications for Corporate Transformation

The dominance of JP Morgan and Houlihan Lokey signals a profound shift in corporate strategic thinking. Modern mergers and acquisitions are no longer viewed as mere financial transactions but as complex, transformative processes requiring exceptional strategic acumen. These leading advisory firms have demonstrated an extraordinary ability to navigate intricate regulatory landscapes, manage cross-border complexities, and provide visionary guidance that extends far beyond traditional transactional boundaries. Their success reflects a deeper understanding of how strategic corporate realignments can drive sustainable competitive advantages in an increasingly interconnected global economy.Technological Innovation and Advisory Excellence

The contemporary M&A advisory landscape is being dramatically reshaped by technological innovations. Advanced data analytics, artificial intelligence, and sophisticated predictive modeling have become integral to developing comprehensive strategic insights. JP Morgan and Houlihan Lokey have positioned themselves at the cutting edge of this technological revolution, leveraging sophisticated algorithms and machine learning techniques to provide clients with unprecedented strategic clarity. Their approach represents a paradigm shift from traditional advisory models, integrating technological prowess with deep financial expertise.Future Trajectory of Financial Advisory Services

As global economic dynamics continue to evolve rapidly, the role of elite financial advisory firms becomes increasingly critical. The success of JP Morgan and Houlihan Lokey offers a compelling glimpse into the future of corporate strategic advisory services. Their performance suggests a future where financial advisory will be characterized by holistic, technology-driven approaches that seamlessly blend deep sector expertise, advanced analytical capabilities, and strategic vision. This evolution promises to redefine how corporations conceptualize and execute transformative strategic initiatives.RELATED NEWS

Finance

Wall Street Veteran Brian Whaley Joins Dechert, Supercharging Structured Finance Team

2025-03-31 17:00:00

Finance

Financial Lifeline: Safe Harbor Partners with Colorado Credit Union to Restructure Debt

2025-03-04 21:40:00

Finance

Global Reach: Lili Revolutionizes Small Business Payments with International Wire Transfer Feature

2025-02-19 16:38:29