Navigating Market Chaos: 5 Expert Strategies Financial Advisors Are Using Now

Finance

2025-04-14 08:30:03Content

In the bustling world of financial advisory, client communication is reaching new heights. "Our phones are constantly ringing," shared a seasoned financial planner, highlighting the intense demand for professional financial guidance in today's complex economic landscape. The surge in client interactions underscores the growing need for personalized financial strategies and expert advice.

Professionals across the industry are experiencing an unprecedented volume of client inquiries, reflecting the increasing complexity of personal and business financial planning. From investment strategies to retirement planning, clients are seeking comprehensive insights to navigate their financial futures with confidence.

Financial Advisors Overwhelmed: The Surge in Client Consultations Amid Economic Uncertainty

In the rapidly evolving landscape of financial planning, professionals are experiencing an unprecedented wave of client interactions that signals deeper economic complexities and growing investor anxieties. The current financial ecosystem is witnessing a transformative moment where traditional advisory services are being reimagined and redefined.Navigating Turbulent Financial Waters: Insights from the Front Lines of Wealth Management

The Rising Tide of Client Consultations

Financial advisory firms are currently experiencing an extraordinary surge in client communications, reflecting the intricate and volatile nature of contemporary economic environments. Professionals across the industry are reporting a significant increase in phone calls, consultations, and urgent inquiries from clients seeking guidance and reassurance. This unprecedented volume of interactions suggests a profound shift in investor sentiment and a growing need for personalized financial strategies. The complexity of these conversations extends far beyond traditional financial advice. Clients are increasingly seeking comprehensive insights that address not just investment portfolios, but holistic financial wellness. Financial planners are now required to be part strategist, part psychologist, and part economic interpreter, helping clients navigate through uncertain economic terrains.Understanding the Drivers of Client Anxiety

Multiple interconnected factors are contributing to this heightened client engagement. Global economic uncertainties, market volatility, geopolitical tensions, and rapid technological disruptions are creating an environment of unprecedented complexity. Investors are no longer content with generic advice; they demand nuanced, personalized strategies that can adapt to rapidly changing circumstances. The digital transformation of financial services has also played a crucial role. Clients now have access to real-time information, sophisticated analytical tools, and multiple investment platforms. This democratization of financial knowledge has simultaneously empowered and overwhelmed investors, driving them to seek professional guidance more frequently and intensively.The Evolving Role of Financial Advisors

Modern financial planners are transforming from traditional number-crunchers to holistic financial architects. They are now expected to provide comprehensive solutions that integrate technological insights, predictive analytics, and personalized risk management strategies. The ability to communicate complex financial concepts in accessible, relatable language has become a critical skill. Technological advancements like artificial intelligence and machine learning are enabling advisors to offer more sophisticated, data-driven recommendations. However, the human element remains irreplaceable. Clients still value the empathy, understanding, and personalized approach that only human professionals can provide.Strategies for Effective Client Engagement

Successful financial advisory practices are developing innovative approaches to manage the increasing client interactions. This includes implementing advanced communication technologies, developing robust digital platforms, and training advisors in advanced communication and emotional intelligence skills. Proactive communication, transparent reporting, and the ability to provide context around complex financial trends are becoming differentiating factors. Advisors who can effectively translate global economic trends into actionable, personalized strategies are finding themselves at a significant competitive advantage.The Future of Financial Advisory Services

The current trend suggests a fundamental restructuring of financial advisory services. The future will likely be characterized by highly personalized, technology-enhanced, and holistic financial guidance. Advisors who can seamlessly blend technological capabilities with human insights will be best positioned to thrive in this evolving landscape. As economic uncertainties continue to challenge traditional financial paradigms, the relationship between advisors and clients will become increasingly collaborative, dynamic, and sophisticated. The phone calls flooding financial planning offices are not just conversations—they are windows into a transforming financial ecosystem.RELATED NEWS

Finance

Breaking Barriers: The 25 Most Influential Women Reshaping Finance in 2025

2025-03-10 04:23:37

Finance

Medallion Financial Set to Unveil Strategic Insights at Upcoming Investor Gathering

2025-03-13 12:00:00

Finance

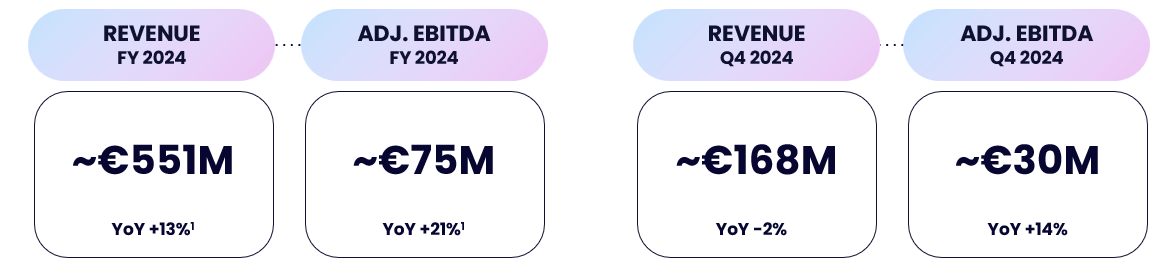

Breaking: Azerion Reveals Q4 Financial Snapshot, Signals Strong 2024 Performance

2025-02-27 06:40:00