Nvidia's Market Meltdown: $250B Vanishes as Trump's Tech Blockade Strikes Chip Giant

Finance

2025-04-17 16:04:22Content

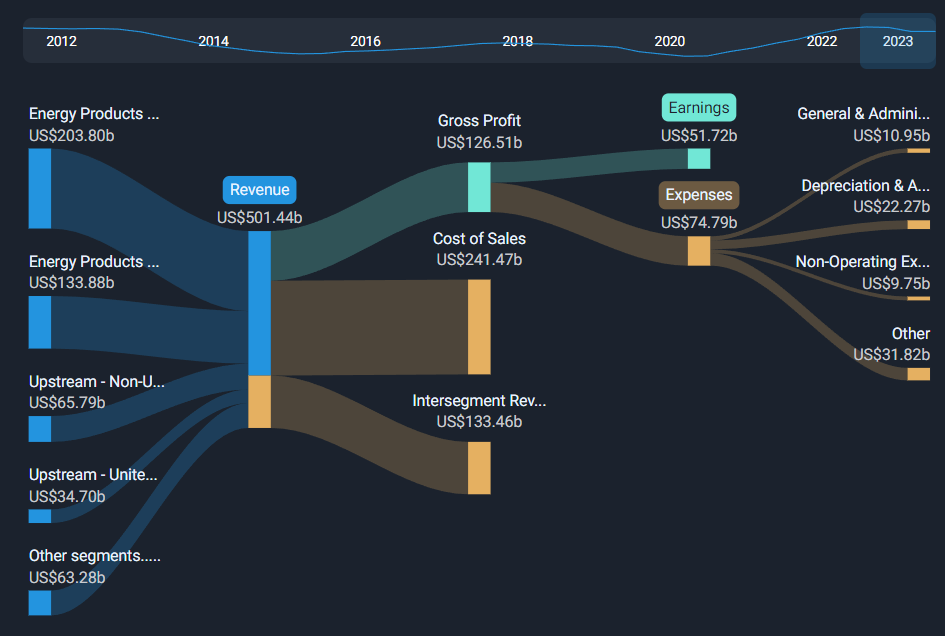

Nvidia's stock market rollercoaster continues as the tech giant experiences a significant downturn, with its market capitalization plummeting by over $250 billion since the revelation of new export restrictions. The semiconductor leader has been navigating turbulent waters following the latest regulatory challenges, sending ripples through the investment landscape.

Investors are closely watching the company's response to these export controls, which have triggered a substantial sell-off and raised questions about Nvidia's future growth potential in international markets. The dramatic market cap erosion underscores the sensitivity of tech stocks to geopolitical and regulatory developments, highlighting the delicate balance tech companies must maintain in an increasingly complex global business environment.

As Nvidia grapples with these challenges, the market remains on edge, anticipating the company's strategic moves and potential mitigation efforts in the face of these unexpected regulatory hurdles.

Tech Titan's Tumble: Nvidia's Market Value Evaporates in Stunning Export Control Fallout

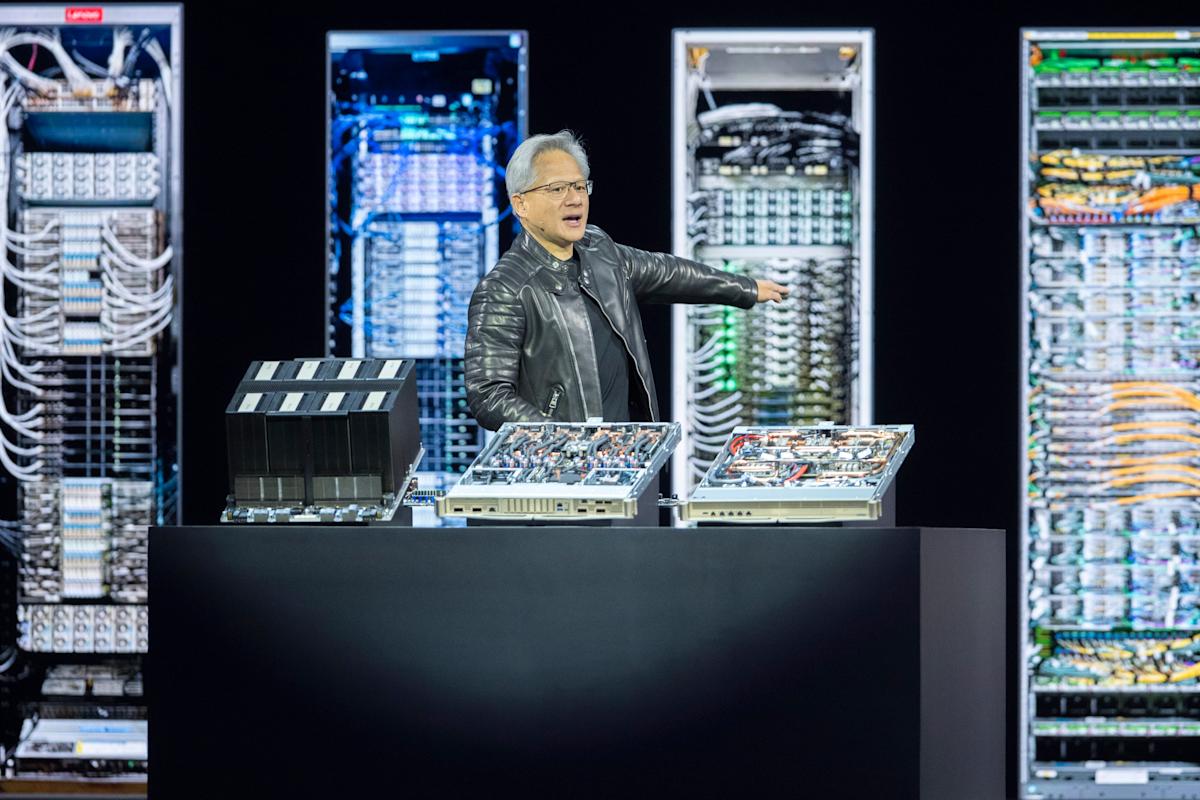

In the high-stakes world of technological innovation and global trade, Nvidia finds itself at the epicenter of a dramatic market transformation. The semiconductor giant's recent encounter with export control regulations has sent shockwaves through the investment landscape, triggering a significant financial recalibration that has investors and industry analysts scrambling to understand the implications.When Regulations Reshape Technological Empires: A Billion-Dollar Market Shift Unfolds

The Geopolitical Chessboard of Semiconductor Exports

The intricate landscape of international technology trade has always been a delicate balance of innovation, strategic interests, and regulatory constraints. Nvidia's recent experience illuminates the profound impact that government regulations can have on even the most robust technological enterprises. Export controls are not merely bureaucratic hurdles but sophisticated instruments of economic and technological diplomacy that can instantaneously alter a company's market trajectory. The semiconductor industry operates within an incredibly complex global ecosystem where technological supremacy is as much about geopolitical strategy as it is about engineering prowess. When export restrictions are implemented, they create ripple effects that extend far beyond immediate financial metrics, potentially reshaping entire technological supply chains and international competitive dynamics.Market Capitalization in the Crosshairs: Understanding Nvidia's Financial Vulnerability

Nvidia's market capitalization represents more than just a numerical figure—it's a reflection of investor confidence, technological potential, and strategic positioning in the global tech landscape. The staggering $250 billion market value erosion is not simply a financial statistic but a profound statement about the fragility of technological enterprises in an increasingly regulated global environment. Investors and market analysts are now meticulously dissecting the implications of these export controls. The sudden market value decline suggests a complex interplay of regulatory pressure, geopolitical tensions, and the inherent volatility of technology-driven markets. Each percentage point of stock decline represents not just monetary loss but a recalibration of market expectations and technological potential.Technological Sovereignty and Global Trade Dynamics

The Nvidia scenario epitomizes the broader narrative of technological sovereignty in the 21st century. Export controls are powerful mechanisms through which nations can strategically manage technological proliferation, protecting national security interests while simultaneously influencing global technological development. For Nvidia, this represents a critical moment of strategic recalibration. The company must now navigate a landscape where technological innovation is increasingly intertwined with geopolitical considerations. Adapting to these new regulatory environments requires not just financial resilience but also sophisticated diplomatic and strategic maneuvering.Investor Sentiment and Future Projections

The market's reaction to Nvidia's export control challenges reveals the delicate psychology of technological investment. Investors are simultaneously risk-averse and opportunity-seeking, constantly evaluating the potential for recovery and strategic repositioning. The current market dynamics suggest a period of significant uncertainty. Nvidia's ability to demonstrate adaptability, develop alternative market strategies, and maintain technological leadership will be crucial in restoring investor confidence. The coming months will be a critical test of the company's resilience and strategic vision.RELATED NEWS

Finance

RBA Rate Cut Bombshell: Major Bank Predicts Massive Monetary Intervention

2025-05-05 05:25:30

Finance

Wall Street's AI Gamble: Regulators Sound the Alarm on Artificial Intelligence Risks

2025-03-28 13:00:17

Finance

Financial Leadership Wanted: Columbus Launches High-Stakes Search for New Finance Director

2025-04-14 05:15:00