Financial Watchdog Under Siege: How CFPB's Brutal Budget Cut Could Shake Wall Street

Finance

2025-04-18 02:00:00Content

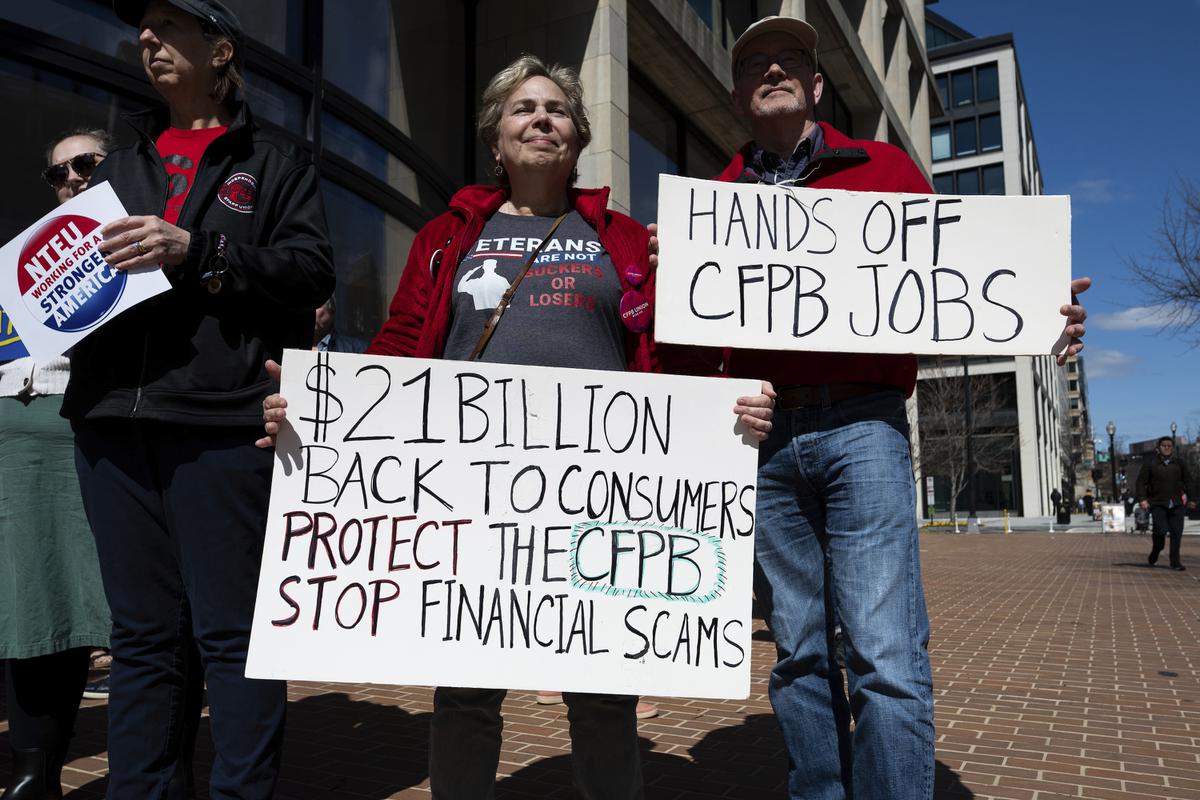

In a shocking move that has sent ripples through the financial sector, the agency abruptly terminated 1,500 employees on Thursday, potentially triggering a catastrophic disruption in mortgage markets. This drastic action not only defies a standing court order but also raises serious concerns about the stability of the housing finance landscape.

The mass layoffs come at a critical moment, threatening to unravel delicate financial mechanisms and potentially causing widespread economic uncertainty. Legal experts are already warning that the agency's decision could have far-reaching consequences, challenging existing judicial directives and potentially destabilizing the mortgage industry.

Stakeholders are watching closely as the situation unfolds, with many questioning the agency's motivations and the potential fallout from such a dramatic workforce reduction. The potential "meltdown" of mortgage markets looms large, casting a shadow of uncertainty over homeowners, financial institutions, and the broader economic ecosystem.

As tensions rise and legal challenges mount, the agency's controversial decision stands as a stark reminder of the fragile interconnectedness of modern financial systems and the profound impact of corporate actions on millions of lives.

Mortgage Market Tremors: Unprecedented Mass Layoffs Spark Industry-Wide Panic

In an unprecedented move that has sent shockwaves through the financial sector, a major agency has executed a massive workforce reduction, potentially destabilizing the delicate ecosystem of mortgage markets and raising critical questions about the industry's future stability.Workforce Disruption Threatens Financial Landscape

The Seismic Shift in Mortgage Industry Employment

The recent termination of 1,500 workers represents more than a simple corporate restructuring. This dramatic workforce reduction signals a profound transformation within the mortgage sector, exposing underlying vulnerabilities that have long been simmering beneath the surface. Financial analysts are scrambling to understand the broader implications of such a sweeping personnel change, which could potentially trigger a cascading effect across interconnected financial systems. Experts suggest that these mass layoffs are not merely a cost-cutting measure, but potentially a strategic realignment in response to rapidly changing market dynamics. The unprecedented scale of workforce reduction hints at deeper structural challenges facing the mortgage industry, including technological disruption, regulatory pressures, and evolving economic landscapes.Legal and Economic Ramifications of Mass Terminations

The agency's decision to terminate 1,500 employees directly contradicts existing court orders, introducing a complex legal dimension to the already volatile situation. This blatant disregard for judicial mandates raises significant concerns about corporate governance and potential legal consequences. Financial legal experts are closely monitoring the situation, anticipating potential litigation and regulatory interventions. The potential market meltdown extends far beyond immediate employment concerns. Mortgage markets, which form a critical component of the broader financial ecosystem, could experience substantial disruption. The sudden removal of a significant workforce might create operational bottlenecks, reduce processing capabilities, and potentially compromise the efficiency of mortgage-related services.Technological Transformation and Workforce Adaptation

Underlying these dramatic changes is a broader narrative of technological transformation. Automation, artificial intelligence, and advanced data analytics are rapidly reshaping traditional mortgage industry paradigms. The mass layoffs might represent a strategic pivot towards more technologically integrated operational models, where human workforce is increasingly supplemented or replaced by sophisticated digital systems. This technological evolution demands unprecedented levels of workforce adaptability. Professionals in the mortgage sector must rapidly upskill, embracing digital competencies and developing versatile skill sets that align with emerging industry requirements. The current workforce reduction could be interpreted as a critical inflection point in this ongoing technological metamorphosis.Broader Economic and Social Implications

The ripple effects of these mass terminations extend well beyond the immediate corporate context. Families and individuals dependent on stable employment in the mortgage sector now face significant economic uncertainty. The psychological and financial stress induced by such large-scale job losses can have profound societal implications, potentially affecting consumer confidence and regional economic dynamics. Moreover, this development underscores the increasingly volatile nature of contemporary employment landscapes. Traditional notions of job security are being fundamentally challenged, compelling workers across various sectors to develop more resilient, adaptable professional strategies.Future Outlook and Industry Resilience

While the current scenario appears challenging, it also presents opportunities for innovation and strategic reimagining. The mortgage industry has historically demonstrated remarkable resilience, adapting to complex economic environments and technological disruptions. The current workforce transformation might ultimately catalyze more efficient, technologically advanced operational frameworks. Stakeholders across the financial ecosystem—from regulatory bodies to industry leaders and workforce representatives—must collaborate to navigate these turbulent transitions, ensuring that technological progress does not come at the expense of human capital and economic stability.RELATED NEWS

Finance

Austerity Strikes Again: UK Treasury Plots Welfare Rollback to Mend Fiscal Wounds

2025-03-05 08:08:55